A nonprofit corporation is one that is organized for charitable or benevolent purposes. These corporations include certain hospitals, universities, churches, and other religious organizations. A nonprofit entity does not have to be a nonprofit corporation, however. Nonprofit corporations do not have shareholders, but have members or a perpetual board of directors or board of trustees.

Ohio Articles of Incorporation for Non-Profit Organization, with Tax Provisions

Description

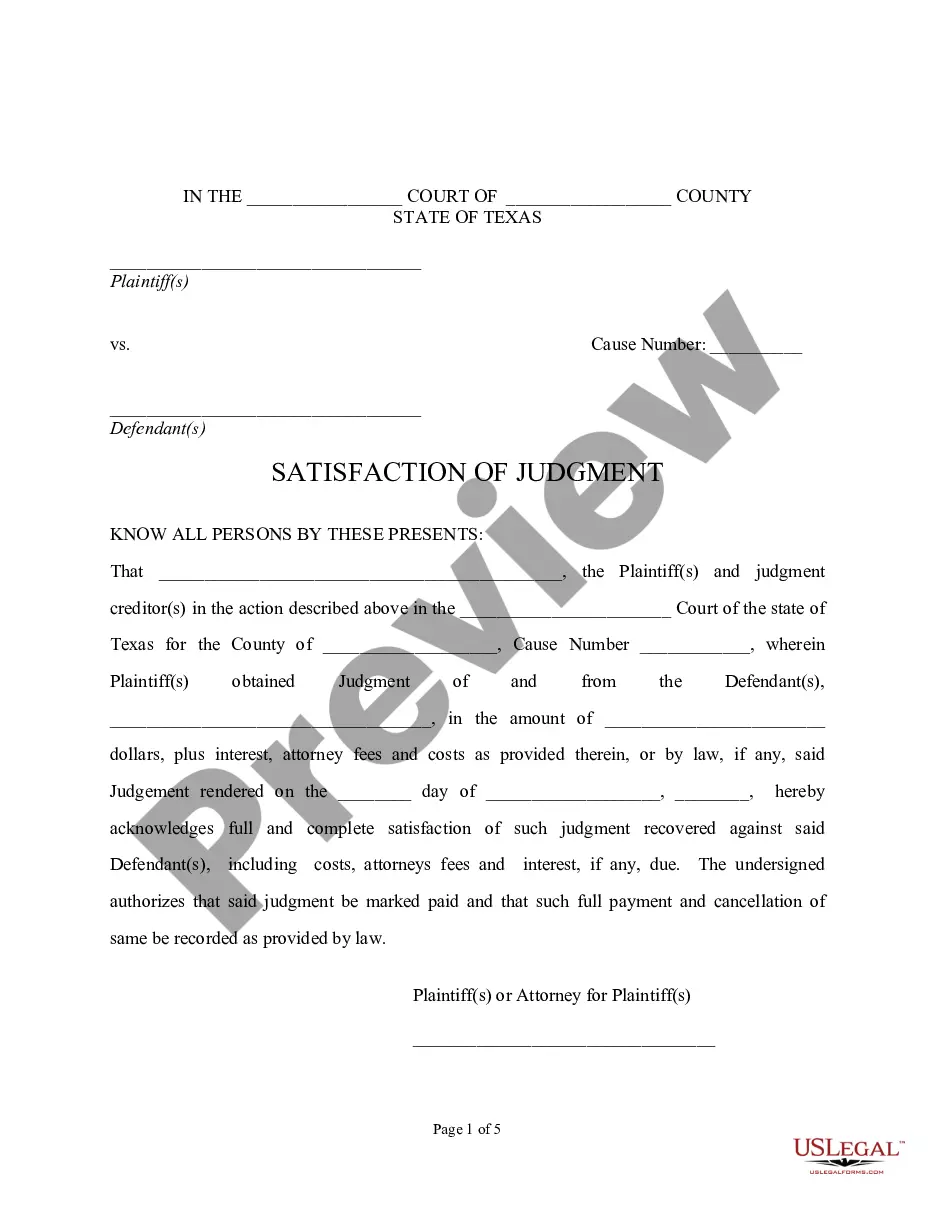

How to fill out Articles Of Incorporation For Non-Profit Organization, With Tax Provisions?

