Ohio Shareholders Buy Sell Agreement of Stock in a Close Corporation with Agreement of Spouse and Stock Transfer Restrictions A Shareholders Buy Sell Agreement is a legally binding contract in which the shareholders of a close corporation agree to buy and sell each other's stock under specific circumstances. In Ohio, this agreement can be further enhanced by the inclusion of an Agreement of Spouse and Stock Transfer Restrictions. These additional clauses provide comprehensive protection and control over the transfer of shares in a close corporation. Below, we will discuss the key components of these agreements and their different types. 1. Shareholders Buy Sell Agreement: — The Buy Sell Agreement defines the situations in which a shareholder can sell their stock and the process for determining the price. — It typically addresses events like death, disability, retirement, divorce, bankruptcy, or voluntary withdrawal from the corporation. — The agreement sets forth the terms and conditions for the sale of shares, including the valuation method and the rights of first refusal or mandatory buybacks. 2. Agreement of Spouse: — This clause is added to address the marital rights and interests of shareholders' spouses in the close corporation's stock. — It may require spousal consent for any stock transfers, ensuring that the interests of the spouse are considered before selling or transferring shares. — Spousal consent provisions protect the family unit and help maintain the stability and continuity of the close corporation. 3. Stock Transfer Restrictions: — Stock Transfer Restriction clauses impose specific limitations and conditions on the transferability of shares. — These restrictions can include pre-approval requirements, rights of first refusal, drag-along or tag-along rights, or restrictions on transferring shares to outsiders. — By incorporating stock transfer restrictions, the close corporation can control who becomes a shareholder, ensuring that only qualified individuals or entities own company stock. It is important to note that variations of these agreements exist depending on the specific needs and objectives of the close corporation. Some alternate types of Shareholders Buy Sell Agreement of Stock in a Close Corporation with Agreement of Spouse and Stock Transfer Restrictions are: 1. Cross-Purchase Agreement: — In this arrangement, individual shareholders agree to buy the stock directly from the selling shareholder. — Each shareholder maintains a separate agreement with every other shareholder. — Useful when there are relatively few shareholders and each wants control over whom they buy stocks from. 2. Entity-Purchase Agreement: — In this scenario, the corporation itself is obligated to buy the stock from the selling shareholder. — The corporation holds a master agreement with each individual shareholder. — Beneficial when therArmandoof shareholders or the corporation wants to maintain control over the stock ownership. 3. Hybrid Agreement: — A combination of Cross-Purchase and Entity-Purchase Agreements. — Offers flexibility by allowing certain shareholders to buy directly while the corporation purchases shares under specific circumstances. By implementing an Ohio Shareholders Buy Sell Agreement of Stock in a Close Corporation with Agreement of Spouse and Stock Transfer Restrictions, close corporations can establish clear guidelines and protect the interests of all parties involved. These agreements ensure smooth transitions during various events and maintain the corporation's stability for future success.

Ohio Shareholders Buy Sell Agreement of Stock in a Close Corporation with Agreement of Spouse and Stock Transfer Restrictions

