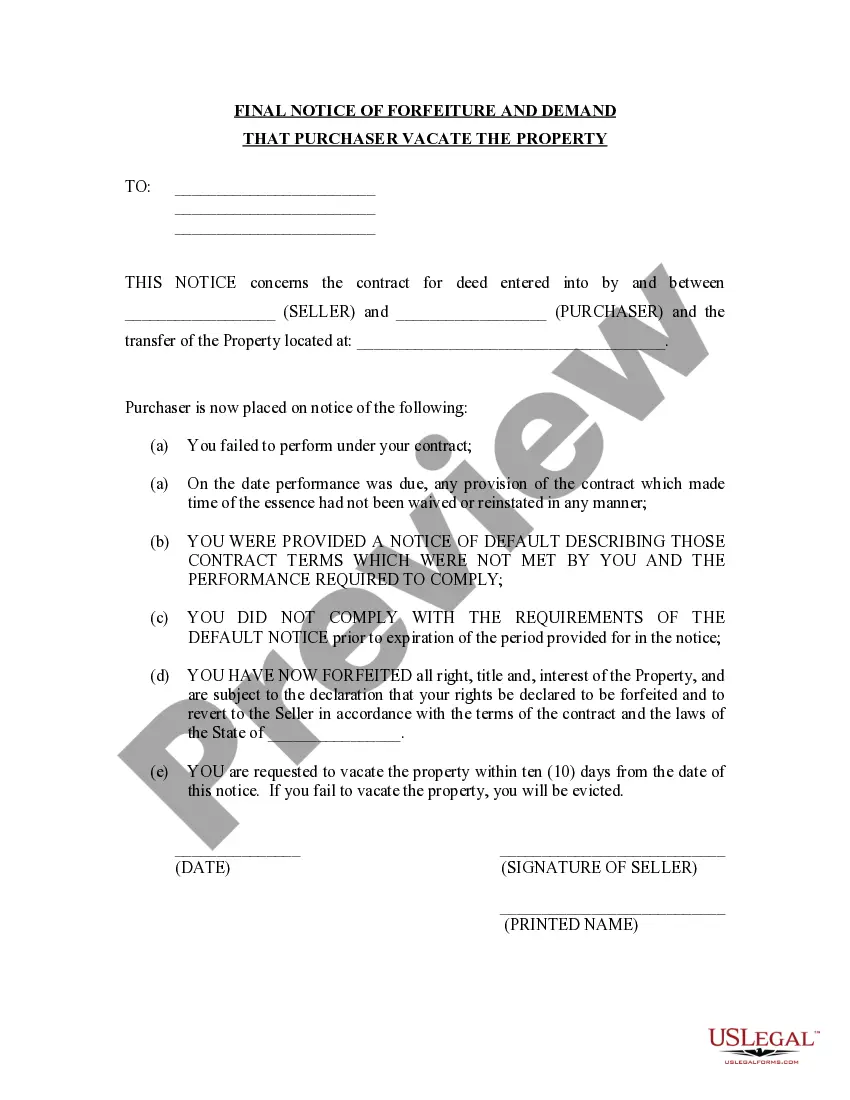

The Ohio Sale of Deceased Partner's Interest refers to a legal process that takes place when a partner in a business passes away and their ownership stake needs to be transferred or sold. This ensures a smooth transition of the deceased partner's interest to the remaining partners or other parties involved. In Ohio, there are a few different types of sales that may occur when dealing with a deceased partner's interest: 1. Assignment or Transfer: In this type of sale, the interest of the deceased partner is assigned or transferred to the surviving partners. This allows the business to continue operating without disruption, as the surviving partners gain the deceased partner's share of ownership. 2. Sale to Remaining Partners: In some cases, the surviving partners may decide to purchase the deceased partner's interest. This can be done through negotiations and a buyout agreement, which may involve determining the fair market value of the partner's interest and establishing payment terms. 3. Sale to Third Parties: If the remaining partners are not interested or capable of purchasing the deceased partner's interest, it can be sold to an external party. This process often involves finding a buyer who is willing to purchase the interest at a fair price, potentially through advertising or networking within the industry. 4. Liquidation: In certain situations, it may be in the best interest of the business to liquidate the deceased partner's interest. This means selling off the partner's portion of the business assets, paying off any liabilities, and distributing the remaining funds or assets to the partner's estate or beneficiaries. It is important to note that the process of the Ohio Sale of Deceased Partner's Interest may involve legal complexities and potential disputes. A thorough understanding of partnership agreements, business valuation, and Ohio laws regarding partnerships is crucial. Consultation with an attorney specializing in business law or estate planning is highly recommended ensuring compliance and a smooth transition during this process.

