A joint venture is a relationship between two or more people who combine their labor or property for a single business undertaking. They share profits and losses equally, or as otherwise provided in the joint venture agreement. The single business undertaking aspect is a key to determining whether or not a business entity is a joint venture as opposed to a partnership.

A joint venture is very similar to a partnership. In fact, some States treat joint ventures the same as partnerships with regard to partnership statutes such as the Uniform Partnership Act. The main difference between a partnership and a joint venture is that a joint venture usually relates to the pursuit of a single transaction or enterprise even though this may require several years to accomplish. A partnership is generally a continuing or ongoing business or activity. While a partnership may be expressly created for a single transaction, this is very unusual. Most Courts hold that joint ventures are subject to the same principles of law as partnerships.

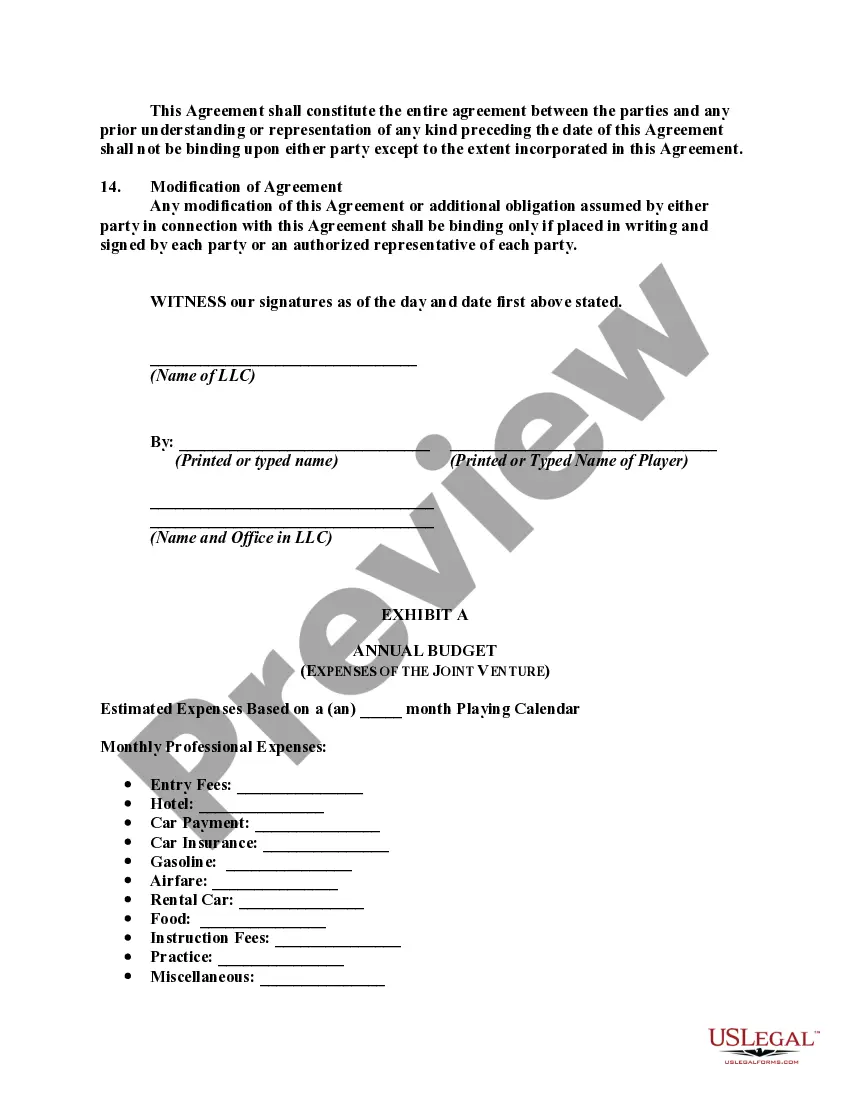

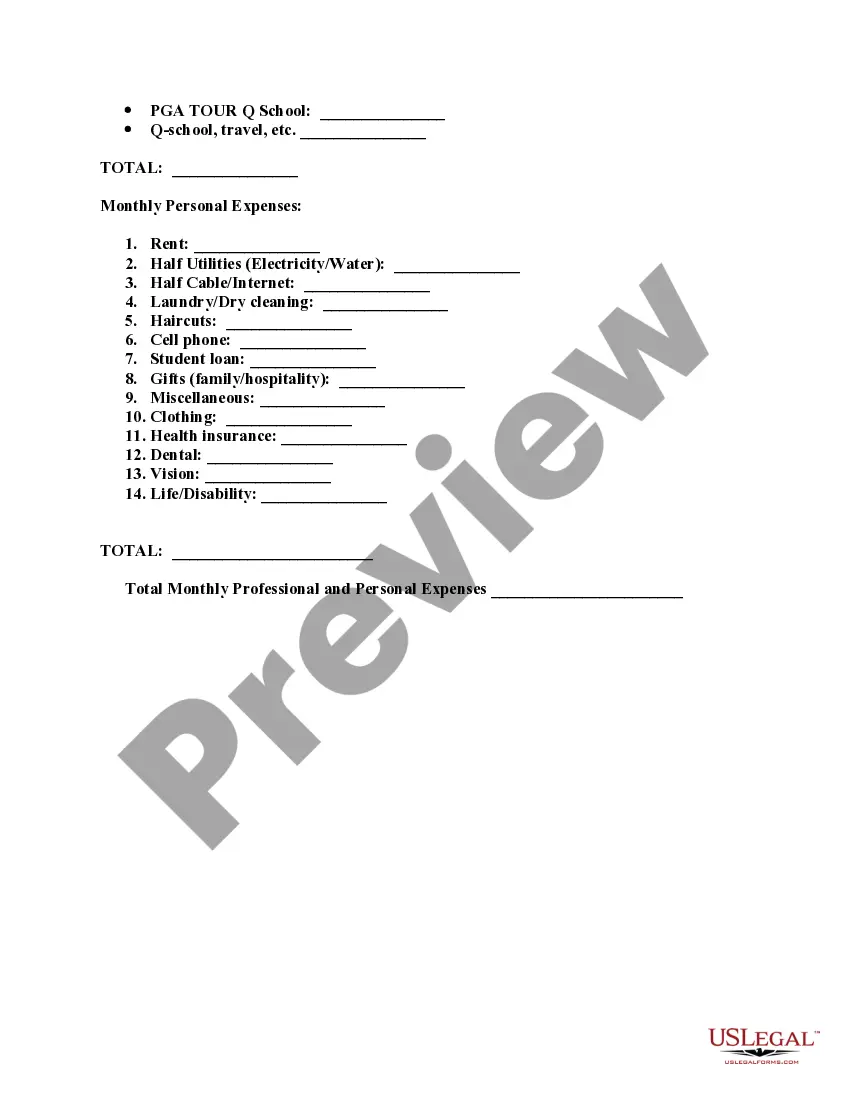

The Ohio Joint Venture Agreement between a Limited Liability Company (LLC) and Professional Golfer to Sponsor and Provide Funds is a legally binding document that outlines the terms and conditions of a partnership formed between an LLC and a professional golfer. This agreement establishes the structure and responsibilities of the joint venture, ensuring transparency and effective collaboration between the parties involved. Keywords: Ohio, Joint Venture Agreement, Limited Liability Company (LLC), Professional Golfer, Sponsor, Provide Funds. 1. Overview: The Ohio Joint Venture Agreement between an LLC and a Professional Golfer to Sponsor and Provide Funds is designed to establish a mutually beneficial partnership in the field of professional golf. This agreement ensures that both the LLC and the professional golfer have a clear understanding of their roles, financial obligations, and expectations. 2. Types of Joint Venture Agreements: There can be various types of Ohio Joint Venture Agreements between an LLC and a Professional Golfer to Sponsor and Provide Funds. These agreements can differ based on the specific terms negotiated between the parties. Common examples include profit-sharing joint ventures, marketing and sponsorship joint ventures, and event-specific joint ventures. Each type of joint venture agreement will have its unique focus and objectives. 