Ohio Financial Record Storage Chart is a comprehensive tool used by financial institutions and businesses in Ohio to track and organize their financial records. This chart serves as a detailed record-keeping solution, ensuring compliance with state and federal regulations while providing easy access to important financial information when needed. The Ohio Financial Record Storage Chart is designed to accurately categorize various types of financial documents based on their importance and retention periods. It helps businesses determine how long each type of record should be kept, allowing them to adhere to legal requirements while avoiding unnecessary storage costs. The chart includes relevant keywords such as "financial records," "record-keeping," "compliance," and "retention periods" to accurately classify financial documents. It assists in organizing and tracking various types of financial records, including but not limited to: 1. Tax records: This category encompasses tax returns, supporting documentation, and any other records related to taxes. The chart clearly determines how long each record must be retained based on Ohio's regulations. 2. Financial statements: Financial statements, including balance sheets, income statements, and cash flow statements, are crucial for businesses to analyze their financial performance over time. The chart specifies the retention period for various financial statements. 3. Invoices and receipts: Ohio Financial Record Storage Chart guides businesses in storing invoices and receipts for a certain period, allowing them to maintain accurate financial records for accounting and auditing purposes. 4. Payroll records: Payroll records, such as timesheets, pay stubs, and tax withholding forms, are essential for businesses' employee management and tax reporting. The chart indicates how long these records should be maintained. 5. Contracts and agreements: This category covers various financial contracts, agreements, and legal documents like loan agreements, leases, and partnership agreements. The chart outlines the retention periods for such documents, ensuring businesses stay compliant with laws and regulations. 6. Bank statements and canceled checks: The Ohio Financial Record Storage Chart provides guidance on how long businesses should retain bank statements, canceled checks, deposit slips, and other banking records. 7. Insurance records: This category includes insurance policies, claims, and related documents. The chart specifies the retention periods for insurance records to ensure businesses maintain sufficient coverage and manage claims effectively. By implementing the Ohio Financial Record Storage Chart, businesses can stay organized, efficiently manage their financial records, and comply with Ohio's specific regulations. It simplifies record-keeping processes and enables businesses to access important financial information when required, saving time and effort in the long run.

Ohio Financial Record Storage Chart

Description

How to fill out Ohio Financial Record Storage Chart?

Are you currently within a situation that you need papers for both organization or specific functions nearly every working day? There are a lot of authorized record templates available on the Internet, but locating kinds you can trust is not simple. US Legal Forms delivers a huge number of form templates, just like the Ohio Financial Record Storage Chart, that happen to be published to meet state and federal needs.

Should you be previously informed about US Legal Forms website and have your account, simply log in. Following that, you can acquire the Ohio Financial Record Storage Chart format.

Unless you have an bank account and wish to begin to use US Legal Forms, abide by these steps:

- Get the form you require and ensure it is for that appropriate town/state.

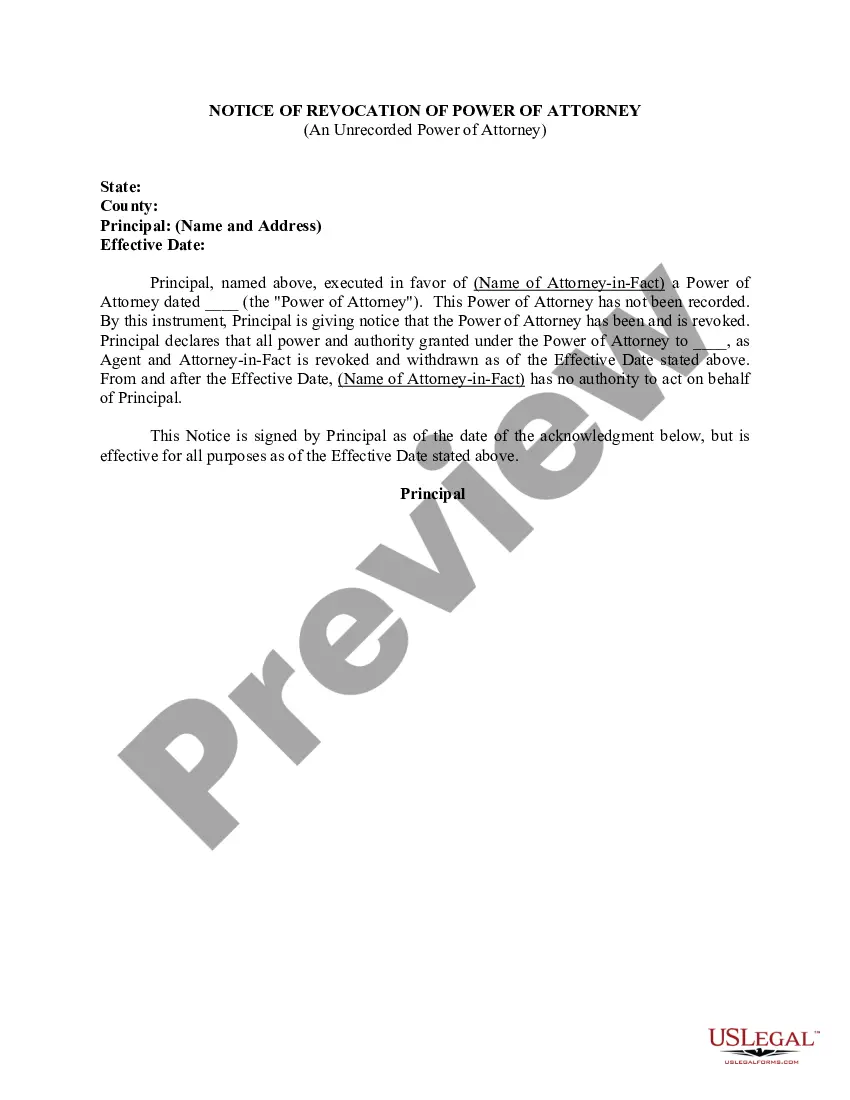

- Make use of the Review button to examine the form.

- Read the explanation to actually have selected the right form.

- When the form is not what you`re seeking, use the Look for area to get the form that suits you and needs.

- If you find the appropriate form, simply click Get now.

- Pick the costs plan you desire, fill out the required info to produce your bank account, and pay for your order with your PayPal or Visa or Mastercard.

- Decide on a practical paper formatting and acquire your backup.

Discover all the record templates you might have purchased in the My Forms menu. You can get a extra backup of Ohio Financial Record Storage Chart whenever, if necessary. Just click on the needed form to acquire or print out the record format.

Use US Legal Forms, one of the most considerable assortment of authorized kinds, to conserve time as well as avoid errors. The services delivers skillfully made authorized record templates which you can use for a selection of functions. Create your account on US Legal Forms and start generating your life easier.