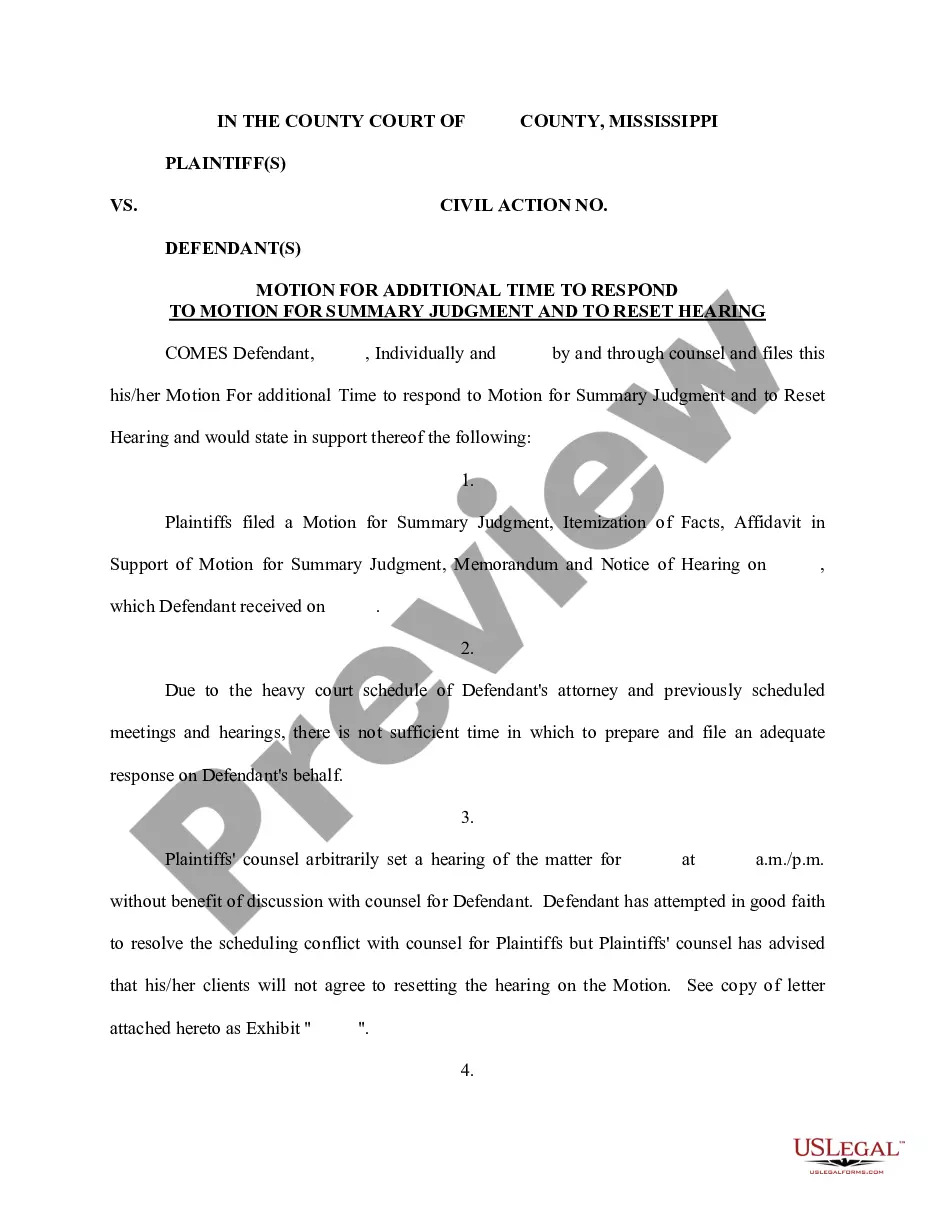

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

The Ohio Continuing Guaranty of Payment and Performance of all Obligations and Liabilities Due to Lessor from Lessee under Lease with Mortgage Securing Guaranty is a legal agreement in Ohio that ensures the continuous payment and fulfillment of various obligations and liabilities of the lessee to the lessor under a lease agreement with a mortgage securing guaranty. This type of guaranty is commonly used in commercial real estate transactions to provide additional security to lessors. Under this guaranty, the guarantor agrees to be held personally liable for any unpaid rent, fees, damages, or any other financial obligations that may arise from the lease agreement. The guarantor also guarantees the performance of all other obligations, such as property maintenance, repairs, and compliance with lease terms. The Ohio Continuing Guaranty of Payment and Performance of all Obligations and Liabilities Due to Lessor from Lessee under Lease with Mortgage Securing Guaranty may have various forms or types depending on the specific terms and conditions agreed upon by the parties involved. Some common variations include: 1. Limited Guaranty: This type of guaranty limits the guarantor's liability to a specific amount or a defined portion of the lessee's obligations. It provides a certain level of protection for the guarantor, limiting their exposure to potential losses. 2. Unconditional Guaranty: In an unconditional guaranty, the guarantor accepts full responsibility for the lessee's obligations without any limitations or conditions. This type of guaranty provides maximum security for the lessor, as the guarantor's liability is not restricted in any way. 3. Specific Performance Guaranty: A specific performance guaranty ensures that the lessee will fulfill specific obligations under the lease agreement, such as completing certain construction or renovation work outlined in the lease. This type of guaranty is often used when financial compensation alone may not adequately remedy a breach of contract. It is crucial for all parties involved in a lease agreement with a mortgage securing guaranty to thoroughly understand the specific terms and obligations outlined in the Ohio Continuing Guaranty. Consulting with legal professionals familiar with Ohio real estate laws and lease agreements is highly recommended ensuring compliance and mitigate any potential risks.