Ohio Reorganization of Partnership by Modification of Partnership Agreement refers to a legal process in the state of Ohio that allows partnerships to be reorganized or modified through the amendment of their partnership agreement. This process provides a way for partnerships to adapt and address changing circumstances, objectives, or business needs. The Ohio Revised Code outlines the provisions and procedures for the Reorganization of Partnership by Modification of Partnership Agreement. Under this framework, partnerships can implement changes such as altering the partnership’s name, adding or removing partners, changing profit and loss distribution, modifying capital contributions, adjusting management roles, and amending termination provisions. The primary purpose of the Ohio Reorganization of Partnership by Modification of Partnership Agreement is to ensure that the partnership agreement accurately represents the interests and intentions of all partners involved. By allowing modifications or reorganization, the partners can maintain a more efficient and effective partnership structure that aligns with their current and future goals. Some significant types of Ohio Reorganization of Partnership by Modification of Partnership Agreement may include: 1. Change in Profit and Loss Distribution: Partnerships might choose to modify the distribution of profits and losses to reflect changes in partner contributions, roles, or other agreed-upon factors. This reorganization is aimed at ensuring fairness and equity amongst partners. 2. Addition or Removal of Partners: Partnerships often experience changes in membership due to various circumstances. Whether a new partner joins or an existing partner withdraws, the partnership agreement can be modified to reflect the revised composition of the partnership. 3. Alteration of Capital Contributions: When partners decide to revise the amounts or methods of capital contributions, they can modify the partnership agreement. This reorganization can occur when a partner wishes to invest more capital or when partners agree to adjust their contributions based on changing business needs. 4. Amendments to Management Roles: Partnerships may require modifications to the partnership agreement to accommodate changes in managerial responsibilities. This could involve redefining decision-making authority, appointing new managing partners, or adjusting voting rights. 5. Termination Provisions: The Reorganization of Partnership by Modification of Partnership Agreement in Ohio also covers amendments related to the conditions and procedures for partnership dissolution or termination. Partnerships can modify these provisions to align with their desired exit strategies or to address unforeseen circumstances. It is important to note that any modifications made through the Ohio Reorganization of Partnership by Modification of Partnership Agreement must comply with the Ohio Revised Code and should be drafted and executed with legal guidance to ensure accuracy and enforceability. In summary, Ohio Reorganization of Partnership by Modification of Partnership Agreement allows partnerships in Ohio to adapt and update their partnership agreements to accommodate changes in membership, capital contributions, profit distribution, management roles, and termination provisions. By leveraging this process, partnerships can maintain a flexible and efficient structure that aligns with their evolving business objectives.

Ohio Reorganization of Partnership by Modification of Partnership Agreement

Description

How to fill out Ohio Reorganization Of Partnership By Modification Of Partnership Agreement?

Are you presently in a place where you need to have documents for possibly organization or individual uses nearly every day time? There are a variety of lawful file web templates accessible on the Internet, but finding types you can rely on is not effortless. US Legal Forms offers a huge number of develop web templates, much like the Ohio Reorganization of Partnership by Modification of Partnership Agreement, which are published to fulfill federal and state specifications.

In case you are currently informed about US Legal Forms website and get a free account, simply log in. Next, you are able to down load the Ohio Reorganization of Partnership by Modification of Partnership Agreement format.

Should you not provide an accounts and wish to start using US Legal Forms, abide by these steps:

- Get the develop you require and make sure it is for that right city/county.

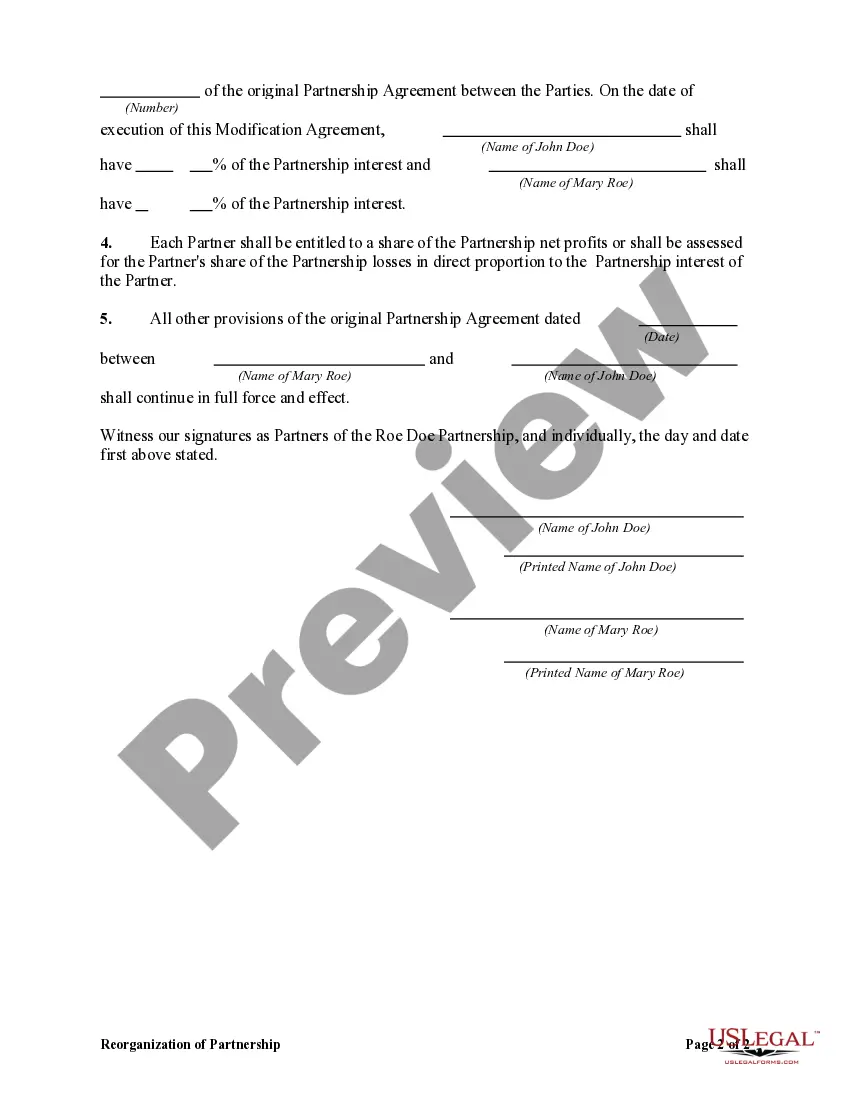

- Utilize the Preview key to analyze the form.

- Read the outline to actually have chosen the right develop.

- In the event the develop is not what you`re trying to find, take advantage of the Research industry to obtain the develop that suits you and specifications.

- Once you find the right develop, just click Buy now.

- Choose the prices plan you desire, submit the necessary information and facts to make your money, and pay for an order using your PayPal or credit card.

- Decide on a hassle-free paper structure and down load your copy.

Find each of the file web templates you may have bought in the My Forms food list. You can obtain a additional copy of Ohio Reorganization of Partnership by Modification of Partnership Agreement at any time, if required. Just go through the needed develop to down load or produce the file format.

Use US Legal Forms, the most extensive collection of lawful varieties, in order to save efforts and steer clear of mistakes. The service offers expertly created lawful file web templates which can be used for a range of uses. Make a free account on US Legal Forms and start creating your way of life a little easier.