Ohio Qualified Subchapter-S Trust for Benefit of Child with Crummy Trust Agreement is a legal instrument designed to provide financial benefits to a child while also taking advantage of tax benefits under Subchapter S of the Internal Revenue Code. This type of trust consists of two key components — the Qualified Subchapter S Corporation (Q-Sub) and the Crummy Trust Agreement. The main purpose of an Ohio Qualified Subchapter-S Trust is to enable a child to receive financial benefits from a family business or closely held corporation without imposing a heavy tax burden. By utilizing a Qualified Subchapter-S Corporation, the trust can pass income, deductions, and credits directly to the child beneficiary, who will be responsible for reporting them on their personal tax return. This allows the child to benefit from the trust's income while also taking advantage of lower individual tax rates. The Crummy Trust Agreement is an essential element of this arrangement, as it acts as a mechanism for ensuring that contributions made to the trust qualify for the annual gift tax exclusion. The agreement gives the child beneficiary the right to withdraw funds gifted to the trust within a specific timeframe, typically 30 days. By providing this withdrawal power, the contributions made to the trust are considered present interests, which allows the donor to utilize the annual gift tax exclusion. This exclusion currently stands at $15,000 per person per year (2021), meaning that individuals can gift up to this amount without incurring gift taxes. There are several types of Ohio Qualified Subchapter-S Trusts for the benefit of a child with a Crummy Trust Agreement, including: 1. Discretionary Ohio Qualified Subchapter-S Trust with Crummy Powers: This type of trust provides the trustee with discretionary authority over the distributions to the child beneficiary, allowing flexibility in determining when and how much income and principal should be distributed. 2. Support Ohio Qualified Subchapter-S Trust with Crummy Powers: In this trust arrangement, the trustee is directed to distribute funds to the child beneficiary for their support, health, education, maintenance, and other reasonable needs. The trustee has the discretion to determine the appropriate amount to be distributed based on the child's needs. 3. Accumulation Ohio Qualified Subchapter-S Trust with Crummy Powers: This trust structure aims to accumulate income and growth within the trust for the future benefit of the child beneficiary. The trustee may make limited distributions to cover reasonable expenses or medical emergencies, but the primary goal is to grow the trust assets over time. 4. Ohio Qualified Subchapter-S Trust with Crummy Powers and Spendthrift Provisions: This type of trust incorporates spendthrift provisions to protect the trust assets from creditors and potential mismanagement by the child beneficiary. The trustee has the discretion to provide distributions for the child's well-being while ensuring the long-term preservation of the trust assets. In conclusion, an Ohio Qualified Subchapter-S Trust for Benefit of Child with Crummy Trust Agreement combines the benefits of a Qualified Subchapter-S Corporation with the Crummy Trust Agreement to provide tax advantages and financial benefits to a child beneficiary. Different types of these trusts exist, each offering varying levels of flexibility, support, accumulation, and asset protection. It is important to consult with legal and tax professionals to understand the specific requirements and advantages of each type when considering this estate planning option.

Ohio Qualified Subchapter-S Trust for Benefit of Child with Crummey Trust Agreement

