Ohio Sample Letter for Exemption of Ad Valorem Taxes

Description

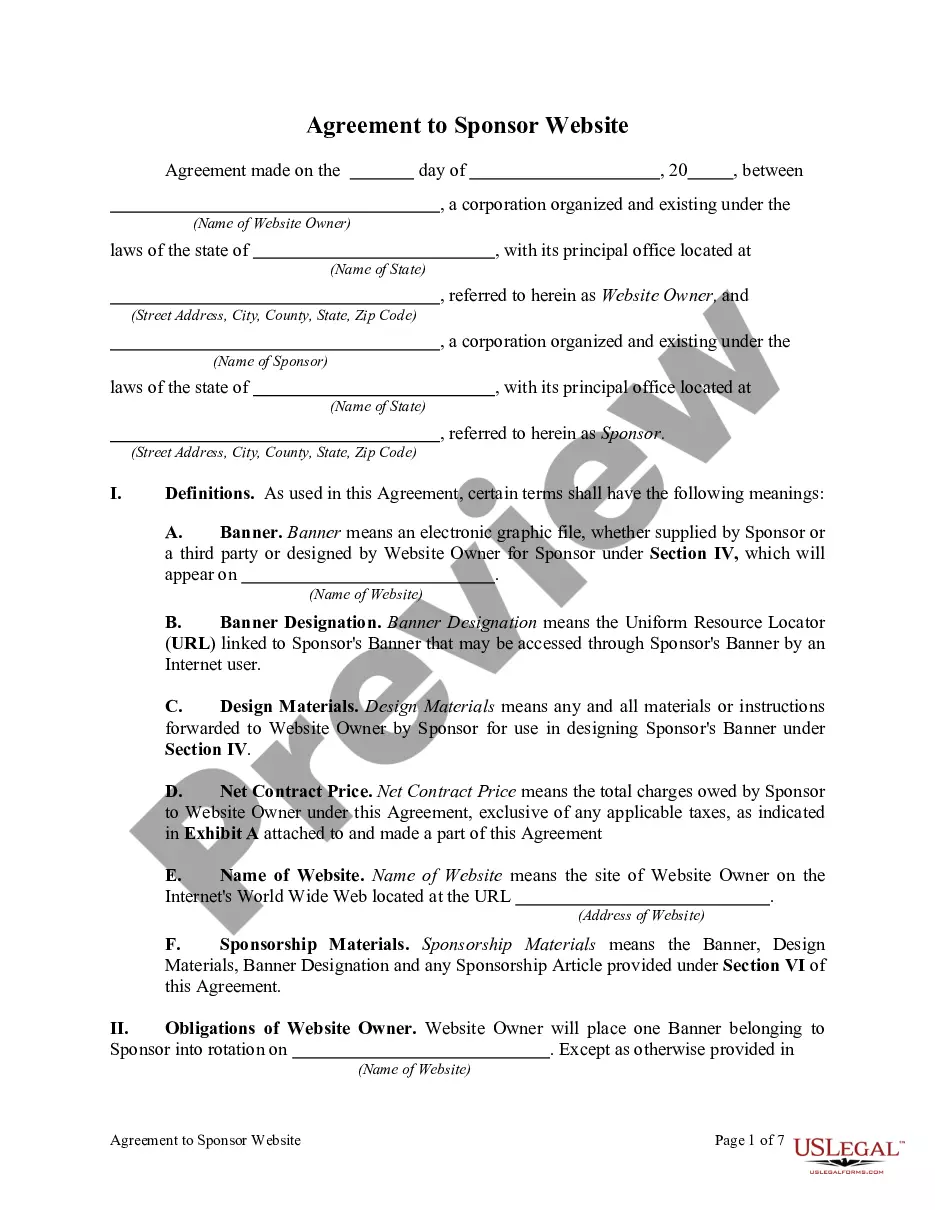

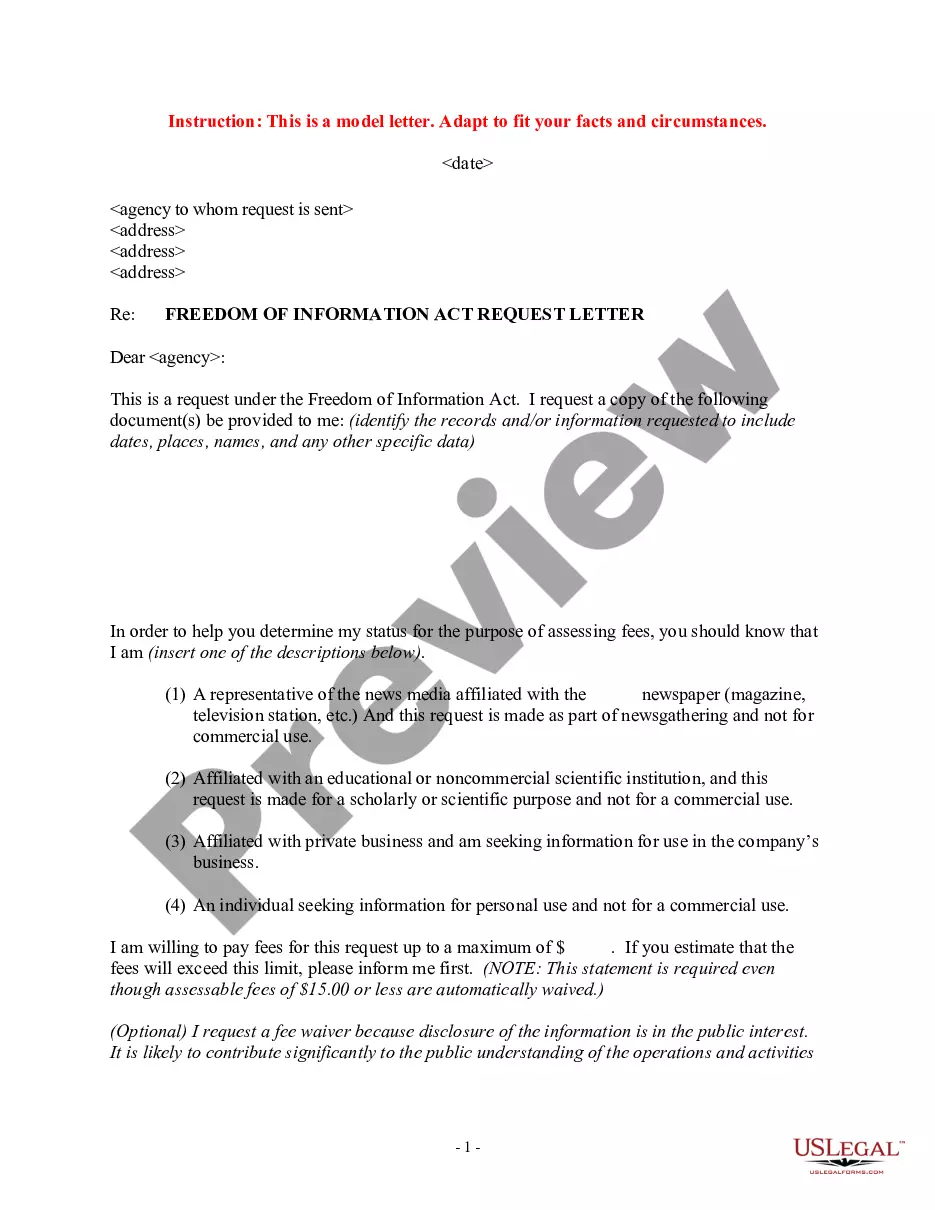

How to fill out Sample Letter For Exemption Of Ad Valorem Taxes?

US Legal Forms - one of several largest libraries of legitimate types in the States - delivers a wide array of legitimate document web templates it is possible to download or print out. While using website, you may get a huge number of types for enterprise and person functions, sorted by categories, suggests, or key phrases.You will discover the most recent types of types just like the Ohio Sample Letter for Exemption of Ad Valorem Taxes within minutes.

If you already have a membership, log in and download Ohio Sample Letter for Exemption of Ad Valorem Taxes from the US Legal Forms local library. The Download option can look on each form you look at. You have access to all formerly delivered electronically types in the My Forms tab of your profile.

If you want to use US Legal Forms the first time, listed here are simple instructions to help you began:

- Ensure you have chosen the proper form to your area/area. Go through the Preview option to review the form`s content material. Browse the form information to ensure that you have chosen the proper form.

- In the event the form doesn`t match your specifications, use the Look for industry near the top of the display to find the one that does.

- In case you are happy with the form, verify your option by clicking the Buy now option. Then, select the rates plan you like and give your references to register for the profile.

- Process the transaction. Make use of your credit card or PayPal profile to accomplish the transaction.

- Pick the structure and download the form on your system.

- Make modifications. Fill out, edit and print out and indicator the delivered electronically Ohio Sample Letter for Exemption of Ad Valorem Taxes.

Every format you put into your bank account does not have an expiry day and is also the one you have eternally. So, in order to download or print out one more version, just check out the My Forms portion and click in the form you will need.

