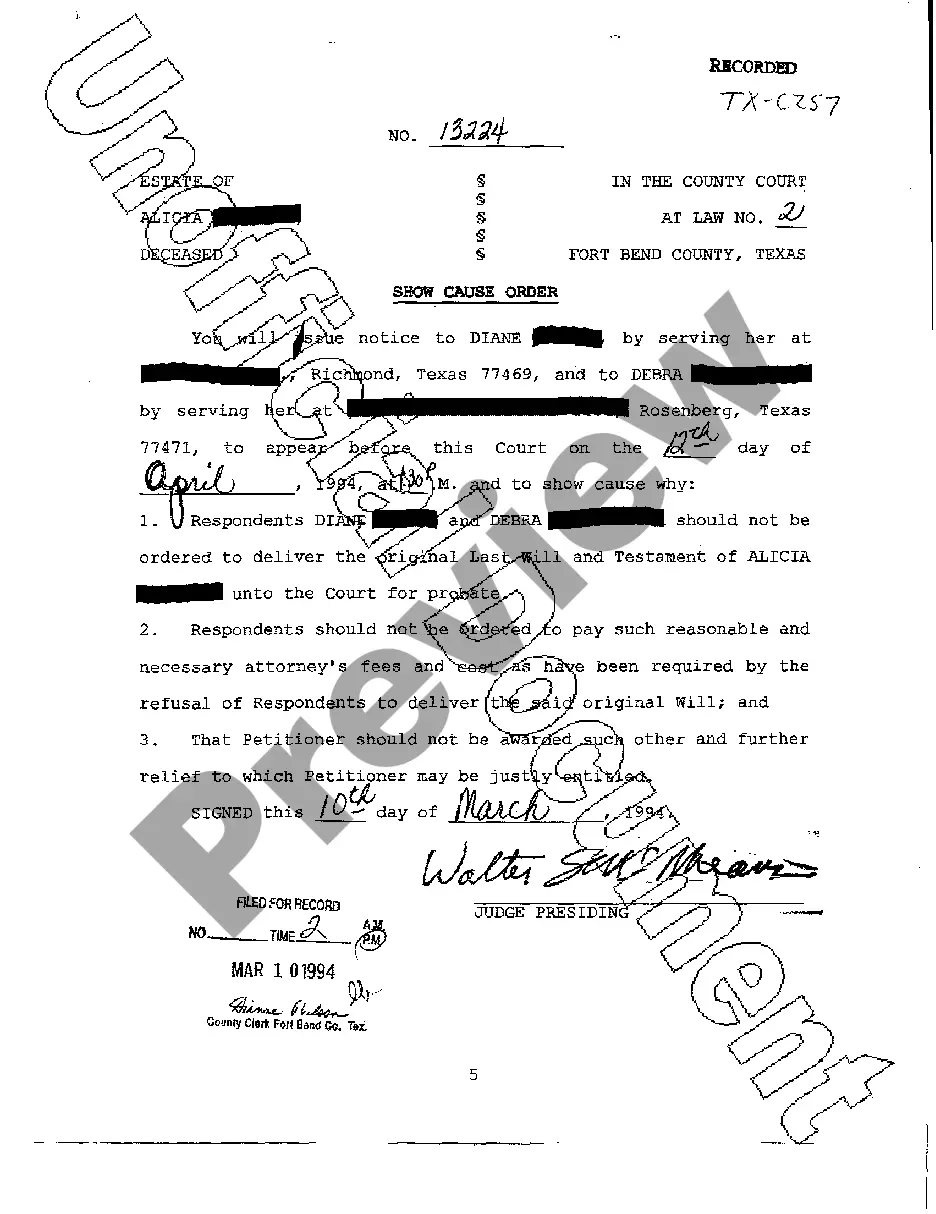

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Ohio Deed of Trust Securing Obligations Pursuant to Indemnification Agreement is a legal document often used in real estate transactions within the state of Ohio. This detailed description aims to provide an overview and understanding of the document's purpose, requirements, and its various types. A Deed of Trust Securing Obligations is a legal instrument that serves as security for a debt or obligation. In the context of an Indemnification Agreement, this document provides additional protection to one party (the "secured party") by granting them a security interest in certain property or assets owned by another party (the "debtor"). The purpose is to guarantee the fulfillment of specific obligations, typically financial or contractual, outlined in the indemnification agreement. By creating a Deed of Trust, the debtor conveys a defined interest in the property to a trustee, who holds it on behalf of the secured party. This interest is typically a lien or mortgage, serving as collateral for the obligations owed under the indemnification agreement. In the event of default or non-compliance by the debtor, the secured party has the right to foreclose on the property and sell it to satisfy the debt. In Ohio, there are different types of Deeds of Trust Securing Obligations Pursuant to Indemnification Agreement, which may vary depending on the specific circumstances or requirements of the parties involved. Some notable types include: 1. Real Estate Deed of Trust: This type of Deed of Trust secures obligations related to real property, such as a mortgage or a loan in which the property serves as collateral. It provides security to lenders and protects their financial interests while allowing borrowers to utilize the property. 2. Personal Property Deed of Trust: This type of Deed of Trust secures obligations related to personal property, such as equipment, vehicles, or inventory. It allows creditors to establish a security interest in these assets, offering protection in case of default or non-payment. 3. Assignment of Rents Deed of Trust: This type of Deed of Trust secures obligations related to rental income generated by a property. In this scenario, the secured party has the right to collect rental payments directly should the debtor default, ensuring the fulfillment of financial obligations. Ohio Deeds of Trust Securing Obligations Pursuant to Indemnification Agreement play a crucial role in protecting the rights and interests of parties involved in various contractual or financial agreements. It is essential to consult with legal professionals to ensure the proper creation and execution of these documents, considering the specific circumstances