Ohio Lease Purchase Agreement for Business: A Detailed Overview The Ohio Lease Purchase Agreement for Business, also known as a lease-to-own agreement or rent-to-own agreement, is a legally binding contract between a landlord, or lessor, and a tenant, or lessee, in the state of Ohio. This agreement is designed to provide businesses with an alternative method to acquire assets or property, allowing them to lease the property for a specified period with the option to purchase it at the end. The Ohio Lease Purchase Agreement for Business offers various benefits to both parties involved and can be customized to fit specific business needs. Keywords: Ohio, Lease Purchase Agreement, Business, rent-to-own agreement, landlord, lessor, tenant, lessee, assets, property, lease, purchase, benefits, customized, needs. Types of Ohio Lease Purchase Agreement for Business: 1. Commercial Real Estate Lease Purchase Agreement: This type of agreement is suitable for businesses looking to acquire commercial real estate such as office spaces, retail stores, warehouses, or industrial buildings. It allows the business to lease the property for a predetermined period, during which they have the option to purchase it at an agreed-upon price. 2. Equipment Lease Purchase Agreement: Ideal for businesses in need of specific equipment or machinery, this agreement allows them to lease the equipment from the lessor for a specified period. At the end of the lease term, the lessee can choose to purchase the equipment at a predetermined price, usually with a portion of the lease payments applied as a down payment. 3. Vehicle Lease Purchase Agreement: This type of lease purchase agreement is commonly used by businesses that require vehicles for their operations. Whether it's a fleet of cars, trucks, or specialized vehicles, this agreement enables businesses to lease the vehicles with the option to buy them at the end of the lease term. 4. Business Asset Lease Purchase Agreement: Businesses in need of other assets, such as machinery, technology, or furniture, can utilize this type of Ohio Lease Purchase Agreement for Business. It allows the lessee to lease the assets for a specific period and provides them with the option to acquire ownership at the end of the lease, typically at a predetermined price. Regardless of the type of Ohio Lease Purchase Agreement for Business, it is essential to have clearly defined terms and conditions regarding the lease period, purchase price, frequency of payments, maintenance responsibilities, and any additional provisions required to protect the interests of both parties. In summary, the Ohio Lease Purchase Agreement for Business offers businesses a flexible and viable option to acquire assets, property, or equipment without an immediate large outlay of capital. By understanding the various types of agreements available, businesses can select the most suitable option to meet their specific needs while enjoying the potential advantages of leasing with the option to purchase.

