Title: Understanding Ohio Release of Lien for Cars: A Comprehensive Guide Introduction: When it comes to buying or selling a car in Ohio, it's essential to understand the concept of a release of lien. This legal document plays a vital role in ensuring the smooth transfer of vehicle ownership. In this article, we will delve into the details of Ohio Release of Lien for Cars, its purpose, different types, and the key steps involved in obtaining one. 1. What is an Ohio Release of Lien for Car? A release of lien for a car in Ohio is a written document issued by the lien holder (typically a lending institution or bank) to acknowledge that the lien on a vehicle has been fully satisfied. It serves as proof that any financial obligations tied to the vehicle have been fulfilled, facilitating the transfer of ownership from the lien holder to the buyer. 2. Types of Ohio Release of Lien for Car: a) Voluntary Lien Release: This type of lien release is voluntarily initiated by the lien holder upon the fulfillment of the car loan's terms, which may include full repayment or meeting other financial obligations. b) Involuntary Lien Release: In rare situations, an involuntary lien release may occur due to legal action, incorrect filing, or errors in the lien documentation. These releases are typically initiated by the court or relevant authorities. 3. Key Steps to Obtain an Ohio Release of Lien for Car: a) Loan Repayment: Ensure that you have completely paid off the car loan, meeting all financial obligations set forth by the loan agreement. b) Contact the Lien holder: Reach out to your lien holder (bank, lending institution, or credit union) to request the release of lien forms. c) Complete the Required Forms: Fill out the release of lien forms accurately, providing all necessary information, such as the vehicle identification number (VIN), your personal details, and the loan details. d) Notarize the Forms: Most lien release forms in Ohio require notarization to authenticate their validity. Locate a notary public and sign the forms in their presence. e) Submit the Forms: Once the forms are completed and notarized, submit them to the lien holder. Keep a copy for your records. f) Receive the Release of Lien: After verifying the information, the lien holder will issue a formal release of lien document, indicating the satisfaction of the vehicle loan. 4. Importance of Ohio Release of Lien for Car: Obtaining a release of lien for your car is crucial as it legally proves the absence of any financial encumbrances on the vehicle. It ensures a seamless transfer of ownership during vehicle sales or when securing a new loan using the vehicle as collateral. Conclusion: Understanding the Ohio Release of Lien for Cars is vital for anyone involved in the buying or selling process. By fulfilling the necessary steps and obtaining this essential document, you can ensure a smooth transition of ownership while safeguarding your rights. Always consult with the lien holder or seek legal advice if you encounter any complexities.