Description

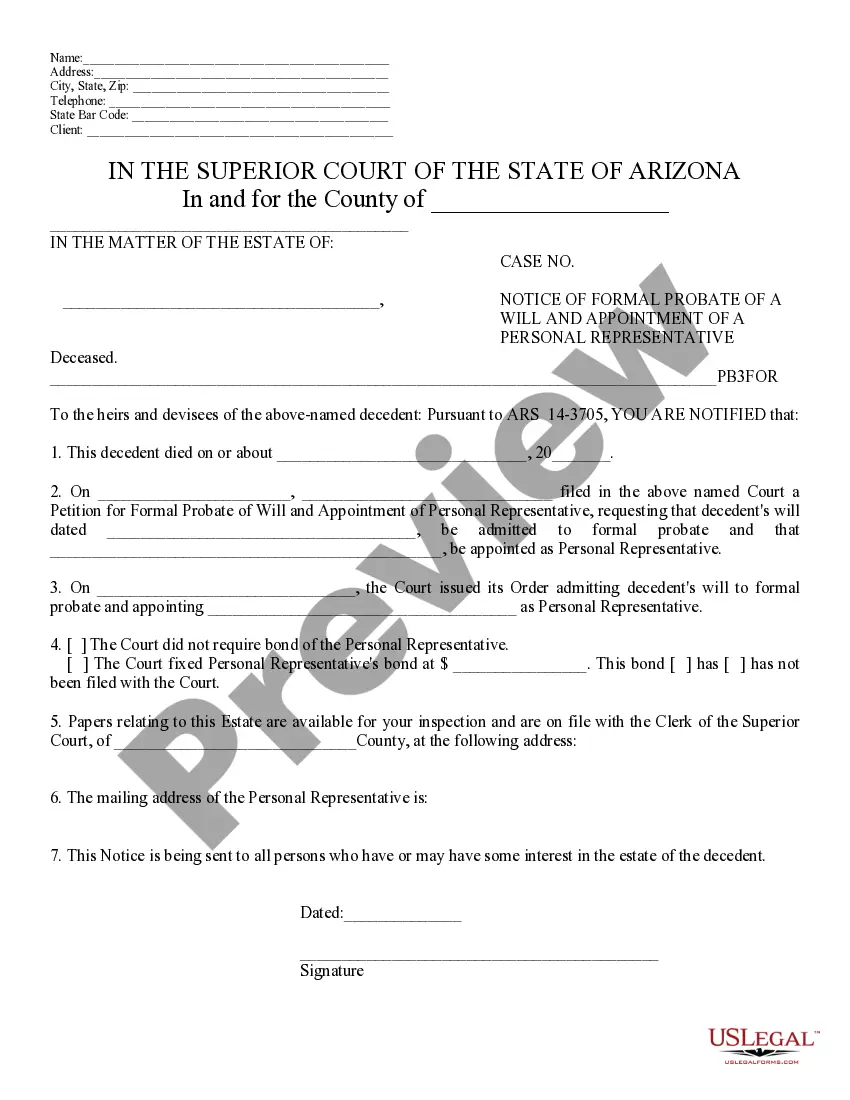

How to fill out Ohio Shareholders Buy Sell Agreement Of Stock In A Close Corporation With Agreement Of Spouse And Stock Transfer Restrictions?

US Legal Forms - one of the greatest libraries of legal forms in the States - delivers a wide range of legal file themes you may download or produce. While using web site, you can find a huge number of forms for company and individual uses, categorized by categories, says, or keywords.You will find the newest types of forms such as the Ohio Shareholders Buy Sell Agreement of Stock in a Close Corporation with Agreement of Spouse and Stock Transfer Restrictions in seconds.

If you already have a registration, log in and download Ohio Shareholders Buy Sell Agreement of Stock in a Close Corporation with Agreement of Spouse and Stock Transfer Restrictions through the US Legal Forms library. The Down load button can look on each form you perspective. You get access to all earlier downloaded forms within the My Forms tab of your account.

If you want to use US Legal Forms for the first time, here are basic instructions to help you get began:

- Make sure you have chosen the best form to your metropolis/county. Select the Review button to review the form`s content. Look at the form explanation to actually have chosen the right form.

- If the form does not fit your demands, make use of the Look for industry on top of the display screen to obtain the one that does.

- When you are happy with the form, confirm your choice by clicking on the Get now button. Then, opt for the pricing plan you prefer and give your credentials to sign up for the account.

- Approach the deal. Make use of bank card or PayPal account to perform the deal.

- Select the structure and download the form on your own system.

- Make alterations. Load, edit and produce and indicator the downloaded Ohio Shareholders Buy Sell Agreement of Stock in a Close Corporation with Agreement of Spouse and Stock Transfer Restrictions.

Each and every format you included in your account lacks an expiry particular date which is your own property forever. So, if you want to download or produce yet another copy, just go to the My Forms area and click on the form you need.

Gain access to the Ohio Shareholders Buy Sell Agreement of Stock in a Close Corporation with Agreement of Spouse and Stock Transfer Restrictions with US Legal Forms, the most substantial library of legal file themes. Use a huge number of professional and condition-certain themes that meet your organization or individual requires and demands.

