Ohio Sale and Leaseback Agreement for Commercial Building is a legal contract that enables a property owner in Ohio to sell their commercial building to another party and simultaneously lease it back from the buyer. This arrangement allows the property owner to obtain immediate capital while retaining possession and continued use of the building. In this article, we will discuss the intricacies of Ohio Sale and Leaseback Agreements for Commercial Buildings, exploring their benefits, process, and different types. Sale and Leaseback agreements are commonly employed when a commercial building owner seeks to unlock the equity tied up in their property without having to relocate their business operations. By selling the building to a third party and leasing it back, the owner secures funds to invest in business growth, repay debts, or carry out renovations, while still acting as the occupant of the premises. It is an effective financial tool for businesses in Ohio looking to optimize their balance sheets and improve cash flow. Now, let's take a closer look at the different types of Ohio Sale and Leaseback Agreements for Commercial Buildings: 1. Capital Leaseback Agreement: This type of agreement involves a long-term leaseback arrangement where the property owner maintains the benefits and risks associated with ownership, with an option to repurchase the property at the end of the lease term. 2. Operating Leaseback Agreement: In an operating leaseback agreement, the original property owner becomes a lessee and pays periodic rental payments to the new property owner. This type of agreement is more common for short-term leaseback arrangements, usually lasting less than five years. 3. Synthetic Leaseback Agreement: A synthetic leaseback agreement combines the accounting treatment of a lease with financing. Here, the property owner transfers ownership to a special purpose entity (SPE) and leases the property back, allowing them to maintain control while enjoying the benefits of off-balance sheet financing. When entering into an Ohio Sale and Leaseback Agreement for a Commercial Building, it is crucial for both parties to consult legal professionals who specialize in real estate transactions. These attorneys will ensure all aspects of the agreement, including terms, conditions, and lease provisions, meet the requirements outlined in the state's laws and regulations. In summary, Ohio Sale and Leaseback Agreements for Commercial Buildings offer property owners an excellent opportunity to unlock capital tied up in their properties while retaining control and use of the premises. By exploring the different types of agreements — capital leaseback, operating leaseback, and synthetic leaseback — businesses in Ohio can choose the structure that best suits their specific requirements. Consulting with legal professionals experienced in real estate transactions is vital to ensure all aspects of the agreement comply with Ohio laws.

Ohio Sale and Leaseback Agreement for Commercial Building

Description

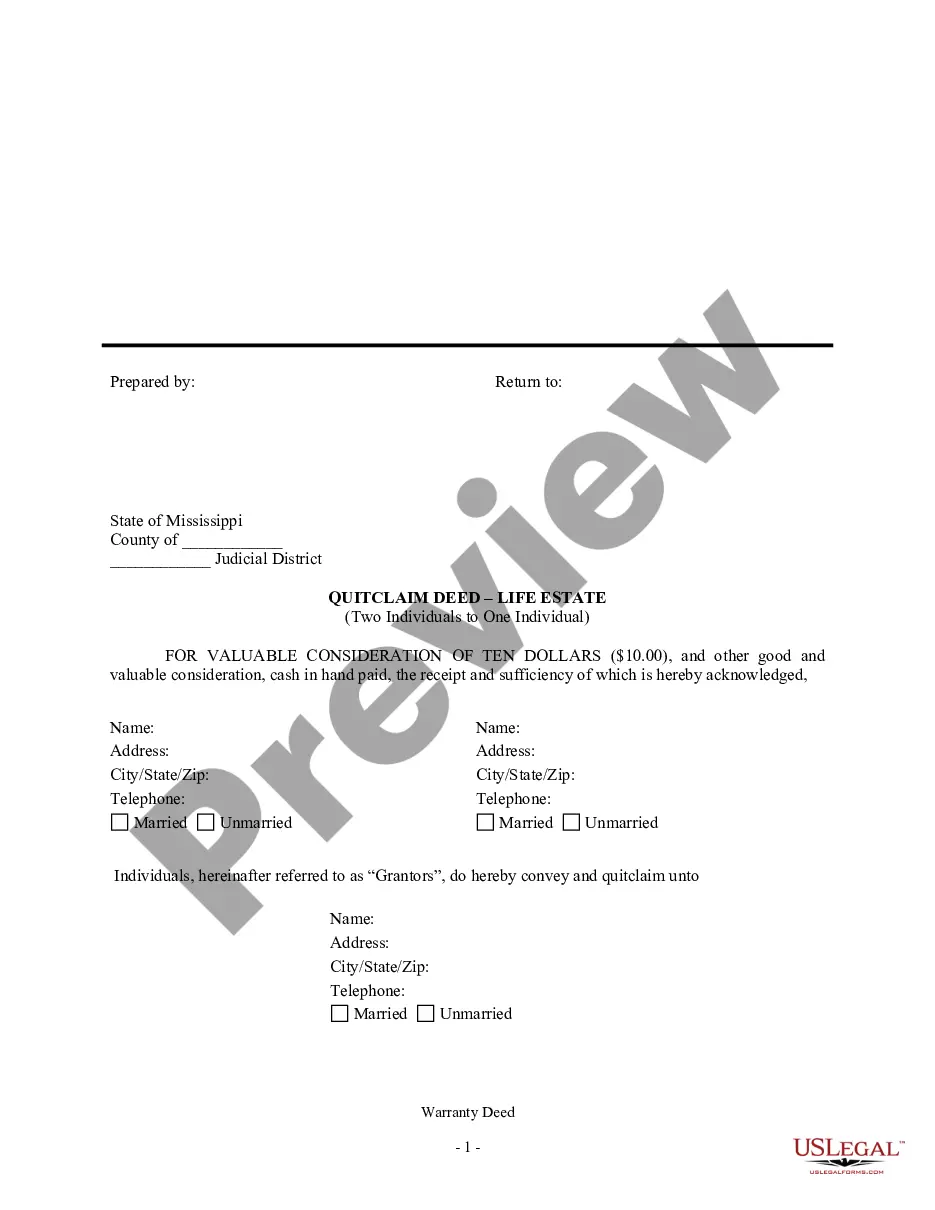

How to fill out Ohio Sale And Leaseback Agreement For Commercial Building?

