An agister is a person who feeds or pastures livestock for a fee. The duty of an agister to keep fences in good repair need not be made an express condition of the agreement, since this duty is implied. Agistment contracts are generally subject to the law of bailments.In this form, the agister is contracting out its responsibilities to a third party.

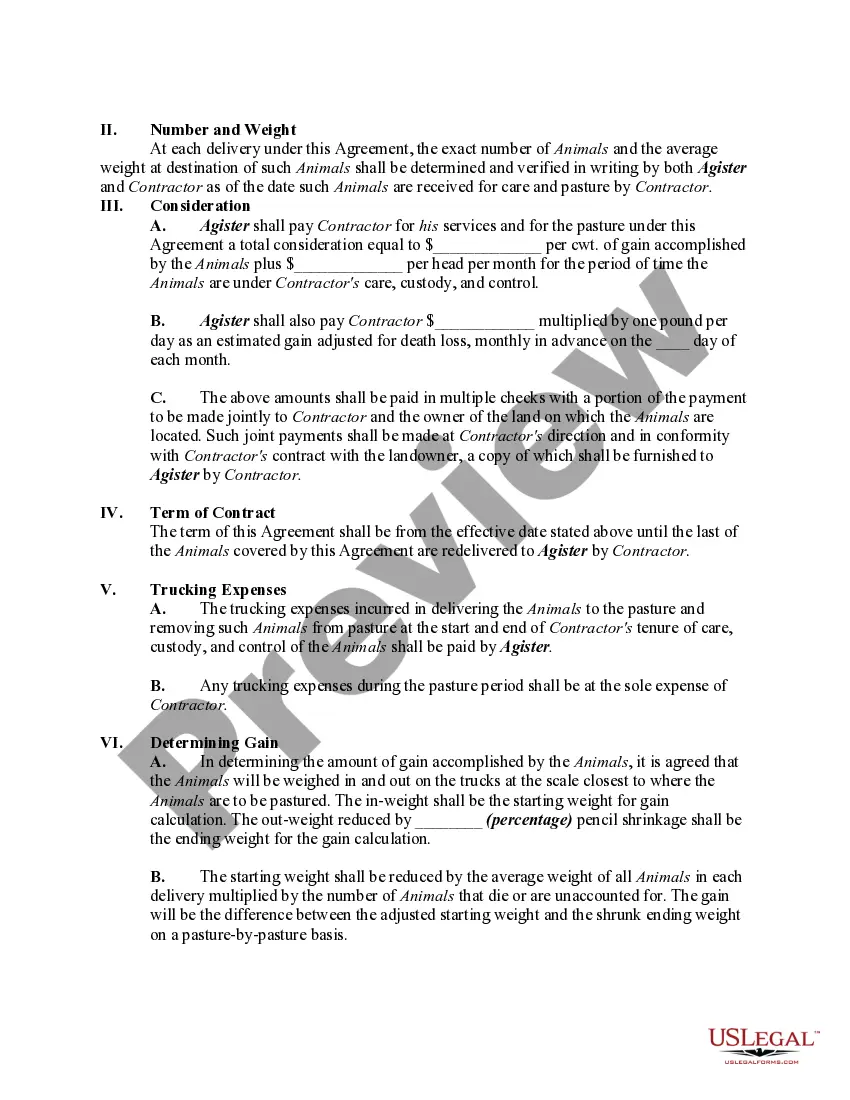

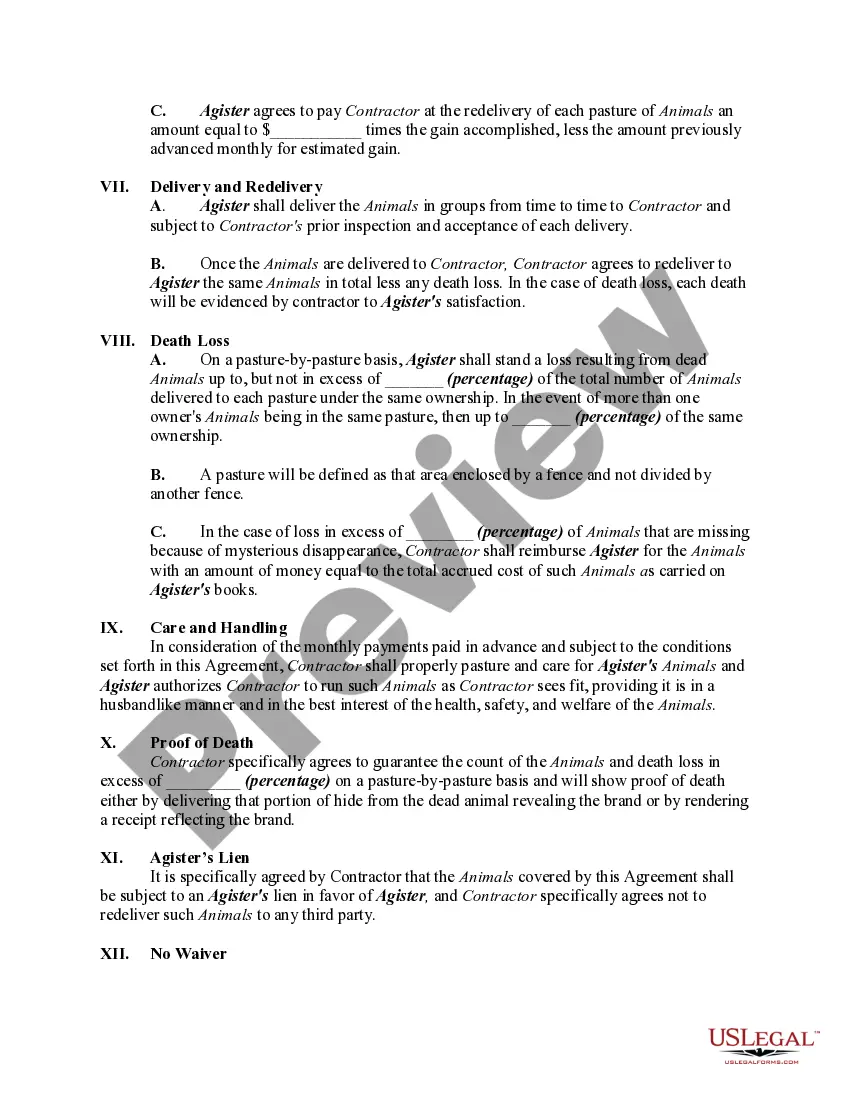

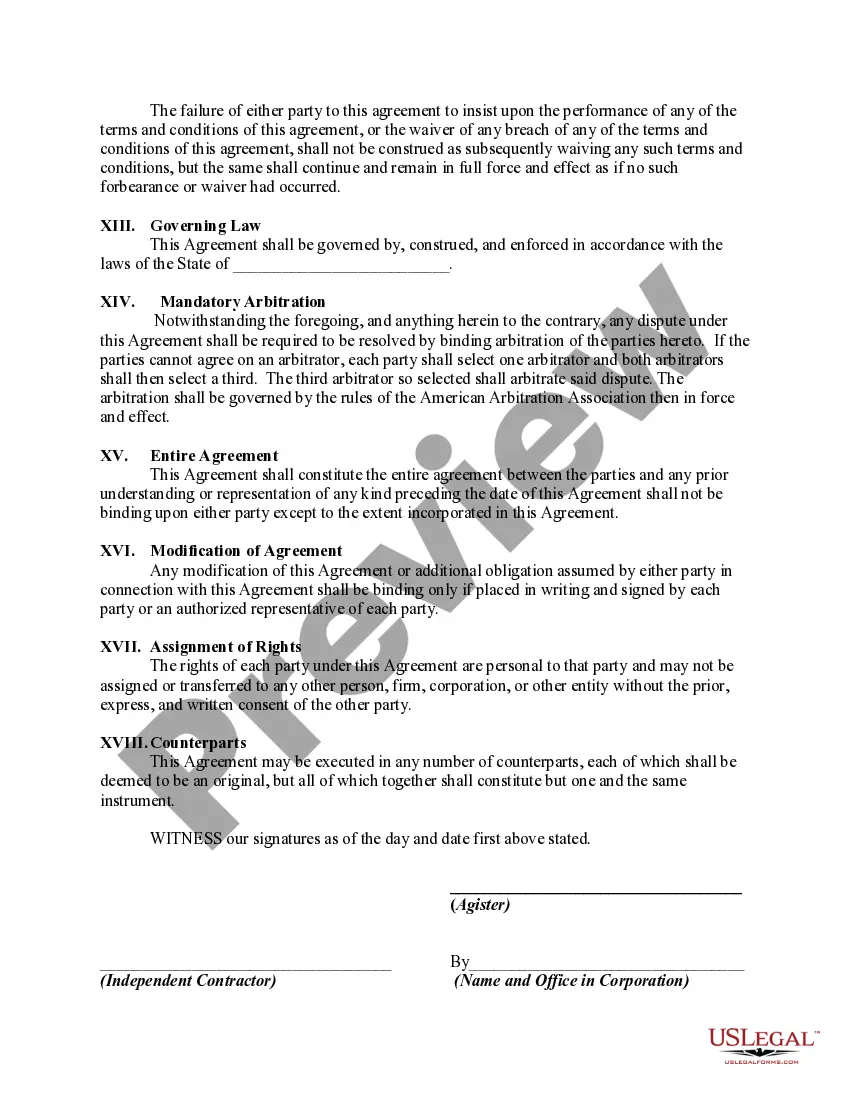

Ohio Agreement or Contract Between Sister and Self-Employed Independent Contractor An Ohio Agreement or Contract is a legal document that outlines the terms and conditions between a sister (the person or entity providing the agreement services) and a self-employed independent contractor (the individual or business entity utilizing the agreement services). This agreement governs the agreement of livestock, such as horses, cattle, sheep, or goats, where the livestock owner or trainer requires temporary boarding, care, and management of their animals. Key Terms and Conditions: 1. Parties: The agreement identifies the sister (boarding facility or individual) and the self-employed independent contractor (owner or trainer of the livestock). 