Ohio Mortgage Deed is a legal document that serves as evidence of a mortgage agreement between the borrower and the lender. It outlines the terms and conditions of the loan, as well as the property being used as collateral. When signed by both parties, the Ohio Mortgage Deed becomes a binding contract. This document contains essential information such as the names and addresses of the borrower (mortgagor) and lender (mortgagee), the amount of the loan, the interest rate, and the repayment terms. It also specifies the property's legal description, including its address and parcel identification number (PIN). Ohio recognizes several types of Mortgage Deeds, each catering to different circumstances: 1. Fixed-Rate Mortgage Deed: This is the most common type of mortgage in Ohio. It involves a fixed interest rate throughout the loan term, offering stability and predictability for both the borrower and the lender. 2. Adjustable-Rate Mortgage Deed (ARM): With an ARM, the interest rate is variable and may change periodically during the loan term. The rate is typically fixed for an initial period, then adjusted based on market conditions. Borrowers who expect their income to increase or plan to sell the property before the rate adjusts may opt for an ARM. 3. Balloon Mortgage Deed: This type of mortgage allows borrowers to make lower monthly payments for a specific period, usually five to seven years. At the end of this period, the remaining balance becomes due in one lump sum payment, which often necessitates refinancing or selling the property. 4. FHA Insured Mortgage Deed: The Federal Housing Administration (FHA) provides mortgage insurance to protect lenders against borrower default. This type of mortgage is typically sought by first-time homebuyers or those with lower credit scores or limited down payment funds. 5. VA Guaranteed Mortgage Deed: Reserved for eligible veterans, active-duty service members, and surviving spouses, this mortgage program is guaranteed by the Department of Veterans Affairs. It offers favorable terms and benefits, including low-to-no down payment requirements and competitive interest rates. Regardless of the type of Ohio Mortgage Deed, it is crucial for both parties to thoroughly read and understand the terms before signing. Consulting with a real estate attorney or a mortgage professional is highly recommended ensuring compliance with Ohio's laws and regulations, safeguarding the rights and interests of all involved parties.