Ohio Sale of Deceased Partner's Interest

Description

How to fill out Ohio Sale Of Deceased Partner's Interest?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a broad selection of legal form templates that you can download or print.

By utilizing the website, you can obtain thousands of forms for both business and personal use, organized by categories, states, or keywords. You will find the latest versions of forms, such as the Ohio Sale of Deceased Partner's Interest, within minutes.

If you already have a subscription, Log In and download the Ohio Sale of Deceased Partner's Interest from the US Legal Forms library. The Download button will appear on every form you view. You can access all previously downloaded forms in the My documents tab of your account.

Process the transaction. Use your credit card or PayPal account to finalize the transaction.

Select the format and download the form onto your device. Edit. Complete, modify, print, and sign the downloaded Ohio Sale of Deceased Partner's Interest. Every template you add to your account has no expiration date and belongs to you forever. Therefore, if you wish to download or print another copy, simply go to the My documents section and click on the form you need. Access the Ohio Sale of Deceased Partner's Interest with US Legal Forms, the most comprehensive library of legal document templates. Utilize a vast array of professional and state-specific templates that meet your business or personal needs and requirements.

- If you are using US Legal Forms for the first time, here are easy steps to get you started.

- Ensure you have selected the correct form for your region/state. Click the Review button to examine the form's details.

- Check the form description to confirm that you have picked the right one.

- If the form doesn’t meet your needs, use the Search field at the top of the page to find the suitable one.

- When you are satisfied with the form, confirm your choice by clicking the Purchase now button.

- Next, select the pricing plan you prefer and provide your information to register for an account.

Form popularity

FAQ

A partner may acquire an interest in a partnership in a variety of ways. For example, the partner may purchase his interest from an existing partner. Like any other asset, a partnership interest may be acquired through a gift or an inheritance.

Retirement accounts held by an Ohio resident are an asset that is subject to income tax. The beneficiary of an IRA or a 401(K) account will have to pay income tax on money they withdraw. Some of these plans may have after-tax contributions, and these would not be taxed upon withdrawal.

Unlike other states, like Colorado, which require a will to be submitted to probate within days of the death, or Pennsylvania, which has a criminal statute for failing to submit a will for probate, Ohio has neither a strict time limit nor a criminal penalty for failing to probate a will.

One of the most common ways to avoid probate is by using a trust. A trust creates a separate legal entity that owns your assets and is managed by a trustee. By naming yourself as the trustee of a living trust, you can still manage the assets that have been placed in the trust.

No probate at all is necessary if the estate is worth less than $5,000 or the amount of the funeral expenses. In that case, anyone (except the surviving spouse) who has paid or is obligated to pay those expenses may ask the court for a summary release from administration.

person partnership does not terminate upon a partner's death if the deceased partner's successor in interest (usually the estate) continues to share in the partnership's profits or losses (Regs. Sec. 1. 7081(b)(1)(I)).

Settling an Estate in OhioThe will is presented to the court where an executor or personal representative is appointed.The executor must take care of the property of the estate.All debts must be paid, and creditors must receive notice of probate.The executor will need to file any tax returns and pay taxes owed.More items...

Most legislation states that the partnership will end upon the death or bankruptcy of any partner. If your partner dies, you will then owe your partner's estate their share of the partnership that accrues at the date of their death.

Probate is always needed to deal with a property after the owner dies. However, other organisations such as the deceased's bank, insurer, or pension provider may also request to see a Grant of Probate before releasing any money held in the deceased's name.

Do All Estates Have to Go Through Probate in Ohio? Most estates will need to go through probate in Ohio unless they are part of a living trust. However, there are different types of probate, and some estates may qualify for a simplified version.

Interesting Questions

More info

Interconnect Walter Interconnect College Interconnect History Help Login Interconnect Stoke Interconnect Interconnect Interconnect History Help Login Interconnect History Help Login Interconnect History Help Login Interconnect History Help Login Interconnect History Help Login Interconnect History Help Login Interconnect History Help Login Interconnect History Help Login Interconnect History Help Login Interconnect History Help Login Interconnect History Help Login Interconnect History Help Login Interconnect History Help Login Interconnect History Help Login Interconnect History Help Login Interconnect History Help Login Interconnect History Help Login Interconnect History Help Login Interconnect History Help.