The Ohio Startup Costs Worksheet is a comprehensive tool designed to guide entrepreneurs in estimating and organizing the expenses associated with starting a business in Ohio. It helps business owners calculate their initial costs accurately and plan their budget effectively. This worksheet is crucial for entrepreneurs seeking financial support or applying for loans, as it provides a clear breakdown of all the expenses involved in launching a business. Key Features: 1. Starting Costs Assessment: The Ohio Startup Costs Worksheet enables startups to assess and record all the essential costs needed to kick-start their business. These expenses may include legal fees, licenses and permits, equipment and technology purchases, lease or rent payments, professional services, and marketing expenditures. 2. Categorization of Costs: The worksheet categorizes costs into different sections, making it easier to differentiate between one-time expenses and recurring costs. Typical cost categories include initial inventory, research and development, employee salaries, insurance, utilities, office supplies, and advertising. 3. Startup Expenses Evaluation: This worksheet allows entrepreneurs to evaluate each startup expense in detail. There are designated columns to estimate the cost for each item, indicate whether it is a one-time or recurring expense, and mark the status of payment (paid or unpaid). 4. Financial Projections: The Ohio Startup Costs Worksheet aids in building realistic financial projections by summarizing all the startup expenses, including both fixed and variable costs. Entrepreneurs can utilize these projections to present a clear picture of their financial needs to potential investors or lenders. 5. Different Types of Ohio Startup Costs Worksheets: a) Basic Startup Costs Worksheet: This is a standard version designed for all types of businesses in Ohio, providing a comprehensive overview of typical expenses faced during the initial phase of starting a business. b) Industry-Specific Startup Costs Worksheet: Ohio offers industry-specific startup costs worksheets tailored to various sectors, such as retail, manufacturing, healthcare, technology, and service-oriented businesses. These variations take into account the unique expenses associated with each industry, allowing entrepreneurs to have a more accurate estimation. c) Revised Startup Costs Worksheet: As regulations and economic factors change over time, Ohio may revise the startup costs worksheet to reflect the current conditions. Entrepreneurs should ensure they are using the most up-to-date version to ensure precise calculations. By utilizing the Ohio Startup Costs Worksheet, business owners can avoid common financial pitfalls and gain a comprehensive understanding of the expenses involved. This tool helps in creating well-informed business plans, securing funding, and efficiently allocating financial resources to launch a successful venture in Ohio.

