The Ohio Investment Letter regarding Intrastate Offering is a comprehensive document that provides detailed information and guidelines to individuals and businesses interested in participating in intrastate offerings within the state of Ohio. This letter serves as a vital resource for investors, issuers, and intermediaries involved in intrastate securities transactions. An intrastate offering refers to the sale of securities to investors within the state of Ohio, typically exempted from federal registration requirements. The Ohio Investment Letter is designed to ensure compliance with Ohio securities laws, regulations, and policies, thus safeguarding the interests of both investors and issuers. Some key aspects covered in the Ohio Investment Letter regarding Intrastate Offering include: 1. Legal Framework: The letter outlines the legal framework governing intrastate offerings in Ohio, including references to relevant statutes, regulations, and administrative rules. It ensures that all parties involved understand the legal requirements and obligations associated with intrastate securities transactions. 2. Eligibility Criteria: The Ohio Investment Letter describes the eligibility criteria for issuers aiming to make intrastate offerings. It provides details on the qualifications necessary to participate in such offerings, ensuring that only eligible issuers are granted the opportunity to raise capital through intrastate securities transactions. 3. Investor Protection: The letter emphasizes investor protection and educates issuers and intermediaries about their responsibility to provide accurate and complete information to potential investors. It highlights the importance of transparency, risk disclosure, and fair dealing practices maintaining investor confidence and trust. 4. Exemptions and Limitations: The Ohio Investment Letter discusses the various exemptions and limitations associated with intrastate offerings. It clarifies which types of securities may be exempted from federal registration requirements and the conditions that must be met to qualify for such exemptions. Different types of Ohio Investment Letters regarding Intrastate Offering may include: 1. Ohio Investment Letter for Individual Investors: This type of letter is specifically tailored to individuals interested in participating in intrastate offerings within Ohio. It provides comprehensive guidance on investment opportunities, risks, and legal requirements applicable to individual investors. 2. Ohio Investment Letter for Businesses: This letter targets businesses seeking to raise capital through intrastate offerings. It offers insights into the process, eligibility criteria, and legal obligations for businesses considering this fundraising method. 3. Ohio Investment Letter for Intermediaries: Intermediaries, such as broker-dealers or crowdfunding platforms, play a crucial role in facilitating intrastate offerings. This specific letter provides intermediaries with an overview of their responsibilities, compliance requirements, and best practices ensuring a transparent and efficient investment process. In summary, the Ohio Investment Letter regarding Intrastate Offering is a valuable resource that guides investors, issuers, and intermediaries through the intricacies of intrastate securities transactions in Ohio. It promotes transparency, compliance, and investor protection, ultimately contributing to the growth and development of Ohio's capital market.

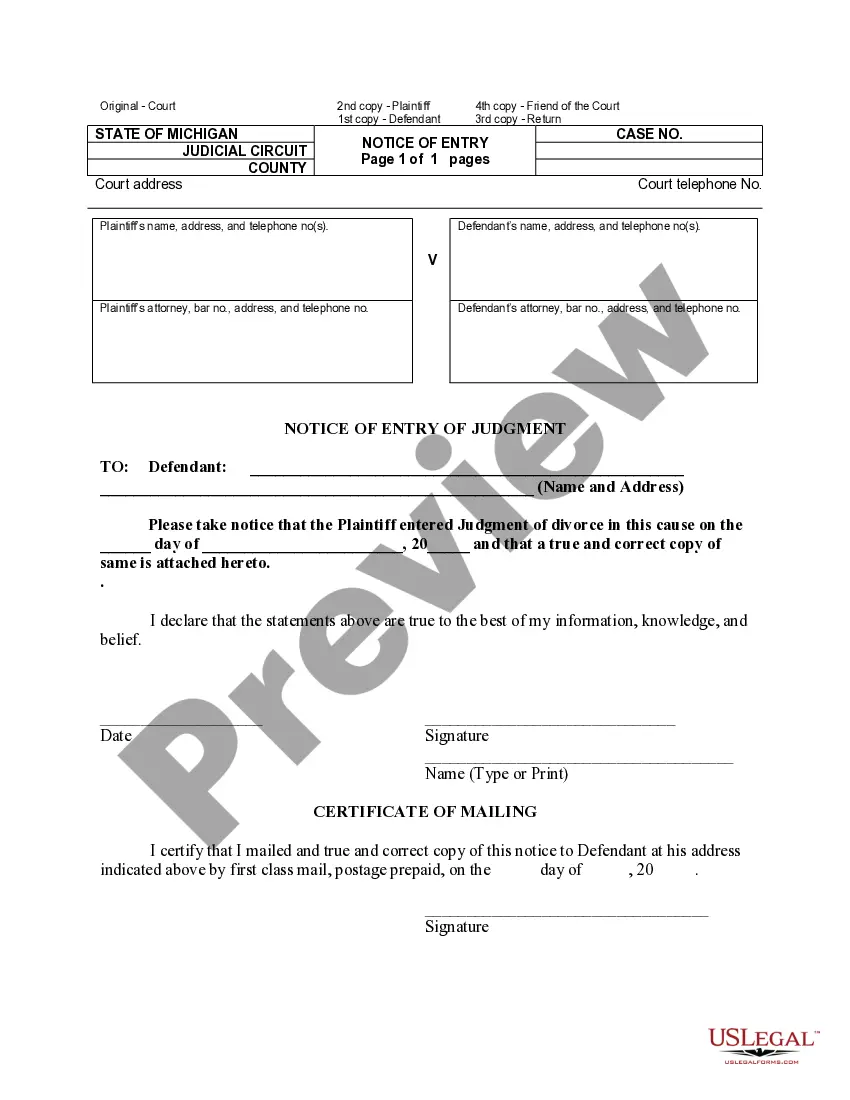

Ohio Investment Letter regarding Intrastate Offering

Description

How to fill out Ohio Investment Letter Regarding Intrastate Offering?