Ohio Lease Purchase Agreement for Business

Description

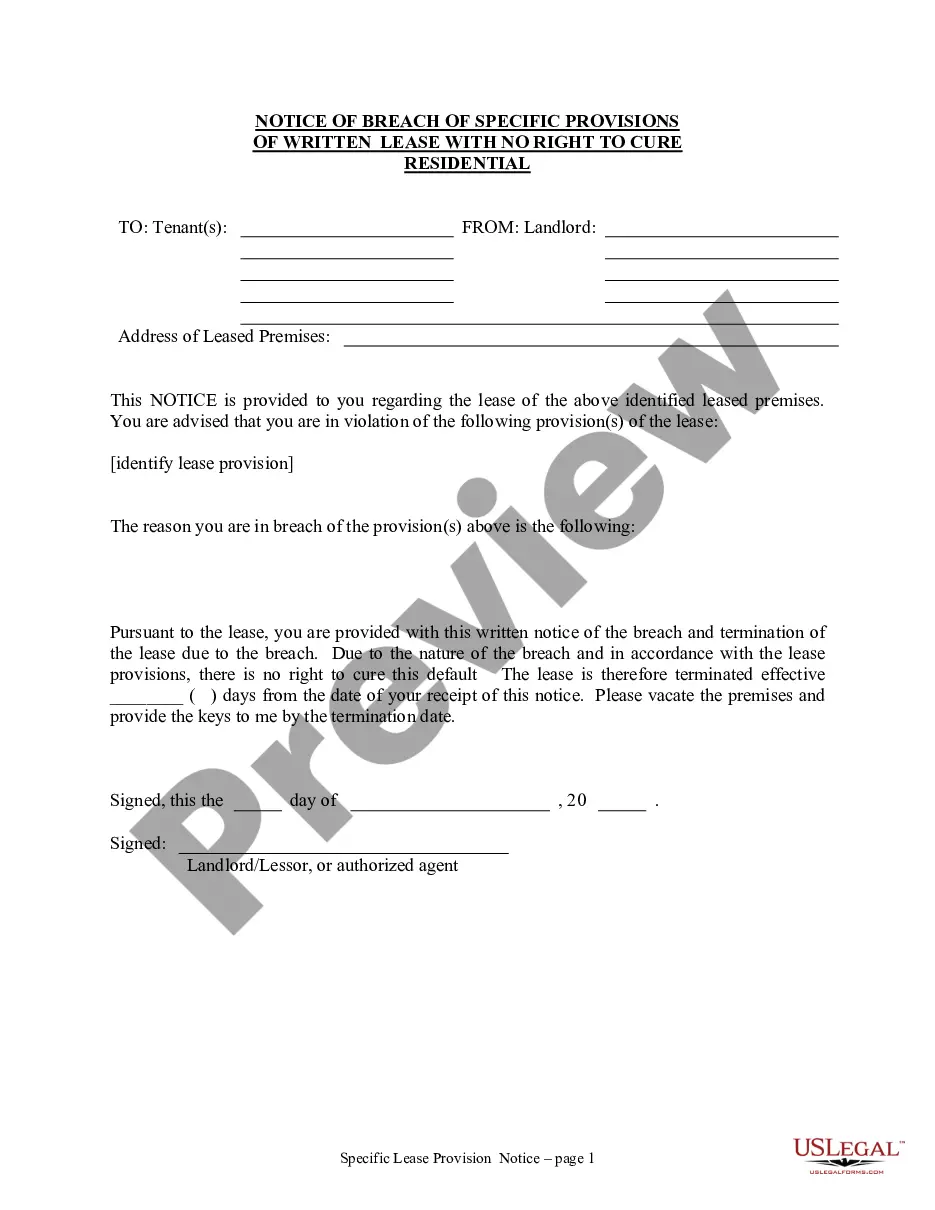

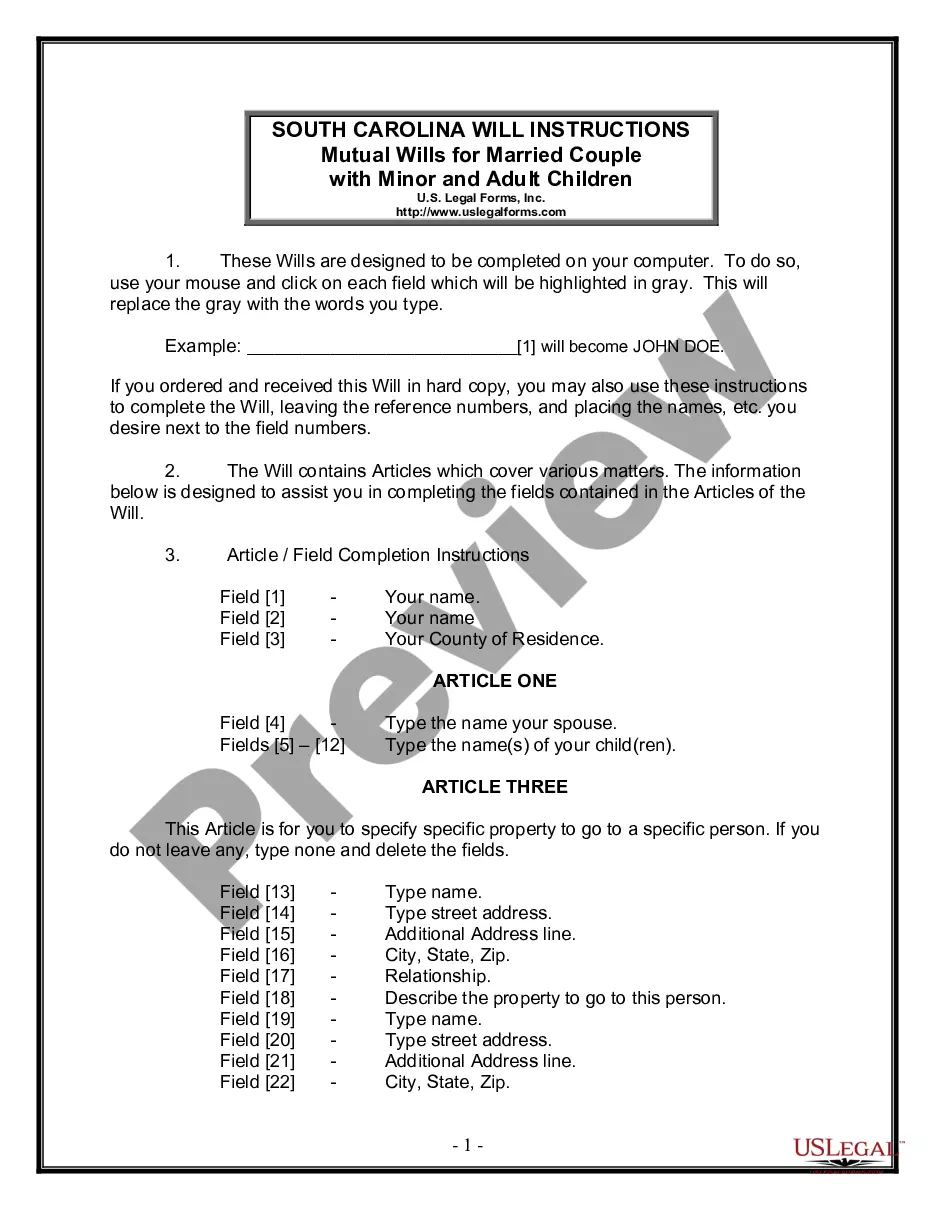

How to fill out Ohio Lease Purchase Agreement For Business?

