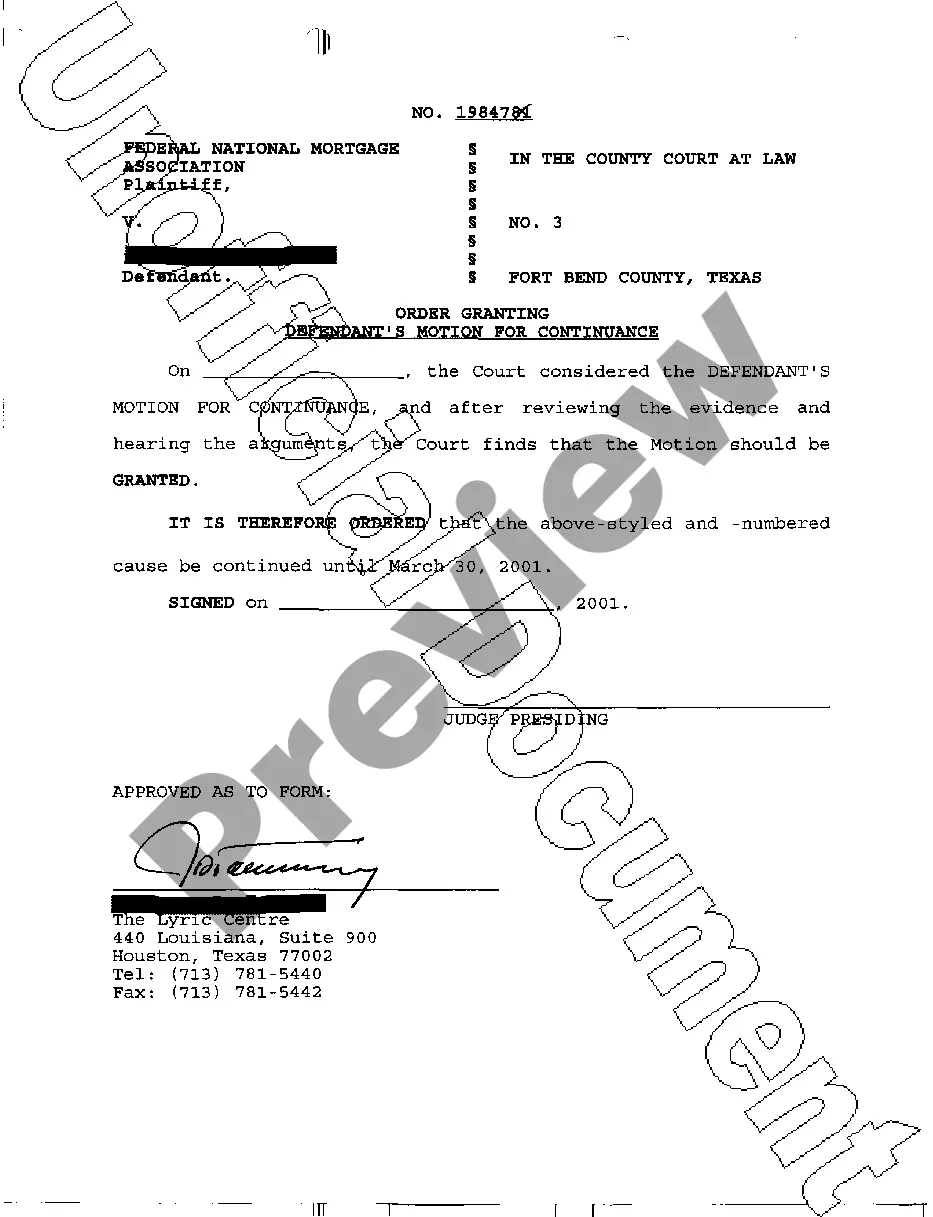

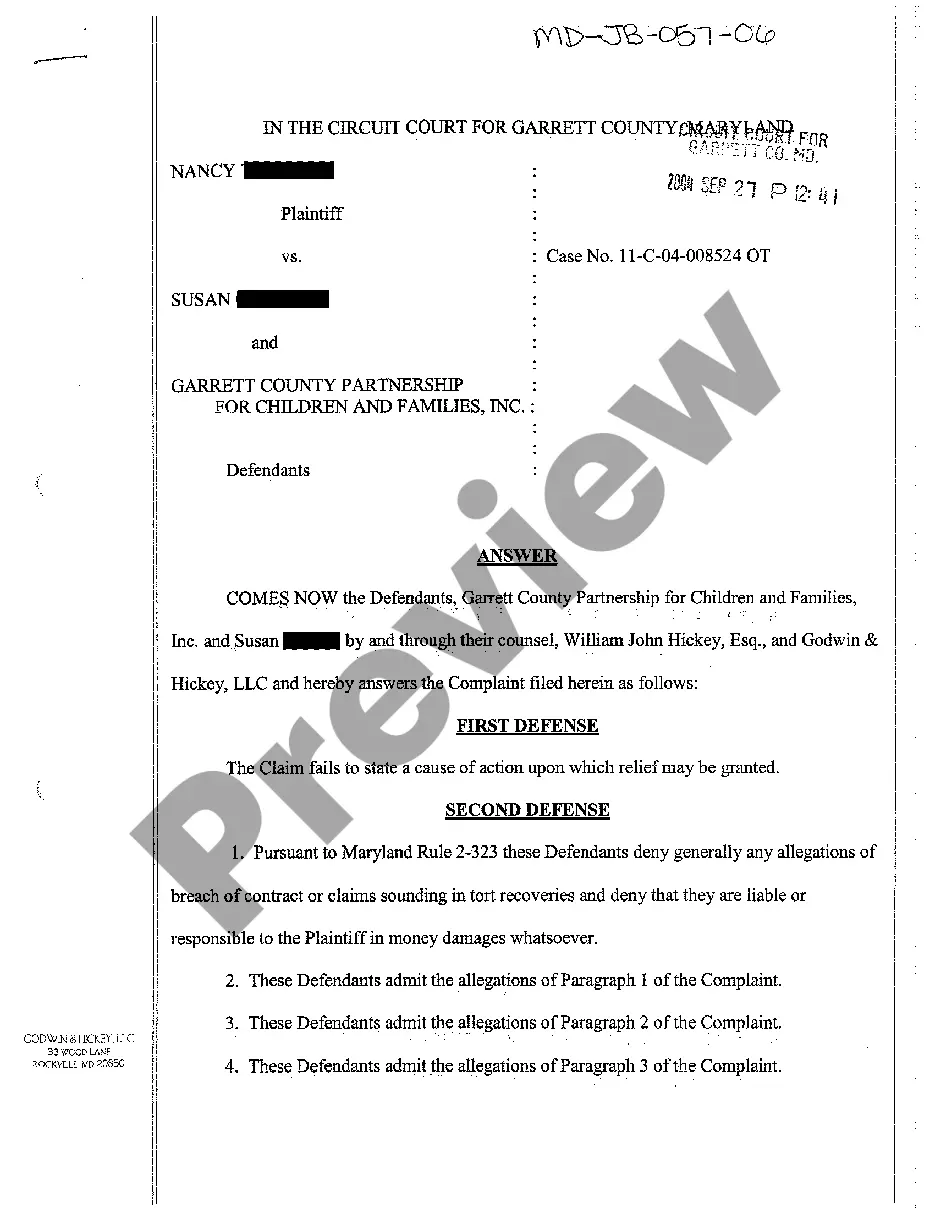

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Ohio Petition to Determine Distribution Rights of the Assets of a Decedent

Description

How to fill out Petition To Determine Distribution Rights Of The Assets Of A Decedent?

If you wish to comprehensive, down load, or print authorized record web templates, use US Legal Forms, the most important assortment of authorized forms, which can be found on the web. Use the site`s simple and easy hassle-free search to find the papers you require. Various web templates for enterprise and personal purposes are categorized by types and claims, or key phrases. Use US Legal Forms to find the Ohio Petition to Determine Distribution Rights of the Assets of a Decedent in a couple of clicks.

Should you be presently a US Legal Forms customer, log in for your bank account and then click the Acquire option to get the Ohio Petition to Determine Distribution Rights of the Assets of a Decedent . You can even entry forms you previously delivered electronically from the My Forms tab of your own bank account.

If you use US Legal Forms initially, follow the instructions beneath:

- Step 1. Make sure you have selected the form for the proper city/land.

- Step 2. Make use of the Preview method to look through the form`s articles. Do not forget to see the outline.

- Step 3. Should you be not happy with the kind, take advantage of the Lookup area towards the top of the display to discover other versions from the authorized kind web template.

- Step 4. After you have found the form you require, select the Get now option. Select the costs strategy you like and include your qualifications to register for the bank account.

- Step 5. Method the transaction. You should use your Мisa or Ьastercard or PayPal bank account to accomplish the transaction.

- Step 6. Select the structure from the authorized kind and down load it on your device.

- Step 7. Full, revise and print or signal the Ohio Petition to Determine Distribution Rights of the Assets of a Decedent .

