Ohio Testamentary Provisions for Charitable Remainder Annuity Trust for Term of Years

Description

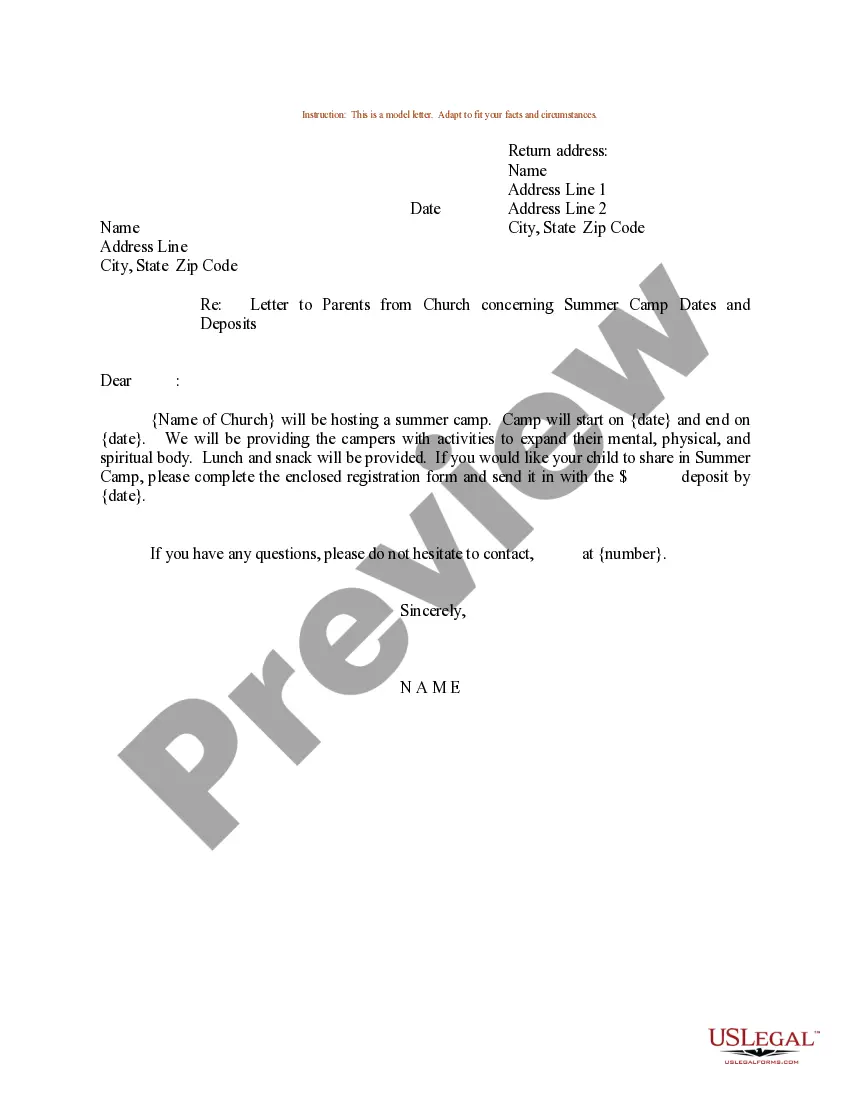

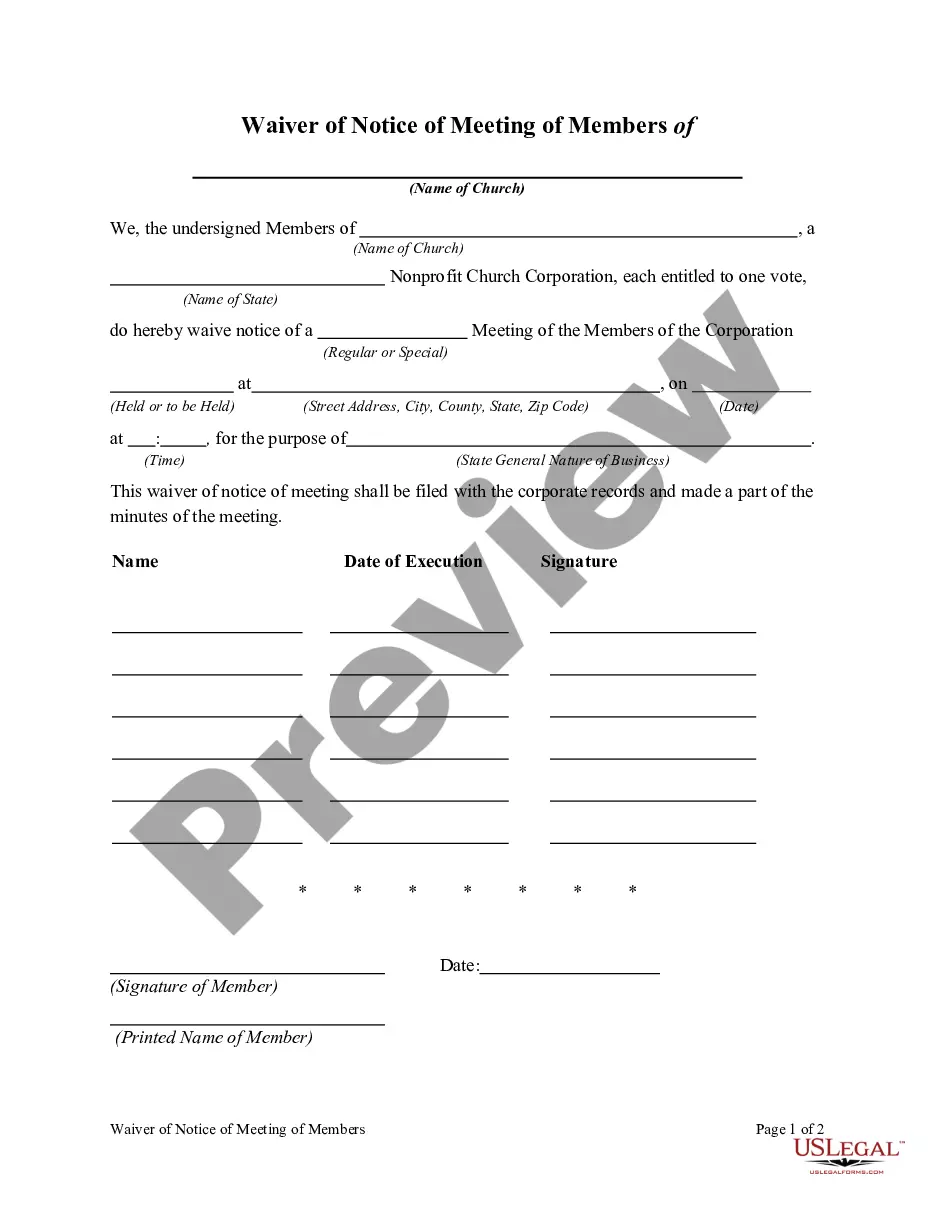

How to fill out Testamentary Provisions For Charitable Remainder Annuity Trust For Term Of Years?

Have you ever been in a situation where you require documents for either business or personal reasons almost every day.

There are numerous legal document templates accessible online, but locating reliable ones can be challenging.

US Legal Forms provides a vast array of form templates, including the Ohio Testamentary Provisions for Charitable Remainder Annuity Trust for Term of Years, designed to comply with state and federal regulations.

Utilize US Legal Forms, the most extensive collection of legal forms, to save time and avoid mistakes.

The service offers well-crafted legal document templates suitable for various needs. Create an account on US Legal Forms and start simplifying your life.

- If you are already familiar with the US Legal Forms site and have an account, simply Log In.

- Then, you can download the Ohio Testamentary Provisions for Charitable Remainder Annuity Trust for Term of Years template.

- If you do not have an account and want to start using US Legal Forms, follow these instructions.

- Locate the form you need and ensure it is for the correct region/county.

- Utilize the Review button to examine the document.

- Check the description to confirm you have selected the right form.

- If the form isn't what you seek, use the Research field to find the form that matches your needs and criteria.

- Once you find the right form, click Purchase now.

- Select the pricing plan you prefer, fill in the required information to create your account, and pay for your order using PayPal or Visa or Mastercard.

- Choose a suitable file format and download your copy.

- You can find all the document templates you’ve purchased in the My documents section.

- You can acquire another copy of the Ohio Testamentary Provisions for Charitable Remainder Annuity Trust for Term of Years anytime, if needed.

- Just select the necessary form to download or print the document template.

Form popularity

FAQ

