Ohio Provisions for Testamentary Charitable Remainder Unit rust for One Life is a legal instrument specifically designed to support charitable causes while providing income to a named individual (known as the income recipient) during their lifetime. This trust is established under Ohio law and follows specific guidelines and provisions to ensure its legality and effectiveness. The Ohio Provisions for Testamentary Charitable Remainder Unit rust for One Life allows the creator (known as the Granter) to transfer assets into the trust, which are then managed and invested by a designated trustee. The income recipient is entitled to receive a predetermined percentage of the trust's value, typically paid annually or at regular intervals. Upon the death of the income recipient, the remaining trust assets are distributed to one or more charitable organizations, as specified by the Granter. The charitable organizations must meet the legal requirements set by Ohio law and should be tax-exempt organizations eligible to receive tax-deductible charitable contributions. There are several types of Ohio Provisions for Testamentary Charitable Remainder Unit rust for One Life, each with its own variations and characteristics. Some common types include: 1. Charitable Remainder Unit rust (CUT) with Net Income: In this type of trust, the income recipient receives the least of either the net income generated by the trust or a fixed percentage of the trust's value. Any remaining trust assets are distributed to the charitable organization upon the income recipient's death. 2. Charitable Remainder Unit rust (CUT) with Make-up Provision: This type of trust allows the income recipient to make up any income missed in prior years due to insufficient net income generated by the trust. The trust must still pay a stated percentage of its value each year to the income recipient. 3. Flip Charitable Remainder Unit rust: This type of trust begins as a Charitable Remainder Annuity Trust (CAT) or a Charitable Remainder Unit rust (CUT) during the income recipient's lifetime. Upon the occurrence of a specified triggering event (such as the death of a non-income beneficiary or the sale of a specific asset), the trust "flips" to a different type, typically a CUT. It is essential to consult with an experienced attorney or financial advisor when establishing an Ohio Provisions for Testamentary Charitable Remainder Unit rust for One Life to ensure compliance with Ohio law and to maximize its benefits for both the income recipient and the chosen charitable organizations.

