Ohio Assignment of Property in Attached Schedule

Description

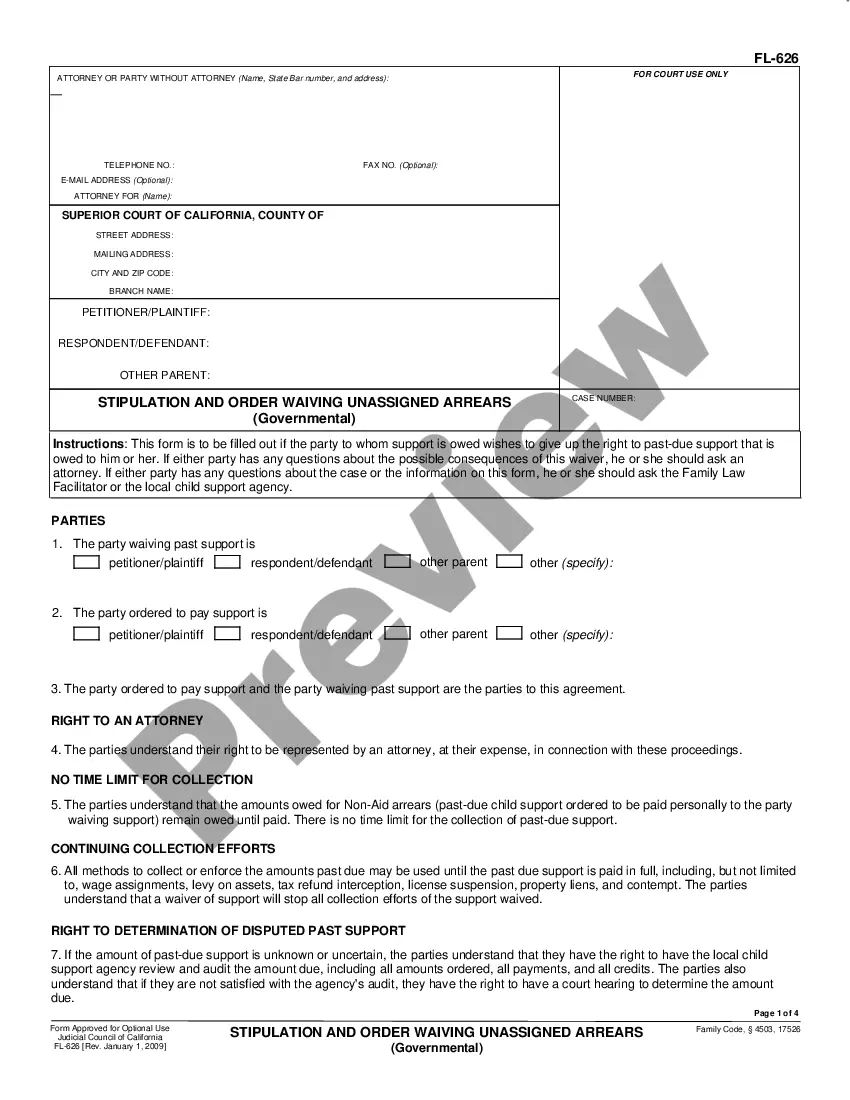

How to fill out Assignment Of Property In Attached Schedule?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a diverse selection of legal form templates you can download or create.

By utilizing the website, you can access countless forms for business and personal purposes, categorized by types, states, or keywords. You can find the latest editions of forms such as the Ohio Assignment of Property in Attached Schedule within moments.

If you currently own a subscription, Log In and obtain the Ohio Assignment of Property in Attached Schedule from the US Legal Forms library. The Download button will be visible on every form you view. You can access all previously downloaded forms in the My documents section of your account.

Process the payment. Use your credit card or PayPal account to complete the transaction.