If you wish to full, obtain, or printing legitimate file themes, use US Legal Forms, the biggest assortment of legitimate kinds, that can be found on-line. Take advantage of the site`s easy and hassle-free research to discover the papers you want. A variety of themes for business and personal uses are categorized by groups and suggests, or keywords and phrases. Use US Legal Forms to discover the Ohio Investment Letter regarding Intrastate Offering with a couple of clicks.

Should you be currently a US Legal Forms customer, log in to the account and then click the Down load key to obtain the Ohio Investment Letter regarding Intrastate Offering. You can even accessibility kinds you previously saved from the My Forms tab of the account.

If you use US Legal Forms for the first time, refer to the instructions listed below:

- Step 1. Be sure you have selected the shape for that correct metropolis/region.

- Step 2. Make use of the Preview method to examine the form`s information. Never forget to see the description.

- Step 3. Should you be not satisfied with the develop, use the Research discipline towards the top of the screen to get other versions of your legitimate develop design.

- Step 4. Upon having located the shape you want, go through the Get now key. Select the pricing prepare you choose and add your references to register for the account.

- Step 5. Process the deal. You may use your credit card or PayPal account to complete the deal.

- Step 6. Select the formatting of your legitimate develop and obtain it on your own gadget.

- Step 7. Complete, change and printing or indicator the Ohio Investment Letter regarding Intrastate Offering.

Each legitimate file design you get is your own property for a long time. You might have acces to every single develop you saved within your acccount. Select the My Forms section and select a develop to printing or obtain yet again.

Contend and obtain, and printing the Ohio Investment Letter regarding Intrastate Offering with US Legal Forms. There are thousands of professional and condition-certain kinds you can utilize for your business or personal demands.

Form popularity

FAQ

To write an investment statement, begin by outlining the key components of your investment strategy. Clearly define your goals, the type of investments you favor, and how they relate to ideas found in the Ohio Investment Letter regarding Intrastate Offering. Be straightforward and specific in your language, ensuring that your reader can easily understand your intentions and objectives.

Writing an investment letter involves a structured approach. Start by clearly stating your proposal and the specific investment opportunity, referencing the requirements for an Ohio Investment Letter regarding Intrastate Offering when applicable. Make sure to include details such as expected returns and how the investment aligns with the recipient's interests. Aim for clarity and conciseness to keep the reader engaged.

Politeness is key when asking for an investment. Begin by expressing appreciation for the recipient's time and consideration. Then, clearly articulate what you are asking for, perhaps including how your proposal relates to the Ohio Investment Letter regarding Intrastate Offering, ensuring they understand the value and potential benefits before making your request.

When opening an investment letter, it's important to address the recipient with respect and clarity. Start with a proper greeting, followed by an introduction that explains your interest in their investment opportunity. This can include a brief mention of the Ohio Investment Letter regarding Intrastate Offerings to establish the context and importance of your request.

To start a letter of interest regarding an Ohio Investment Letter for an Intrastate Offering, begin with a clear and professional salutation. You should introduce yourself and state the purpose of your letter succinctly, emphasizing your engagement with the investment opportunity. This sets the tone for a direct and meaningful conversation about your intentions.

Certain securities qualify for exemption from registration at the state level. Common exemptions include government securities, bank securities, and offerings of a limited size. When you utilize an Ohio Investment Letter regarding Intrastate Offering, you can often navigate these exemptions more easily, allowing for a smoother investment process.

Yes, state laws do regulate intrastate sales of securities. Each state, including Ohio, has its own framework for overseeing these transactions. When considering an Ohio Investment Letter regarding Intrastate Offering, it is crucial to understand the specific regulations that apply within your state to ensure compliance and to protect your investment.

In some cases, intrastate offerings may be exempt from state registration, but this often depends on the specific conditions of the offering. States typically have different criteria that need to be met for such exemptions to apply. It is essential to consult the Ohio Investment Letter regarding Intrastate Offering and experts at platforms like uslegalforms to understand the requirements and ensure your offering remains compliant.

Yes, even though intrastate offerings benefit from reduced federal oversight, they may still require state registration depending on local laws. Each state has its own rules governing securities transactions, including intrastate offerings. Utilizing a service like uslegalforms can help you ensure compliance with state registration when dealing with the Ohio Investment Letter regarding Intrastate Offering.

The intrastate exemption allows companies to offer and sell securities to residents of their home state without federal registration, provided they meet specific criteria. To qualify, the company must conduct a substantial portion of its business within the state and sell to local investors. Understanding the intrastate exemption is crucial for businesses seeking to leverage the Ohio Investment Letter regarding Intrastate Offering.