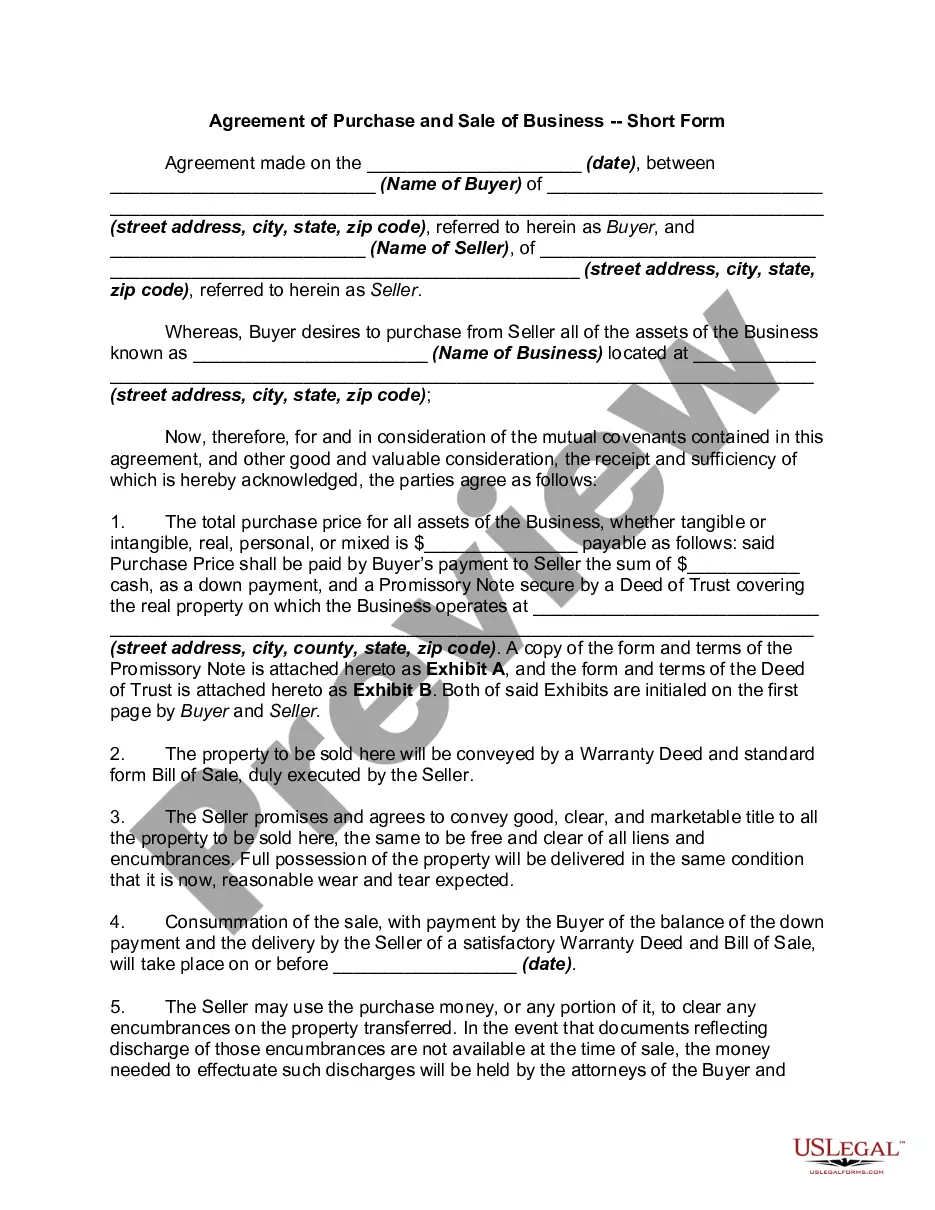

This form involves the sale of a small business. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

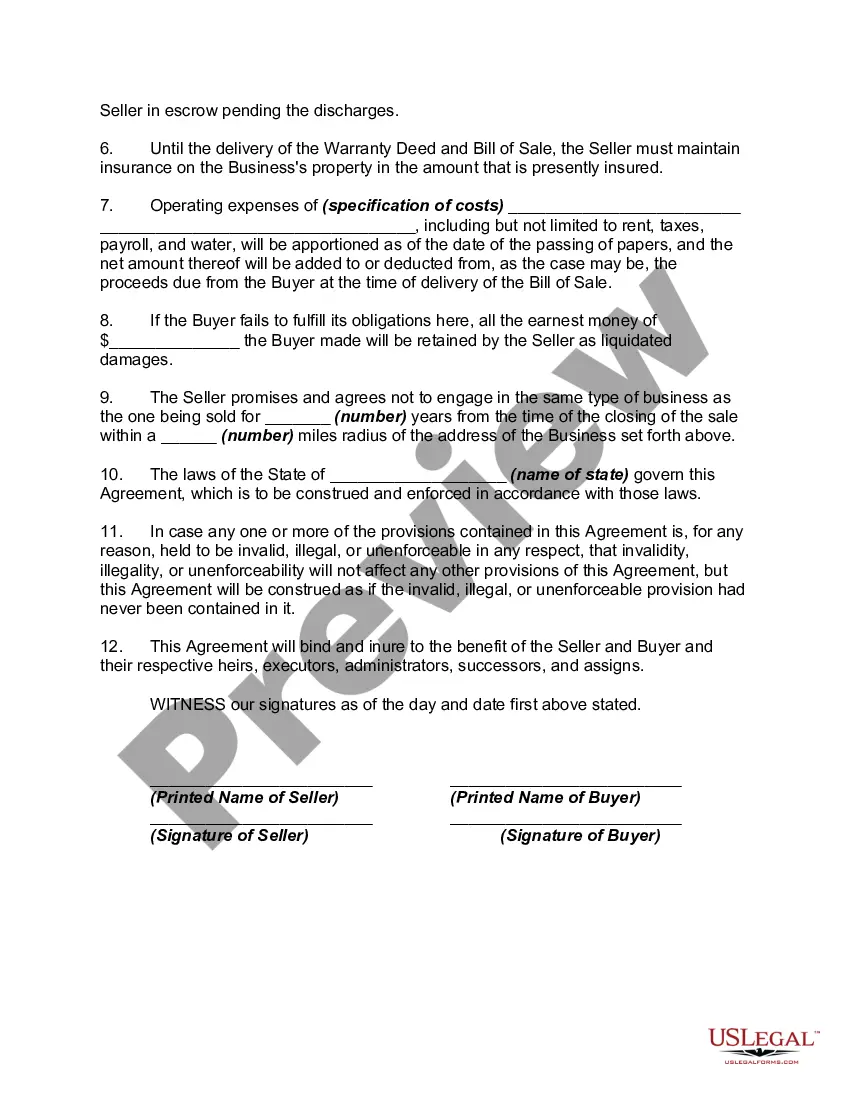

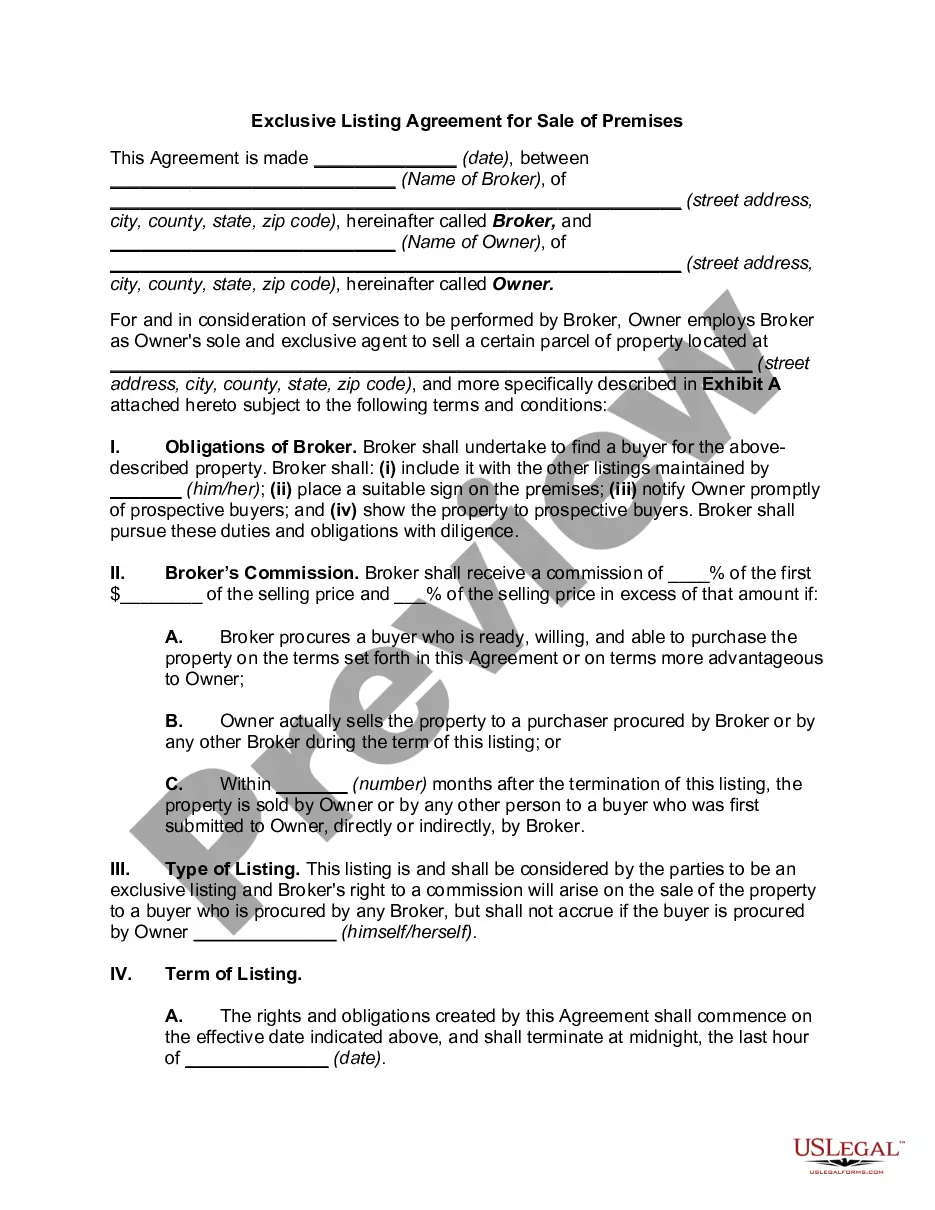

The Ohio Agreement of Purchase and Sale of Business — Short Form is a legal document used in Ohio to outline the terms and conditions of a business sale transaction. This agreement serves as a legally binding contract between the buyer and the seller, describing the purchase price, assets included, and other critical details involved in the sale. The Ohio Agreement of Purchase and Sale of Business — Short Form can vary depending on the specific business type or industry involved. Some common variations of this agreement include: 1. Retail Business — Short Form: This type of agreement is tailored for the sale of a retail business, such as a clothing store, grocery store, or restaurant. It includes specific clauses related to inventory, customer databases, and equipment relevant to the retail sector. 2. Service Business — Short Form: Designed for businesses that primarily provide services such as consulting firms, marketing agencies, or healthcare clinics. This agreement emphasizes the transfer of intangible assets, client contracts, and intellectual property. 3. Manufacturing Business — Short Form: This version focuses on businesses involved in manufacturing and production, accounting for items like machinery, raw materials, production processes, and existing supplier contracts. 