When it comes to charitable giving and estate planning, Ohio offers various options for individuals looking to convey a condominium unit to a charity while reserving a life tenancy for themselves and their spouse. By utilizing an Ohio Deed Conveying Condominium Unit to Charity with Reservation of Life Tenancy in Donor and Donor's Spouse, individuals can ensure their charitable desires are met while still retaining the right to live in the property for the duration of their lives. One type of Ohio Deed Conveying Condominium Unit to Charity with Reservation of Life Tenancy in Donor and Donor's Spouse is the Life Estate Deed. This legal document allows the donor and their spouse to retain the right to occupy and use the condominium unit until their passing. However, upon their death, the property automatically transfers to the named charitable organization. Another type of Ohio Deed Conveying Condominium Unit to Charity with Reservation of Life Tenancy in Donor and Donor's Spouse is the Remainder Interest Deed. This deed allows the donor and their spouse to enjoy the use and benefits of the condominium unit during their lifetime. However, instead of the property transferring directly to the charity upon their death, it is held in trust for the organization until a specified time, such as the death of the surviving spouse or a predetermined date. The Ohio Deed Conveying Condominium Unit to Charity with Reservation of Life Tenancy in Donor and Donor's Spouse provides individuals with a flexible and philanthropic approach to estate planning. It allows donors to make a significant charitable contribution while still ensuring they have a comfortable place to live until the end of their lives. By choosing this option, individuals can leave a lasting legacy while supporting causes close to their heart. Keywords: Ohio Deed, Conveying, Condominium Unit, Charity, Reservation of Life Tenancy, Donor, Donor's Spouse, Life Estate Deed, Remainder Interest Deed, estate planning, charitable giving, philanthropic, lasting legacy.

Ohio Deed Conveying Condominium Unit to Charity with Reservation of Life Tenancy in Donor and Donor's Spouse

Description

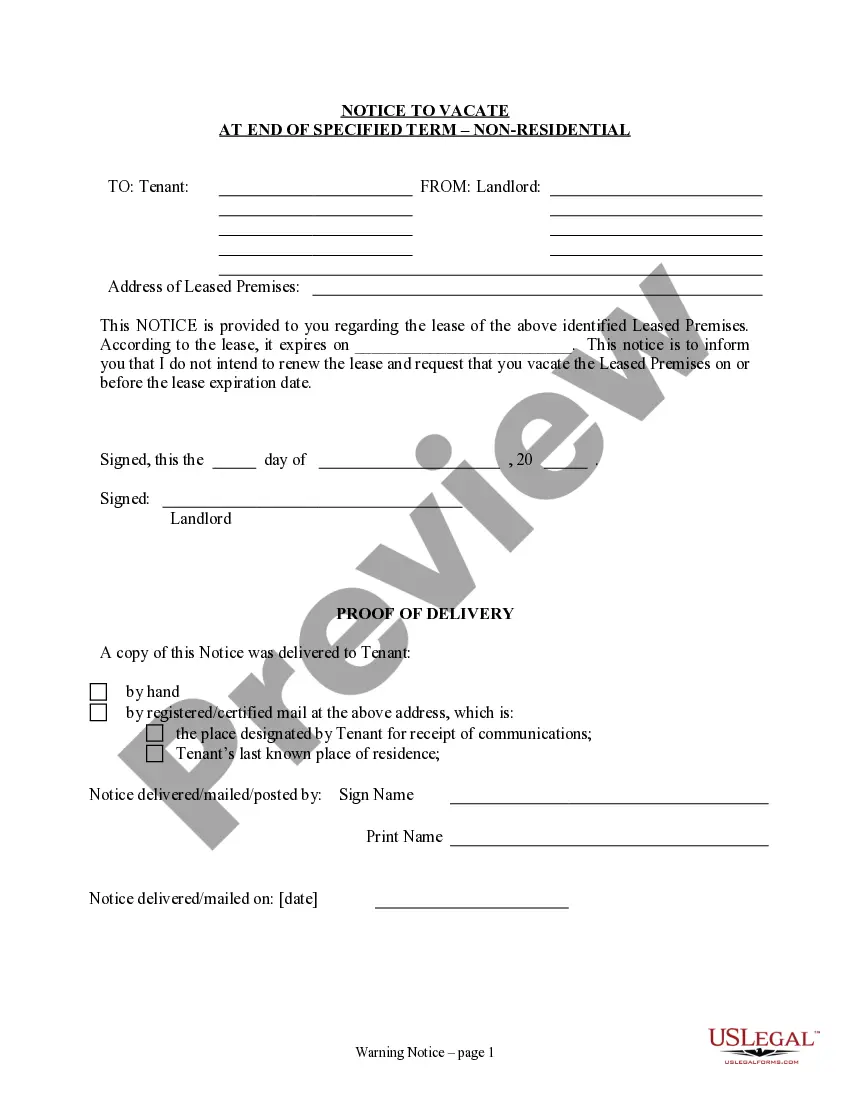

How to fill out Ohio Deed Conveying Condominium Unit To Charity With Reservation Of Life Tenancy In Donor And Donor's Spouse?

If you wish to complete, obtain, or print lawful file web templates, use US Legal Forms, the biggest selection of lawful varieties, which can be found on the Internet. Utilize the site`s simple and easy handy search to find the papers you need. A variety of web templates for enterprise and personal functions are categorized by categories and says, or keywords and phrases. Use US Legal Forms to find the Ohio Deed Conveying Condominium Unit to Charity with Reservation of Life Tenancy in Donor and Donor's Spouse in just a few mouse clicks.

When you are previously a US Legal Forms client, log in to your bank account and click the Download key to get the Ohio Deed Conveying Condominium Unit to Charity with Reservation of Life Tenancy in Donor and Donor's Spouse. You can even accessibility varieties you formerly saved within the My Forms tab of the bank account.

If you are using US Legal Forms the very first time, follow the instructions listed below:

- Step 1. Make sure you have chosen the form for your proper city/country.

- Step 2. Make use of the Review option to examine the form`s content. Do not neglect to read the outline.

- Step 3. When you are unhappy with all the kind, take advantage of the Lookup area on top of the display to locate other models of your lawful kind design.

- Step 4. Upon having identified the form you need, click the Acquire now key. Pick the prices plan you choose and add your references to register for the bank account.

- Step 5. Approach the transaction. You can utilize your credit card or PayPal bank account to perform the transaction.

- Step 6. Choose the formatting of your lawful kind and obtain it on your device.

- Step 7. Full, revise and print or indicator the Ohio Deed Conveying Condominium Unit to Charity with Reservation of Life Tenancy in Donor and Donor's Spouse.

Each and every lawful file design you acquire is yours permanently. You may have acces to every single kind you saved inside your acccount. Select the My Forms segment and pick a kind to print or obtain again.

Contend and obtain, and print the Ohio Deed Conveying Condominium Unit to Charity with Reservation of Life Tenancy in Donor and Donor's Spouse with US Legal Forms. There are thousands of professional and state-specific varieties you can utilize for your enterprise or personal needs.