Form popularity

FAQ

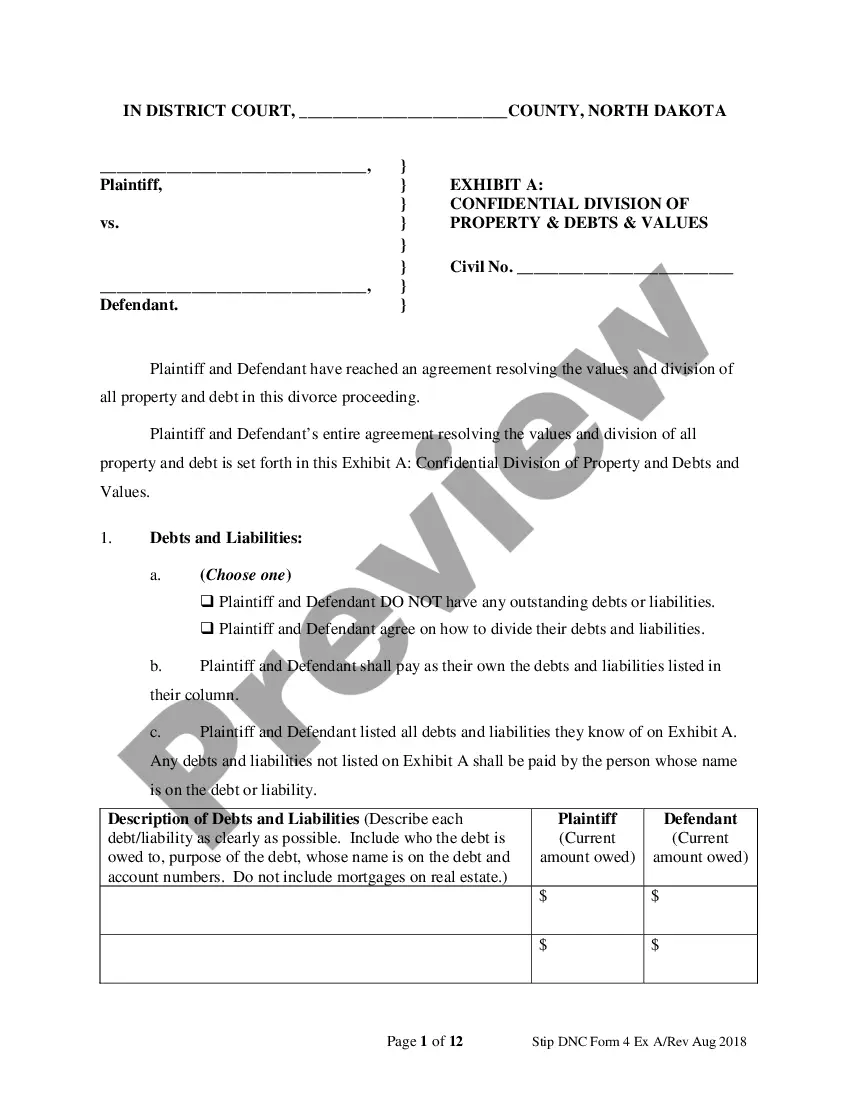

Entity-purchase agreement Under an entity-purchase plan, the business purchases an owner's entire interest at an agreed-upon price if and when a triggering event occurs. If the business is a corporation, the plan is referred to as a stock redemption agreement.

To buyout a shareholder, a company must be able to pay for the value of the ownership interest. A company can fund the purchase of a shareholder's interest by using: The Assets of the Business: A buyout agreement may stipulate that the company can pay over time with the income earned from the business.

Stock transfer restrictions come in several general flavors: Requirement that the board or the other shareholders approve a transfer of stock; Right of first refusal; Mandatory buyback by the company or other shareholders.

The buy and sell agreement is also known as a buy-sell agreement, a buyout agreement, a business will, or a business prenup.

The business owners individually own the policies insuring each other's lives. When a business owner dies, the proceeds are paid to those surviving owners who hold one or more policies on the deceased owner, and these surviving owners buy the shares from the deceased owner's personal representative.

sell agreement establishes the fair value of a person's share in the business, which comes in handy if a partner wants to remain in the company after another partner's exit. This helps forestall disagreements about whether a buyout offer is fair since the agreement establishes these figures ahead of time.

Definition. 1. A buy-sell agreement is an agreement among the owners of the business and the entity. 2. The buy-sell agreement usually provides for the purchase and sale of ownership interests in the business at a price determined in accordance with the agreement, upon the occurrence of certain (usually future) events.

A shareholder buyout agreement is a contract that determines how shares can be sold and bought within the organisation. These agreements are imperative for many types of businesses including corporations and limited liability companies.

The sale of the shares may be accomplished in two very different ways. First, each shareholder can agree to purchase, pro rata or otherwise, all the stock being sold. This is called a "cross purchase" of stock.

Buy-sell agreements, also called buyout agreements and shareholder agreements, are legally binding documents between two business partners that govern how business interests are treated if one partner leaves unexpectedly.