Ohio Second Mortgage with Mortgagor's Recertification of Representations, Warranties and Covenants in First Mortgage

Description

How to fill out Second Mortgage With Mortgagor's Recertification Of Representations, Warranties And Covenants In First Mortgage?

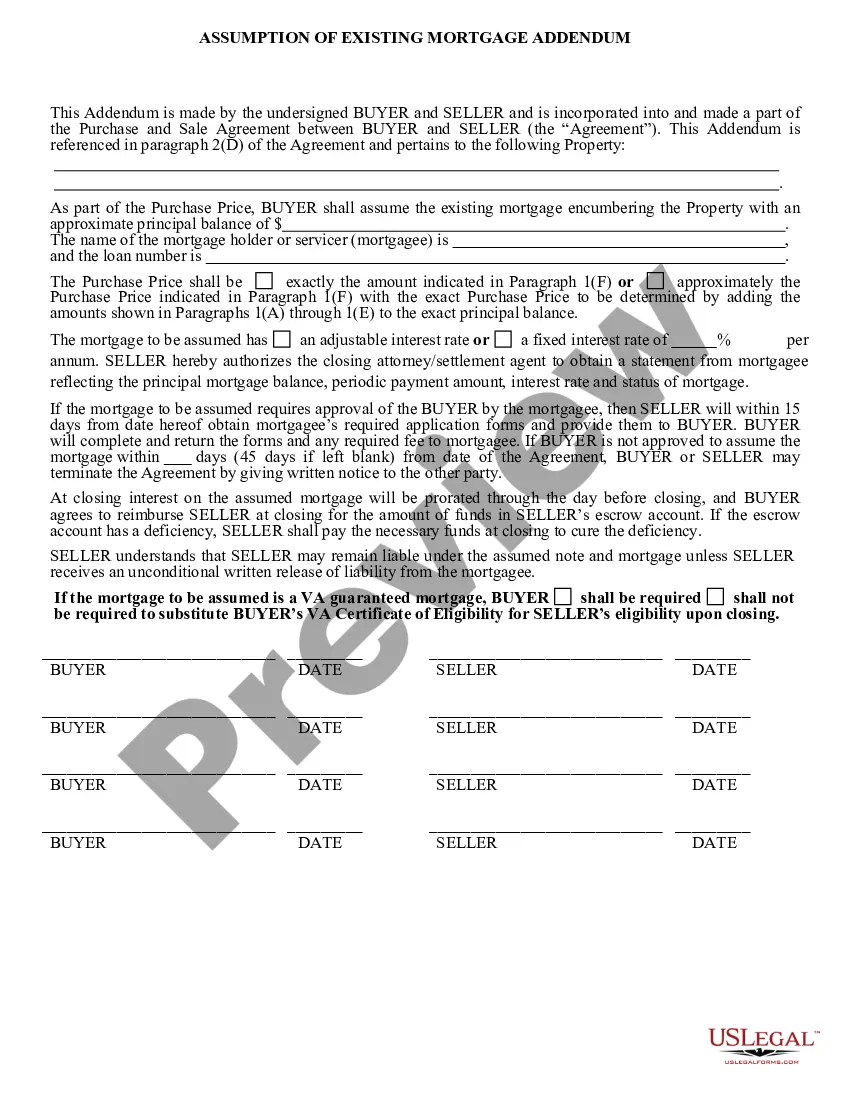

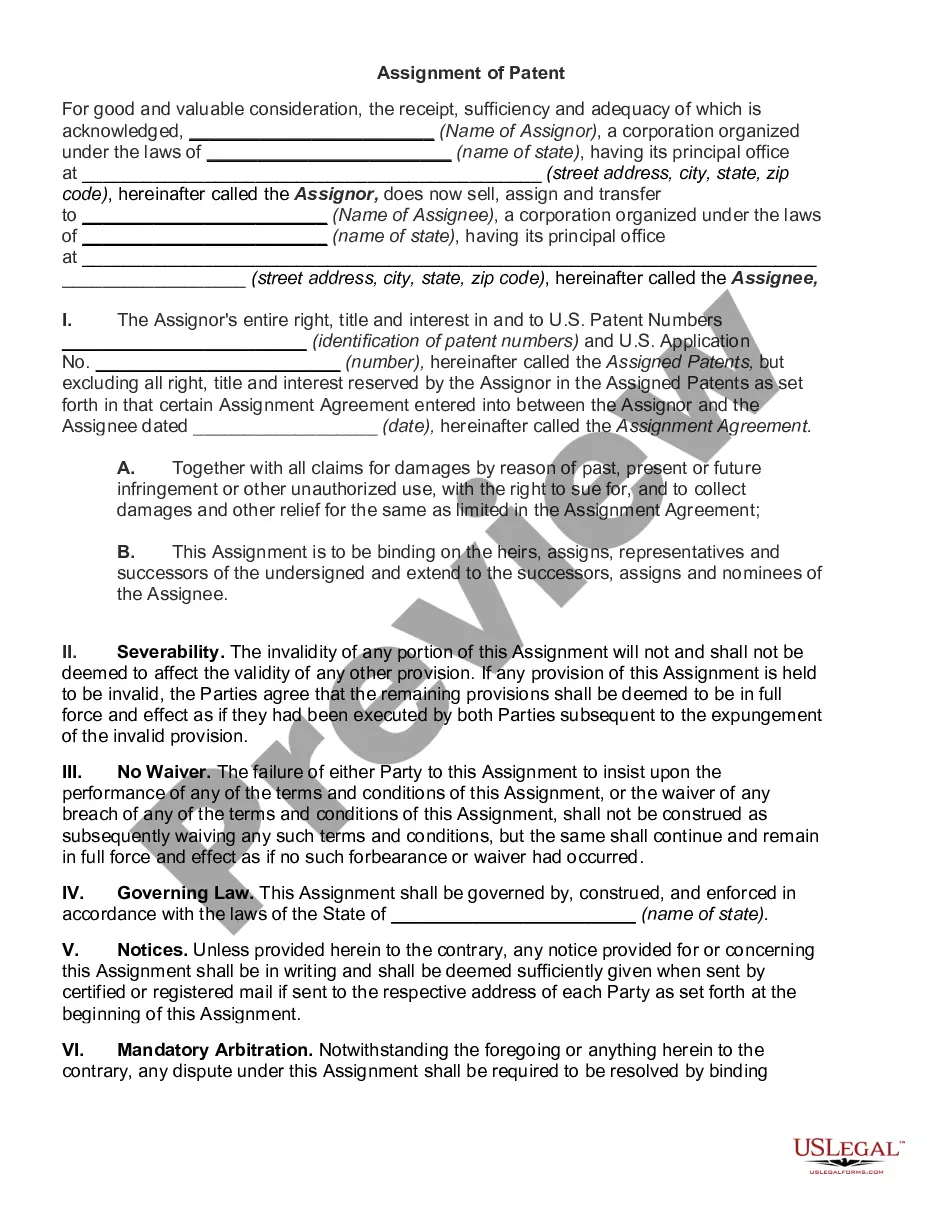

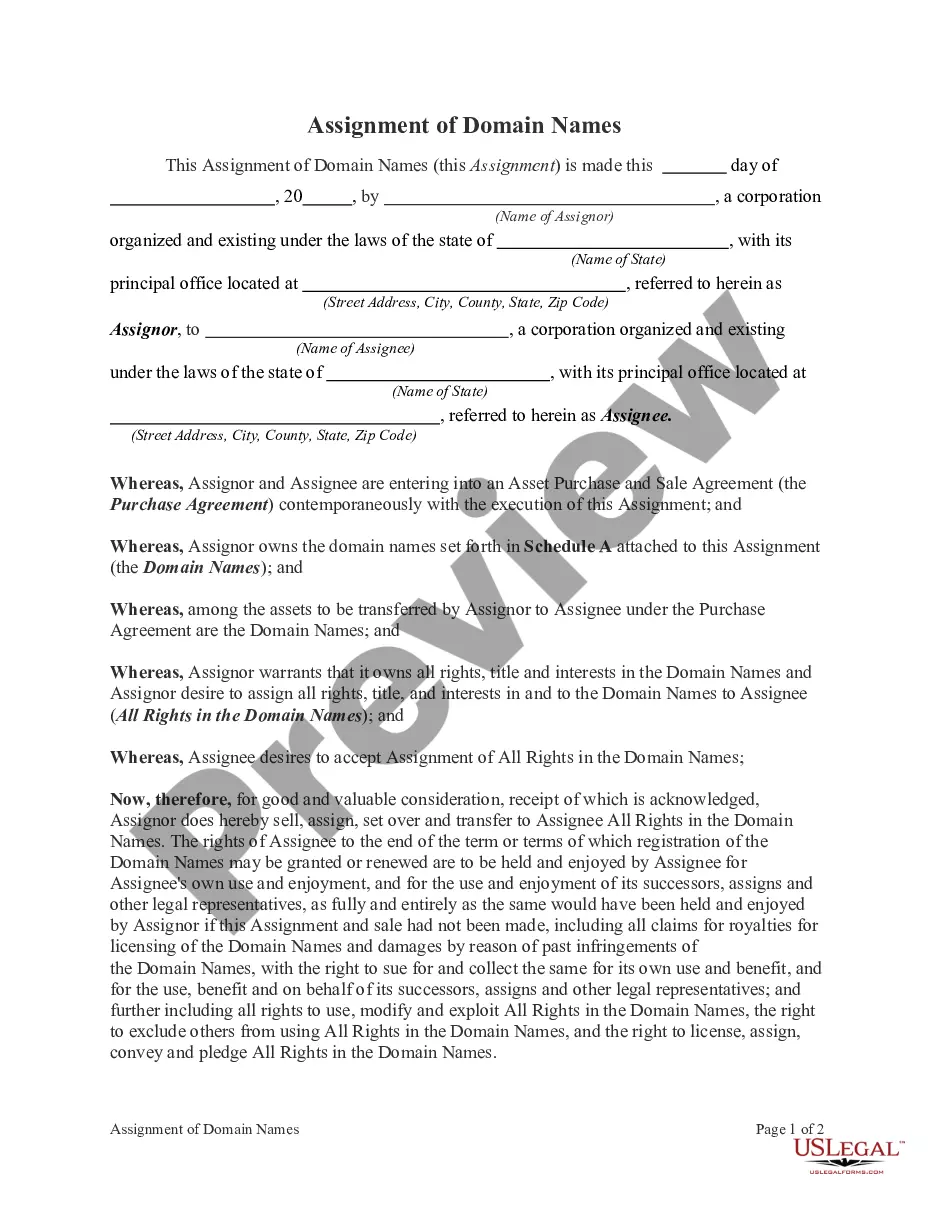

Choosing the right authorized papers design might be a struggle. Of course, there are plenty of templates available on the Internet, but how would you find the authorized kind you need? Use the US Legal Forms web site. The service delivers a large number of templates, like the Ohio Second Mortgage with Mortgagor's Recertification of Representations, Warranties and Covenants in First Mortgage, which can be used for business and private requires. All the forms are checked out by specialists and meet up with federal and state specifications.

Should you be currently registered, log in in your account and click on the Download switch to find the Ohio Second Mortgage with Mortgagor's Recertification of Representations, Warranties and Covenants in First Mortgage. Make use of account to search through the authorized forms you have bought earlier. Proceed to the My Forms tab of your respective account and obtain yet another version in the papers you need.