Any income that you receive from your charitable trust could reduce the total contribution that you end up leaving to your charity. You may risk leaving nothing to your charity if you plan to receive high payments from the trust while you're alive.

To help you get started on understanding the options available, here's an overview the three primary classes of trusts.Revocable Trusts.Irrevocable Trusts.Testamentary Trusts.More items...?

1. Charitable remainder unit trust (CRUT) pays the beneficiary a fixed percentage of the trust at least annually, often for life or a period up to 20 years.

Any income that you receive from your charitable trust could reduce the total contribution that you end up leaving to your charity. You may risk leaving nothing to your charity if you plan to receive high payments from the trust while you're alive.

The trust can also be used to reduce estate tax liabilities and ensure professional management of the assets. A disadvantage of a testamentary trust is that it does not avoid probatethe legal process of distributing assets through the court.

A CRT may last for the Lead Beneficiaries' joint lives or for a term of years (the term may not exceed 20 years).

The downside of a charitable remainder trust is that it is irrevocable, meaning once you create the trust, you can't cancel it. While you can't revoke the trust, you may have the ability to change the beneficiary if you decide to give to a different charity.

A testamentary charitable remainder trust is created with assets upon your death. The trust then makes regular income payments to your named heirs for life or a term of up to 20 years.

A CRT lets you convert a highly appreciated asset like stock or real estate into lifetime income. It reduces your income taxes now and estate taxes when you die. You pay no capital gains tax when the asset is sold. It also lets you help one or more charities that have special meaning to you.

How Long Can a Charitable Trust Last? Charitable Remainder Trusts can either last the lifetime of another beneficiary, or for a specified term (usually 20 years). At that point, any remaining value would go to your designated charitable organization. Learn more about Charitable Trust tax rules.