Agreements among family members for the settlement of an intestate's estate will be upheld in the absence of fraud and when the rights of creditors are met. Intestate means that the decedent died without a valid will. The termination of any family controversy or the release of a reasonable, bona fide claim in an intestate estate have been held to be sufficient consideration for a family settlement.

Ohio Agreement Between Heirs as to Division of Estate

Description

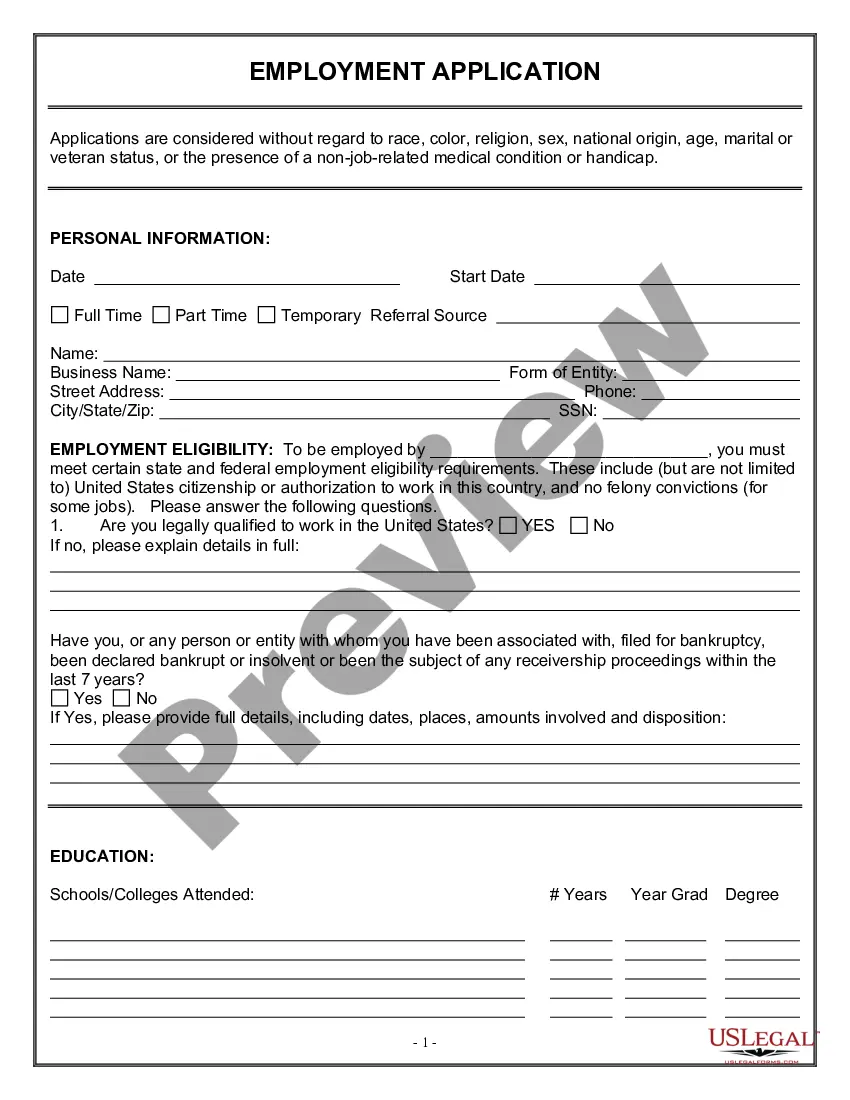

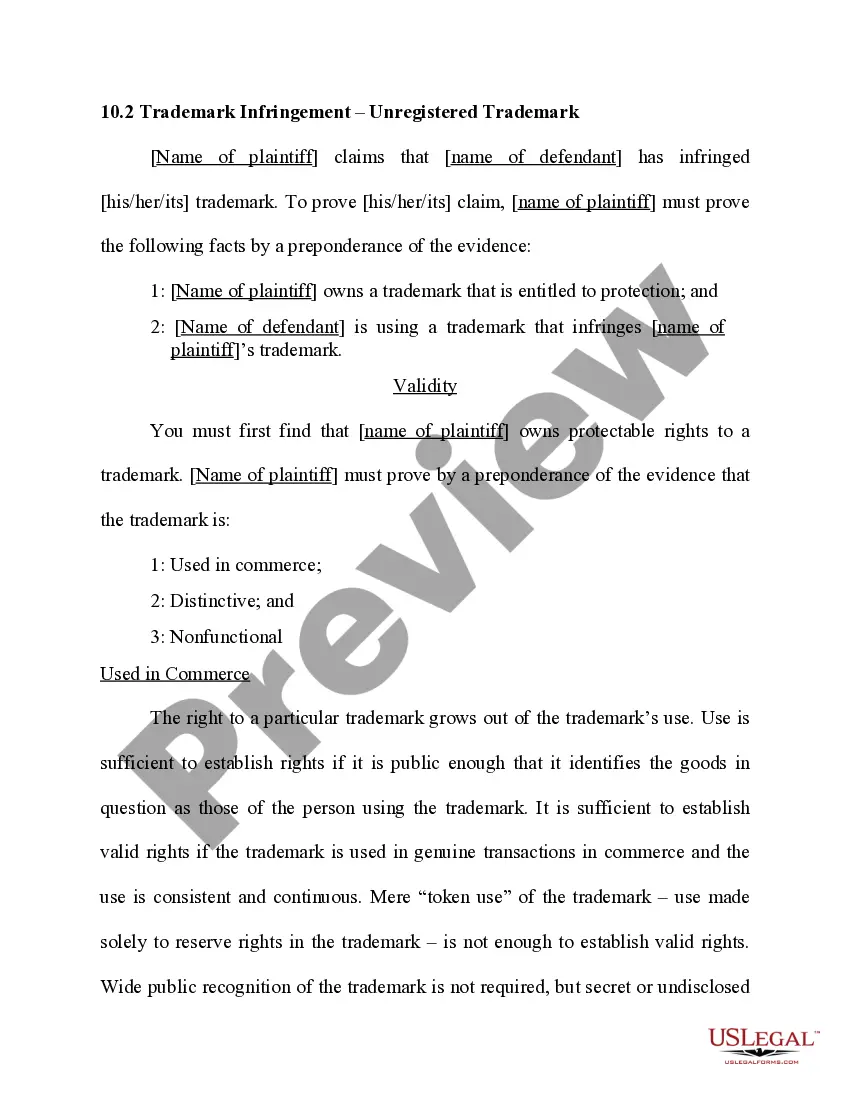

How to fill out Agreement Between Heirs As To Division Of Estate?

Discovering the right legitimate document design might be a battle. Obviously, there are a lot of web templates available on the net, but how do you find the legitimate form you require? Take advantage of the US Legal Forms internet site. The services gives thousands of web templates, like the Ohio Agreement Between Heirs as to Division of Estate, that you can use for organization and private demands. All of the types are examined by professionals and meet up with state and federal specifications.

When you are previously listed, log in to the account and click the Download option to get the Ohio Agreement Between Heirs as to Division of Estate. Make use of account to search through the legitimate types you have ordered in the past. Check out the My Forms tab of your own account and acquire one more version of the document you require.

When you are a whole new consumer of US Legal Forms, listed below are basic recommendations that you can stick to:

- Initially, make sure you have chosen the proper form to your city/county. You can look over the shape while using Preview option and look at the shape explanation to make certain this is the best for you.

- If the form is not going to meet up with your requirements, make use of the Seach industry to discover the right form.

- Once you are positive that the shape is proper, click on the Buy now option to get the form.

- Choose the rates strategy you desire and enter in the required information and facts. Make your account and pay for the transaction utilizing your PayPal account or bank card.

- Select the data file file format and download the legitimate document design to the system.

- Total, change and printing and sign the attained Ohio Agreement Between Heirs as to Division of Estate.

