In a security agreement, the debtor grants a "security interest" in the personal property in order to secure payment of the loan. Granting a security interest in personal property is the same thing as granting a lien in personal property. This form is a sample of a security agreement in farm products that may be referred to when preparing such a form for your particular state.

Ohio Security Agreement with Farm Products as Collateral

Description

How to fill out Security Agreement With Farm Products As Collateral?

US Legal Forms - one of the largest repositories of legal documents in the United States - provides a vast selection of legal document templates that you can download or print.

By utilizing the site, you will access thousands of forms for business and personal purposes, organized by categories, states, or keywords.

You can find the latest versions of forms such as the Ohio Security Agreement with Farm Products as Collateral in just seconds.

Read the form description to verify that you have selected the appropriate document.

If the form does not suit your needs, utilize the Search field at the top of the page to find one that does.

- If you already have a subscription, sign in and download the Ohio Security Agreement with Farm Products as Collateral from the US Legal Forms catalog.

- The Download button will be visible on each form you view.

- You can access all previously acquired forms from the My documents tab of your account.

- If you are using US Legal Forms for the first time, here are some simple steps to help you get started.

- Ensure you have chosen the correct form for your region/state.

- Click the Review button to examine the form's content.

Form popularity

FAQ

Good collateral is typically characterized by its value, liquidity, and ease of enforcement. In the context of an Ohio Security Agreement with Farm Products as Collateral, assets like healthy crops or livestock are often considered strong collateral. They provide reassurance to lenders that they will receive compensation if the borrower fails to meet their obligations.

The collateral description in a security agreement specifies the assets that secure the obligation. A clear and precise description is essential in an Ohio Security Agreement with Farm Products as Collateral to avoid ambiguity. This helps ensure that both parties understand what is at stake, especially in case of default.

Writing a security agreement involves outlining the terms of the collateral, the obligations of the borrower, and the rights of the secured party. Ensure to include specific details such as the description of the collateral and the obligations it secures. Utilizing a template from a reliable platform like uslegalforms can simplify this process and ensure compliance with Ohio laws.

Perfecting collateral requires you to create a security interest and properly file it according to state laws. For Ohio Security Agreement with Farm Products as Collateral, this includes ensuring that your financing statement clearly describes the collateral types involved. Consulting with a legal specialist can help streamline this process and safeguard your interests.

To perfect an interest in uncertificated stock, you should deliver a security agreement to the issuer of the stock, which should clearly describe the collateral. Additionally, you must notify the issuer of your security interest to satisfy the requirements under Ohio law. By doing so, you establish your position as a secured party under the Ohio Security Agreement with Farm Products as Collateral.

A perfected interest in collateral means that your right to the collateral is legally recognized and enforceable. In the context of Ohio Security Agreement with Farm Products as Collateral, this ensures that if the borrower defaults, you have priority over unsecured creditors. Perfecting your interest involves proper filing and adherence to state laws.

To perfect collateral under an Ohio Security Agreement with Farm Products as Collateral, you typically must file a UCC-1 financing statement with the Secretary of State. This establishes your legal claim to the collateral, making it enforceable against third parties. Ensure that the statement accurately describes the collateral to avoid any potential disputes.