Ohio Release of Lien for Car

Description

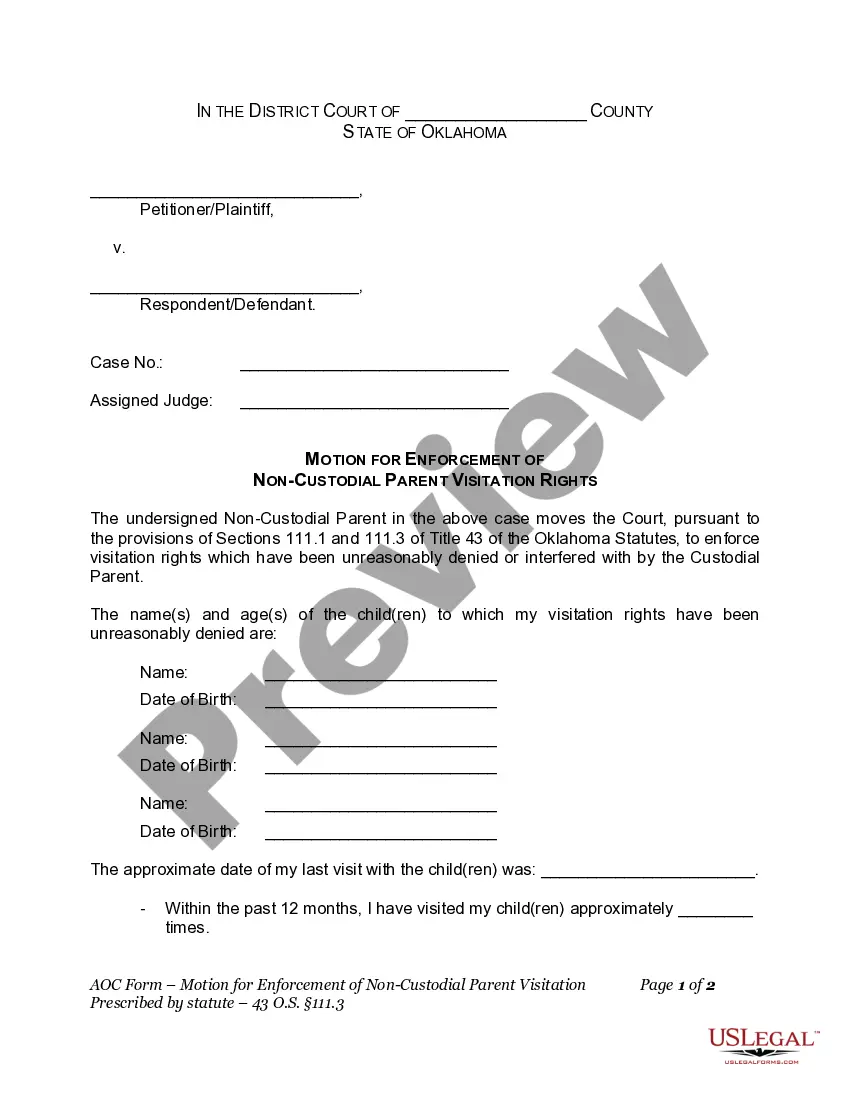

How to fill out Ohio Release Of Lien For Car?

Choosing the right legitimate document format could be a have difficulties. Naturally, there are a variety of themes available on the Internet, but how would you discover the legitimate kind you require? Take advantage of the US Legal Forms web site. The service gives a large number of themes, for example the Ohio Release of Lien for Car, that can be used for company and private requirements. All of the varieties are checked out by pros and meet federal and state requirements.

When you are currently registered, log in for your profile and then click the Acquire button to find the Ohio Release of Lien for Car. Use your profile to check throughout the legitimate varieties you may have acquired previously. Visit the My Forms tab of your respective profile and obtain an additional copy in the document you require.

When you are a new customer of US Legal Forms, here are simple instructions that you should follow:

- Initially, ensure you have selected the appropriate kind to your town/region. It is possible to examine the shape utilizing the Preview button and browse the shape information to guarantee it will be the right one for you.

- In case the kind will not meet your expectations, take advantage of the Seach area to discover the appropriate kind.

- When you are certain that the shape would work, click the Buy now button to find the kind.

- Pick the costs prepare you desire and type in the essential information and facts. Make your profile and buy an order with your PayPal profile or Visa or Mastercard.

- Opt for the file format and down load the legitimate document format for your gadget.

- Complete, change and printing and indication the received Ohio Release of Lien for Car.

US Legal Forms may be the greatest library of legitimate varieties that you can discover numerous document themes. Take advantage of the service to down load appropriately-produced papers that follow express requirements.

Form popularity

FAQ

A search of Ohio Bureau of Motor Vehicles (BMV) records must be performed by submitting a BMV Record Request (form BMV 1173) or the records of any vendor or vendors approved by the registrar of motor vehicles.

What is the OH ELT program? The electronic lien and title (ELT) program is a method by which the Department of Public Safety Bureau of Motor Vehicles (BMV) and a lending institution (lienholder) exchange vehicle and title information electronically.

The Ohio Title Portal also allows vehicle owners to access their vehicle information, which will be shown only on the screen of the device being used by the user, after consent is given.

Luckily, replacing your Ohio vehicle title doesn't have to be part of the hassle! Not only can you do it online, but if you use a company like eTags, you only need your driver's license or ID and a form required by Ohio BMV.

Once your car loan is completely paid off, obtain a car title lien release from your lender so your state BMV or DMV can put the car title in your name. The lien removal process varies by state and typically involves completing paperwork and paying a fee for the new car title.

If your lender does not participate in Ohio's Electronic Lien and Title Program, the lender will mark that the lien was discharged and mail the paper title to you. To remove the lien from BMV records: Bring the title to any County Clerk of Courts Title Office. Apply for a title and pay for title fees.

Once the state liens are paid, you will receive a Lien Satisfaction Notice from the Ohio Attorney General's office. To release the lien, you are to bring the notice to the Clerk's office. The Clerk's office will obtain the release from the Attorney General's lien website and file it with Montgomery County.

If you still owe money on your car, you'll have to pay off the remaining balance of the loan in order to have the lien removed from your title. Alternatively, you have the option of having the buyer pay the lien holder directly, but you'll have to wait for a new title.