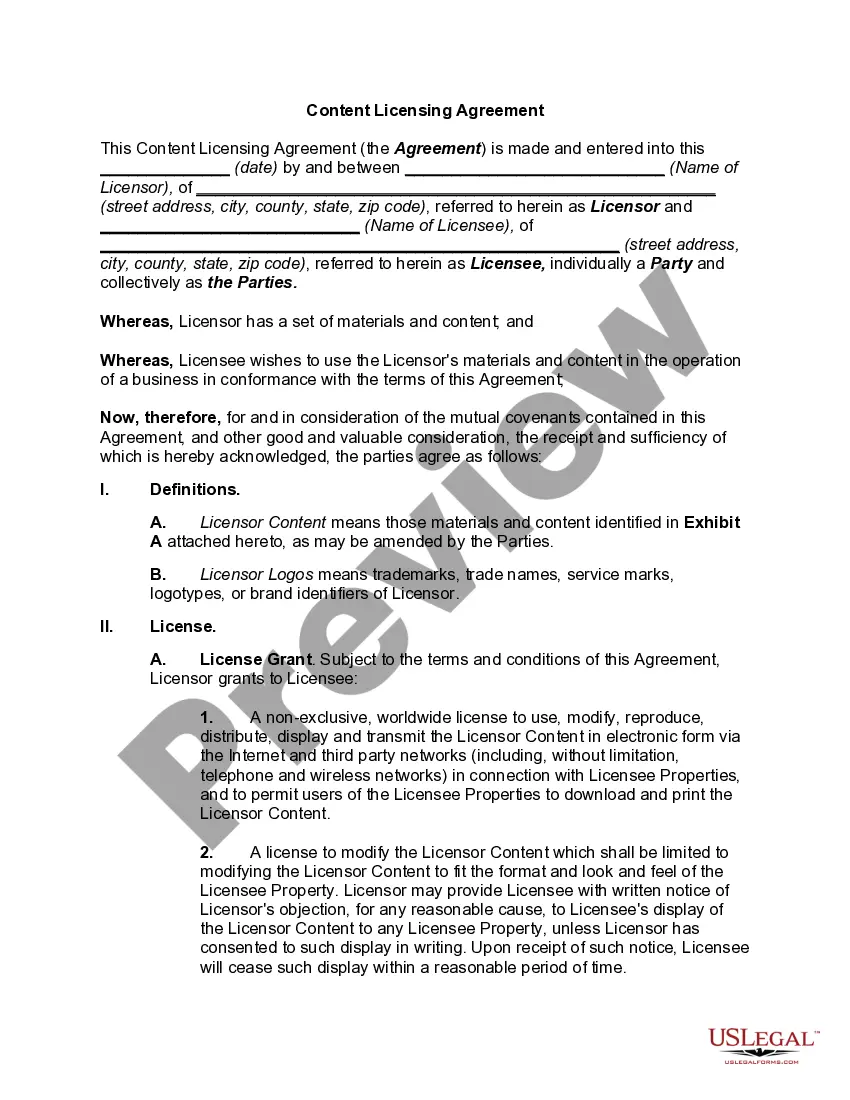

The Ohio Agreement to Compromise Debt is a legal document that establishes the terms and conditions for resolving outstanding debts in the state of Ohio. This agreement acts as a compromise between a debtor and a creditor, outlining the agreed-upon settlement amount, payment schedule, and any other related terms. Keywords: Ohio, Agreement to Compromise Debt, legal document, outstanding debts, debtor, creditor, settlement amount, payment schedule, terms. There are several types of Ohio Agreement to Compromise Debt available, each designed to cater to different scenarios or parties involved. These include: 1. Personal Debt Compromise Agreement: This type of agreement is commonly used when an individual owes money to a creditor, such as credit card debt, medical bills, or personal loans. It outlines the negotiated settlement amount that the debtor can afford to pay, along with a structured payment plan. 2. Business Debt Compromise Agreement: This agreement is utilized in situations where a business entity is struggling to repay its debts. It enables the business and its creditors to come to a mutual agreement on the reduced amount to be paid, the terms of repayment, and any other conditions deemed necessary. 3. Tax Debt Compromise Agreement: In cases where an individual or business owes back taxes to the state of Ohio or the Internal Revenue Service (IRS), a tax debt compromise agreement can be signed. This agreement facilitates a settlement between the taxpayer and the tax authorities, allowing for a reduction in the overall tax liability and a feasible payment plan. 4. Mortgage Debt Compromise Agreement: When a homeowner is facing difficulties in making mortgage payments and is at risk of foreclosure, a mortgage debt compromise agreement can be pursued. This agreement allows the borrower and the lender to negotiate a reduced mortgage balance or interest rate, potentially preventing the foreclosure and enabling the homeowner to keep their property. 5. Student Loan Debt Compromise Agreement: With the rising burden of student loan debt, some individuals may face challenges in repaying their loans. A student loan debt compromise agreement is an option available in certain cases, allowing borrowers to reach a settlement with their loan service or creditor by agreeing on a reduced repayment amount or alternative payment plan. It is crucial to consult with a qualified attorney or financial advisor to navigate the complexities of an Ohio Agreement to Compromise Debt, as each case may have unique circumstances and legal considerations. Understanding the terms and implications of such agreements can provide debtors with the opportunity for financial relief and a fresh start.

Ohio Agreement to Compromise Debt

Description

How to fill out Ohio Agreement To Compromise Debt?

It is possible to spend time on the Internet trying to find the authorized document template that suits the state and federal requirements you will need. US Legal Forms provides thousands of authorized forms which can be analyzed by pros. You can easily acquire or print the Ohio Agreement to Compromise Debt from my service.

If you currently have a US Legal Forms account, you can log in and click the Download key. Next, you can total, revise, print, or sign the Ohio Agreement to Compromise Debt. Every single authorized document template you get is yours permanently. To have one more duplicate for any purchased type, proceed to the My Forms tab and click the corresponding key.

If you work with the US Legal Forms web site initially, keep to the basic directions below:

- Initially, ensure that you have selected the proper document template for your county/metropolis of your choice. Look at the type description to ensure you have selected the right type. If readily available, take advantage of the Preview key to search throughout the document template as well.

- If you want to find one more version in the type, take advantage of the Search area to find the template that suits you and requirements.

- Once you have located the template you would like, click Acquire now to move forward.

- Choose the prices program you would like, type in your references, and sign up for a merchant account on US Legal Forms.

- Complete the financial transaction. You may use your Visa or Mastercard or PayPal account to cover the authorized type.

- Choose the formatting in the document and acquire it to your gadget.

- Make changes to your document if needed. It is possible to total, revise and sign and print Ohio Agreement to Compromise Debt.

Download and print thousands of document templates making use of the US Legal Forms website, that provides the biggest selection of authorized forms. Use skilled and state-specific templates to tackle your small business or specific needs.