A Transmutation Agreement is a marital contract that provides that the ownership of a particular piece of property will, from the date of the agreement forward, be changed. Spouses can transmute, partition, or exchange community property to separate property by agreement. According to some authority, separate property can be transmuted into community property by an agreement between the spouses, but there is also authority to the contrary.

Ohio Transmutation or Postnuptial Agreement to Convert Community Property into Separate Property

Description

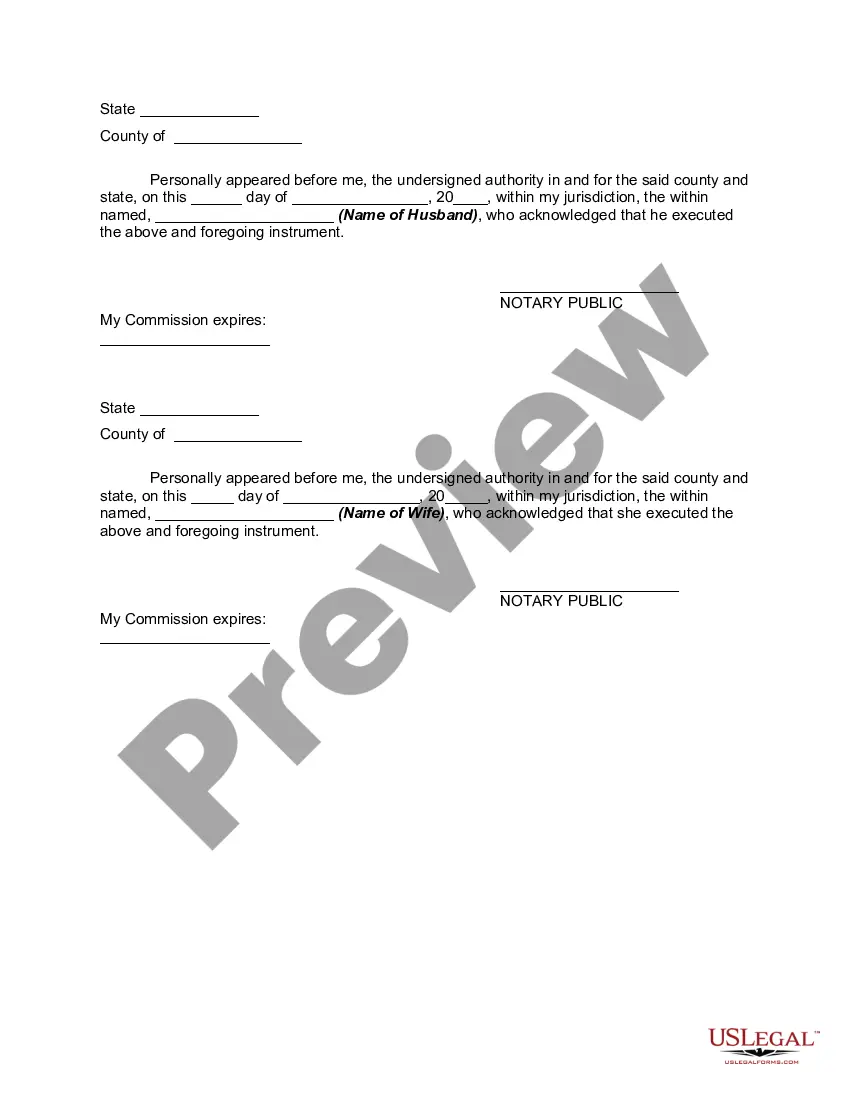

How to fill out Transmutation Or Postnuptial Agreement To Convert Community Property Into Separate Property?

Finding the suitable legitimate document template can be challenging.

Of course, there are numerous templates available online, but how can you locate the authentic form you need.

Utilize the US Legal Forms website. The service offers a multitude of templates, such as the Ohio Transmutation or Postnuptial Agreement to Convert Community Property into Separate Property, which can be utilized for both business and personal purposes.

You can review the form using the Review button and read the form description to confirm it is indeed the right one for you.

- All templates are reviewed by experts and comply with federal and state regulations.

