Ohio Business Selection Worksheet

Description

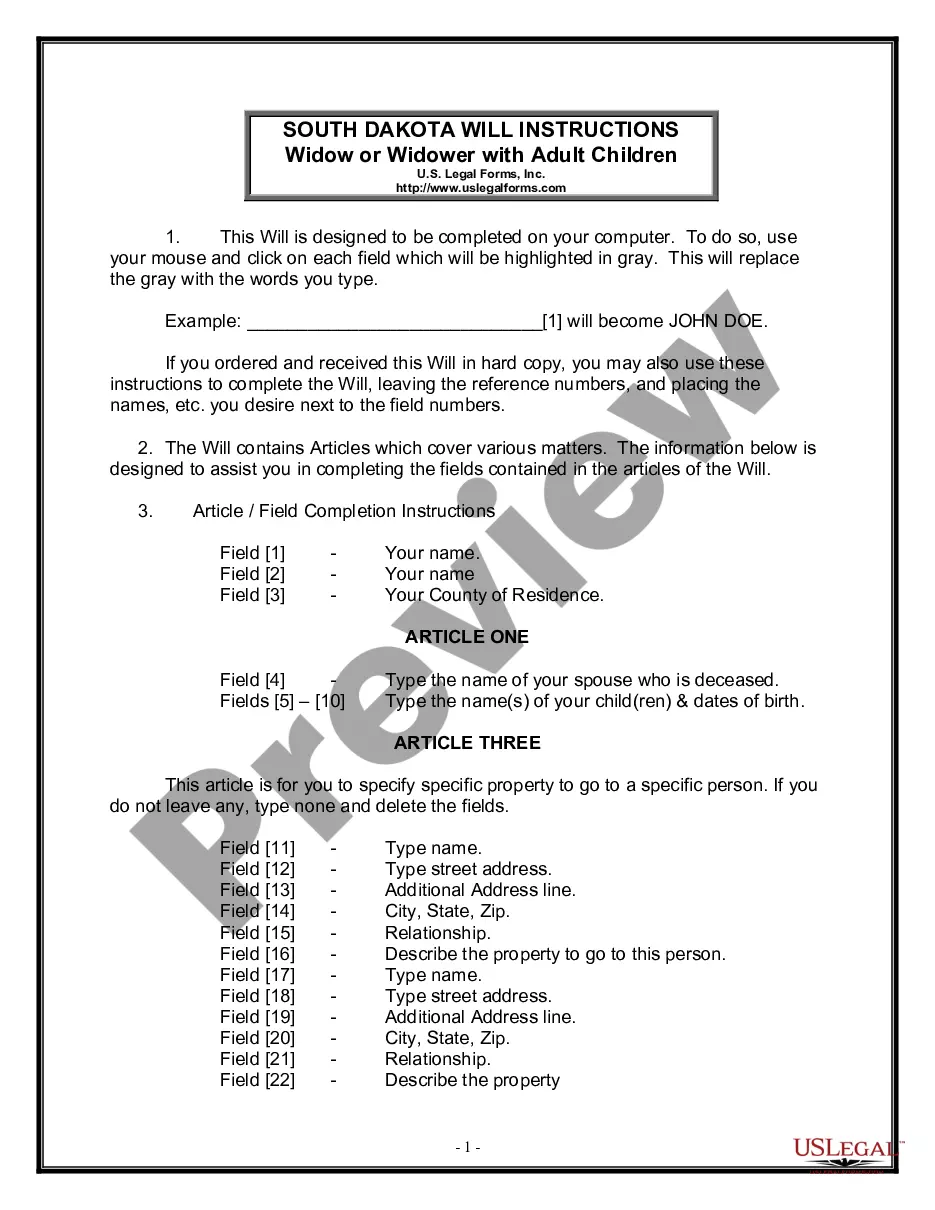

How to fill out Business Selection Worksheet?

Finding the appropriate legal document template can be challenging. Clearly, there are numerous templates accessible online, but how do you secure the legal form you require.

Utilize the US Legal Forms website. This service provides a vast collection of templates, including the Ohio Business Selection Worksheet, which you can use for both business and personal purposes.

All the forms are verified by experts and comply with state and federal regulations.

Once you are confident that the form is suitable, click the Buy now button to acquire the form. Choose the pricing plan you need and enter the necessary information. Create your account and complete the transaction using your PayPal account or credit card. Select the file format and download the legal document template to your device. Fill out, edit, print, and sign the obtained Ohio Business Selection Worksheet. US Legal Forms is the largest library of legal forms where you can find numerous document templates. Leverage the service to download professionally crafted documents that comply with state requirements.

- If you are already registered, Log In to your account and click the Download button to access the Ohio Business Selection Worksheet.

- Use your account to browse through the legal forms you have previously acquired.

- Visit the My documents tab in your account and download another copy of the document you require.

- If you are a new user of US Legal Forms, here are simple steps for you to follow.

- First, ensure that you have selected the correct form for your city/region. You can preview the form using the Preview button and review the form outline to ensure it is suitable for you.

- If the form does not meet your requirements, utilize the Search field to locate the appropriate form.

Form popularity

FAQ

Eligibility for the business income deduction in Ohio generally includes owners of pass-through entities, like sole proprietorships, partnerships, and certain S corporations. To qualify, your business income must meet specific thresholds outlined by state law. The Ohio Business Selection Worksheet is an essential tool to help you understand your eligibility and calculate your deduction accurately.

Small businesses in Ohio enjoy several tax breaks aimed at fostering growth and development. These include the small business deduction, which permits eligible owners to reduce their taxable income. For more information on maximizing these benefits, the Ohio Business Selection Worksheet provides guidance on navigating these tax advantages effectively.

Here's a step-by-step look at how to complete the form.Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number.Step 2: Indicate Multiple Jobs or a Working Spouse.Step 3: Add Dependents.Step 4: Add Other Adjustments.Step 5: Sign and Date Form W-4.

Most for-profit businesses with taxable gross receipts derived from sales to customers in Ohio over $150,000 in the calendar year are subject to the CAT. However, there are a few exclusions: Non-profit organizations, most governmental entities, public works, etc. are not subject to the tax.

23 Who is subject to the CAT? The CAT applies to most businesses including but not limited to retail, wholesale, service, manufacturing and other general businesses regardless of the type of business organization such business operates.

By placing a 0 on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period.

Registration - Taxpayers having over $150,000 in taxable gross receipts sitused to Ohio for the calendar year are required to file returns for the CAT. In order to file returns, a taxpayer must first register for CAT with the Department of Taxation.

As a matter of fact, operating a business at home doesn't mean that you do not have to follow any regulations and there are no restrictions for you in Ohio.

You can find your Withholding Account Number on notices received from the Ohio Department of Taxation. If you cannot locate this document or account number, please call the Ohio Department of Taxation at (888) 405-4039 to request it. Visit the Ohio Business Gateway and click Create an Account.

The CAT applies to persons, which includes most business types, as well as certain individuals with more than $4,500 of Ohio taxable receipts. Taxpayers with more than $150,000 Ohio receipts for a calendar year are required to register for CAT.