Should you be a brand new customer of US Legal Forms, allow me to share straightforward guidelines that you can follow:

- Initial, be sure you have selected the appropriate kind to your town/area. It is possible to look over the shape while using Review switch and read the shape outline to ensure this is basically the right one for you.

- In the event the kind fails to meet up with your preferences, take advantage of the Seach discipline to find the right kind.

- When you are certain that the shape would work, go through the Acquire now switch to find the kind.

- Choose the rates prepare you would like and enter the essential details. Create your account and purchase the transaction utilizing your PayPal account or charge card.

- Pick the document format and down load the authorized papers design in your device.

- Full, edit and print out and indication the received Ohio Second Mortgage with Mortgagor's Recertification of Representations, Warranties and Covenants in First Mortgage.

US Legal Forms is the greatest catalogue of authorized forms for which you can find a variety of papers templates. Use the company to down load skillfully-made papers that follow condition specifications.

Form popularity

FAQ

A silent second mortgage is a second mortgage placed on an asset (such as a home) for down payment funds that are not disclosed to the original lender on the first mortgage. The second mortgage is called "silent" because the borrower does not disclose its existence to the original mortgage lender.

Because the reverse mortgage does not prohibit borrowers from obtaining another financing, finding a lender willing to place a loan behind a reverse mortgage is rare. But it does happen, especially for some home improvement loans.

Second mortgages are called that because they are secondary to the main, primary mortgage used for the home purchase. In the event of a foreclosure, the primary mortgage gets fully paid off before any second mortgages get a dime. They are second liens, behind the first lien of the primary mortgage.

To Pay Off Another Loan or Debt Yep. (Do we recommend doing this? Nope.) Many people use their second home mortgage to pay off student loans, credit cards, medical debt or even to pay off a portion of their first mortgage.

There are two major types of second mortgages you can choose from: a home equity loan or a home equity line of credit (HELOC).