Ohio Commercial Partnership Agreement between an Investor and Worker A commercial partnership agreement between an investor and worker in Ohio is a legal contract that outlines the terms and conditions governing the collaborative relationship between the investor and the worker. This agreement serves as a framework for business ventures, ensuring clarity on how profits and losses will be shared, the role and responsibilities of each party, and other important aspects of the partnership. Keywords: Ohio, commercial partnership agreement, investor, worker, legal contract, terms and conditions, business ventures, profits, losses, roles, responsibilities. Types of Ohio Commercial Partnership Agreements between an Investor and Worker: 1. General Partnership Agreement: This type of agreement establishes a partnership where both the investor and worker contribute capital, resources, or expertise to the business venture. Both parties share profits, losses, and management responsibilities according to their agreed-upon ratios. 2. Limited Partnership Agreement: In a limited partnership, there are two types of partners involved: general partners and limited partners. General partners have unlimited liability and are actively involved in running the business, while limited partners only contribute capital and have limited liability. This agreement specifies the roles, responsibilities, and profit-sharing arrangements for both types of partners. 3. Silent Partnership Agreement: A silent partnership agreement, often referred to as a dormant partnership, enables an investor to provide capital to a worker without actively participating in the business's day-to-day operations. This agreement outlines the financial investment, profit-sharing terms, and the worker's responsibilities in running the business alone. 4. Joint Venture Agreement: A joint venture agreement is suitable when both the investor and worker want to collaborate on a specific project or endeavor. This agreement sets forth the terms of the venture, including financial contributions, profit sharing, decision-making authority, and termination clauses. 5. Equity Partnership Agreement: An equity partnership agreement entails the investment of capital by the investor in exchange for ownership or equity in the worker's business. This agreement outlines the terms of the investment, the percentage of equity held by the investor, profit-sharing arrangements, and exit strategies. It is important for both the investor and worker to seek legal advice when drafting and finalizing a commercial partnership agreement, as each type of agreement has unique legal implications and requirements specific to Ohio regulations.