4. Franchise Business — Short Form: For businesses operating under a franchise model, this agreement considers additional factors such as franchise fees, obligations to the parent company, and the transfer of franchise rights. In addition to these variations, the Ohio Agreement of Purchase and Sale of Business — Short Form typically covers essential elements, including: A. Purchase Price: Clearly states the agreed-upon purchase price for the business and outlines the payment terms and methods. B. Assets Included: Specifies the assets being transferred, such as inventory, equipment, real estate, intellectual property, contracts, employees, and goodwill. C. Liabilities and Debts: Addresses the responsibility for outstanding debts and liabilities of the business being sold. D. Closing Conditions: Sets out the conditions that must be met before the sale can be finalized, including due diligence, inspections, and approvals. E. Representations and Warranties: Outlines the assurances provided by both the buyer and the seller regarding the accuracy of the information provided and the condition of the business being sold. F. Non-Compete Clause: Restricts the seller from engaging in similar business activities within a specific geographic area and for a defined period after the sale. G. Confidentiality and Non-Disclosure: Ensures that all sensitive information shared during the sale process remains confidential and prohibits the buyer and seller from disclosing it to third parties. The Ohio Agreement of Purchase and Sale of Business — Short Form provides a legal framework for business transactions, safeguarding the interests of both parties involved. It is crucial for buyers and sellers to consult with legal