Ohio Independent Contractor Agreement with Church is a legally binding document that outlines the terms and conditions of a working relationship between a church and an independent contractor in the state of Ohio. This agreement serves to clearly define the rights and responsibilities of both parties and ensures a mutual understanding of the project or services to be performed. Key terms within an Ohio Independent Contractor Agreement with Church may encompass: 1. Parties involved: Clearly identify the church as the contracting entity and the independent contractor by providing their legal names, addresses, and contact information. 2. Scope of work: Specify the services or project for which the independent contractor is engaged. It should include a detailed description of the tasks, deliverables, and expected outcomes. 3. Compensation: Define the payment terms agreed upon, such as the agreed upon fee, payment schedule, and method of payment (e.g., check, electronic transfer). 4. Term and termination: Clearly state the start date of the agreement and indicate whether it has an end date or if it will continue indefinitely until terminated by either party. Include provisions for termination, such as notice periods or grounds for termination. 5. Independent contractor status: Emphasize that the independent contractor is not considered an employee of the church. Clarify that the independent contractor will be responsible for their own taxes, insurance, and benefits. 6. Confidentiality and non-disclosure: Include provisions that require the independent contractor to maintain the confidentiality of any sensitive or proprietary information they may have access to during the course of their work with the church. 7. Intellectual property: Outline the ownership and rights to any intellectual property created or used by the independent contractor during the course of the agreement. Specify whether the church or the independent contractor retains ownership. 8. Indemnification and liability: Establish who will bear responsibility for any damages, losses, or legal claims arising from the independent contractor's work. Different types of Ohio Independent Contractor Agreements with Church may vary based on the nature of services needed. For example, specific agreements could be drafted for musicians, clergy, guest speakers, janitorial services, guest artists, or consultants. Each agreement would contain customized terms relevant to the particular contractor's role within the church. In conclusion, an Ohio Independent Contractor Agreement with Church is a necessary legal document to establish the working relationship between a church and an independent contractor. It is important to consult with legal professionals to draft a comprehensive agreement that reflects the specific needs and requirements of both parties involved.

