Ohio Sample Letter for Tax Clearance Letters is a formal document issued by the Ohio Department of Taxation to certify that an individual or business has obtained tax clearance in the state of Ohio. This letter serves as proof that all outstanding tax liabilities have been paid or resolved. The purpose of an Ohio Sample Letter for Tax Clearance Letters is to provide assurance to recipients, such as potential buyers or lenders, that the individual or business is in compliance with Ohio's tax laws. This letter is often required in various financial and legal transactions where tax compliance is a prerequisite. There are several types of Ohio Sample Letter for Tax Clearance Letters depending on the specific situation: 1. Individual Tax Clearance Letter: This type of letter is issued to individuals who have fulfilled their tax obligations, including income tax, property tax, and any other applicable taxes as required by the state of Ohio. 2. Business Tax Clearance Letter: This letter is issued to businesses, such as corporations, partnerships, or sole proprietorship, to validate that all their tax liabilities in Ohio have been fully paid. 3. Sales Tax Clearance Letter: This letter specifically confirms that a business has met its sales tax obligations to the state of Ohio. It indicates that all sales taxes collected from customers have been remitted to the Department of Taxation. 4. Employer Tax Clearance Letter: This type of letter is issued to employers to certify that they have remitted all required payroll taxes, including income tax withholding, Social Security, Medicare, and unemployment taxes, on behalf of their employees. 5. Vendor Tax Clearance Letter: Vendors or suppliers who wish to conduct business with the state of Ohio may be required to submit this letter to demonstrate compliance with tax regulations. It confirms that the vendor has paid all necessary taxes to the state. 6. Estate Tax Clearance Letter: This letter is issued to the executor or administrator of an estate to verify that all necessary estate taxes have been paid in accordance with Ohio laws. It is important to note that the content and format of an Ohio Sample Letter for Tax Clearance Letters may vary. However, it generally includes the taxpayer's identification information, a statement of tax compliance, the effective date of clearance, and the official stamp or seal of the Ohio Department of Taxation. Obtaining an Ohio Sample Letter for Tax Clearance Letters can provide peace of mind and facilitate smooth transactions for taxpayers and businesses in Ohio, ensuring their compliance with the state's tax laws.

