Title: Understanding Ohio Agreement to Form Partnership in Future to Conduct Business Introduction: Ohio Agreement to Form Partnership in Future to Conduct Business is a legal document that sets the foundation for a partnership between two or more parties in Ohio that plan to engage in business activities together at a later date. This detailed description will delve into the key aspects, types, and elements of such agreements, shedding light on their significance in Ohio's business landscape. Keywords: Ohio, Agreement, Form Partnership, Future, Conduct Business Types of Ohio Agreement to Form Partnership in Future to Conduct Business: 1. General Partnership Agreement: A general partnership agreement outlines the terms and conditions agreed upon by partners for conducting business together. It defines each partner's rights, responsibilities, profit/loss sharing, management structure, contributions, and dissolution procedures. 2. Limited Partnership Agreement: A limited partnership agreement differentiates between general partners and limited partners. General partners bear unlimited liability, while limited partners have limited liability, making this agreement suitable for investors seeking to avoid personal liability. 3. Limited Liability Partnership Agreement: A limited liability partnership agreement combines elements of general partnerships and limited liability companies (LCS). It allows partners to enjoy limited personal liability while retaining the flexibility of partnership taxation and management structure. Key Elements of Ohio Agreement to Form Partnership in Future to Conduct Business: 1. Identification of Parties: The agreement should clearly identify all parties involved in the future partnership, along with their respective roles, designations, and responsibilities. 2. Purpose and Scope: The agreement should define the purpose, nature, and scope of the future partnership's activities, ensuring all partners are aligned with the intended business objectives. 3. Duration and Termination: Partnerships may have a specific term or may continue until a designated event occurs. The agreement should outline the duration and conditions leading to the termination or dissolution of the partnership. 4. Contributions and Capital Structure: Partners' contributions, whether in cash, property, or services, must be documented, along with details of the partnership's capital structure and profit/loss sharing ratios. 5. Decision-making and Authority: The agreement should delineate decision-making procedures, voting rights, and the distribution of authority among partners, establishing a framework for efficient governance. 6. Dispute Resolution: Including a dispute resolution mechanism, such as mediation or arbitration, can help partners in resolving conflicts outside of court, ensuring smoother collaboration. 7. Confidentiality and Non-Compete Clauses: Confidentiality clauses safeguard sensitive information, while non-compete clauses restrict partners from engaging in competing businesses during and after the partnership. Conclusion: Ohio Agreement to Form Partnership in Future to Conduct Business lays the groundwork for successful collaborations by establishing clear guidelines, responsibilities, and expectations. Whether it's a general, limited, or limited liability partnership, partners can utilize this legal document to protect their interests, avoid misunderstandings, promote transparency, and foster a thriving business environment in Ohio. Keywords: Ohio, Agreement, Form Partnership, Future, Conduct Business

Ohio Agreement to Form Partnership in Future to Conduct Business

Description

How to fill out Ohio Agreement To Form Partnership In Future To Conduct Business?

Finding the right legitimate file template could be a struggle. Needless to say, there are a lot of themes available on the Internet, but how would you find the legitimate form you will need? Make use of the US Legal Forms internet site. The support delivers 1000s of themes, including the Ohio Agreement to Form Partnership in Future to Conduct Business, that can be used for company and personal requirements. All of the kinds are checked by specialists and meet up with state and federal needs.

Should you be already authorized, log in in your bank account and click on the Obtain button to get the Ohio Agreement to Form Partnership in Future to Conduct Business. Use your bank account to appear with the legitimate kinds you might have ordered in the past. Proceed to the My Forms tab of your respective bank account and obtain one more duplicate from the file you will need.

Should you be a fresh consumer of US Legal Forms, allow me to share easy guidelines for you to follow:

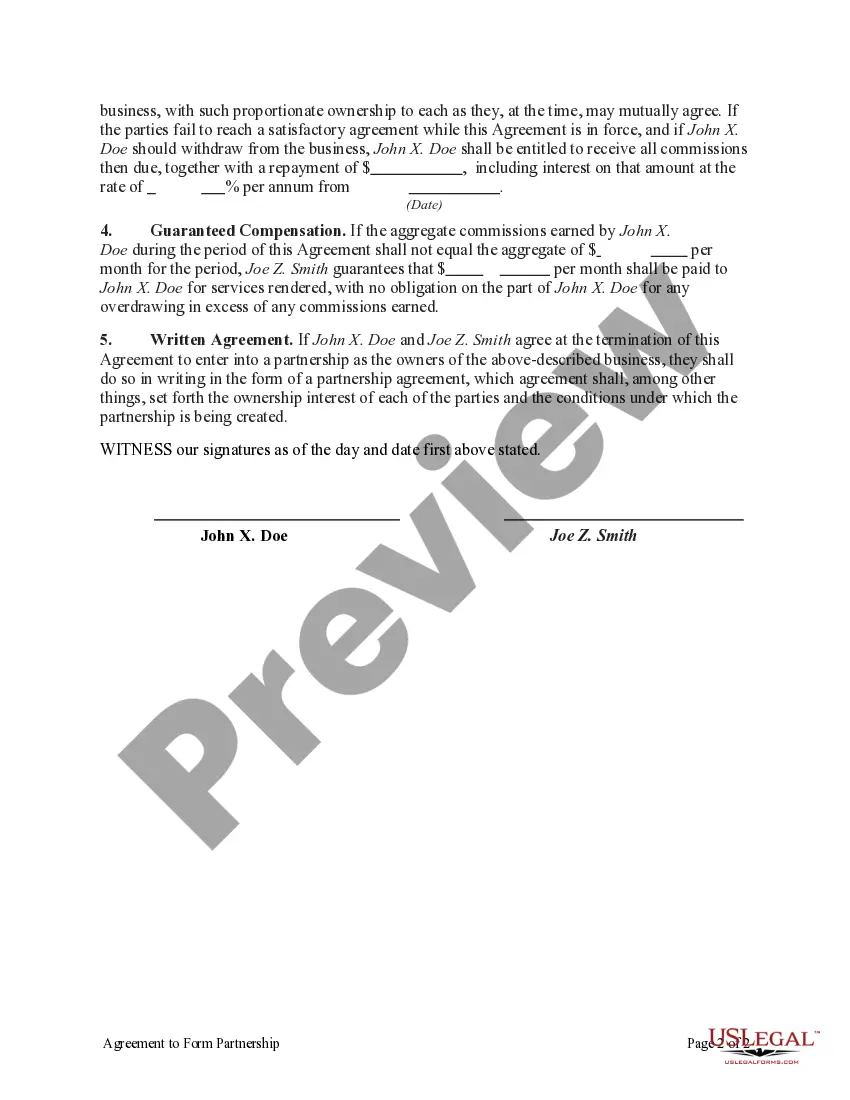

- Very first, make certain you have chosen the right form to your metropolis/region. You can examine the shape making use of the Review button and study the shape outline to guarantee this is the best for you.

- If the form fails to meet up with your requirements, utilize the Seach area to get the appropriate form.

- Once you are certain the shape is proper, click on the Buy now button to get the form.

- Choose the pricing prepare you would like and enter the necessary information. Build your bank account and buy the order making use of your PayPal bank account or Visa or Mastercard.

- Select the document structure and down load the legitimate file template in your product.

- Full, edit and print out and indicator the received Ohio Agreement to Form Partnership in Future to Conduct Business.

US Legal Forms is the most significant local library of legitimate kinds that you can find different file themes. Make use of the company to down load skillfully-created papers that follow express needs.