- If you are already registered, Log In to your account and click the Acquire button to obtain the Ohio Transmutation or Postnuptial Agreement to Convert Community Property into Separate Property.

- Use your account to browse through the legal forms you have previously purchased.

- Navigate to the My documents tab of your account and retrieve another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps you can follow.

- First, ensure you have selected the correct form for your city/region.

Form popularity

FAQ

Yes, postnuptial agreements are valid in Ohio. These agreements allow couples to clarify property ownership after marriage, which can be crucial for minimizing conflicts down the road. When creating an Ohio Transmutation or Postnuptial Agreement to Convert Community Property into Separate Property, it is essential that both spouses fully understand the terms and make informed decisions. Using a trusted platform like USLegalForms can guide you through the process and ensure your rights are protected.

Yes, a postnuptial agreement can hold up in court if it meets certain legal requirements. In Ohio, your agreement must be fair, written, and signed by both spouses. When crafted properly, an Ohio Transmutation or Postnuptial Agreement to Convert Community Property into Separate Property provides legal clarity and protection for both parties. Ensure you consult with a knowledgeable attorney to strengthen the enforceability of your agreement.

Yes, you can create a postnuptial agreement in Ohio to manage your property rights. This legal tool allows you to convert community property into separate property, providing clarity in your financial situation. By utilizing an Ohio Transmutation or Postnuptial Agreement to Convert Community Property into Separate Property, you can ensure that your assets are protected according to your wishes. Consider using the US Legal Forms platform for easy access to the necessary forms and guidance throughout the process.

A transmutation agreement specifically addresses the change in property ownership between spouses, while a postnuptial agreement encompasses a broader range of issues, such as financial responsibilities and asset division. Both documents serve important roles in the management of property and finances in marriage. The Ohio Transmutation or Postnuptial Agreement to Convert Community Property into Separate Property can incorporate elements of both types to suit specific needs. Consulting legal experts can help you understand which agreement best fits your situation.

In California, converting separate property to community property requires a written agreement between spouses similar to Ohio’s approach. Both parties must agree to the change with a well-documented postnuptial agreement that clearly defines the property involved. While this process is distinct from the Ohio Transmutation or Postnuptial Agreement to Convert Community Property into Separate Property, understanding the commonalities can provide vital insights for couples navigating property classification in different states.

Postnuptial agreements faced scrutiny in Ohio due to historical views on spousal financial arrangements. Over time, public policy has shifted towards recognizing the equal rights and responsibilities of spouses, leading to greater acceptance of these agreements. This change allows couples to use the Ohio Transmutation or Postnuptial Agreement to Convert Community Property into Separate Property as a robust tool for managing their financial affairs. Understanding this evolution can offer insight into the significance of these agreements today.

To transmute community property to separate property in Ohio, a clear, written agreement between both spouses is essential. This agreement should specify the property being converted and the intention to classify it as separate property. Utilizing an Ohio Transmutation or Postnuptial Agreement to Convert Community Property into Separate Property provides the necessary legal framework to execute this change effectively. Always consider consulting a legal professional to ensure compliance with applicable laws.

The transmutation rule refers to the legal principle allowing spouses to change the classification of their property from separate to community or vice versa. In Ohio, this means couples can reach agreements to convert property ownership through detailed postnuptial agreements. This process aligns with the Ohio Transmutation or Postnuptial Agreement to Convert Community Property into Separate Property. Understanding this rule can empower couples to better manage their financial assets and responsibilities.

Yes, postnuptial agreements are enforceable in Ohio, provided they meet certain legal requirements. These agreements must be made voluntarily, without coercion, and both spouses should fully disclose their financial situations. The growing acceptance of the Ohio Transmutation or Postnuptial Agreement to Convert Community Property into Separate Property reflects changing public policy attitudes towards such agreements. Consulting legal experts can help ensure your agreement is valid and enforceable.

To transmute separate property to community property in Ohio, both spouses must agree to the change in ownership through a formal written agreement. This agreement should detail the property involved and the intention to classify it as community property. Engaging with a legal professional can also assist in ensuring that the Ohio Transmutation or Postnuptial Agreement to Convert Community Property into Separate Property complies with state laws. This step helps maintain transparency and legal clarity in your financial matters.