Ohio Nonresidential Simple Lease

Description

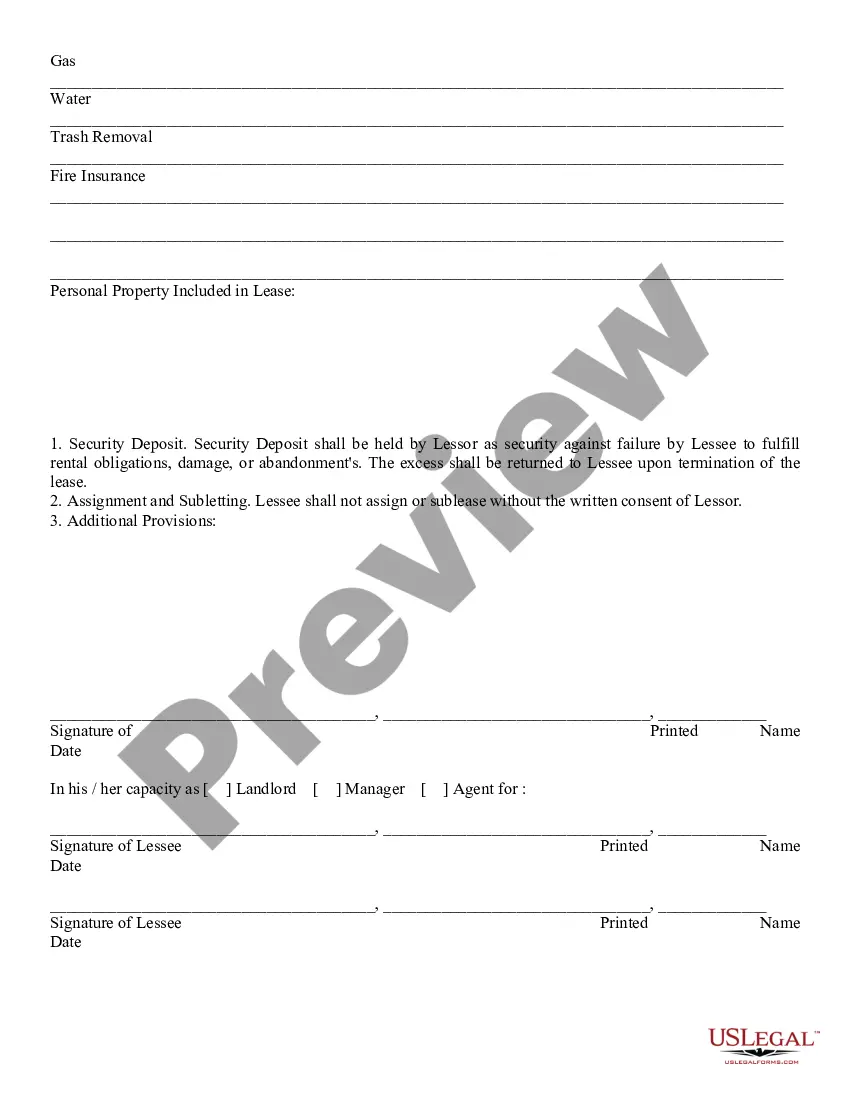

How to fill out Nonresidential Simple Lease?

It is feasible to spend hours online trying to locate the official document template that complies with the state and federal regulations you require.

US Legal Forms offers thousands of legal forms that are evaluated by professionals.

You can easily download or print the Ohio Nonresidential Simple Lease from the service.

If available, use the Review button to preview the document template as well.

- If you have a US Legal Forms account, you can Log In and click on the Download button.

- After that, you can complete, modify, print, or sign the Ohio Nonresidential Simple Lease.

- Every legal document template you acquire is yours permanently.

- To obtain another copy of a previously purchased form, visit the My documents tab and click on the relevant button.

- If you are accessing the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the state/city of your choice.

- Review the form outline to confirm you have chosen the appropriate form.

Form popularity

FAQ

Evicting someone in Ohio without a lease can be challenging, but it is possible. First, you must establish that there is no formal agreement, which typically means proving that the tenant is an at-will occupant. You will need to provide a written notice to the tenant, stating your intention to terminate the occupancy. Since dealing with evictions can be complex, consider utilizing resources like the US Legal Forms platform for guidance on managing nonresidential simple leases and complying with the legal process.

If your husband is not on the lease, you may have legal grounds to ask him to leave, but the situation can be complex. It’s advisable to consider marital laws and any local regulations that may apply. Before taking action, understanding your rights and responsibilities is essential. An Ohio Nonresidential Simple Lease could provide insight into how lease agreements function in non-residential contexts.

Technically, yes, you can live somewhere without being on the lease, but it may not always be the best option. This can complicate matters, especially in the event of a dispute with the landlord. It's beneficial to have a formal agreement in place for peace of mind. An Ohio Nonresidential Simple Lease could clarify the situation if you’re considering a business-related arrangement.

residential property is a type of real estate used for business activities, rather than for housing. This can include warehouses, factories, and business offices. These properties require different lease agreements compared to residential properties. An Ohio Nonresidential Simple Lease provides a clear framework for these types of properties.

An example of a non-residential real property includes commercial buildings, office spaces, or retail stores. These properties are meant for business purposes and are not intended for living. Understanding the differences is crucial, especially when considering agreements. Using an Ohio Nonresidential Simple Lease can ensure all legal requirements are met for non-residential properties.

Yes, someone can live with you in Ohio without being on the lease. However, it's advisable to check your specific lease agreement for any restrictions regarding additional occupants. This situation can create issues, especially if the landlord discovers the arrangement. An Ohio Nonresidential Simple Lease can help define who can occupy the space to avoid misunderstandings.

In Ohio, it is not illegal to live in a rental property without being on the lease. However, it can lead to complications, especially if the landlord is unaware or if disputes arise. It's important to understand that the lease may grant certain rights and responsibilities to the listed tenants. For nonresidential spaces, utilizing an Ohio Nonresidential Simple Lease can clarify these terms.

No, a lease in Ohio does not have to be recorded to be valid. However, recording an Ohio Nonresidential Simple Lease can reinforce your legal rights, especially in case of disputes. It serves as public notice of your interest in the property. To make this process simpler, consider using US Legal Forms to prepare and record your lease properly.

In most cases, you do not need a specific license to rent out residential properties in Ohio. However, certain local jurisdictions may have their own regulations. If you're renting out nonresidential space under an Ohio Nonresidential Simple Lease, ensure you comply with any local requirements. US Legal Forms can provide you with the necessary documents and guidance to stay compliant.

In Ohio, recording a lease is not a requirement. However, for an Ohio Nonresidential Simple Lease, it is often a good idea to record the document to establish priority among competing interests. Recording can prevent disputes regarding the lease's validity. By using US Legal Forms, you can easily navigate the process of creating and recording your lease.