Each and every authorized record web template you acquire is your own forever. You possess acces to every kind you delivered electronically inside your acccount. Select the My Forms area and select a kind to print or down load again.

Be competitive and down load, and print the Ohio Petition to Determine Distribution Rights of the Assets of a Decedent with US Legal Forms. There are millions of professional and condition-certain forms you can use to your enterprise or personal requirements.

Form popularity

FAQ

A distribution is the delivery of cash or an asset to a given heir. After resolving debts and paying any taxes due, the executor should distribute the remaining estate to the heirs in ance with the instructions in the will (or as dictated by the court).

(B)(1) Every administrator and executor, within six months after appointment, shall render a final and distributive account of the administrator's or executor's administration of the estate unless one or more of the following circumstances apply: (a) An Ohio estate tax return must be filed for the estate.

Probate court is a specialized type of court that deals with the property and debts of a person who has died. The basic role of the probate court judge is to assure that the deceased person's creditors are paid, and that any remaining assets are distributed to the proper beneficiaries.

A will is a legal document that sets forth your wishes regarding the distribution of your property and the care of any minor children. If you die without a will, those wishes may not be carried out.

Common sources of information about asset existence include: The will. A list the decedent prepared in advance. The decedent's lawyer or tax accountant.

If some of the children of an intestate are living and others are dead, the estate shall descend to the children who are living and to the lineal descendants of the children who are dead, so that each child who is living will inherit the share to which the child who is living would have been entitled if all the ...