Ohio Independent Contractor Agreement with Church

Description

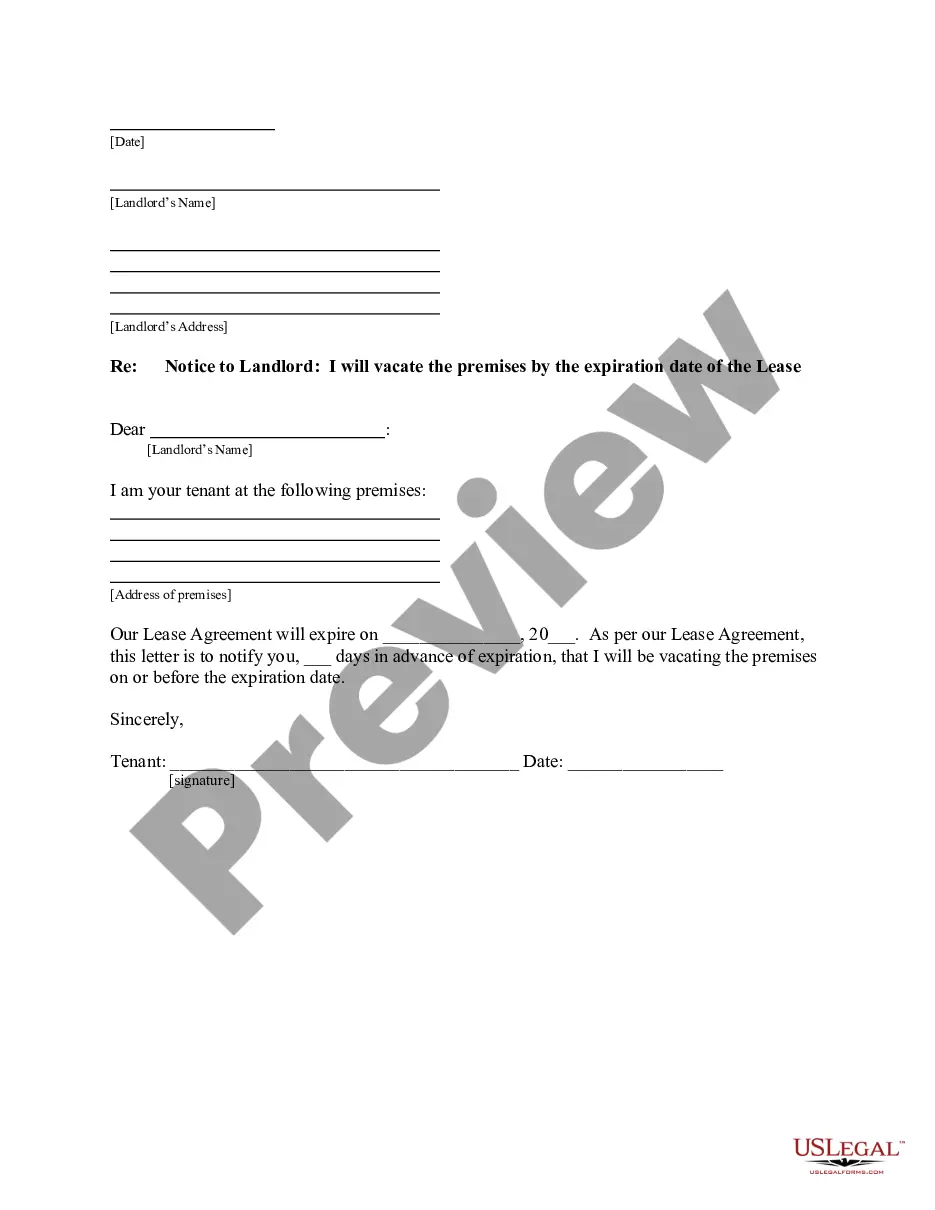

How to fill out Ohio Independent Contractor Agreement With Church?

It is possible to devote hours on the web searching for the legitimate record design that fits the state and federal specifications you need. US Legal Forms provides thousands of legitimate kinds which can be analyzed by pros. You can easily download or printing the Ohio Independent Contractor Agreement with Church from your service.

If you already possess a US Legal Forms accounts, it is possible to log in and click on the Obtain switch. Afterward, it is possible to comprehensive, modify, printing, or indicator the Ohio Independent Contractor Agreement with Church. Every legitimate record design you buy is the one you have eternally. To obtain yet another duplicate of any obtained develop, check out the My Forms tab and click on the corresponding switch.

If you work with the US Legal Forms website for the first time, adhere to the simple recommendations below:

- Very first, make certain you have selected the correct record design for that area/metropolis of your choice. Look at the develop information to make sure you have picked out the correct develop. If accessible, take advantage of the Review switch to search through the record design at the same time.

- If you want to get yet another version of the develop, take advantage of the Look for industry to obtain the design that meets your requirements and specifications.

- After you have located the design you desire, simply click Acquire now to carry on.

- Find the rates strategy you desire, type in your credentials, and sign up for your account on US Legal Forms.

- Comprehensive the purchase. You should use your Visa or Mastercard or PayPal accounts to cover the legitimate develop.

- Find the formatting of the record and download it for your product.

- Make adjustments for your record if necessary. It is possible to comprehensive, modify and indicator and printing Ohio Independent Contractor Agreement with Church.

Obtain and printing thousands of record layouts using the US Legal Forms web site, that provides the greatest assortment of legitimate kinds. Use skilled and express-distinct layouts to deal with your company or person requirements.

Form popularity

FAQ

Ten Tips for Making Solid Business Agreements and ContractsGet it in writing.Keep it simple.Deal with the right person.Identify each party correctly.Spell out all of the details.Specify payment obligations.Agree on circumstances that terminate the contract.Agree on a way to resolve disputes.More items...

During President Donald Trump's administration, the DOL issued a final rule clarifying when workers are independent contractors versus employees. The rule applied an economic-reality test that primarily considers whether the worker operates his or her own business or is economically dependent on the hiring entity.

Here are some steps you may use to guide you when you write an employment contract:Title the employment contract.Identify the parties.List the term and conditions.Outline the job responsibilities.Include compensation details.Use specific contract terms.Consult with an employment lawyer.Employment.More items...?

All work required of the contract is performed by the independent contractor and employees. Independent contractors are not typically considered employees of the principal. A "general contractor" is an entity with whom the principal/owner directly contracts to perform certain jobs.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

Every independent contractor agreement should feature an indemnity clause. The purpose of this clause is to ensure that the independent contractor will be held liable for any damage or injury resulting from the independent contractor's work performed under the contract.

According to the Ohio Department of Job and Family Services, an independent contractor is someone who is under contract to perform a special service for an employer. In the case of things like unemployment insurance tax reporting for Ohio independent contractor law, you as an independent contractor are excluded from

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.14-Feb-2022

Independent contractors provide goods or services according to the terms of a contract they have negotiated with an employer. Independent contractors are not employees, and therefore they are not covered under most federal employment statutes.