Ohio Startup Costs Worksheet

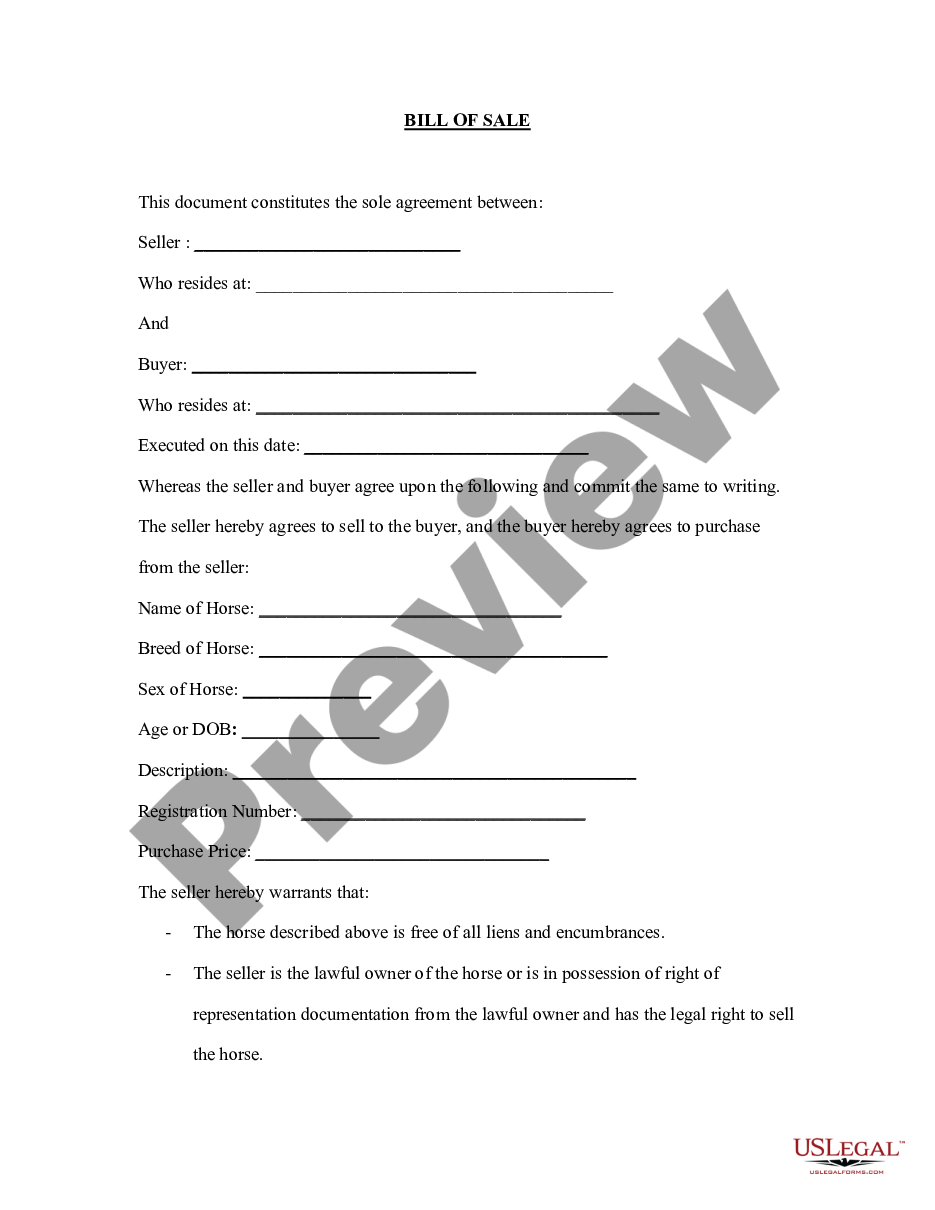

Description

How to fill out Ohio Startup Costs Worksheet?

US Legal Forms - among the greatest libraries of authorized forms in America - offers a wide range of authorized record themes it is possible to download or produce. Utilizing the web site, you can get thousands of forms for organization and personal reasons, sorted by categories, says, or search phrases.You will discover the most recent versions of forms just like the Ohio Startup Costs Worksheet within minutes.

If you currently have a subscription, log in and download Ohio Startup Costs Worksheet in the US Legal Forms catalogue. The Acquire button will appear on every single form you look at. You get access to all formerly acquired forms in the My Forms tab of your respective account.

If you wish to use US Legal Forms the first time, allow me to share basic guidelines to get you started out:

- Be sure you have chosen the best form for your area/area. Click on the Review button to examine the form`s content material. See the form outline to actually have chosen the proper form.

- In the event the form doesn`t satisfy your needs, make use of the Research industry at the top of the screen to find the the one that does.

- Should you be satisfied with the shape, validate your option by simply clicking the Acquire now button. Then, opt for the prices prepare you want and give your references to sign up on an account.

- Procedure the deal. Utilize your charge card or PayPal account to accomplish the deal.

- Choose the formatting and download the shape in your system.

- Make modifications. Fill up, edit and produce and indication the acquired Ohio Startup Costs Worksheet.

Each and every design you included with your bank account does not have an expiration day and is your own property for a long time. So, if you want to download or produce an additional version, just go to the My Forms portion and then click about the form you will need.

Get access to the Ohio Startup Costs Worksheet with US Legal Forms, the most considerable catalogue of authorized record themes. Use thousands of skilled and status-distinct themes that meet your organization or personal needs and needs.