Barter is the trading of goods or services directly for other goods or services, without using money or any other similar unit of account or medium of exchange. Bartering is sometimes used among business as the method for the exchange of goods and services. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Ohio Bartering Contract or Exchange Agreement

Description

How to fill out Bartering Contract Or Exchange Agreement?

Are you in a situation where you need documentation for potential organizational or specific aims almost every day.

There are many trustworthy document templates available online, but finding versions you can trust is challenging.

US Legal Forms offers a vast selection of document templates, such as the Ohio Bartering Contract or Exchange Agreement, which can be filled out to meet state and federal requirements.

If you find the correct document, click Get now.

Choose the pricing plan you prefer, complete the necessary information to set up your account, and pay for the transaction using your PayPal or credit card.

- If you are currently familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you may download the Ohio Bartering Contract or Exchange Agreement template.

- If you do not possess an account and wish to start using US Legal Forms, follow these steps.

- Obtain the document you need and ensure it is for the correct city/county.

- Use the Review button to examine the document.

- Check the description to confirm you have selected the right document.

- If the document does not meet your requirements, use the Search area to find the document that fulfills your needs.

Form popularity

FAQ

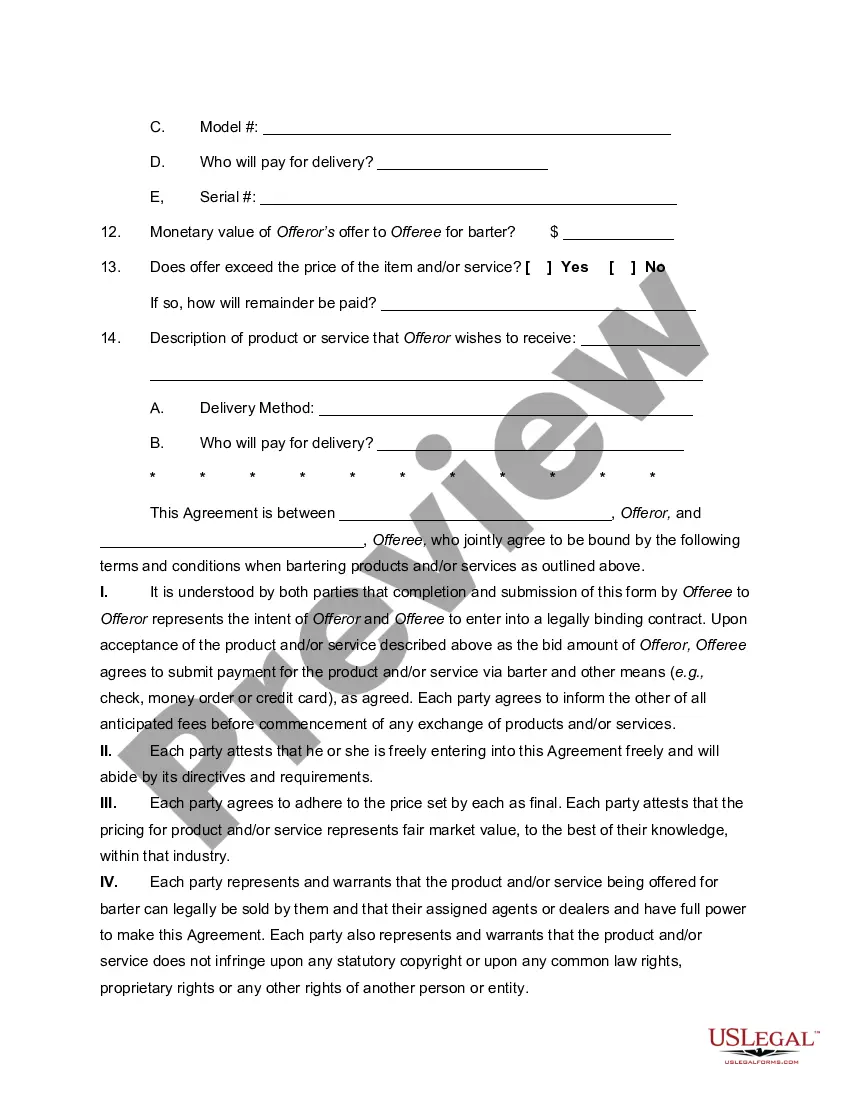

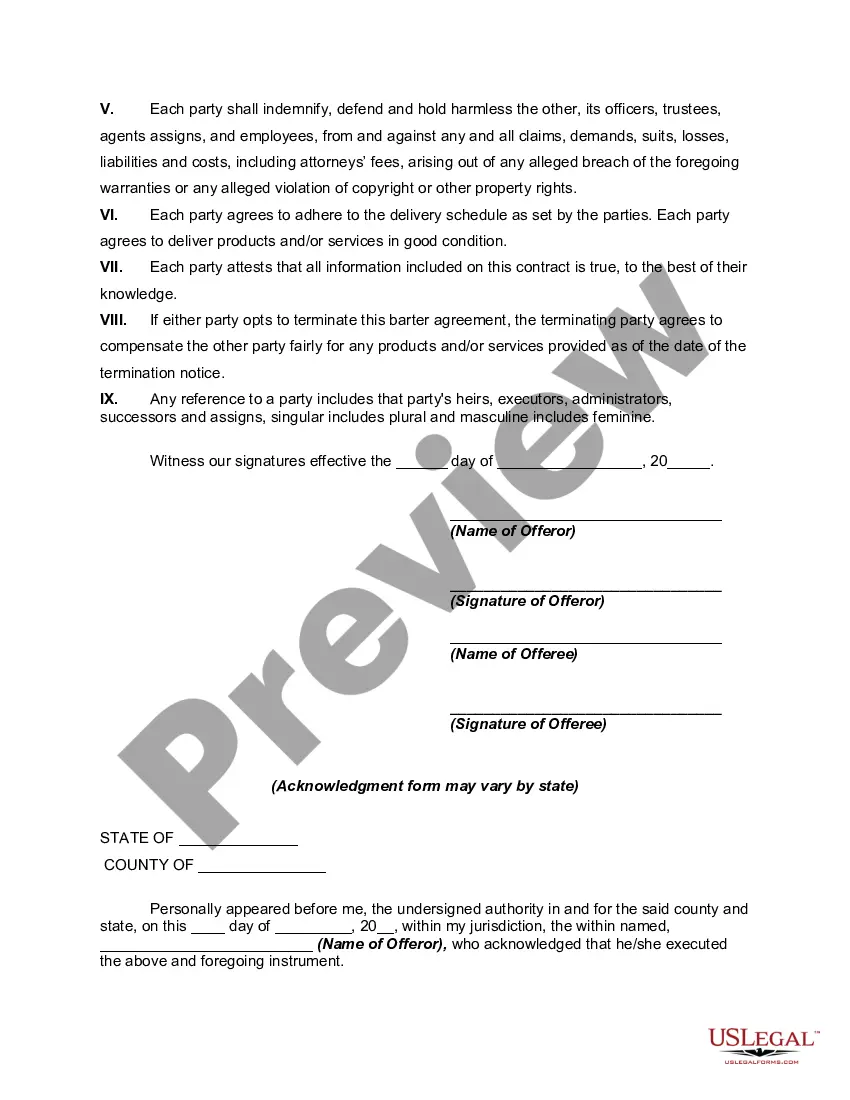

To write a barter agreement, start by clearly outlining the goods or services being exchanged and their agreed-upon values. Ensure both parties sign the Ohio Bartering Contract or Exchange Agreement to formalize the arrangement. This contract should also include terms like the date of the exchange and any other relevant conditions to avoid misunderstandings.

Bartering can be considered a business activity if it is done regularly and with the intent of making a profit. If you frequently engage in barter transactions, it's essential to treat them like a business operation. An Ohio Bartering Contract or Exchange Agreement can help you maintain clear records and comply with any applicable laws and reporting requirements.

