An A-B trust is a revocable living trust which divides into two trusts upon the death of the first spouse. This type of trust makes use of both the estate tax exemption ($3.5 million per person in 2009) and the marital deduction to make it so that no estate taxes are due upon the death of the first spouse. The B Trust is also known as the Bypass trust and it contains the amount of that years applicable exclusion amount. The A trust is the marital deduction trust which will typically contain both the surviving spouse's separate property and one half community property interests but also the residue of the deceased spouse's estate after the estate tax exemption has been utilized by the B trust. The use of an A-B trust ensures that both spouse's applicable exclusion amounts are effectively used, thereby doubling the amount of property which can pass to heirs free of Federal Estate Taxes.

Ohio Marital Deduction Trust - Trust A and Bypass Trust B

Description

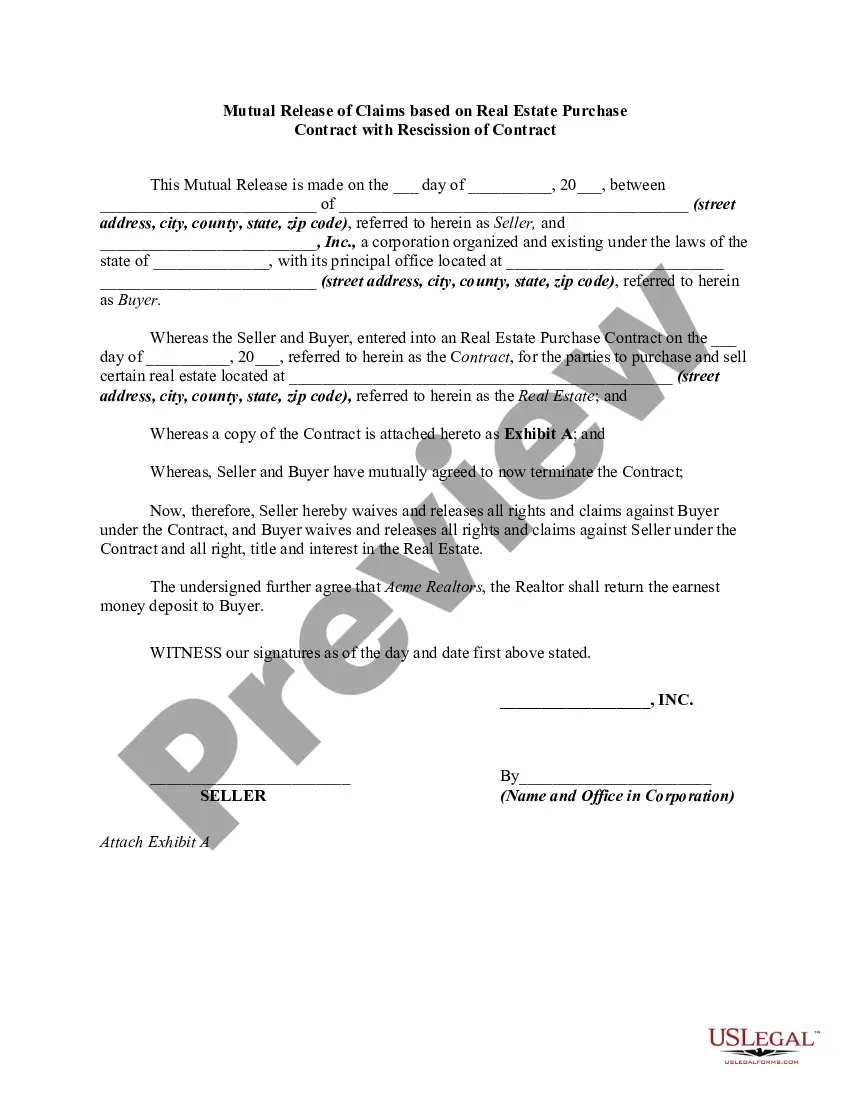

How to fill out Marital Deduction Trust - Trust A And Bypass Trust B?

It is feasible to spend hours online searching for the legal document template that meets your federal and state requirements.

US Legal Forms offers a vast array of legal documents that have been reviewed by experts.

You can download or print the Ohio Marital Deduction Trust - Trust A and Bypass Trust B from my assistance.