It is possible to devote time on the web attempting to find the legitimate papers format that meets the state and federal needs you will need. US Legal Forms gives 1000s of legitimate varieties that happen to be analyzed by professionals. You can actually obtain or printing the Ohio Lease Purchase Agreement for Business from my assistance.

If you already possess a US Legal Forms bank account, you are able to log in and then click the Down load button. After that, you are able to comprehensive, revise, printing, or indicator the Ohio Lease Purchase Agreement for Business. Each and every legitimate papers format you acquire is yours eternally. To obtain an additional copy of any obtained kind, proceed to the My Forms tab and then click the related button.

Should you use the US Legal Forms site initially, adhere to the simple recommendations beneath:

- Initial, make certain you have chosen the best papers format for the state/town that you pick. See the kind information to ensure you have chosen the proper kind. If readily available, make use of the Preview button to search with the papers format too.

- If you would like find an additional model in the kind, make use of the Research industry to obtain the format that meets your needs and needs.

- Once you have located the format you desire, just click Purchase now to proceed.

- Select the rates prepare you desire, key in your references, and sign up for your account on US Legal Forms.

- Full the deal. You should use your Visa or Mastercard or PayPal bank account to pay for the legitimate kind.

- Select the structure in the papers and obtain it in your device.

- Make modifications in your papers if required. It is possible to comprehensive, revise and indicator and printing Ohio Lease Purchase Agreement for Business.

Down load and printing 1000s of papers templates making use of the US Legal Forms web site, which provides the largest variety of legitimate varieties. Use specialist and condition-distinct templates to handle your company or person requires.

Form popularity

FAQ

A business sale agreement is a legal document that describes and records the price and other details when a business owner sells the business. It is the final step to transfer ownership after negotiations for the transaction have been completed.

Parts of an Asset Purchase AgreementRecitals. The opening paragraph of an asset purchase agreement includes the buyer and seller's name and address as well as the date of signing.Definitions.Purchase Price and Allocation.Closing Terms.Warranties.Covenants.Indemnification.Governance.More items...

The simple answer is YES. You can write your own contracts. There is no requirement that they must be written by a lawyer. There is no requirement that they have to be a certain form or font.

When your lease purchase agreement reaches the end of its term, you must take ownership of the vehicle. There is no option to return it. You'll be required to pay the final balloon payment, and then the car will be yours. You will no longer have any obligations to the leasing company.

A Business Purchase Agreement is a contract used to transfer the ownership of a business from a seller to a buyer. It includes the terms of the sale, what is or is not included in the sale price, and optional clauses and warranties to protect both the seller and the purchaser after the transaction has been completed.

How to Write a Business Purchase Agreement?Step 1 Parties and Business Information. A business purchase agreement should detail the names of the buyer and seller at the start of the agreement.Step 2 Business Assets.Step 3 Business Liabilities.Step 4 Purchase Price.Step 6 Signatures.

Any purchase agreement should include at least the following information:The identity of the buyer and seller.A description of the property being purchased.The purchase price.The terms as to how and when payment is to be made.The terms as to how, when, and where the goods will be delivered to the purchaser.More items...?

In an asset purchase, the buyer will only buy certain assets of the seller's company. The seller will continue to own the assets that were not included in the purchase agreement with the buyer. The transfer of ownership of certain assets may need to be confirmed with filings, such as titles to transfer real estate.

Provisions of an APA may include payment of purchase price, monthly installments, liens and encumbrances on the assets, condition precedent for the closing, etc. An APA differs from a stock purchase agreement (SPA) under which company shares, title to assets, and title to liabilities are also sold.

Know How to Fill Out the Business Bill of SaleDate of Sale.Buyer's name and address.Seller's name and address.Business name and details, which include: State of incorporation. Address of the business's main headquarters. Assets, shares, personal property and other interests included with the company.

Interesting Questions

More info

Direct Sellers and Buyers. Selling Process Brokers and Buyers. Direct Sellers and Buyers. Small Business Selling Process Brokers and Buyers. Direct Sellers and Buyers. Direct Buyers and Sellers. Direct Seller and Buyers. Small Business Sellers and Buyers. How-to Guides Flexible Business Lending Guide Lending 101: Lending is a great way for entrepreneurs to grow their business. With our step-by-step guide — the most comprehensive guide to using a business loan — you will be able to learn which areas to focus on and which areas to avoid. We go into great detail about all the common lending products on the market, and how to use each one to get the best return on your loan. How does business lending work? Business loans are easy to obtain. Our guide takes you step-by-step through the process of getting a new business debt and financing, as well as explaining the common loan products and how to apply for each one. Get Started Quickly — Start with our guide.