Ohio Mortgage Deed

Description

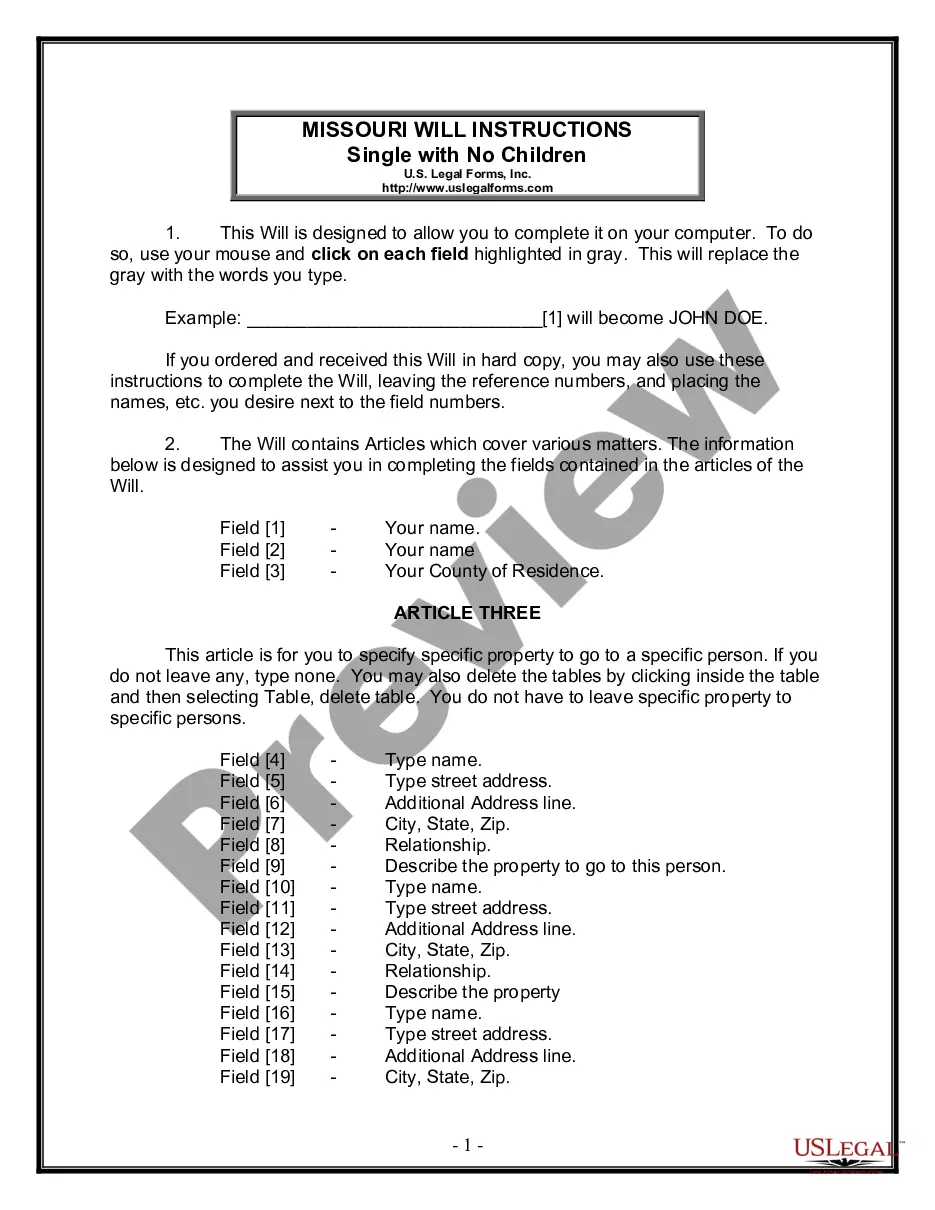

How to fill out Ohio Mortgage Deed?

Are you currently inside a position in which you will need papers for possibly company or specific reasons just about every day? There are a lot of legal papers themes accessible on the Internet, but getting versions you can rely on is not effortless. US Legal Forms offers thousands of kind themes, like the Ohio Mortgage Deed, that are created to satisfy state and federal needs.

In case you are already acquainted with US Legal Forms site and get a merchant account, basically log in. Following that, you are able to obtain the Ohio Mortgage Deed design.

Should you not have an profile and need to begin to use US Legal Forms, adopt these measures:

- Discover the kind you want and make sure it is to the proper town/region.

- Make use of the Preview button to analyze the form.

- Read the description to actually have selected the correct kind.

- In case the kind is not what you`re trying to find, take advantage of the Search industry to obtain the kind that meets your needs and needs.

- When you obtain the proper kind, click on Acquire now.

- Pick the rates prepare you desire, submit the necessary information and facts to produce your money, and buy the order using your PayPal or Visa or Mastercard.

- Choose a hassle-free document file format and obtain your backup.

Discover each of the papers themes you may have bought in the My Forms food list. You can aquire a further backup of Ohio Mortgage Deed whenever, if possible. Just click the needed kind to obtain or produce the papers design.

Use US Legal Forms, the most considerable selection of legal types, in order to save efforts and avoid blunders. The assistance offers expertly produced legal papers themes which can be used for an array of reasons. Generate a merchant account on US Legal Forms and begin making your lifestyle a little easier.

Form popularity

FAQ

A deed transferring Ohio real estate is filed in the county recorder's office of the county where the property is situated. The county recorder's office records the deed in the county's ?official records? and indexes the deed by party names, date, and property description.

An attorney licensed to practice law in Ohio must prepare deeds, powers of attorney, and other instruments that are to be recorded. One exception is that a party to the transaction may prepare an instrument in which they are a party.

Focusing on this geographical region, the Deed of Trust is the preferred or required security instrument for real property in the following states: Maryland, North Carolina, Tennessee, Virginia and West Virginia. Mortgages are used in Kentucky, Ohio and Pennsylvania.

If you want to obtain a copy of the deed to your home, contact your local county recorder. In Ohio, county recorders are responsible for maintaining land records and making them accessible to the public. The Ohio Revised Code establishes fees recorders may charge for various services.

Yes. As of February 1, 2002, Ohio law no longer requires two witnesses to the signing of the seller's quitclaim deed or to other transfers of title to real property such as a mortgage or land contract. You can create a valid deed as long as an authorized public notary notarizes it.

To put simply, the deed is the legal document that proves who holds title to a property, while a mortgage is an agreement between a financial lender and borrower to repay the amount borrowed to purchase a home.

A deed is a physical, legal document that conveys the ownership rights to a real estate property. In Ohio, the deed must be signed by the seller to be valid, and should be duly stamped and attested in the presence of a notary.

If you want to obtain a copy of the deed to your home, contact your local county recorder. In Ohio, county recorders are responsible for maintaining land records and making them accessible to the public. The Ohio Revised Code establishes fees recorders may charge for various services.