Get access to the Ohio Sample Letter for Exemption of Ad Valorem Taxes with US Legal Forms, probably the most substantial local library of legitimate document web templates. Use a huge number of professional and state-certain web templates that satisfy your company or person requires and specifications.

Form popularity

FAQ

Ohio accepts the Uniform Sales and Use Tax Certificate created by the Multistate Tax Commission as a valid exemption certificate. By its terms, this certificate may be used only for claiming an exemption based on resale or on the incorporation of the item purchased into a product for sale.

An exemption certificate issued to an exempt organization without dates shall expire upon notice by the Office of Tax and Revenue. Taxpayers will be provided a notice 180 days prior to the expiration of their exemption certificate and will receive a second notice 30 days prior to expiration.

Ohio has two types of Homestead Exemption: (1) senior and disabled persons homestead exemption and (2) disabled veterans enhanced homestead exemption. Senior and Disabled Persons Homestead Exemption protects the first $25,000 of your home's value from taxation.

Common exemptions from Ohio sales and use tax: Groceries and food sold for off premises consumption. Prescription medicines. Housing related utilities, such as gas, electric, water and steam.

Visit IRS.gov to apply to become a tax-exempt organization. Also, contact the Ohio Department of Taxation and your county and local governments to determine how to apply for applicable exemptions. Register with the Ohio Attorney General's Office if entity is a charitable organization.

Visit IRS.gov to apply to become a tax-exempt organization. Also, contact the Ohio Department of Taxation and your county and local governments to determine how to apply for applicable exemptions. Register with the Ohio Attorney General's Office if entity is a charitable organization.

You are entitled to a personal exemption of $1,200 for yourself and an additional $1,200 for your spouse if you are filing a joint return. Ohio allows a dependent exemption for dependent children and persons other than yourself and your spouse to whom you provide support AND claim on your federal tax return.