Revenue sharing is a funding arrangement in which one government unit grants a portion of its tax income to another government unit. For example, provinces or states may share revenue with local governments, or national governments may share revenue with provinces or states. Laws determine the formulas by which revenue is shared, limiting the controls that the unit supplying the money can exercise over the receiver and specifying whether matching funds must be supplied by the receiver.

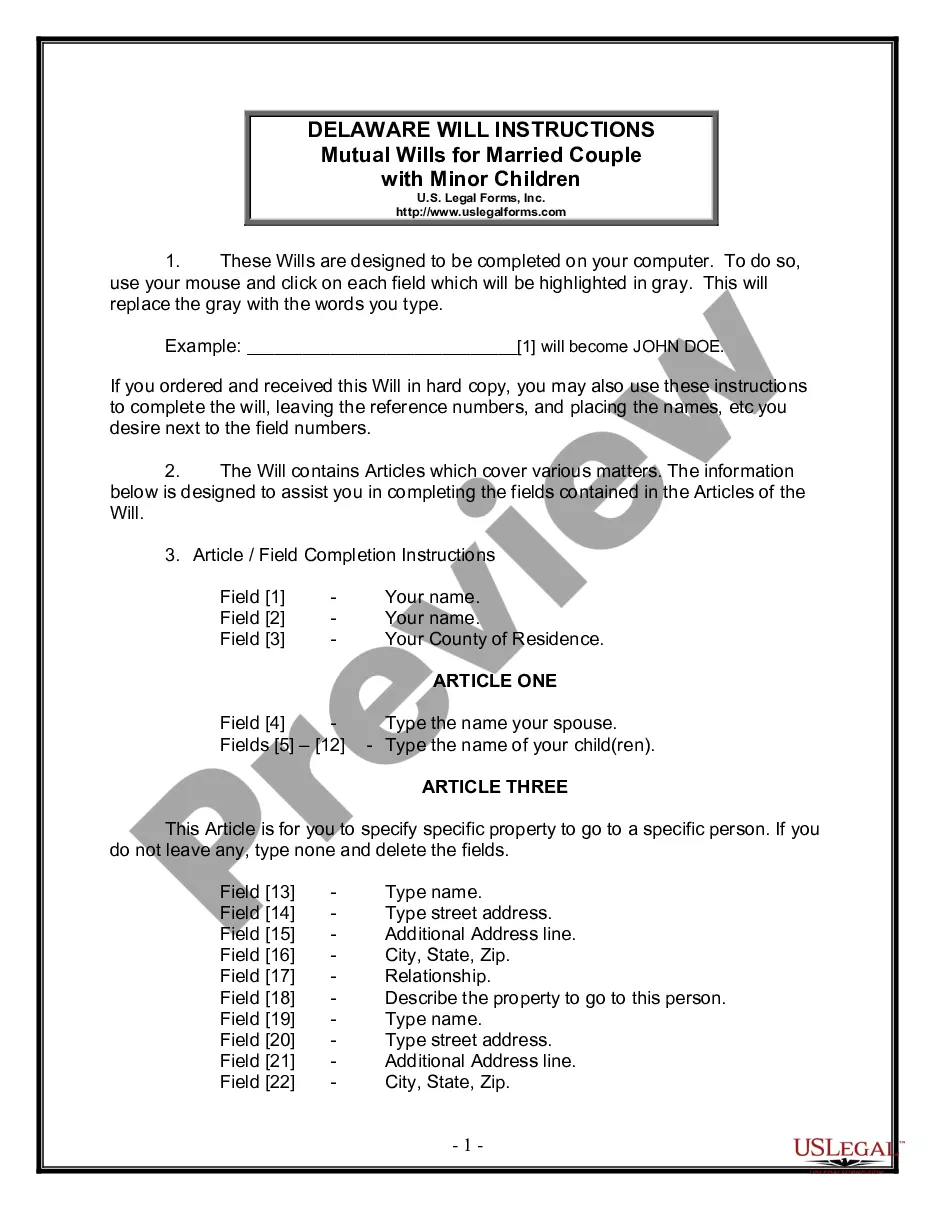

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

The Ohio Revenue Sharing Agreement is a financial arrangement between the state government of Ohio and its local governments, aimed at distributing a portion of the state's revenue to support the funding needs of local jurisdictions. This agreement is crucial in ensuring a fair distribution of resources and promoting collaboration between the state and its localities. Under the Ohio Revenue Sharing Agreement, the state government allocates a portion of its tax revenue to be shared with local governments, including counties, municipalities, townships, and school districts. This sharing of revenue helps to supplement the local government budgets, which may be insufficient to meet the demands of essential services such as education, infrastructure development, public safety, and social programs. There are different types of Ohio Revenue Sharing Agreements, each catering to specific needs and priorities. Some of these may include: 1. County Revenue Sharing Agreements: These agreements focus on distributing revenue to individual counties, enabling local governments to fund necessary county-level services, such as maintaining county roads and bridges, operating county parks, and providing health and human services. 2. Municipal Revenue Sharing Agreements: These agreements channel funds to individual municipalities within Ohio, facilitating the delivery of crucial city services like garbage collection, local law enforcement, street maintenance, and recreational facilities. 3. Township Revenue Sharing Agreements: These agreements aim to support Ohio's townships in maintaining and improving local infrastructure, particularly roads, bridges, and wastewater systems. Additionally, the revenue sharing provisions help townships provide essential services, such as fire and emergency services, land use planning, and zoning enforcement. 4. School District Revenue Sharing Agreements: These agreements primarily target supporting Ohio's school districts in managing their budgets and meeting the educational needs of students. The shared revenue assists in funding quality education programs, hiring qualified teachers, providing necessary learning materials, and maintaining school facilities. Overall, the Ohio Revenue Sharing Agreement plays a pivotal role in fostering equitable distribution of resources across the state. By ensuring that local governments receive a fair share of the state's revenue, this agreement strengthens the collaboration between the state and its localities, ultimately benefiting Ohio residents by enhancing public services and maintaining a high quality of life.