This form is an example of a contract to donate a horse to a rescue or other organization. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Ohio Equine or Horse Donation Contract

Description

How to fill out Equine Or Horse Donation Contract?

Are you currently in a situation where you frequently require documents for either business or personal reasons.

There are several authentic document templates available online, but locating reliable ones can be challenging.

US Legal Forms offers a vast selection of form templates, such as the Ohio Equine or Horse Donation Agreement, designed to comply with both state and federal regulations.

Once you have the right form, click Purchase now.

Choose the pricing plan you want, fill out the necessary information to create your account, and make your payment via PayPal or credit card. Select a convenient file format and download your copy. Access all the document templates you have purchased in the My documents section. You can request an additional copy of the Ohio Equine or Horse Donation Agreement any time if needed. Just go through the required form to obtain or print the document template. Use US Legal Forms, the most extensive collection of legal forms, to save time and prevent mistakes. The service offers professionally crafted legal document templates suitable for a variety of purposes. Create an account on US Legal Forms and start making your life easier.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Ohio Equine or Horse Donation Agreement template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it corresponds to your specific city/area.

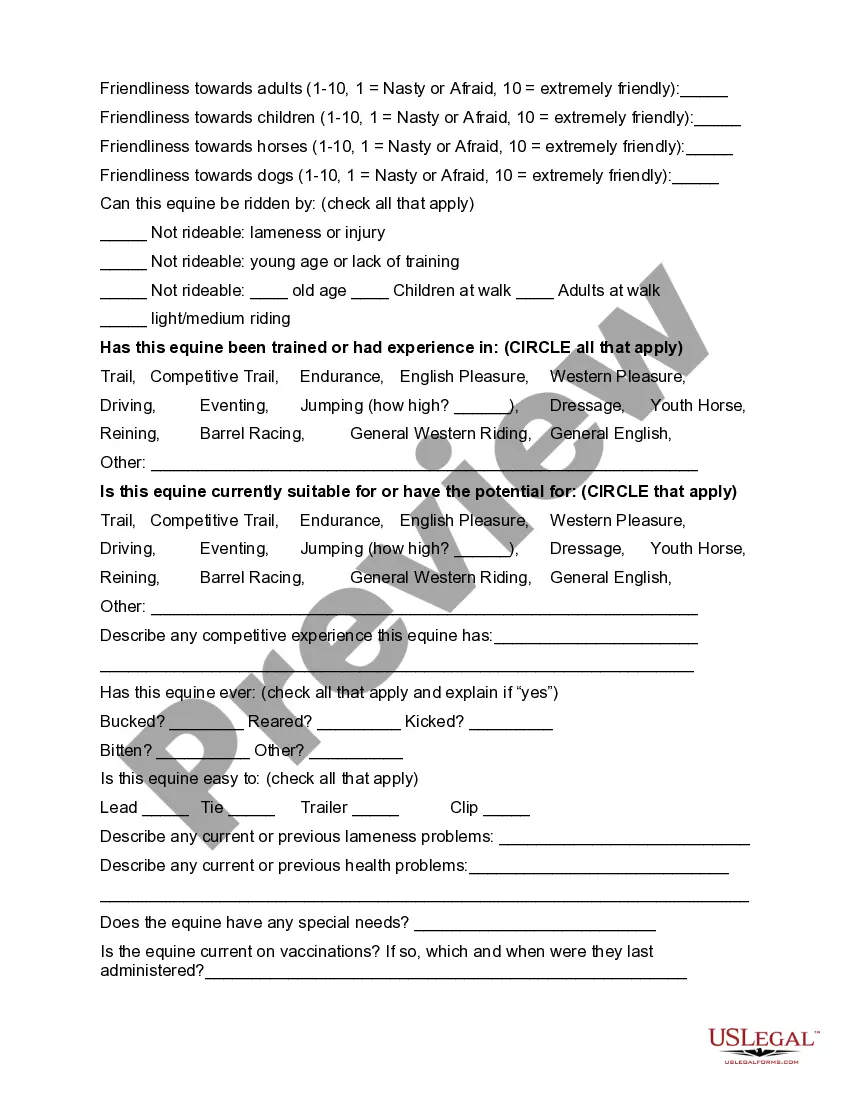

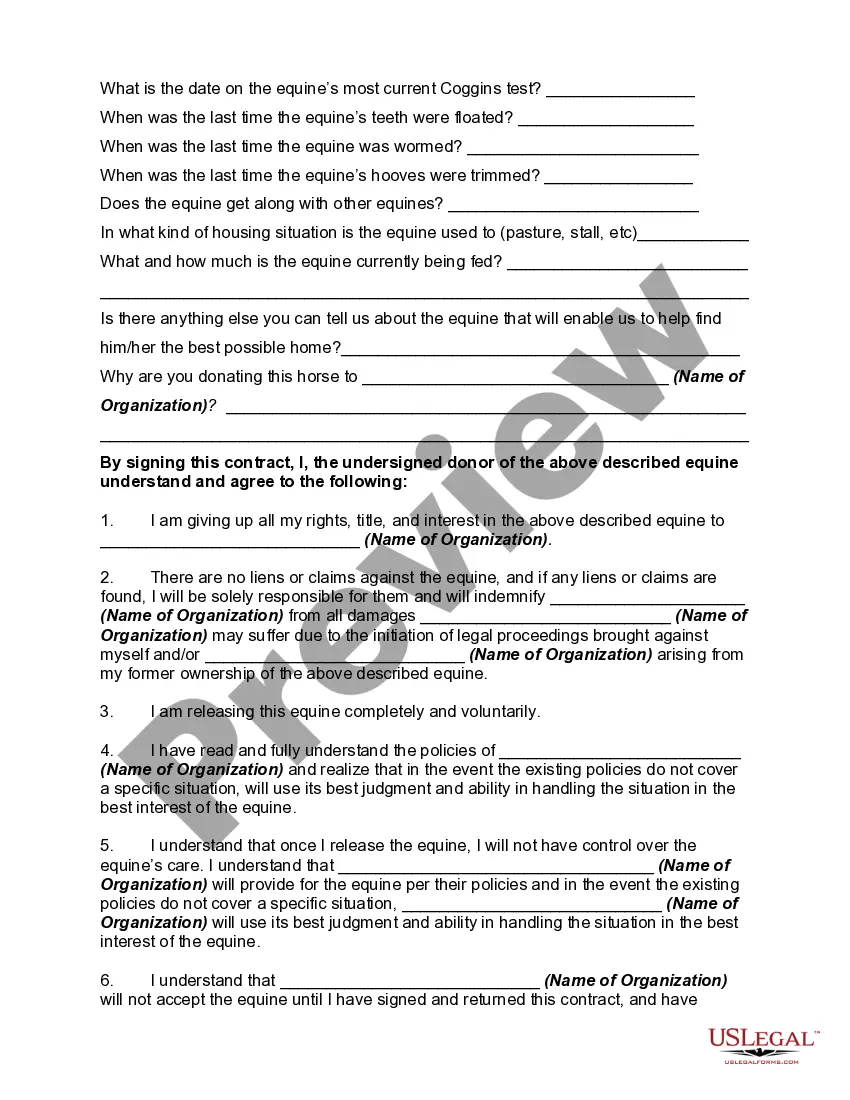

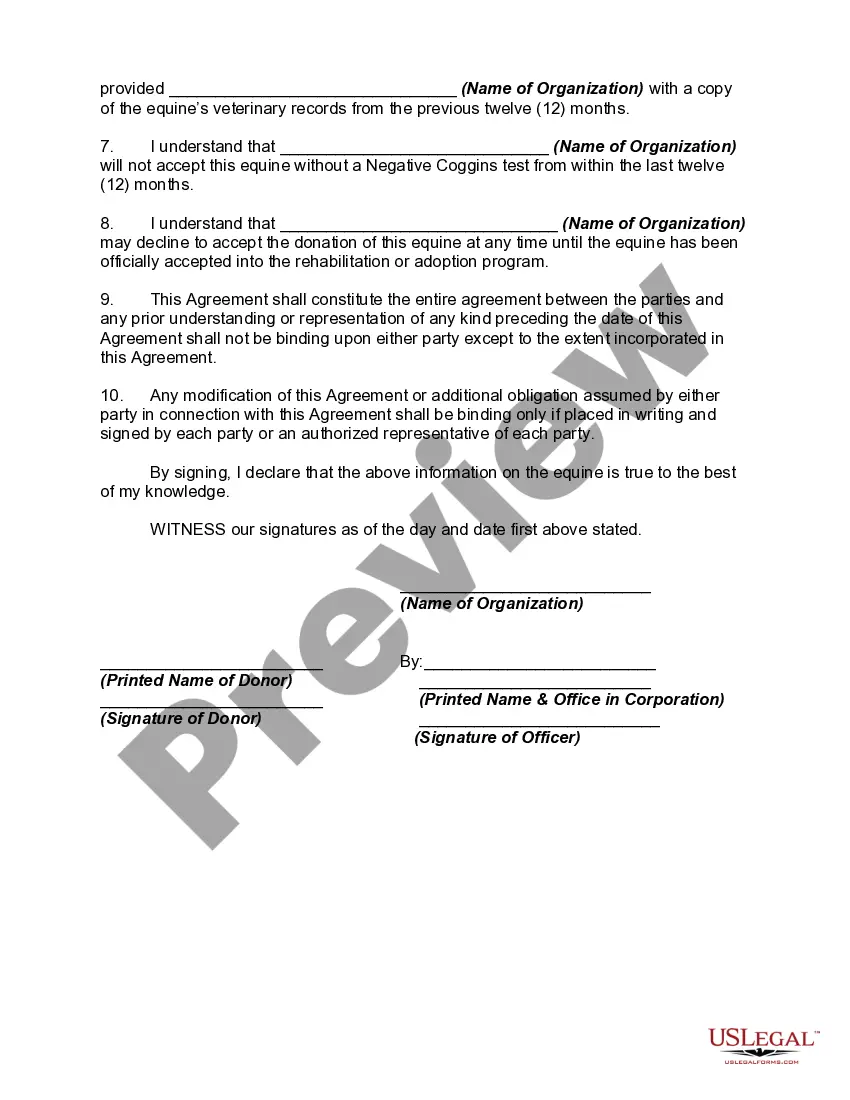

- Utilize the Preview button to review the document.

- Check the details to confirm you have selected the correct form.

- If the form does not meet your needs, use the Search field to find a suitable form.

Form popularity

FAQ