Ohio Sample Letter for Tax Clearance Letters

Description

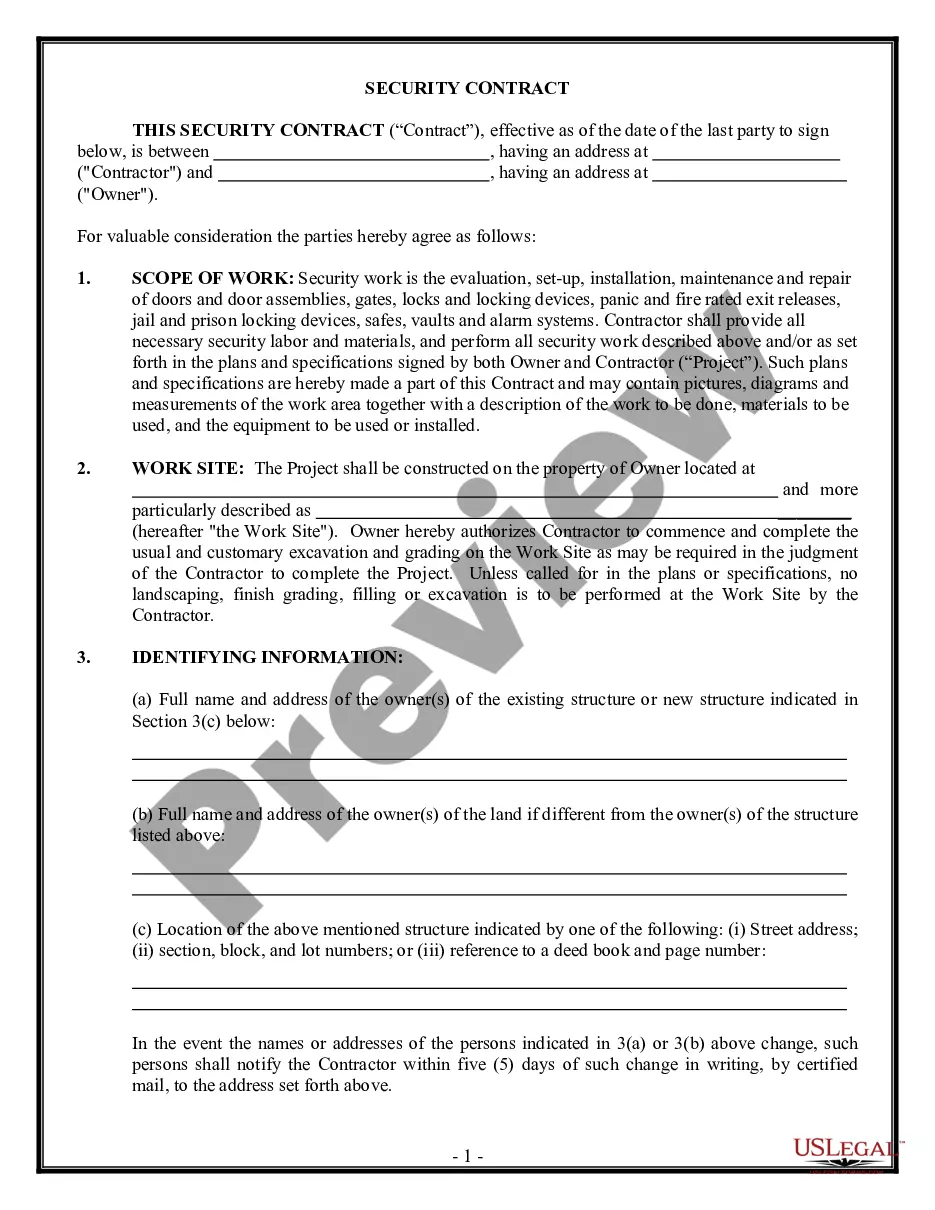

How to fill out Ohio Sample Letter For Tax Clearance Letters?

US Legal Forms - among the greatest libraries of legitimate varieties in the USA - offers a wide range of legitimate papers themes you can acquire or printing. While using internet site, you may get 1000s of varieties for business and individual functions, categorized by types, suggests, or keywords and phrases.You can find the most up-to-date variations of varieties much like the Ohio Sample Letter for Tax Clearance Letters in seconds.

If you already possess a subscription, log in and acquire Ohio Sample Letter for Tax Clearance Letters in the US Legal Forms local library. The Down load option can look on every kind you perspective. You have accessibility to all earlier acquired varieties from the My Forms tab of the account.

If you would like use US Legal Forms the very first time, listed below are basic instructions to help you get started:

- Be sure to have chosen the right kind for your personal area/state. Click on the Preview option to review the form`s content material. Browse the kind information to actually have selected the right kind.

- In case the kind does not suit your requirements, utilize the Research industry near the top of the screen to obtain the one which does.

- In case you are satisfied with the form, verify your choice by clicking on the Purchase now option. Then, choose the costs prepare you want and give your references to register for an account.

- Procedure the purchase. Make use of your credit card or PayPal account to accomplish the purchase.

- Find the formatting and acquire the form on the gadget.

- Make alterations. Fill out, edit and printing and signal the acquired Ohio Sample Letter for Tax Clearance Letters.

Every template you added to your money does not have an expiry particular date and it is your own eternally. So, in order to acquire or printing another duplicate, just visit the My Forms area and then click about the kind you require.

Get access to the Ohio Sample Letter for Tax Clearance Letters with US Legal Forms, by far the most substantial local library of legitimate papers themes. Use 1000s of specialist and condition-specific themes that meet up with your small business or individual demands and requirements.