Description

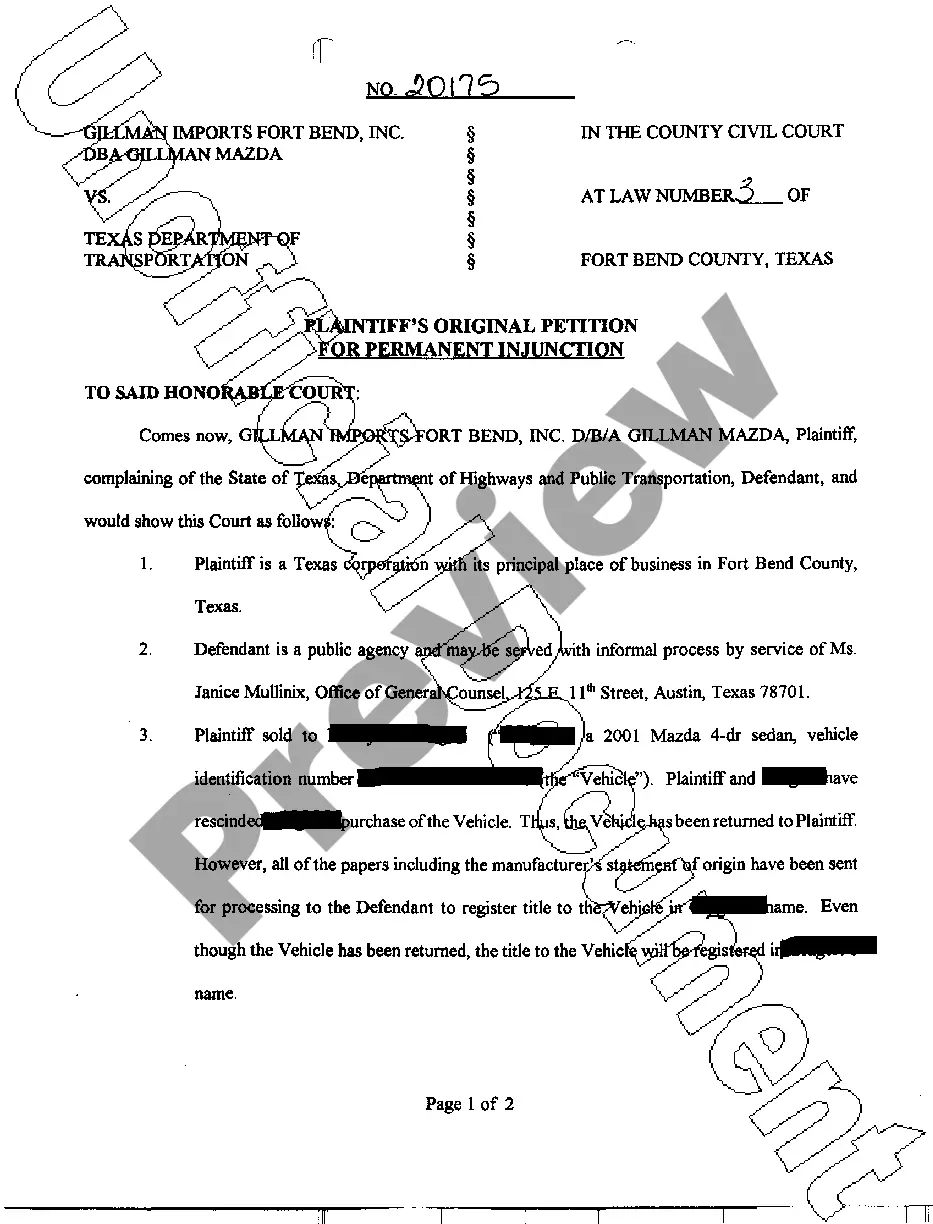

How to fill out Ohio Qualified Subchapter-S Trust For Benefit Of Child With Crummey Trust Agreement?

US Legal Forms - among the biggest libraries of lawful forms in the States - offers a wide array of lawful file layouts you can down load or print out. While using web site, you can find a large number of forms for company and person reasons, sorted by categories, states, or search phrases.You can find the most up-to-date models of forms much like the Ohio Qualified Subchapter-S Trust for Benefit of Child with Crummey Trust Agreement in seconds.

If you already possess a subscription, log in and down load Ohio Qualified Subchapter-S Trust for Benefit of Child with Crummey Trust Agreement from the US Legal Forms library. The Acquire switch will appear on every single type you view. You get access to all previously saved forms within the My Forms tab of the accounts.

If you would like use US Legal Forms for the first time, here are easy directions to get you started off:

- Make sure you have picked out the right type to your area/area. Click the Review switch to analyze the form`s content. Look at the type outline to actually have chosen the correct type.

- When the type does not fit your specifications, use the Lookup area at the top of the display to find the the one that does.

- In case you are happy with the shape, verify your decision by simply clicking the Purchase now switch. Then, choose the prices prepare you like and give your accreditations to sign up for the accounts.

- Process the deal. Utilize your bank card or PayPal accounts to perform the deal.

- Choose the format and down load the shape on your own device.

- Make changes. Load, edit and print out and sign the saved Ohio Qualified Subchapter-S Trust for Benefit of Child with Crummey Trust Agreement.

Each web template you added to your bank account does not have an expiry time which is your own property for a long time. So, in order to down load or print out one more backup, just go to the My Forms area and then click around the type you need.

Obtain access to the Ohio Qualified Subchapter-S Trust for Benefit of Child with Crummey Trust Agreement with US Legal Forms, the most considerable library of lawful file layouts. Use a large number of specialist and express-specific layouts that meet up with your company or person demands and specifications.

Form popularity

FAQ

Net investment income tax of a QSST 1411(a)(2)). The tax also applies to QSSTs to the extent the net investment income is retained in the trust. Although the S corporation income of a QSST is taxed to the individual income beneficiary, capital gain on the sale of the S corporation stock is taxed at the trust level.

Crummey trusts are typically used by parents to provide their children with lifetime gifts while sheltering their money from gift taxes as long as the gift's value is equal to or less than the permitted annual exclusion amount.

Advantages of a Crummey TrustA Crummey Trust allows you to take advantage of the gift tax exclusions and simultaneously minimize your estate taxes.You do not have to provide an opportunity for the beneficiary to withdraw the entire balance of the trust until a certain age.A Crummey trust can have multiple beneficiaries.More items...?12-Sept-2019

A QSST is one of several types of trusts that are eligible to hold stock in an S corporation. Its two primary requirements are (1) there can be only one beneficiary of the trust and (2) all income must be distributed at least annually (Sec.

This trust type is established by your will. It's an eligible S corporation shareholder for up to two years after the transfer and then must either distribute the stock to an eligible shareholder or qualify as a QSST or ESBT.

Crummey Trust, Definition This type of trust is typically used by parents who want to make financial gifts to minor or adult children, though anyone can establish one on behalf of a beneficiary.

A Qualified Subchapter S Trust, commonly referred to as a QSST Election, or a Q-Sub election, is a Qualified Subchapter S Subsidiary Election made on behalf of a trust that retains ownership as the shareholder of an S corporation, a corporation in the United States which votes to be taxed.

The main difference between an ESBT and a QSST is that an ESBT may have multiple income beneficiaries, and the trust does not have to distribute all income. Unlike with the QSST, the trustee, rather than the beneficiary, must make the election.

A Crummey Trust allows you to take advantage of the gift tax exclusions and simultaneously minimize your estate taxes. You do not have to provide an opportunity for the beneficiary to withdraw the entire balance of the trust until a certain age. A Crummey trust can have multiple beneficiaries.