If available, utilize the Preview button to review the document template as well. If you need to find another version of the document, use the Search field to locate the template that fulfills your needs and specifications.

- If you already have a US Legal Forms account, you may Log In and click the Acquire button.

- After that, you can complete, modify, print, or sign the Ohio Marital Deduction Trust - Trust A and Bypass Trust B.

- Every legal document template you purchase is yours indefinitely.

- To obtain another copy of a purchased document, visit the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for your specific county/town.

- Review the document description to ensure you have chosen the appropriate template.

Form popularity

FAQ

A marital deduction trust is a type of trust that allows for the transfer of assets to a spouse without incurring federal estate taxes at the time of the transfer. The concept is designed to provide financial security for the surviving spouse while deferring tax obligations until later. It's an integral part of the Ohio Marital Deduction Trust - Trust A and Bypass Trust B, helping to facilitate smoother estate planning and ensure that more of your wealth remains with your loved ones.

A marital deduction trust allows assets to be transferred to a surviving spouse without incurring immediate estate taxes, providing them with financial support during their lifetime. On the other hand, a Bypass Trust enables the assets to bypass the surviving spouse's estate, offering tax benefits for heirs instead. Understanding the Ohio Marital Deduction Trust - Trust A and Bypass Trust B can help you make informed decisions about estate planning and tax implications.

The primary disadvantage of a Bypass Trust lies in its complexity and the potential for higher administrative costs. With the Ohio Marital Deduction Trust - Trust A and Bypass Trust B, it often requires additional legal work, which can be burdensome for your family. Furthermore, since the assets in a Bypass Trust are not part of the surviving spouse's estate, it can limit their access to the funds if needed for living expenses.

A QTIP Trust, or Qualified Terminable Interest Property Trust, allows a surviving spouse to receive income from the trust during their lifetime, while ensuring the principal goes to other beneficiaries after their death. In contrast, a Bypass Trust, associated with the Ohio Marital Deduction Trust - Trust A and Bypass Trust B, helps reduce estate taxes by passing assets directly to heirs, bypassing the surviving spouse's estate. This essential distinction can affect your estate planning strategy significantly, especially if tax efficiency is a priority.

To fund a bypass trust, you typically transfer certain assets into the trust’s name, which can happen during your lifetime or upon your death through your will. It is key to identify which assets to place in the trust to best utilize its tax benefits. Working with a professional familiar with the nuances of the Ohio Marital Deduction Trust - Trust A and Bypass Trust B can help streamline the funding process and ensure it aligns with your estate planning goals.

A marital trust, often known as Trust A, is established to provide financial support to the surviving spouse after one partner passes away. This trust allows the surviving spouse to access the trust assets without restrictions, promoting financial security. Additionally, marital trusts often qualify for the estate tax marital deduction, making them a valuable tool within the framework of the Ohio Marital Deduction Trust - Trust A and Bypass Trust B.

Funding a bypass trust involves transferring assets to the trust while you are still alive or upon your death. It's important to designate the trust as the beneficiary of specific assets, such as life insurance or investment accounts. Consulting with an estate planning professional can help ensure that your Ohio Marital Deduction Trust - Trust A and Bypass Trust B is funded correctly to maximize its benefits.

Marital trusts, like Trust A, can have disadvantages, notably that all assets within the trust remain part of the surviving spouse's estate upon their passing. This situation can lead to unforeseen estate tax liabilities. Moreover, if the surviving spouse decides to withdraw assets, it may diminish the trust's intended purpose. In contrast, understanding how the Ohio Marital Deduction Trust - Trust A and Bypass Trust B interact can help you make informed choices.

Trust A, often referred to as a marital trust, is designed to benefit the surviving spouse by allowing them access to the trust's assets during their lifetime. In contrast, Trust B, or the bypass trust, is established to hold assets away from the estate of the surviving spouse, thus avoiding estate taxes on those assets upon their death. Understanding the distinctions between the Ohio Marital Deduction Trust - Trust A and Bypass Trust B is crucial for effective estate planning.

If a bypass trust is never funded, it won't serve its intended purpose in your estate plan. The assets that could benefit from tax advantages will remain in your estate, which may lead to higher estate taxes. Consequently, the potential benefits of using an Ohio Marital Deduction Trust - Trust A and Bypass Trust B won't be realized. Always consider funding the bypass trust to ensure your wishes are honored.