The Ohio Bill of Transfer to a Trust is a legal document used in the state of Ohio to transfer ownership of assets or property to a trust. This document ensures that the assets mentioned in the trust agreement are properly titled in the name of the trust, allowing the appointed trustee to manage and distribute them according to the specifications outlined in the trust. The Ohio Bill of Transfer to a Trust is an essential component of estate planning and is commonly used to avoid probate and ensure a smooth transfer of assets upon the settler's death. By transferring assets to a trust, individuals can dictate who will receive their assets, how and when they will be distributed, and potentially minimize estate taxes. There are several types of Ohio Bill of Transfer to a Trust that can be utilized based on specific circumstances. These include: 1. Revocable Trust Bill of Transfer: This type of trust allows the settler to maintain control over the assets transferred to the trust during their lifetime. The settler has the ability to modify or revoke the trust, as well as change the beneficiaries or terms. 2. Irrevocable Trust Bill of Transfer: In contrast to a revocable trust, an irrevocable trust cannot be modified or revoked once established. The assets transferred to this type of trust are typically shielded from estate taxes and creditor claims, providing asset protection benefits. 3. Testamentary Trust Bill of Transfer: This type of trust is created through the settler's will and only takes effect upon their death. The assets are transferred to the trust after probate, and the trustee is responsible for managing the assets and distributing them to the beneficiaries according to the terms of the trust. 4. Special Needs Trust Bill of Transfer: This type of trust is designed to provide for individuals with disabilities or special needs without jeopardizing their eligibility for government benefits. The assets transferred to the trust are used to supplement their needs and enhance their quality of life. 5. Charitable Remainder Trust Bill of Transfer: This type of trust allows individuals to transfer assets to a trust, receive income from it during their lifetime, and then donate the remaining assets to a charitable organization upon their death. Overall, the Ohio Bill of Transfer to a Trust is a crucial legal document used to ensure the smooth transition of assets and property into a trust. By carefully considering the specific circumstances and goals, individuals can choose the appropriate type of trust and draft a comprehensive bill of transfer that aligns with their wishes and objectives.

Ohio Bill of Transfer to a Trust

Description

How to fill out Ohio Bill Of Transfer To A Trust?

If you wish to full, down load, or printing legitimate document layouts, use US Legal Forms, the greatest collection of legitimate types, that can be found on-line. Use the site`s basic and convenient lookup to find the documents you will need. Numerous layouts for company and person functions are categorized by types and suggests, or keywords and phrases. Use US Legal Forms to find the Ohio Bill of Transfer to a Trust in just a handful of mouse clicks.

When you are presently a US Legal Forms customer, log in to your bank account and click the Download button to find the Ohio Bill of Transfer to a Trust. You can even access types you in the past delivered electronically from the My Forms tab of the bank account.

Should you use US Legal Forms the very first time, follow the instructions under:

- Step 1. Be sure you have selected the form for the right metropolis/land.

- Step 2. Make use of the Review method to check out the form`s articles. Never forget to see the information.

- Step 3. When you are unhappy with the type, make use of the Search industry near the top of the display screen to find other variations of the legitimate type design.

- Step 4. Upon having discovered the form you will need, click on the Get now button. Pick the rates strategy you prefer and add your references to register on an bank account.

- Step 5. Process the deal. You may use your charge card or PayPal bank account to perform the deal.

- Step 6. Select the formatting of the legitimate type and down load it on your device.

- Step 7. Total, modify and printing or signal the Ohio Bill of Transfer to a Trust.

Each and every legitimate document design you buy is the one you have for a long time. You might have acces to each type you delivered electronically with your acccount. Go through the My Forms section and pick a type to printing or down load again.

Compete and down load, and printing the Ohio Bill of Transfer to a Trust with US Legal Forms. There are thousands of expert and status-specific types you may use for the company or person requirements.

Form popularity

FAQ

You can obtain a Transfer on Death (TOD) form in Ohio through various official channels. Many people find it convenient to download the Ohio Bill of Transfer to a Trust form directly from online legal services like USLegalForms. This platform provides easy access to essential legal documents, ensuring you have the correct form for your needs. Simply visit their website, select the appropriate form, and follow the instructions to complete your transfer process smoothly.

Yes, you can transfer a mortgaged home into a trust, including the terms of the Ohio Bill of Transfer to a Trust. However, it is essential to consider the mortgage agreement, as some loans include a due-on-sale clause that could be triggered by such a transfer. Working with a legal expert can help navigate these complexities and ensure the transfer complies with all requirements, allowing you to protect your asset.

Transferring assets from one trust to another involves drafting a trust transfer document. This document outlines the assets being transferred and must comply with the terms of both trusts. It is advisable to work with an attorney experienced in the Ohio Bill of Transfer to a Trust during this process. Achieving this ensures a seamless transition while adhering to legal requirements.

Generally, transferring assets from a trust is not taxable, as long as the trust is revocable. However, tax implications can vary depending on the specific circumstances and type of trust involved. It's crucial to consult professionals who understand the Ohio Bill of Transfer to a Trust for personalized guidance. They can help clarify any tax obligations you may encounter.

