A Bill of Sale with encumbrances means that whatever product is being sold has some sort of lien, mortgage, or monies owing, and the Buyer is agreeing that they will take on these obligations upon purchase.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

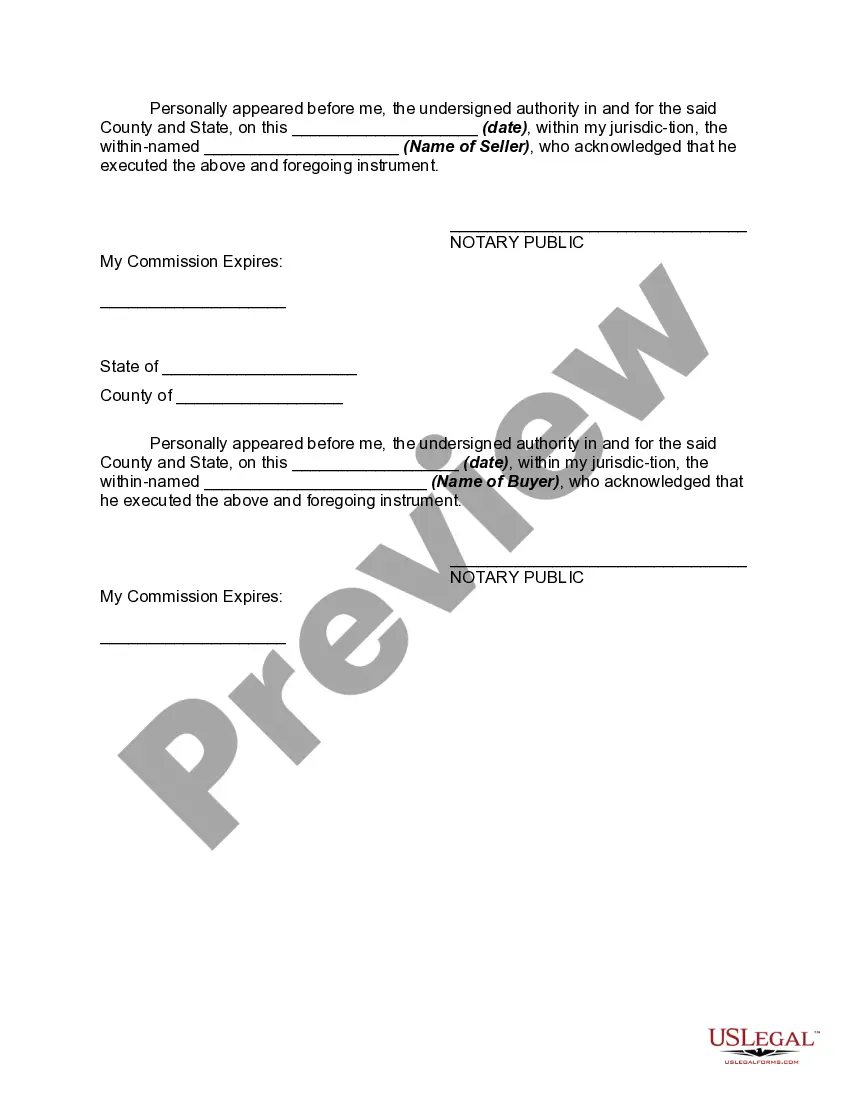

The Ohio Bill of Sale with Encumbrances is a legal document used to transfer ownership of a property or item from one party to another, while also disclosing any existing encumbrances or liens on the property. This bill of sale ensures a transparent and lawful transaction, protecting both the buyer and the seller. Encumbrances refer to any claims or outstanding debts on the property that may affect the transfer of ownership. These can include mortgages, liens, easements, or any other legal interests in the property held by a third party. It is crucial to disclose these encumbrances in the bill of sale to inform the buyer about any potential obligations or risks associated with the purchase. There are different types of Ohio Bill of Sale with Encumbrances, which are tailored to specific types of transactions or properties: 1. Ohio Real Estate Bill of Sale with Encumbrances: This document is used primarily for the sale of real estate properties, such as residential homes, commercial buildings, or land. It includes a detailed description of the property, identifies the parties involved, and lists any encumbrances that may exist. 2. Ohio Vehicle Bill of Sale with Encumbrances: This type of bill of sale is used for the transfer of ownership of motor vehicles, including cars, motorcycles, trucks, and recreational vehicles. It outlines the vehicle's details, identifies the buyer and seller, and includes information regarding any existing liens or encumbrances, such as outstanding auto loans. 3. Ohio Personal Property Bill of Sale with Encumbrances: This form of bill of sale is used when transferring ownership of personal property, such as furniture, electronics, or valuable assets. It ensures that the buyer is aware of any encumbrances, such as existing leases or warranties, that may affect their rights to the property. Regardless of the specific type, an Ohio Bill of Sale with Encumbrances serves as a legally binding document that provides essential information about the transfer of ownership, protecting the rights of both parties involved. It is important to consult with a legal professional to ensure the accurate completion and understanding of this document before entering into any transaction.The Ohio Bill of Sale with Encumbrances is a legal document used to transfer ownership of a property or item from one party to another, while also disclosing any existing encumbrances or liens on the property. This bill of sale ensures a transparent and lawful transaction, protecting both the buyer and the seller. Encumbrances refer to any claims or outstanding debts on the property that may affect the transfer of ownership. These can include mortgages, liens, easements, or any other legal interests in the property held by a third party. It is crucial to disclose these encumbrances in the bill of sale to inform the buyer about any potential obligations or risks associated with the purchase. There are different types of Ohio Bill of Sale with Encumbrances, which are tailored to specific types of transactions or properties: 1. Ohio Real Estate Bill of Sale with Encumbrances: This document is used primarily for the sale of real estate properties, such as residential homes, commercial buildings, or land. It includes a detailed description of the property, identifies the parties involved, and lists any encumbrances that may exist. 2. Ohio Vehicle Bill of Sale with Encumbrances: This type of bill of sale is used for the transfer of ownership of motor vehicles, including cars, motorcycles, trucks, and recreational vehicles. It outlines the vehicle's details, identifies the buyer and seller, and includes information regarding any existing liens or encumbrances, such as outstanding auto loans. 3. Ohio Personal Property Bill of Sale with Encumbrances: This form of bill of sale is used when transferring ownership of personal property, such as furniture, electronics, or valuable assets. It ensures that the buyer is aware of any encumbrances, such as existing leases or warranties, that may affect their rights to the property. Regardless of the specific type, an Ohio Bill of Sale with Encumbrances serves as a legally binding document that provides essential information about the transfer of ownership, protecting the rights of both parties involved. It is important to consult with a legal professional to ensure the accurate completion and understanding of this document before entering into any transaction.