Ohio Sample Letter for Payment of Corporate Income and Franchise Taxes and Annual Report Filing Fees Dear [Recipient's Name], I am writing to address the payment of our corporate income and franchise taxes, as well as the annual report filing fees for our organization. As a responsible corporate citizen, we understand the importance of fulfilling our tax obligations promptly and accurately. Firstly, we appreciate the opportunity to operate our business within the state of Ohio. As part of conducting business activities, every qualifying corporation is required to pay corporate income and franchise taxes. These taxes contribute to the state's revenue, allowing for infrastructure development, public services, and various other essential programs that benefit both businesses and residents. To ensure compliance, we have carefully reviewed the tax assessment provided by the Ohio Department of Taxation. After thorough evaluation, we acknowledge the amount due and are prepared to remit the payment in a timely manner. Enclosed with this letter, you will find a check for the total amount specified in the assessment. We understand that adhering to Ohio's tax code is of utmost importance to maintain a good standing with the state. In addition to the tax payment, we are also aware of the need to file our annual report and pay associated filing fees. Complying with this requirement is mandatory for all businesses registered in Ohio, and we recognize the significance of submitting accurate and complete information. Attached to this letter, you will find our completed annual report, containing the necessary details as mandated by the Ohio Secretary of State. We have duly completed and reviewed each section to ensure accuracy and transparency. Furthermore, we have included a check covering the required filing fees as indicated in the instructions provided. By submitting the payment for our corporate income and franchise taxes and filing our annual report promptly, we aim to satisfy our financial obligations and maintain our good standing with the state of Ohio. We emphasize our commitment to responsible business practices and appreciate the collaboration of the Ohio Department of Taxation and Ohio Secretary of State in ensuring a fair and efficient tax system. We look forward to receiving confirmation of payment and an acknowledgment of our annual report submission. Please do not hesitate to reach out if there are any questions or additional requirements in this regard. Thank you for your attention to this matter. Sincerely, [Your Name] [Your Company Name] [Your Contact Information]

Ohio Sample Letter for Payment of Corporate Income and Franchise Taxes and Annual Report Filing Fees

