Ohio Non-Exclusive Online Affiliate Program Agreement

Description

How to fill out Non-Exclusive Online Affiliate Program Agreement?

Selecting the appropriate legal document template can be quite challenging. Naturally, there are numerous designs available online, but how can you obtain the legal form you require? Utilize the US Legal Forms website. This service offers thousands of templates, including the Ohio Non-Exclusive Online Affiliate Program Agreement, that you can utilize for business and personal purposes. All forms are reviewed by experts and meet state and federal regulations.

If you are already registered, Log In to your account and click on the Download button to acquire the Ohio Non-Exclusive Online Affiliate Program Agreement. Use your account to search for the legal documents you have purchased previously. Navigate to the My documents section of your account to download another copy of the document you need.

If you are a new user of US Legal Forms, here are simple instructions you should follow: First, ensure you have selected the correct form for your city/county. You can review the form using the Preview button and examine the form description to confirm it is suitable for you. If the form does not meet your requirements, use the Search field to find the appropriate form.

- Once you are certain the form is correct, click the Purchase now button to obtain the form.

- Choose the pricing plan you prefer and enter the necessary details.

- Create your account and finalize the purchase using your PayPal account or credit card.

- Select the file format and download the legal document template to your device.

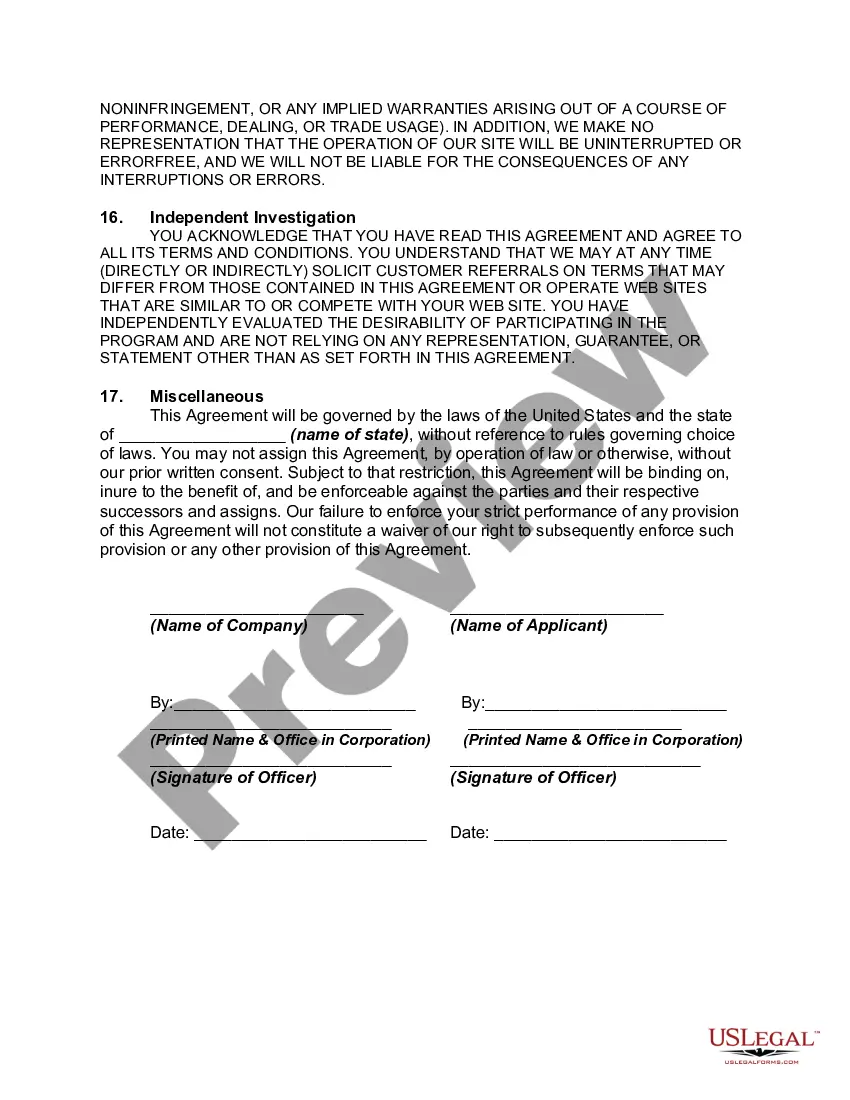

- Complete, modify, print, and sign the obtained Ohio Non-Exclusive Online Affiliate Program Agreement.