The amount you need to donate to receive a tax write-off varies based on the type of organization. Generally, any donation you make, as long as it is to a qualified charity, can be written off. Using an Ohio Equine or Horse Donation Contract can simplify the process, as it outlines your donation, ensuring you receive the maximum allowable benefits during tax season.

For tax purposes, a horse is generally classified as personal property. This classification means that the horse is considered tangible property that can be bought, sold, or donated. When you use an Ohio Equine or Horse Donation Contract, it helps clarify the donation's terms, making it easier to address any questions about the horse's property status in tax considerations.

Donating to a horse rescue can also qualify as a tax write-off if the organization is a registered charity. You may claim a deduction for the value of your donation. To ensure you comply with tax regulations, it's wise to use an Ohio Equine or Horse Donation Contract when making your donation. This contract serves as clear evidence of your contribution.

Yes, donating a horse can be tax-deductible under certain conditions. If you donate your horse to a qualified charitable organization, you may be eligible to deduct the fair market value of the horse on your taxes. It is important to document the donation properly, which is where an Ohio Equine or Horse Donation Contract can be valuable, as it provides a written record for you and the charity.

To give away a horse, start by ensuring you have a clear understanding of the horse's health, temperament, and any special needs. You can reach out to local equine rescues, horse enthusiasts, or use online platforms. Additionally, if you want to formalize the process, consider using an Ohio Equine or Horse Donation Contract. This document helps you outline the terms of the donation, ensuring a smooth transition for both you and the new owner.