One of the most significant mistakes parents make is failing to fund the trust properly. Setting up a trust is only the first step; you must also transfer assets into it. Without this critical action, the trust does not serve its purpose, and assets may go through probate. Understanding the intricacies of the Ohio Bill of Transfer to a Trust can help avoid this common pitfall.

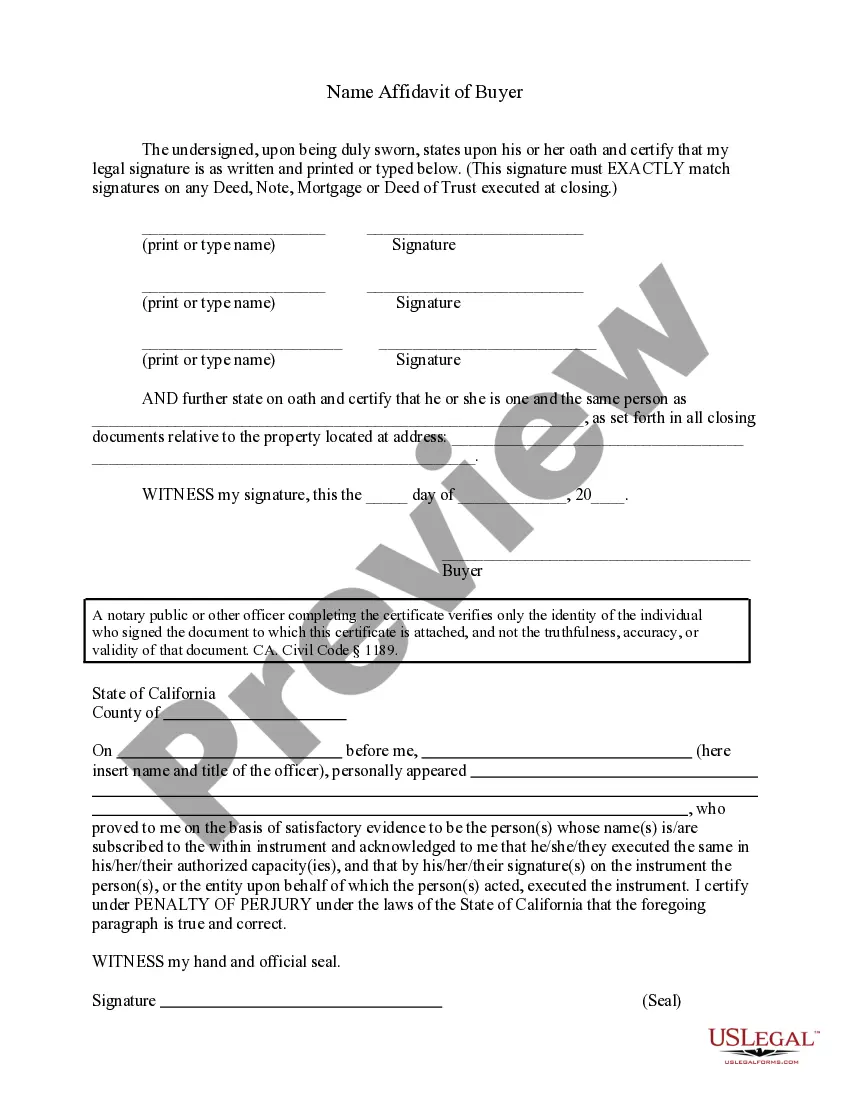

The bill of transfer for a trust is a legal document or method that allows the transfer of assets to a trust. Specifically, the Ohio Bill of Transfer to a Trust outlines the procedures and requirements for effectively transferring ownership. This legal framework secures the beneficiary's interests and ensures compliance with Ohio state laws. Always consult a legal expert when drafting or executing this document.

To transfer assets into a trust, you need to formally change the title of each asset to the name of the trust. This may include real estate, bank accounts, and investments. It's essential to work with a professional familiar with the Ohio Bill of Transfer to a Trust to ensure proper documentation and execution. This process ensures that your assets are safeguarded and managed according to your wishes.

Choosing between a transfer on death and a trust often depends on your specific needs. A trust, such as the Ohio Bill of Transfer to a Trust, provides more control over how your assets are managed and distributed after your passing. Meanwhile, a transfer on death is simpler and does not require ongoing management. However, trusts offer more privacy and can help avoid probate.

A bill of transfer in a trust is a legal document used to convey property into a trust. Specifically, the Ohio Bill of Transfer to a Trust serves this purpose, ensuring that the property is legally transferred from the owner to the trust. It details the property and the parties involved, helping facilitate a smooth transition of assets.

Section 5808.13 of the Ohio Revised Code outlines the legal provisions concerning the transfer of property into trusts. This section provides clarity on the Ohio Bill of Transfer to a Trust and lays down essential guidelines for effective property management and transfer. Understanding these legalities is crucial for anyone considering this route.

Interesting Questions

More info

Manners Video Resources View Legalities Transfer Your Personal Information Get a Personal Statement Find a Local Attorney Search.