Ohio Conveyance of Deed to Lender in Lieu of Foreclosure

Description

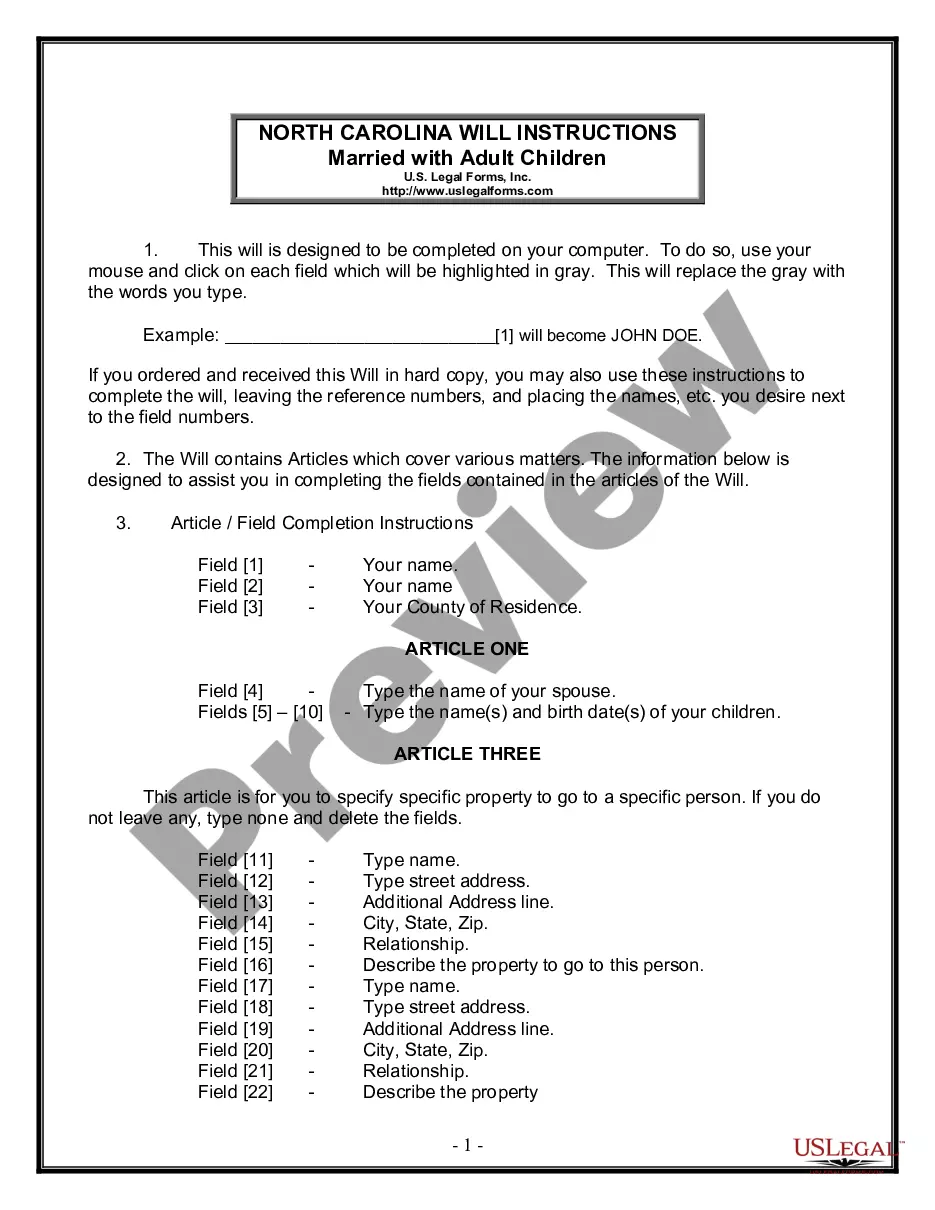

How to fill out Conveyance Of Deed To Lender In Lieu Of Foreclosure?

US Legal Forms - one of many largest libraries of authorized types in the United States - provides an array of authorized file templates you can obtain or print out. Using the site, you may get 1000s of types for business and specific uses, sorted by categories, states, or key phrases.You will find the most up-to-date versions of types such as the Ohio Conveyance of Deed to Lender in Lieu of Foreclosure in seconds.

If you currently have a membership, log in and obtain Ohio Conveyance of Deed to Lender in Lieu of Foreclosure from the US Legal Forms catalogue. The Down load switch will appear on each and every develop you view. You gain access to all formerly acquired types within the My Forms tab of your bank account.

In order to use US Legal Forms for the first time, here are easy directions to help you began:

- Ensure you have picked the best develop for the metropolis/state. Click the Review switch to review the form`s information. Look at the develop description to ensure that you have selected the appropriate develop.

- In case the develop does not satisfy your demands, make use of the Lookup industry on top of the screen to discover the one which does.

- In case you are pleased with the form, confirm your selection by clicking on the Purchase now switch. Then, choose the prices prepare you want and supply your qualifications to sign up on an bank account.

- Approach the transaction. Utilize your credit card or PayPal bank account to accomplish the transaction.

- Pick the format and obtain the form on your own system.

- Make adjustments. Complete, revise and print out and indicator the acquired Ohio Conveyance of Deed to Lender in Lieu of Foreclosure.

Every design you included in your money does not have an expiry date which is yours forever. So, if you wish to obtain or print out an additional backup, just go to the My Forms section and click on around the develop you need.

Gain access to the Ohio Conveyance of Deed to Lender in Lieu of Foreclosure with US Legal Forms, by far the most comprehensive catalogue of authorized file templates. Use 1000s of specialist and status-particular templates that fulfill your small business or specific needs and demands.

Form popularity

FAQ

What might prevent an Arizona lender from accepting a borrower's deed in lieu of foreclosure? What if the title is encumbered by liens? the lender may balk at accepting the deed, since this affects the ability to resell the property for a profit.

Understanding Deed in Lieu of Foreclosure In this process, the mortgagor deeds the collateral property, which is typically the home, back to the lender serving as the mortgagee in exchange for the release of all obligations under the mortgage. Both sides must enter into the agreement voluntarily and in good faith.

Similar to a short sale, a deed in lieu of foreclosure likely will not damage your credit as severely as a foreclosure or a bankruptcy. As noted above, the burden of selling your home shifts to someone else, so it may be more appealing than a short sale.

Drawbacks Of A Deed In Lieu No guarantee of acceptance: Your lender isn't obligated to accept your deed in lieu of foreclosure. Your credit will still take a hit: While a deed in lieu arrangement won't harm your credit as drastically as a foreclosure, you can still expect your score to drop.

Disadvantages to Lender A lender should also hesitate before accepting a lieu deed where there are outstanding subordinate liens or judgments against the property. In such a situation, the lender will have to foreclose its mortgage, with the attendant expense and time involved to obtain clear title.