US Legal Forms will be the most significant local library of legitimate types that you can find a variety of document web templates. Take advantage of the company to download appropriately-created papers that stick to condition specifications.

Form popularity

FAQ

Seeking Legal Recourse If you believe that the executor is not living up to their duties, you have two legal options: petition the court or file a civil lawsuit.

Before the executor can finalize probate and close the estate, they must provide a final accounting that includes: An itemized list of the estate's assets. Any funds or property received by the estate during its administration.

(B)(1) Every administrator and executor, within six months after appointment, shall render a final and distributive account of the administrator's or executor's administration of the estate unless one or more of the following circumstances apply: (a) An Ohio estate tax return must be filed for the estate.

These rules are set forth in Chapter 2127 of the Ohio Revised Code, entitled ?Sale of Lands.? If the estate fiduciary wishes to sell the real estate by consent, he or she must obtain the consent of the surviving spouse and all of the beneficiaries of the will (or heirs if there is no will).

To fulfill the deceased's wishes, the executor can sell the property without the approval of all beneficiaries. However, the beneficiaries will stay informed throughout the process. When a will is valid, the estate executor is approved by the judge to oversee and make decisions regarding the deceased person's estate.

If the executor or administrator distributes any part of the assets of the estate within three months after the death of the decedent, the executor or administrator shall be personally liable only to those claimants who present their claims within that three-month period.

If there is no spouse and no children, the deceased's parents will inherit. More distant relatives?aunts, nephews, cousins of any degree, etc. ?are next in line if the deceased had no spouse, children, or parents. If the court cannot locate any living relatives, the state of Ohio will inherit the entire estate.

To the executor or administrator in writing, and to the probate court by filing with it a copy of the written claim that has been filed with the fiduciary, or. By sending a written claim by ordinary mail addressed to the decedent if it is actually received by the fiduciary within 6 months of the date of death.