professionals to tailor the agreement to their specific business type and ensure compliance with Ohio state laws.The Ohio Agreement of Purchase and Sale of Business — Short Form is a legal document used in Ohio to outline the terms and conditions of a business sale transaction. This agreement serves as a legally binding contract between the buyer and the seller, describing the purchase price, assets included, and other critical details involved in the sale. The Ohio Agreement of Purchase and Sale of Business — Short Form can vary depending on the specific business type or industry involved. Some common variations of this agreement include: 1. Retail Business — Short Form: This type of agreement is tailored for the sale of a retail business, such as a clothing store, grocery store, or restaurant. It includes specific clauses related to inventory, customer databases, and equipment relevant to the retail sector. 2. Service Business — Short Form: Designed for businesses that primarily provide services such as consulting firms, marketing agencies, or healthcare clinics. This agreement emphasizes the transfer of intangible assets, client contracts, and intellectual property. 3. Manufacturing Business — Short Form: This version focuses on businesses involved in manufacturing and production, accounting for items like machinery, raw materials, production processes, and existing supplier contracts. 4. Franchise Business — Short Form: For businesses operating under a franchise model, this agreement considers additional factors such as franchise fees, obligations to the parent company, and the transfer of franchise rights. In addition to these variations, the Ohio Agreement of Purchase and Sale of Business — Short Form typically covers essential elements, including: A. Purchase Price: Clearly states the agreed-upon purchase price for the business and outlines the payment terms and methods. B. Assets Included: Specifies the assets being transferred, such as inventory, equipment, real estate, intellectual property, contracts, employees, and goodwill. C. Liabilities and Debts: Addresses the responsibility for outstanding debts and liabilities of the business being sold. D. Closing Conditions: Sets out the conditions that must be met before the sale can be finalized, including due diligence, inspections, and approvals. E. Representations and Warranties: Outlines the assurances provided by both the buyer and the seller regarding the accuracy of the information provided and the condition of the business being sold. F. Non-Compete Clause: Restricts the seller from engaging in similar business activities within a specific geographic area and for a defined period after the sale. G. Confidentiality and Non-Disclosure: Ensures that all sensitive information shared during the sale process remains confidential and prohibits the buyer and seller from disclosing it to third parties. The Ohio Agreement of Purchase and Sale of Business — Short Form provides a legal framework for business transactions, safeguarding the interests of both parties involved. It is crucial for buyers and sellers to consult with legal professionals to tailor the agreement to their specific business type and ensure compliance with Ohio state laws.