The Ohio Self-Assessment Worksheet is a valuable tool designed to help individuals in Ohio evaluate their tax liability and ensure accurate reporting. This worksheet acts as a guide that enables taxpayers to calculate their taxable income, deductions, and credits accurately. This self-assessment worksheet is essential for individuals residing in Ohio as it helps them determine their state income tax liability based on their specific circumstances. It assists in identifying which deductions and credits they are eligible for, ultimately optimizing their tax savings. There are different types of Ohio Self-Assessment Worksheets depending on the taxpayer's filing status and specific situation. Some common types include: 1. Ohio Self-Assessment Worksheet for Single Filers: This worksheet is tailored for individuals who file their taxes as single and do not qualify for any other filing status such as head of household or qualifying widow(er) with dependent child. 2. Ohio Self-Assessment Worksheet for Married Joint Filers: This worksheet is specifically designed for married couples filing jointly. It considers the combined income, deductions, and credits of both spouses to determine their joint tax liability. 3. Ohio Self-Assessment Worksheet for Married Separate Filers: This worksheet is for married individuals who choose to file separate tax returns. It allows them to calculate their individual tax liability by allocating income, deductions, and credits accordingly. 4. Ohio Self-Assessment Worksheet for Head of Household Filers: This worksheet caters to individuals who qualify for the head of household filing status. They must provide specific information regarding their dependents, income, deductions, and credits to accurately determine their tax liability. These various types of Ohio Self-Assessment Worksheets ensure that taxpayers can follow the state's tax laws and accurately determine their tax liability. By providing a detailed breakdown of income, deductions, and credits, these worksheets enable individuals to maximize their tax savings while remaining compliant with Ohio's tax regulations. In conclusion, the Ohio Self-Assessment Worksheet is a vital tool for residents of Ohio to accurately evaluate their tax liability. By utilizing the appropriate type of worksheet based on their filing status, individuals can ensure accurate reporting and potentially optimize their tax savings.

Ohio Self-Assessment Worksheet

Description

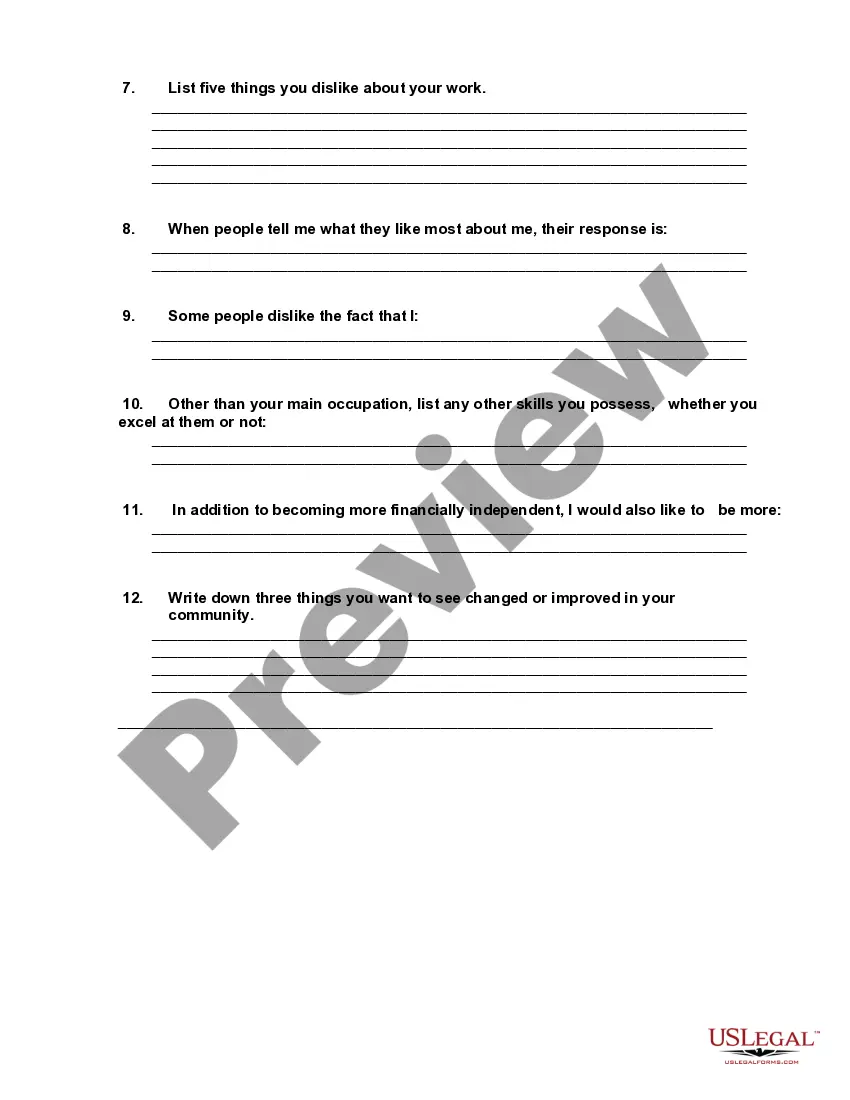

How to fill out Self-Assessment Worksheet?

Have you found yourself in a situation where you require documentation for either business or personal matters almost every day? There are numerous legitimate form templates accessible online, but finding reliable ones is not straightforward.

US Legal Forms offers a vast array of form templates, including the Ohio Self-Assessment Worksheet, designed to comply with state and federal requirements.

If you are already acquainted with the US Legal Forms website and have an account, simply Log In. Then, you can download the Ohio Self-Assessment Worksheet template.

- Obtain the form you require and ensure it is suited for the correct city/state.

- Use the Preview option to examine the form.

- Read the description to confirm that you have selected the appropriate form.

- If the form isn’t what you’re looking for, utilize the Search field to find the form that fits your needs.

- Once you find the correct form, click Buy now.

- Select the pricing plan you prefer, complete the necessary information to create your account, and pay for the transaction using your PayPal or Visa or Mastercard.

- Choose a suitable file format and download your copy.

Form popularity

FAQ

You need to file an Ohio school district tax return if you owe taxes based on your income or residency in a school district. If your income exceeds the school district's threshold, submitting a return is mandatory. The Ohio Self-Assessment Worksheet can assist in identifying your requirements and making the filing process easier.

assessment worksheet is a tool that helps taxpayers evaluate their income, deductions, and tax liabilities. In the context of Ohio, the Ohio SelfAssessment Worksheet enables individuals to determine their school district tax responsibilities. It simplifies the process, allowing you to take an informed approach to filing your taxes.