and legal requirements within the state of Ohio.Ohio Deed of Trust Securing Obligations Pursuant to Indemnification Agreement is a legal document often used in real estate transactions within the state of Ohio. This detailed description aims to provide an overview and understanding of the document's purpose, requirements, and its various types. A Deed of Trust Securing Obligations is a legal instrument that serves as security for a debt or obligation. In the context of an Indemnification Agreement, this document provides additional protection to one party (the "secured party") by granting them a security interest in certain property or assets owned by another party (the "debtor"). The purpose is to guarantee the fulfillment of specific obligations, typically financial or contractual, outlined in the indemnification agreement. By creating a Deed of Trust, the debtor conveys a defined interest in the property to a trustee, who holds it on behalf of the secured party. This interest is typically a lien or mortgage, serving as collateral for the obligations owed under the indemnification agreement. In the event of default or non-compliance by the debtor, the secured party has the right to foreclose on the property and sell it to satisfy the debt. In Ohio, there are different types of Deeds of Trust Securing Obligations Pursuant to Indemnification Agreement, which may vary depending on the specific circumstances or requirements of the parties involved. Some notable types include: 1. Real Estate Deed of Trust: This type of Deed of Trust secures obligations related to real property, such as a mortgage or a loan in which the property serves as collateral. It provides security to lenders and protects their financial interests while allowing borrowers to utilize the property. 2. Personal Property Deed of Trust: This type of Deed of Trust secures obligations related to personal property, such as equipment, vehicles, or inventory. It allows creditors to establish a security interest in these assets, offering protection in case of default or non-payment. 3. Assignment of Rents Deed of Trust: This type of Deed of Trust secures obligations related to rental income generated by a property. In this scenario, the secured party has the right to collect rental payments directly should the debtor default, ensuring the fulfillment of financial obligations. Ohio Deeds of Trust Securing Obligations Pursuant to Indemnification Agreement play a crucial role in protecting the rights and interests of parties involved in various contractual or financial agreements. It is essential to consult with legal professionals to ensure the proper creation and execution of these documents, considering the specific circumstances and legal requirements within the state of Ohio.