Ohio Comprehensive Commercial Deed of Trust and Security Agreement

Description

How to fill out Comprehensive Commercial Deed Of Trust And Security Agreement?

US Legal Forms - one of many most significant libraries of legitimate kinds in the States - delivers an array of legitimate file themes you are able to download or print out. While using internet site, you can get thousands of kinds for company and person functions, sorted by groups, says, or keywords and phrases.You can get the newest variations of kinds much like the Ohio Comprehensive Commercial Deed of Trust and Security Agreement within minutes.

If you currently have a subscription, log in and download Ohio Comprehensive Commercial Deed of Trust and Security Agreement in the US Legal Forms catalogue. The Download switch can look on each and every form you see. You get access to all previously saved kinds within the My Forms tab of the bank account.

If you want to use US Legal Forms initially, here are simple recommendations to get you started:

- Ensure you have selected the right form to your area/county. Go through the Preview switch to analyze the form`s content. Look at the form description to actually have selected the right form.

- When the form does not satisfy your specifications, make use of the Look for field on top of the monitor to discover the one who does.

- Should you be satisfied with the form, affirm your selection by clicking the Buy now switch. Then, select the costs plan you favor and supply your references to sign up to have an bank account.

- Method the financial transaction. Make use of credit card or PayPal bank account to accomplish the financial transaction.

- Find the structure and download the form in your product.

- Make adjustments. Fill out, change and print out and sign the saved Ohio Comprehensive Commercial Deed of Trust and Security Agreement.

Every single format you added to your money does not have an expiration particular date and is your own property forever. So, if you want to download or print out another copy, just visit the My Forms segment and click about the form you want.

Obtain access to the Ohio Comprehensive Commercial Deed of Trust and Security Agreement with US Legal Forms, probably the most considerable catalogue of legitimate file themes. Use thousands of specialist and state-certain themes that satisfy your small business or person demands and specifications.

Form popularity

FAQ

What is a General Security Agreement? A GSA is a contract signed between two parties, a borrower and a lender. The GSA protects the lender by creating a security interest in all or some of the assets of the borrower. In sum, the GSA outlines the terms and conditions of the loan, and lists the assets used for security.

By Practical Law Banking and Finance. This is a standard form of specific security deed for a single company incorporated in Australia to grant security over shares or other marketable securities which it owns.

This is a standard form security trust deed. It creates a single security trust specifically for use in syndicated finance or other finance transactions where security is held on trust by a security trustee for the benefit of a group of secured finance parties (the beneficiaries).

In addition to standardizing protection against security risks, ISAs also help ensure ownership of Data and contractual protection against breaches or misuse of Data caused by Counterparties with access to Data.

Security agreement definition If a borrower defaults, the security agreement allows the lender to collect the borrower's collateral and either sell it or hold onto it until the loan is repaid. Some security agreements allow the lender to sell the collateral immediately.

A security agreement creates the security interest, making it enforceable between the secured party and the debtor. A UCC-1 financing statement neither creates a security interest nor does it alter its scope; it only gives notice of the security interest to third parties.

A security agreement is a document that provides a lender a security interest in a specified asset or property that is pledged as collateral. Security agreements often contain covenants that outline provisions for the advancement of funds, a repayment schedule, or insurance requirements.

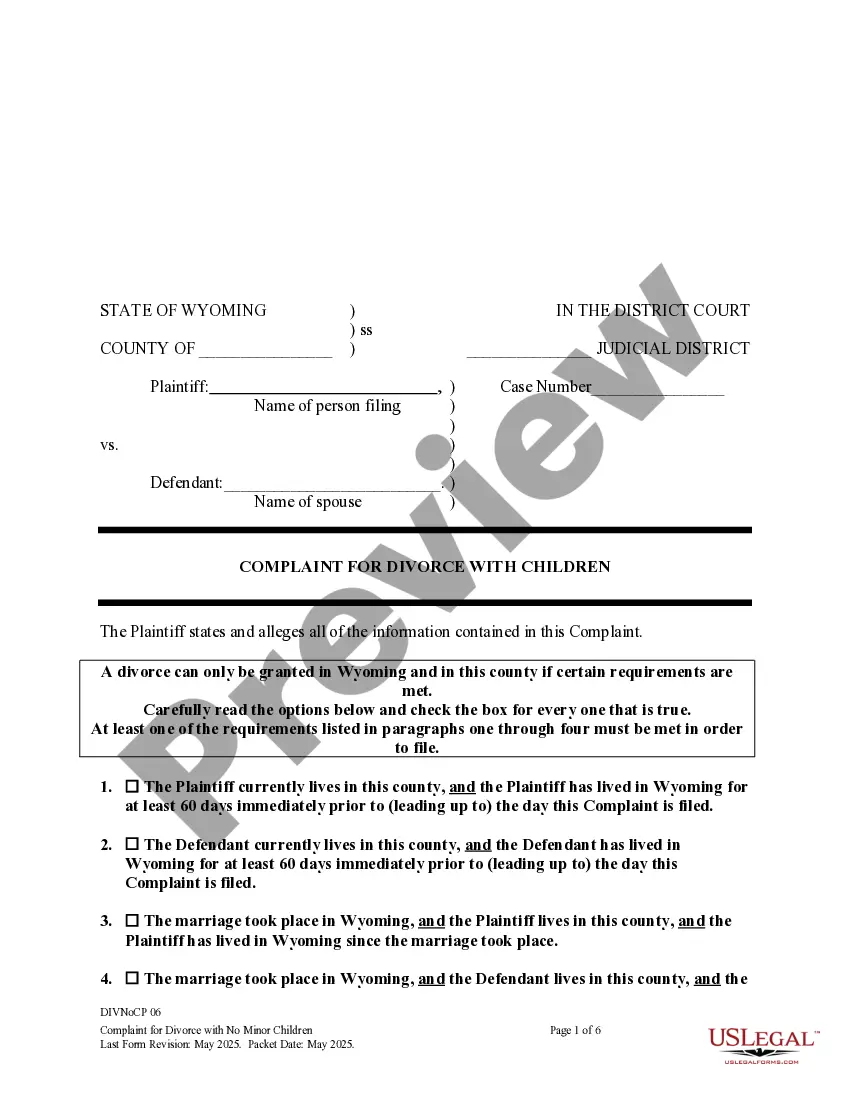

Mortgage States and Deed of Trust States StateMortgage StateDeed of Trust StateNew YorkYNorth CarolinaYNorth DakotaYOhioY47 more rows