2. Description of Services: It details the specific agreement services, such as boarding, feeding, watering, and general care of the livestock. The agreement may also include additional services, like exercising, grooming, or veterinary care, if agreed upon. 3. Payment Terms: The contract specifies the compensation method, be it a fixed fee, a daily, weekly, or monthly rate, or a percentage of the livestock's value. Payment terms, due dates, and any additional charges (e.g., veterinary expenses) should also be clearly defined. 4. Duration and Termination: The agreement outlines the start and end dates of the agreement period. Additionally, terms for early termination by either party, including notice period, penalties, or prorated fees, if any, are mentioned. 5. Responsibilities of the Sister: This section details the obligations of the sister regarding the care, feeding, and supervision of the livestock. It may include provisions for safe handling, stabling, turnout, and the use of appropriate facilities and equipment. 6. Responsibilities of the Self-Employed Independent Contractor: This section outlines the obligations of the contractor, such as providing accurate and current health and ownership records, promptly paying fees, and abiding by any facility rules or regulations. 7. Liability and Insurance: The contract should address the allocation of liability and require the sister and the contractor to maintain appropriate insurance coverage for accidents, injuries, or property damage. Types of Ohio Agreement or Contract: 1. Standard Agreement: This is the typical contract used when a sister offers standard boarding and care services for livestock. 2. Training Agreement: This type of contract is specifically designed for self-employed trainers who provide training or conditioning services in addition to the basic agreement services. 3. Breeding Agreement: This agreement is used when the livestock owner requires specialized breeding services, such as artificial insemination or foaling assistance, along with agreement. 4. Rehabilitation Agreement: This contract caters to situations where injured or recovering animals need special care, such as limited turnout, daily medical treatments, or rehabilitative exercises. In conclusion, the Ohio Agreement or Contract between a sister and a self-employed independent contractor serves to protect the interests of both parties involved in the temporary boarding and care of livestock. By defining the rights, responsibilities, and payment terms, this legally binding agreement ensures a transparent and fair relationship between the sister and the contractor.