Choose the format and download the form to your device. Make edits. Fill in, modify, print, and sign the downloaded Ohio Assignment of Property in Attached Schedule. Each document you add to your account has no expiration date and is yours indefinitely. Therefore, if you wish to download or print another copy, simply navigate to the My documents section and click on the form you need. Access the Ohio Assignment of Property in Attached Schedule with US Legal Forms, one of the most extensive libraries of legal document templates. Utilize thousands of professional and state-specific templates that fulfill your business or personal requirements and specifications.

- If you are using US Legal Forms for the first time, here are simple instructions to help you get started.

- Ensure you have selected the right form for your area/region. Click the Preview button to review the content of the form.

- Examine the form details to ensure you have chosen the correct form.

- If the form does not suit your needs, use the Search box at the top of the screen to find one that meets your criteria.

- If you are satisfied with the form, confirm your choice by clicking the Buy Now button.

- Then, select the pricing plan you prefer and provide your information to register for the account.

Form popularity

FAQ

Moving out during a divorce can significantly impact your legal rights regarding property and custody arrangements. Leaving the marital home may weaken your position during negotiations, especially concerning the equitable division of assets. Staying in the home can help you maintain a claim on property rights as dictated by the Ohio Assignment of Property in Attached Schedule. Always consider legal advice before making decisions.

In Ohio, a house is typically divided based on its marital value, taking into account factors like equity and contributions by both spouses. The court aims for an equitable distribution, which may involve selling the home and splitting the proceeds or compensating one spouse to maintain ownership. It’s advisable to seek legal counsel and comprehend the Ohio Assignment of Property in Attached Schedule to navigate this complex process effectively.

An executor transfers property in Ohio by following a legal process that involves validating the will and settling any debts of the deceased. Once the estate is settled, the executor can distribute property to the beneficiaries as per the will's terms. It's essential to consult legal resources or a professional service, like USLegalForms, for guidance on the Ohio Assignment of Property in Attached Schedule to ensure compliance with all state laws.

Yes, Ohio follows equitable distribution laws, meaning property is divided fairly but not necessarily equally between parties in a divorce. Courts take into account several factors such as the income, length of marriage, and contributions of both spouses. This approach ensures a just outcome based on each person's situation. Understanding the Ohio Assignment of Property in Attached Schedule can clarify how property will likely be divided in your case.

In Ohio, property acquired during a marriage is generally considered marital property, regardless of whose name is on the title. Therefore, your wife may indeed be entitled to a portion of the house's value during divorce proceedings. The division of property often depends on various factors, including contributions and the duration of the marriage. Consider consulting with a legal expert on Ohio Assignment of Property in Attached Schedule to understand your rights.

Yes, you can assign contracts in Ohio, provided that the original contract does not prohibit assignment. The process often involves securing documentation—as outlined in the Ohio Assignment of Property in Attached Schedule—so that all parties involved understand their rights and responsibilities following the assignment.

Section 5301.68 of the Ohio Revised Code pertains to the assignment of property rights, including the formalization of an assignment contract. This section establishes important guidelines for the Ohio Assignment of Property in Attached Schedule, ensuring that such agreements are recognized legally and protect the interests of all parties involved.

Transferring property title to a family member in Ohio typically involves completing a property deed and filing it with the local county recorder's office. Be sure to include any necessary information and documentation related to the Ohio Assignment of Property in Attached Schedule, which can help define the transfer terms and responsibilities clearly.

In Ohio, a parcel of at least 10 acres is generally required to be officially considered a farm. However, farming operations may qualify even on smaller plots depending on the nature and intensity of the agricultural activities. When dealing with an Ohio Assignment of Property in Attached Schedule, understanding these requirements can facilitate better land use planning and transitions.

A valid assignment of a contract requires the assignor's intent to transfer rights, proper notification to the assignee, and adherence to any contractual restrictions. The use of the Ohio Assignment of Property in Attached Schedule can help formalize this transfer, ensuring all parties understand their roles and obligations.