Ohio Provisions for Testamentary Charitable Remainder Unitrust for One Life

Description

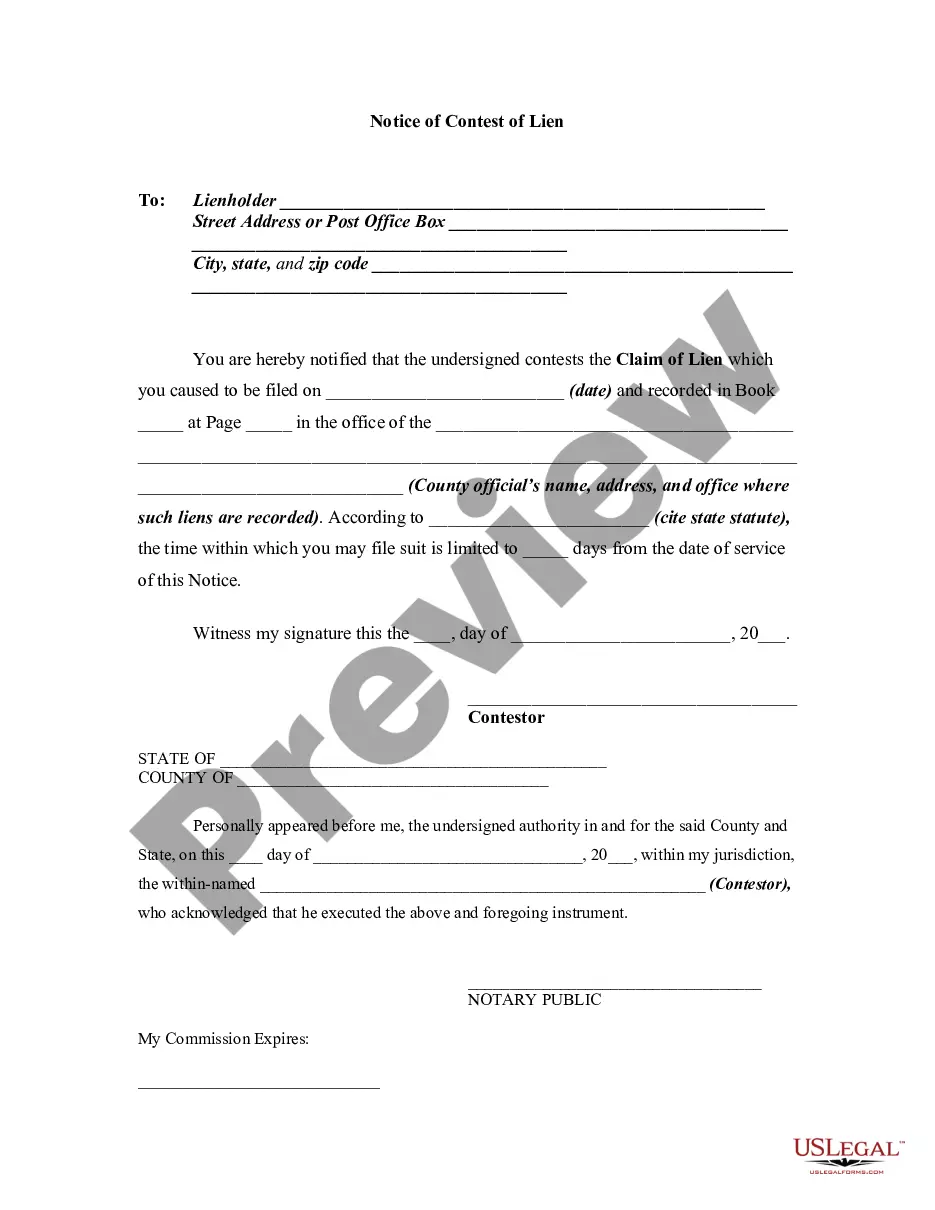

How to fill out Ohio Provisions For Testamentary Charitable Remainder Unitrust For One Life?

US Legal Forms - one of many greatest libraries of legitimate varieties in the States - provides a wide range of legitimate file templates you are able to obtain or produce. Utilizing the website, you can find 1000s of varieties for business and personal uses, sorted by classes, claims, or search phrases.You will find the newest types of varieties just like the Ohio Provisions for Testamentary Charitable Remainder Unitrust for One Life in seconds.

If you have a registration, log in and obtain Ohio Provisions for Testamentary Charitable Remainder Unitrust for One Life through the US Legal Forms collection. The Down load key will appear on every single form you see. You gain access to all formerly saved varieties within the My Forms tab of your own accounts.

If you want to use US Legal Forms the very first time, here are straightforward instructions to get you started out:

- Be sure to have picked out the best form to your city/state. Select the Review key to examine the form`s articles. Look at the form information to actually have selected the correct form.

- In the event the form doesn`t fit your specifications, use the Look for discipline near the top of the screen to discover the one which does.

- When you are happy with the shape, confirm your selection by visiting the Buy now key. Then, pick the pricing strategy you want and give your references to register for the accounts.

- Process the financial transaction. Make use of your bank card or PayPal accounts to finish the financial transaction.

- Pick the format and obtain the shape on your own product.

- Make changes. Complete, edit and produce and sign the saved Ohio Provisions for Testamentary Charitable Remainder Unitrust for One Life.

Every single format you included in your money lacks an expiration particular date and is the one you have permanently. So, if you wish to obtain or produce yet another version, just check out the My Forms section and then click around the form you want.

Gain access to the Ohio Provisions for Testamentary Charitable Remainder Unitrust for One Life with US Legal Forms, the most substantial collection of legitimate file templates. Use 1000s of skilled and express-specific templates that fulfill your organization or personal needs and specifications.