Description

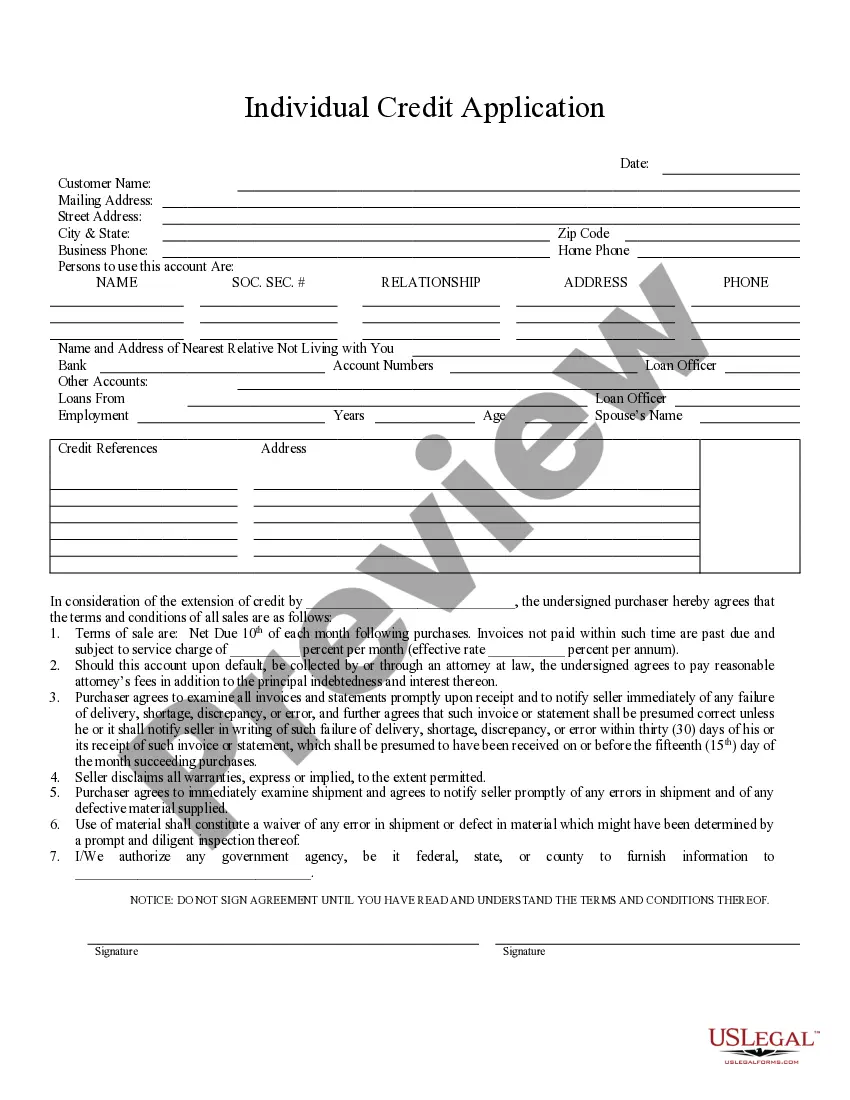

How to fill out Ohio Sample Letter For Payment Of Corporate Income And Franchise Taxes And Annual Report Filing Fees?

Choosing the best authorized papers format can be a have difficulties. Naturally, there are tons of web templates available online, but how can you obtain the authorized kind you will need? Make use of the US Legal Forms website. The support offers thousands of web templates, for example the Ohio Sample Letter for Payment of Corporate Income and Franchise Taxes and Annual Report Filing Fees, which can be used for company and private requirements. All the kinds are inspected by experts and meet federal and state needs.

If you are already listed, log in to the profile and then click the Download key to have the Ohio Sample Letter for Payment of Corporate Income and Franchise Taxes and Annual Report Filing Fees. Utilize your profile to look throughout the authorized kinds you might have bought in the past. Go to the My Forms tab of your respective profile and have yet another copy in the papers you will need.

If you are a new consumer of US Legal Forms, listed below are easy instructions for you to follow:

- Initially, ensure you have selected the proper kind to your metropolis/region. You can check out the form making use of the Review key and browse the form information to guarantee this is basically the best for you.

- In case the kind does not meet your expectations, use the Seach area to find the proper kind.

- When you are certain that the form would work, click the Buy now key to have the kind.

- Choose the rates prepare you would like and type in the essential details. Create your profile and pay money for your order using your PayPal profile or credit card.

- Pick the file file format and obtain the authorized papers format to the product.

- Complete, revise and print and indication the acquired Ohio Sample Letter for Payment of Corporate Income and Franchise Taxes and Annual Report Filing Fees.

US Legal Forms will be the biggest catalogue of authorized kinds in which you can discover various papers web templates. Make use of the company to obtain appropriately-created documents that follow condition needs.

Form popularity

FAQ

The Department requires certain taxpayers to verify their identity in an effort to combat tax fraud and safeguard taxpayer dollars. Taxpayers are selected for identity verification using data analysis of information on the tax return and other factors.

Do I have to file an annual report? Business entities in Ohio are not required to file an annual report.

Do I have to file an annual report? Business entities in Ohio are not required to file an annual report.

Choose a Name for Your Ohio LLC. You should choose a unique name for your LLC. ... Appoint a Registered Agent for Your Ohio LLC. Every Ohio LLC must have an agent for service of process in the state. ... File Articles of Organization. ... Prepare an Operating Agreement. ... Get an EIN & Comply With Other Tax & Regulatory Requirements.

Essentially, the Ohio corporate income tax functions similar to the personal income tax most residents of the state must pay. The corporate income tax is a progressive tax system. Businesses in Ohio must file a tax return every year.

Ohio LLCs are federally taxed as pass-through entities by default and do not pay federal company taxes. Unless the LLC has specifically elected and successfully filed to be taxed otherwise, the LLC's revenue simply passes through to the members who are then responsible for individual income tax.

Plan to keep your LLC compliant and in active status on the state's website. Ohio LLCs are not required to file an annual report. You may need to pay quarterly tax payments and may also need to maintain a registered agent for your business.

There is no annual fee (sometimes called an ?Annual Report?) in Ohio for LLCs. Should I hire an LLC formation service? You aren't required to hire a professional service company to form your Ohio LLC. You're allowed to form your LLC yourself if you'd like.