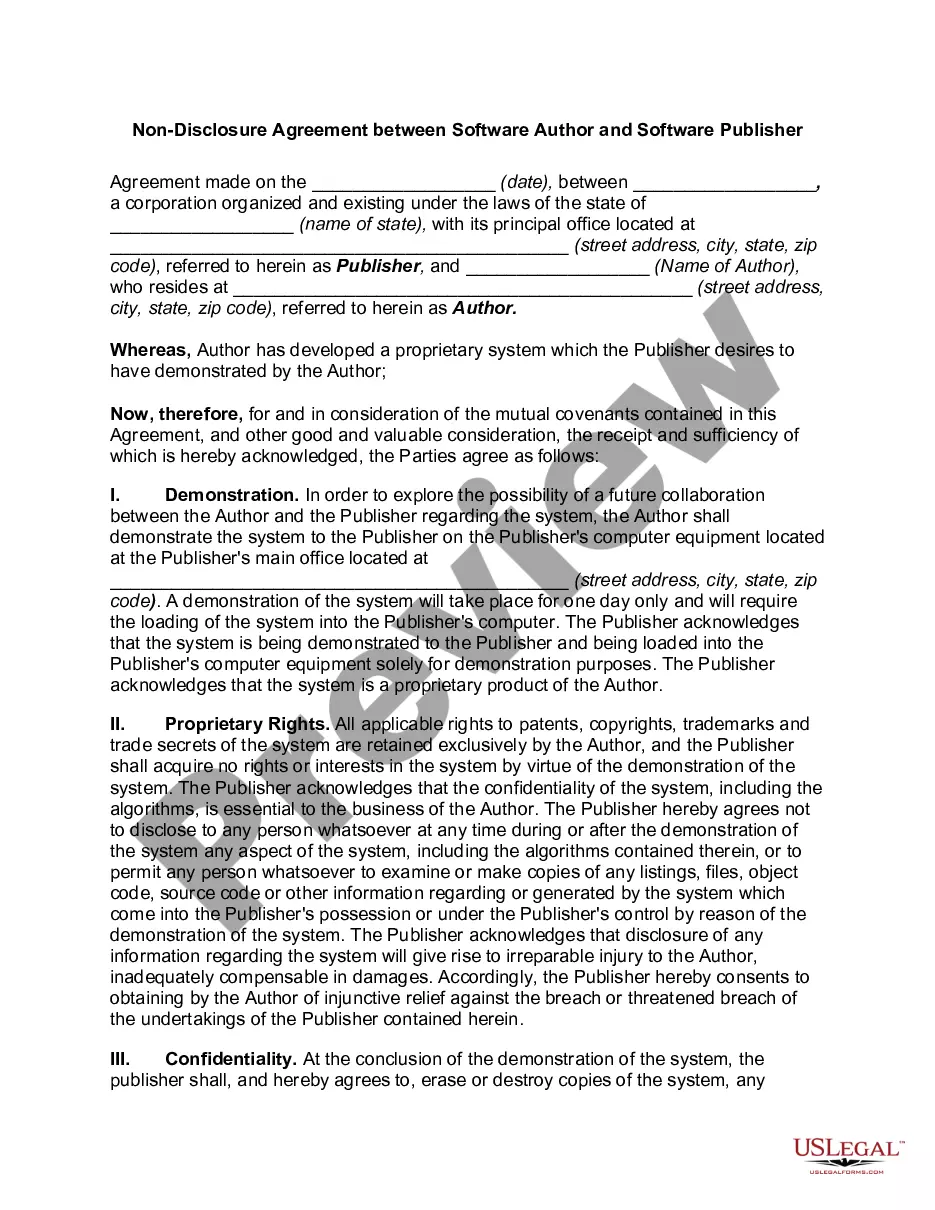

The financing statement of a security agreement serves as the official record of the lender's interest in the collateral identified in the agreement. This document is essential for establishing priority among creditors. When dealing with an Ohio Security Agreement with Farm Products as Collateral, a properly filed financing statement ensures that the lender's rights are recognized in case of default.

A financing statement is a document that provides public notice of a security interest in personal property. It includes details such as the names of the debtor and creditor, along with a description of the collateral. This statement plays a vital role for anyone using an Ohio Security Agreement with Farm Products as Collateral, as it helps protect the lender’s interests.

A security agreement is a contract that establishes a secured party’s interest in collateral, such as farm products. In contrast, a financing statement is a legal document filed to give notice of this interest to third parties. For those utilizing the Ohio Security Agreement with Farm Products as Collateral, understanding how these two documents work together is crucial for protecting your rights.