A consultant is someone who gives expert or professional advice. Consultants are ordinarily hired on an independent contractor basis, therefore, the hiring party is not liable to others for the acts or omissions of the consultant. As distinguished from an employee, a consultant pays their own Social Security, income taxes without payroll deduction, has no retirement or health plan rights, and often is not entitled to worker's compensation coverage.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

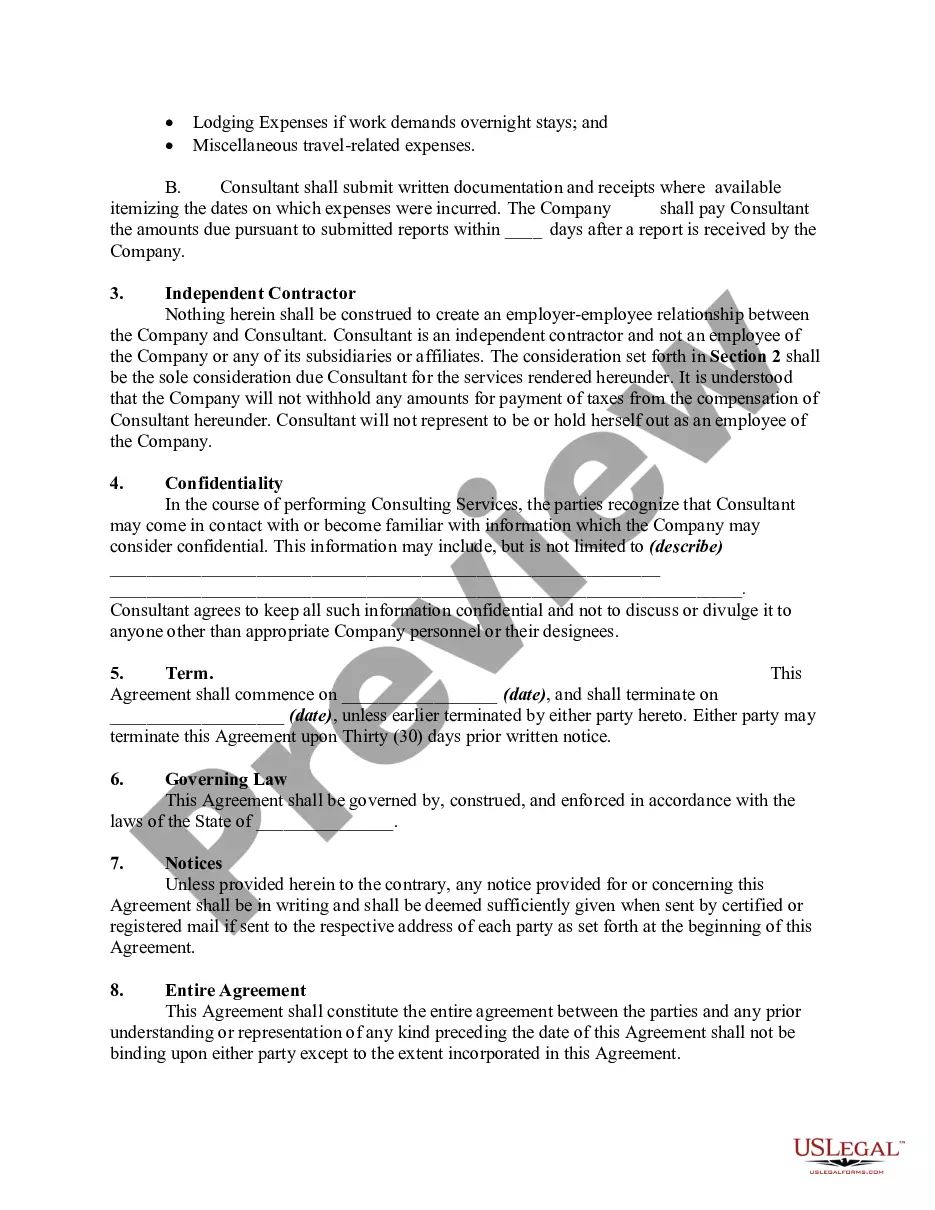

An Ohio Consulting Agreement — Short refers to a concise legal contract that outlines the terms and conditions between a consultant and a client in the state of Ohio. This agreement sets the framework for the professional consulting services being provided and helps establish a clear understanding between both parties involved. Key Elements of an Ohio Consulting Agreement — Short: 1. Parties: Clearly state the names and addresses of the consultant and the client who are entering into the agreement. 2. Scope of Work: Describe in detail the specific consulting services that will be provided by the consultant, including any deliverables or milestones that need to be met during the engagement. 3. Compensation: Specify the payment structure, rates, and terms of payment for the consulting services rendered. This section may also include provisions for expenses, reimbursements, and any applicable taxes. 4. Term and Termination: Define the duration of the agreement, outlining the start and end dates. Additionally, include provisions for early termination, termination for cause, or the possibility of renewal. 5. Intellectual Property: Clarify who retains ownership rights of any intellectual property created during the consulting engagement. This may involve specifying whether the consultant or the client will have exclusive rights or if there will be shared ownership. 6. Confidentiality: Establish the responsibility of both parties to maintain the confidentiality of any sensitive or proprietary information shared during the course of the consulting engagement. Include the terms for handling confidential information and any non-disclosure obligations. 7. Independent Contractor Status: Clearly state that the consultant is an independent contractor and not an employee of the client. This section resolves any confusion regarding the consultant's tax obligations, benefits, or liability. Types of Ohio Consulting Agreement — Short: 1. General Consulting Agreement: This is the widely-used standard form of a short consulting agreement in Ohio, suitable for a wide array of consulting services across various industries. 2. Technology Consulting Agreement: Specifically designed for technology consultants who offer specialized services such as IT consulting, software development, system optimization, or cybersecurity assessments. 3. Management Consulting Agreement: Tailored for consultants specializing in business management, strategic planning, operations, or organizational development, providing guidance to enhance a client's overall efficiency and effectiveness. 4. Financial Consulting Agreement: Targeting consultants in the financial sector who offer expertise in areas like accounting, tax planning, investment advisory, or risk management. In conclusion, an Ohio Consulting Agreement — Short is a crucial legal document that safeguards the rights and obligations of both the consultant and the client. It ensures a mutual understanding and a smooth consulting engagement.