The rules for bartering generally include the need for an agreement between the parties involved and compliance with tax regulations. In Ohio, an Ohio Bartering Contract or Exchange Agreement can outline the specifics of the exchange, including what is being traded and its value. Always ensure that both parties are satisfied with the terms to avoid disputes.

A contract of barter or exchange is a formal agreement between two parties detailing the goods or services each party will provide. This Ohio Bartering Contract or Exchange Agreement defines the terms, value, and conditions of the exchange. It serves as a clear record that protects the interests of both parties involved.

Bartering is considered a form of income under the tax laws. When you engage in a barter transaction, you must report the fair market value of what you received in an Ohio Bartering Contract or Exchange Agreement. Proper documentation helps ensure compliance with tax regulations and simplifies the reporting process.

Claiming bartering on your taxes requires you to report the fair market value of the goods or services received in the exchange. According to the IRS, you should include this value as income on your tax return. An Ohio Bartering Contract or Exchange Agreement can provide you with a record of the value exchanged, which can be useful during tax season.

To record a barter transaction, both parties should document the details of the exchange in an Ohio Bartering Contract or Exchange Agreement. This contract should state the value of the goods or services exchanged, along with the date of the transaction. Keeping accurate records can help you track the value exchanged and assist in your financial documentation.

To write a barter agreement, start by outlining the specifics of the goods or services involved. Include the names of both parties, the agreed values, and a timeline for the exchange. Making use of an Ohio Bartering Contract or Exchange Agreement template can simplify this process and ensure all necessary details are included.

The basics of bartering involve exchanging goods or services that you own for things you need. It's essential first to agree on the value of what each party offers. To formalize the agreement, you should utilize an Ohio Bartering Contract or Exchange Agreement to prevent any potential disputes.

Yes, the IRS does allow bartering, but it requires you to report the fair market value of the goods or services you received. All barter transactions should be properly documented, often through an Ohio Bartering Contract or Exchange Agreement, to ensure compliance with tax laws.