Ohio Sample of a Collection Letter to Small Business in Advance

Description

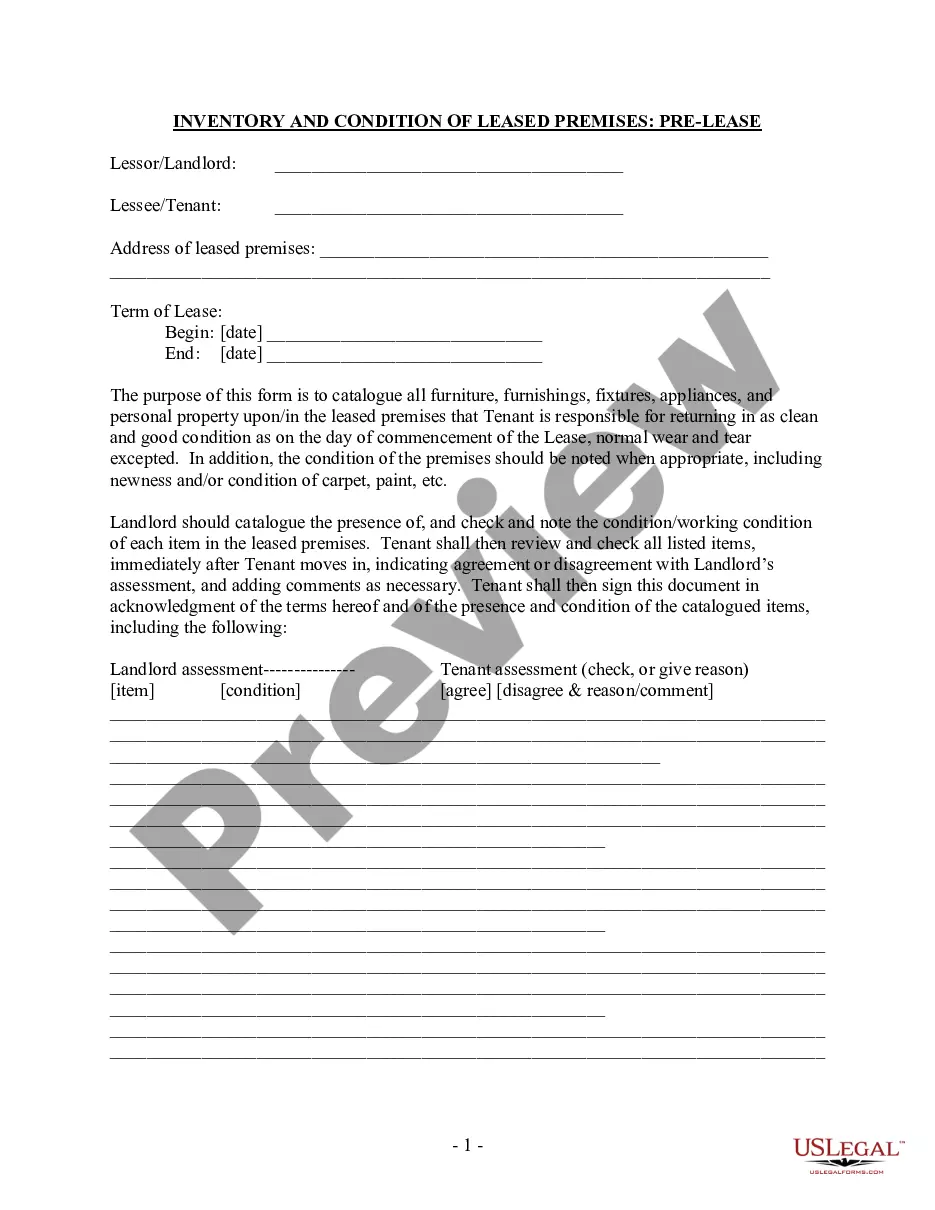

How to fill out Sample Of A Collection Letter To Small Business In Advance?

Selecting the optimal legal document template can be a challenge. There are certainly numerous templates accessible online, but how do you find the legal form you require? Utilize the US Legal Forms website. This service provides thousands of templates, including the Ohio Sample of a Collection Letter to Small Business in Advance, which can be utilized for business and personal purposes. All forms are reviewed by experts and meet state and federal requirements.