Absolutely, you can donate a horse to charity. Many organizations accept horse donations to support their missions, whether it’s for rehabilitation, education, or other charitable purposes. Ensure that you have an Ohio Equine or Horse Donation Contract before proceeding, as this document formalizes the donation and protects both parties involved. It’s a thoughtful way to contribute to a cause while ensuring a smooth transition for the horse.

While UC Davis welcomes horse donations, bringing your horse to the campus for other reasons depends on specific program guidelines. The university's equestrian program may have restrictions regarding non-donated horses. It's best to inquire directly with their administration about bringing a horse to campus, and having an Ohio Equine or Horse Donation Contract can enhance your discussions around horse-related activities.

To donate a horse to charity, start by researching organizations that align with your values and mission. Once you find a suitable charity, reach out to them for specific donation procedures. It is crucial to prepare a detailed Ohio Equine or Horse Donation Contract to ensure a smooth transfer and clarify any obligations on both sides. This legal document serves to protect your interests and the charity's as well.

Yes, UC Davis has a well-established equestrian program that offers a range of opportunities for students and horse enthusiasts. This program encompasses both educational and practical experiences in the equine field. By donating a horse, you can contribute to the program’s growth and help students develop their skills in handling and caring for horses, all facilitated through an Ohio Equine or Horse Donation Contract.

Yes, you can receive a tax write-off for donating a horse, as it may qualify as a charitable contribution. However, to take full advantage of this benefit, you should have a properly executed Ohio Equine or Horse Donation Contract. This document will substantiate your donation and provide the necessary details for tax reporting. It’s advisable to consult a tax professional to understand the specifics related to your situation.