You can spend hours online looking for the appropriate legal document format that meets both federal and state regulations you require.

US Legal Forms offers a vast array of legal templates that have been examined by experts.

You can obtain or print the Ohio Articles of Incorporation for Non-Profit Organization, with Tax Provisions from my service.

First, ensure you have selected the correct document format for your chosen county/town. Review the form details to confirm it is the appropriate template. If available, utilize the Preview button to view the document format as well.

- If you already have a US Legal Forms account, you can Log In and then click the Download button.

- Then, you can fill out, edit, print, or sign the Ohio Articles of Incorporation for Non-Profit Organization, with Tax Provisions.

- Every legal document template you obtain is yours forever.

- To get another copy of the purchased form, go to the My documents tab and click the corresponding button.

- If you are visiting the US Legal Forms website for the first time, follow the simple steps below.

Form popularity

FAQ

You need at least three people on your non-profit board in Ohio. This allows for better decision-making and governance while complying with the state's requirements. Keeping your board diverse and engaged is vital, and outlining this structure in your Ohio Articles of Incorporation for Non-Profit Organization, with Tax Provisions, is a positive step towards your organization's success.

Yes, even small nonprofits in Ohio need a board of directors. The board provides oversight and guidance, ensuring that the organization adheres to its mission and complies with legal requirements. When addressing your organization's structure, consider detailing your board’s responsibilities in your Ohio Articles of Incorporation for Non-Profit Organization, with Tax Provisions.

Writing articles of incorporation for a non-profit involves several key elements, including the organization’s name, purpose, and board structure. It is crucial to include provisions regarding tax-exempt status and any other compliance requirements specific to Ohio. Platforms like USLegalForms can guide you through the process of creating Ohio Articles of Incorporation for Non-Profit Organization, with Tax Provisions, ensuring you meet all legal requirements.

The 33% rule refers to the guideline that a nonprofit should not have more than 33% of its board comprised of individuals who are financially associated with the organization, such as employees or their family members. This rule helps maintain independence and ensures that the board can effectively oversee the organization’s activities. It is essential to consider this rule when drafting your Ohio Articles of Incorporation for Non-Profit Organization, with Tax Provisions.

A nonprofit in Ohio must have at least three directors on its board. This requirement is key when filing your Ohio Articles of Incorporation for Non-Profit Organization, with Tax Provisions. Additionally, having diverse members can strengthen your organization's governance and strategy, promoting more informed decisions.

In Ohio, a non-profit organization must have a minimum of three board members for its board of directors. This ensures a balanced decision-making process and helps prevent any conflicts of interest. To meet the requirements outlined in the Ohio Articles of Incorporation for Non-Profit Organization, with Tax Provisions, these board members should be actively involved in the organization’s mission.

Yes, many nonprofits can achieve tax-exempt status in Ohio by filing for 501c3 status with the IRS. This exemption allows organizations to avoid federal income taxes and often state taxes as well. However, maintaining tax-exempt status requires adherence to specific regulations and operational requirements. Starting with Ohio Articles of Incorporation for Non-Profit Organization, with Tax Provisions, sets the stage for your nonprofit to pursue this beneficial status.

To create articles of incorporation for a nonprofit, begin by gathering necessary information, such as the organization's name, mission, and structure. Follow Ohio's requirements by including specific provisions related to the nonprofit's purpose, governance, and dissolution. Using templates or services like USLegalForms can simplify the preparation process, ensuring that your Ohio Articles of Incorporation for Non-Profit Organization, with Tax Provisions, are accurate and compliant.

Choosing between an LLC or corporation for a nonprofit largely depends on the organization's goals. A nonprofit typically opts for incorporation (Inc.) to benefit from established guidelines for governance, tax-exempt status, and credibility. On the other hand, an LLC might offer some flexibility in management and taxation. Ultimately, forming articles of incorporation for a nonprofit ensures that you comply with state laws and can pursue your mission effectively.

To determine if a nonprofit is incorporated, you can check the Ohio Secretary of State's business database for official records. Look for the name of the nonprofit in the database; incorporated entities will have filed articles of incorporation. Furthermore, valid documentation will be available that proves their incorporation status. This verification can provide peace of mind when engaging with nonprofit organizations.