If you are already registered, Log In to your account and click the Download button to acquire the Ohio Sample of a Collection Letter to Small Business in Advance. Use your account to search for the legal forms you have obtained previously. Navigate to the My documents section of your account and download another copy of the document you need.

If you are a new user of US Legal Forms, here are simple instructions for you to follow: First, ensure you have selected the correct form for your locality/region. You can view the form using the Preview button and read the form summary to ensure it is suitable for you. If the form does not meet your requirements, use the Search field to find the appropriate form. Once you are confident the form is correct, click the Download now button to obtain the form.

- Choose the pricing plan you desire and enter the required details.

- Create your account and complete the payment using your PayPal account or Visa or Mastercard.

- Select the document format and download the legal document template to your device.

- Complete, edit, print, and sign the received Ohio Sample of a Collection Letter to Small Business in Advance.

- US Legal Forms is the largest repository of legal forms where you can find a variety of document templates.

- Make use of this service to download properly-prepared paperwork that complies with state regulations.

Form popularity

FAQ

A properly written collection letter must include clear information about the amount owed and the payment deadline. Additionally, it should comply with legal requirements, such as including a statement about the recipient's rights. Using the Ohio Sample of a Collection Letter to Small Business in Advance can provide you with a framework, helping you meet these essential criteria.

The structure of a collection letter typically includes a header, a polite salutation, the body of the letter detailing the payment information, and a closing statement. Make sure to include specific details like the invoice number and payment methods. Referencing the Ohio Sample of a Collection Letter to Small Business in Advance can help ensure your letter follows this standard and includes all necessary elements.

When drafting an effective collection letter, maintain a respectful tone and avoid aggressive language. Ensure that you personalize the letter to the recipient and clearly outline the consequences of not settling the debt. Utilizing the Ohio Sample of a Collection Letter to Small Business in Advance can guide you in creating a letter that strikes the right balance between firmness and professionalism.

To write an effective collection letter, start by clearly stating the purpose of your communication. Use a polite tone, and include essential details such as the amount owed and the due date. Integrating the Ohio Sample of a Collection Letter to Small Business in Advance can help you structure your message effectively, ensuring that your letter is professional and persuasive.

Writing a good collection letter requires clarity, professionalism, and empathy. Start by introducing your company and the purpose of the letter. Clearly state the amount due, as well as any relevant details about the debt, while providing an easy way for the recipient to address the issue. Using an Ohio Sample of a Collection Letter to Small Business in Advance can help you maintain a balanced approach when composing your message.

An example of a collection notice might include a letter or email that highlights the amount owed, outlines terms for repayment, and emphasizes the importance of addressing the debt. It typically states any consequences for non-payment, yet it also offers a route for resolution. For inspiration, consider using an Ohio Sample of a Collection Letter to Small Business in Advance while crafting your notice.

To write a collection statement, start by listing the customer’s details, the outstanding balance, and the due date. Include a summary of previous communications regarding the payment. It’s helpful to follow a structured format, and referring to an Ohio Sample of a Collection Letter to Small Business in Advance can guide you in creating clear and effective statements.

A collection letter is a written request for payment regarding a past-due invoice. It serves as an official reminder that payment is needed to maintain the business relationship. Effectively using an Ohio Sample of a Collection Letter to Small Business in Advance can ensure you strike the right tone between firmness and professionalism while conveying urgency.

Writing a good collection email involves being straightforward yet courteous. Begin by addressing the recipient by name and express your appreciation for their past business. Clearly outline the amount owed and the due date, and provide clear instructions on how they can make the payment. You might consider using an Ohio Sample of a Collection Letter to Small Business in Advance for guidance.

A nice collection letter maintains a professional tone while clearly stating the purpose. For instance, you can start by acknowledging the good relationship you've had with the recipient. Then, gently remind them of the outstanding balance, and provide a simple method for resolving the matter. Using an Ohio Sample of a Collection Letter to Small Business in Advance can help you frame it in the right way.