3. Purpose: The primary purpose of the Ohio Joint Venture Agreement is to combine the resources, expertise, and networks of both parties to achieve common goals. The LLC provides financial support, sponsorship, marketing, and operational assistance to the professional golfer, enabling them to enhance their career and maximize their potential both on and off the golf course. 4. Terms and Conditions: The agreement outlines the specific terms and conditions agreed upon by the LLC and the professional golfer. It includes provisions related to profit sharing, sponsorship obligations, fund allocation, financial reporting, decision-making processes, liability limitations, and dispute resolution mechanisms. These terms ensure that both parties are protected and have a clearly defined framework to operate within. 5. Financial Aspects: The Ohio Joint Venture Agreement clearly defines the financial arrangements between the LLC and the professional golfer. It specifies the amount of funds the LLC will provide to the golfer, the method and frequency of fund disbursement, and the golfer's obligations regarding financial reporting. This agreement may also address profit sharing, with the LLC entitled to a percentage of the golfer's earnings as a return on their investment. 6. Sponsorship and Marketing: The joint venture agreement may include provisions related to sponsorship and marketing activities. It sets out the LLC's obligations to promote the professional golfer, secure sponsorships, manage branding, and coordinate marketing efforts. The golfer may have certain responsibilities, such as participating in promotional events, wearing specified logos, or endorsing products or services. 7. Duration and Termination: The Ohio Joint Venture Agreement has a defined duration, specifying the start and end dates of the joint venture. It may also outline the circumstances under which the agreement can be terminated or extended. Common termination triggers could include breaches of contract, failure to meet financial obligations, or mutual agreement. In conclusion, the Ohio Joint Venture Agreement between a Limited Liability Company and Professional Golfer to Sponsor and Provide Funds is a crucial contract that governs the partnership between the parties. It lays out the responsibilities, financial arrangements, and expectations of both the LLC and the professional golfer, ensuring a collaborative and successful joint venture in the world of professional golf.