US Legal Forms - one of the largest collections of legal documents in the USA - provides an extensive selection of legal document templates that you can purchase or print.

By using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the most recent versions of documents such as the Ohio Sale and Leaseback Agreement for Commercial Property in just moments.

If you already have a membership, Log In to acquire the Ohio Sale and Leaseback Agreement for Commercial Property from your US Legal Forms collection. The Download button will be visible on every document you view. You have access to all of the previously saved forms in the My documents section of your account.

Confirm the transaction. Use your Visa or MasterCard or PayPal account to complete the transaction.

Select the format and download the document to your device. Edit it. Complete, modify, and print the saved Ohio Sale and Leaseback Agreement for Commercial Property. Every template purchased is without an expiration date and is yours permanently. Therefore, if you wish to download or print another copy, simply visit the My documents section and click on the document you wish to access. Obtain the Ohio Sale and Leaseback Agreement for Commercial Property with US Legal Forms, the most extensive library of legal document templates. Utilize thousands of professional and state-specific templates that fulfill your business or personal needs and requirements.

- Ensure you have selected the correct document for your city/state.

- Click on the Preview button to review the content of the form.

- Check the form details to confirm you have selected the appropriate document.

- If the document does not meet your requirements, use the Search bar at the top of the screen to find one that does.

- Once you are satisfied with the form, confirm your choice by clicking on the Download now button.

- Then, choose the payment plan you prefer and provide your information to register for an account.

Form popularity

FAQ

A failed sale and leaseback occurs when the transaction does not go as planned, often due to disputes over property value or lease terms. This situation can lead to financial losses and operational challenges for the involved parties. Understanding the legal intricacies of an Ohio Sale and Leaseback Agreement for Commercial Building can help you avoid such pitfalls. Consulting with experts can provide guidance to ensure a successful arrangement.

In addition to long-term financial commitments, businesses may lose control over their property’s future. The inability to adapt property usage can hinder operational flexibility. It is essential to evaluate these disadvantages when entering into an Ohio Sale and Leaseback Agreement for Commercial Building.

The sale and leaseback process typically begins with property valuation, followed by the sale of the asset to an investor or a financial institution. Once the sale is complete, a lease agreement is put in place, allowing the original owner to occupy the property. Understanding this process will help you navigate an Ohio Sale and Leaseback Agreement for Commercial Building more effectively.

A sale leaseback clause outlines the terms of the lease once the property has been sold. This clause typically covers rental amounts, duration of the lease, and responsibilities for property upkeep. Understanding how these clauses work is vital for negotiating an effective Ohio Sale and Leaseback Agreement for Commercial Building.

The two primary types of sale and leaseback leases are operating leases and finance leases. In an operating lease, the seller retains responsibility for maintenance and insurance, while a finance lease transfers more responsibilities to the buyer. Choosing the right type depends on your goals with the Ohio Sale and Leaseback Agreement for Commercial Building.

Sales and leaseback is a financial strategy where a company sells an asset, such as property, and leases it back from the buyer immediately. This allows the seller to unlock capital while retaining the right to use the asset. In Ohio, many businesses effectively use the Ohio Sale and Leaseback Agreement for Commercial Building to achieve liquidity without affecting operational capabilities, making it a valuable tool for financial planning.

While sale and leaseback transactions provide immediate liquidity, they also come with potential disadvantages. These include losing ownership of the property, possibly paying higher long-term rents, and impacting financial statements in ways that may deter investors. Businesses in Ohio should carefully review their objectives and long-term plans before entering an Ohio Sale and Leaseback Agreement for Commercial Building to ensure it aligns with their goals.

To determine if a sale and leaseback transaction qualifies as a sale, you should assess the transfer of ownership, the terms of the lease agreement, and the intent of both parties. The transaction should involve a legitimate transfer of title to the buyer, along with a fixed lease term outlining the tenant's obligations. Consulting with legal professionals familiar with the Ohio Sale and Leaseback Agreement for Commercial Building will help clarify any complexities in these transactions.

The structure of a sale and leaseback transaction typically involves three main steps: the sale of the property, the lease agreement, and the tenant's continued operation in the space. The seller becomes the tenant after selling the asset, providing a steady rental income stream for the buyer. This arrangement can be highly beneficial in the context of Ohio Sale and Leaseback Agreement for Commercial Building, as it promotes financial flexibility while maintaining occupancy.

Sale and leaseback refers to a transaction where an owner sells an asset and then leases it back from the new owner. For instance, a retailer might sell its store building to an investor and then lease it to keep the location open. This approach provides immediate capital and reduces debt while allowing the retailer to operate without interruption. Explore the Ohio Sale and Leaseback Agreement for Commercial Building to see how it can suit your business needs.