- US Legal Forms is the largest repository of legal forms where you can find various document templates. Utilize the service to download accurately crafted documents that comply with state regulations.

Form popularity

FAQ

A foreign entity refers to any business entity that operates in a state other than where it was formed. In contrast, an LLC, or limited liability company, is a specific type of business entity that provides liability protection to its owners. Essentially, while all LLCs can be considered entities, not all entities are LLCs. This distinction is important for your Ohio Non-Exclusive Online Affiliate Program Agreement, as the structure and registration process may differ.

Registering a foreign business in the US involves choosing a state, then submitting the necessary documentation to the state's Secretary of State office. Each state has its own requirements, typically including an application, a certificate of good standing from your home state, and possibly a registered agent. For smooth navigation of this process, consider using uslegalforms, which provides templates and guidance related to your Ohio Non-Exclusive Online Affiliate Program Agreement.

Registering as a foreign entity in Ohio requires filling out the appropriate application, which you submit to the Secretary of State. You will also need to provide proof of your business formation from your home state. It's recommended to check whether you need a registered agent in Ohio, as this is often necessary. Utilizing services like uslegalforms can help you navigate these requirements when drafting your Ohio Non-Exclusive Online Affiliate Program Agreement.

To register a foreign entity in Ohio, you need to submit an application for a certificate of authority to the Ohio Secretary of State. This process involves providing documents that verify your business is registered in its home state. Additionally, you may need to include a copy of your operating agreement. Using uslegalforms platform can simplify this process with ready-to-use templates for your Ohio Non-Exclusive Online Affiliate Program Agreement.

An affiliate agreement is a contract that defines the terms between a business and its affiliates. This document typically addresses the commission structure, roles, and responsibilities in promoting the business. The Ohio Non-Exclusive Online Affiliate Program Agreement is a practical choice for businesses looking to engage multiple affiliates without exclusivity. By utilizing this type of agreement, you can foster a mutually beneficial relationship that drives sales and growth.

A participating affiliate arrangement refers to the way businesses collaborate with affiliates to promote their offerings. This structure allows affiliates to earn commissions based on performance metrics, enhancing motivation and results. The Ohio Non-Exclusive Online Affiliate Program Agreement supports this arrangement, providing clear guidelines on how affiliates can operate. Thus, you can maximize your marketing reach while maintaining control over your brand.

An affiliation contract is a formal document that establishes a partnership between a business and its affiliates. It typically includes terms regarding compensation, responsibilities, and promotional methods. The Ohio Non-Exclusive Online Affiliate Program Agreement is a specific example designed to accommodate various affiliates simultaneously. This ensures that your business can leverage multiple marketing channels effectively.

A participating affiliate agreement outlines the relationship between a business and its affiliates. This contract details how affiliates can promote the business’s products or services while earning commissions. An Ohio Non-Exclusive Online Affiliate Program Agreement facilitates this arrangement, allowing multiple affiliates to operate without exclusivity. This type of agreement provides flexibility and growth opportunities for your business.

Yes, having a contract for affiliate marketing is essential to establish clear expectations. An agreement protects both the company and the affiliate by defining roles, responsibilities, and payment terms. Using an Ohio Non-Exclusive Online Affiliate Program Agreement template from USLegalForms can simplify the process and ensure you cover all necessary elements.

The contract for affiliate marketing serves as a binding agreement between the affiliate and the company. It defines the parameters of performance, commission structures, and payment timelines. A well-crafted Ohio Non-Exclusive Online Affiliate Program Agreement protects both parties and lays out the expectations clearly.