Ohio Commercial Partnership Agreement between an Investor and Worker

Description

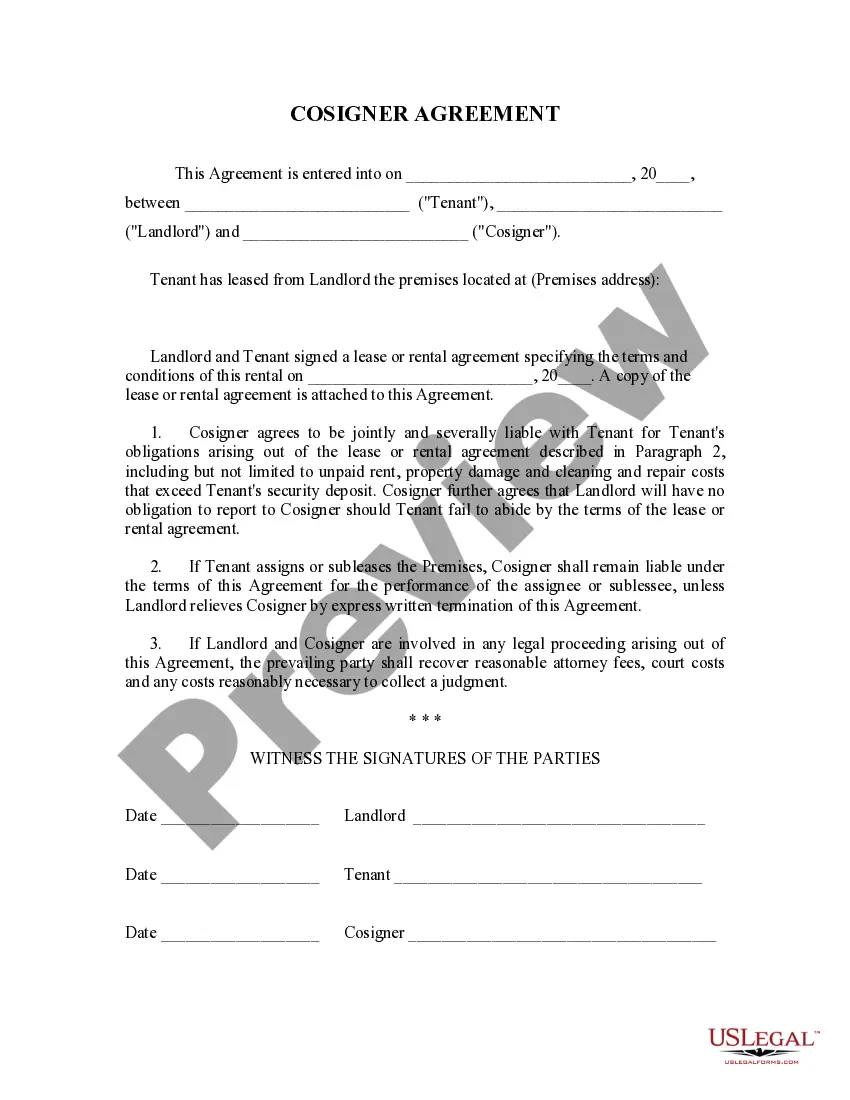

How to fill out Commercial Partnership Agreement Between An Investor And Worker?

You have the capability to spend time online trying to locate the legal document template that meets the state and federal requirements you will require.

US Legal Forms offers a vast array of legal documents that are assessed by professionals.

It is easy to obtain or create the Ohio Commercial Partnership Agreement between an Investor and Employee through my assistance.

If available, use the Preview button to examine the document template as well.

- If you already have a US Legal Forms account, you can Log In and click the Download button.

- After that, you can fill out, modify, print, or sign the Ohio Commercial Partnership Agreement between an Investor and Employee.

- Every legal document template you purchase belongs to you permanently.

- To get another copy of a purchased document, go to the My documents section and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, confirm that you have selected the correct document template for the state/region you prefer.

- Read the form description to ensure you have selected the appropriate template.

Form popularity

FAQ

(1) A person who is a minor according to the law to which he is subject may not be a partner in a firm, but, with the consent of all the partners for the time being, he may be admitted to the benefits of partnership.

Two people can co-exist amiably as a married couple, but they could be totally unsuited as business partners. In fact, small arguments, personal or professional, can escalate to a divorce.

How to Write a Business Partnership Agreementname of the partnership.goals of the partnership.duration of the partnership.contribution amounts of each partner (cash, property, services, future contributions)ownership interests of each partner (assets)management roles and terms of authority of each partner.More items...

Generally speaking, any person can be a partner in a partnership. As was previously mentioned, a partnership is formed when two or more people agree to do business together for profit.

Partners have important duties in a partnership, including (1) the duty to servethat is, to devote herself to the work of the partnership; (2) the duty of loyalty, which is informed by the fiduciary standard: the obligation to act always in the best interest of the partnership and not in one's own best interest; (3)

Duties of PartnersDuty to act in good faith. The partners must act in good faith for the greater common advantage.Duty to Render true accounts.Duty to Indemnify for fraud.Duty not to compete.Duty to be Diligent.Duty to properly use the property of the firm.Duty to account for personal profits.

Divide business roles according to each individual's strengths. For example, if one partner is strong in marketing, operations, and finance and the other partner excels in sales, human resources and leadership then split tasks accordingly.

(1) A person who is a minor according to the law to which he is subject may not be a partner in a firm, but, with the consent of all the partners for the time being, he may be admitted to the benefits of partnership.

Divide business roles according to each individual's strengths. For example, if one partner is strong in marketing, operations, and finance and the other partner excels in sales, human resources and leadership then split tasks accordingly.

Following are the duties of partners:Duty to act in good faith.Duty not to compete.Duty to be diligent.Duty to indemnify for fraud.Duty to render true accounts.Duty to properly use the property of the firm.Duty not to earn personal profits.