Ohio Irrevocable Trust for Lifetime Benefit of Trustor with Power of Invasion in Trustor

Description

How to fill out Irrevocable Trust For Lifetime Benefit Of Trustor With Power Of Invasion In Trustor?

It is feasible to spend hours online attempting to locate the legal document template that complies with the state and federal requirements you require.

US Legal Forms offers thousands of legal documents that have been reviewed by professionals.

You can easily obtain or print the Ohio Irrevocable Trust for Lifetime Benefit of Trustor with Power of Invasion in Trustor from this service.

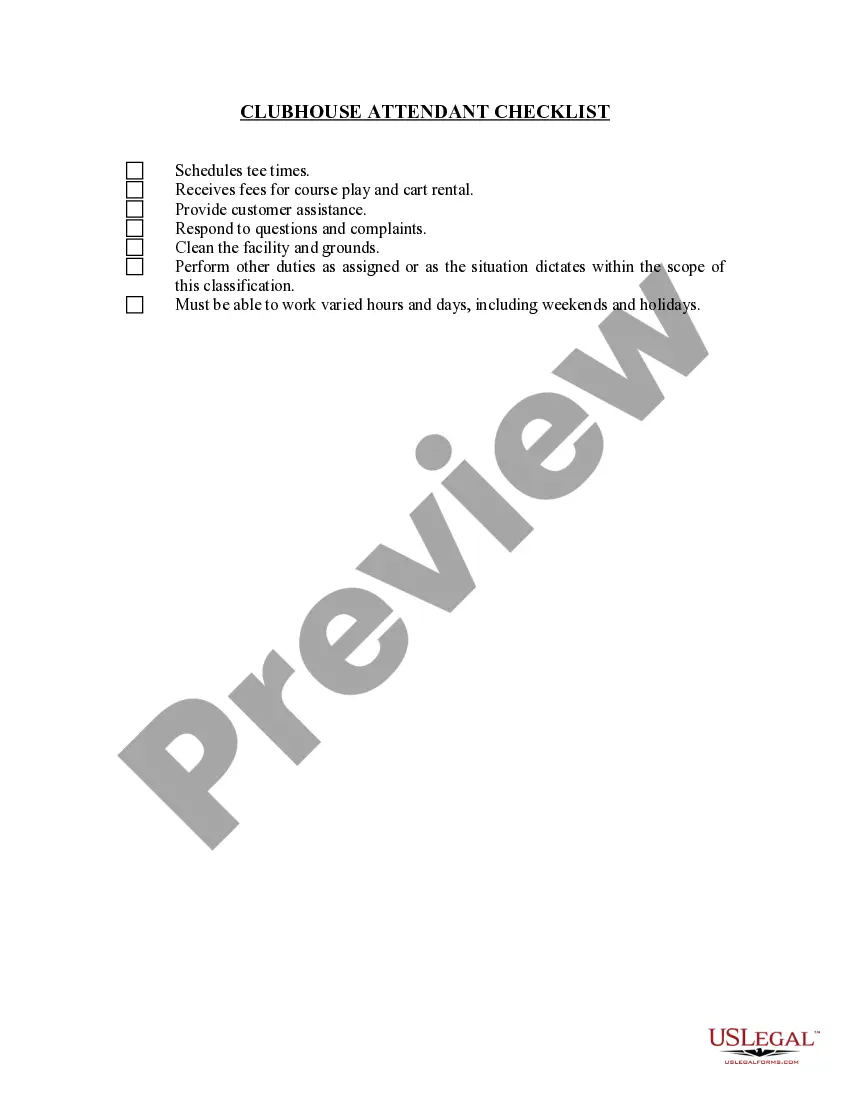

Use the Preview option to review the document template as well.

- If you have a US Legal Forms account, you can Log In and select the Download option.

- After that, you can complete, modify, print, or sign the Ohio Irrevocable Trust for Lifetime Benefit of Trustor with Power of Invasion in Trustor.

- Every legal document template you acquire is yours indefinitely.

- To obtain another copy of any purchased document, go to the My documents tab and click on the corresponding option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for your state/town of choice.

- Review the form outline to guarantee you have chosen the correct document.

Form popularity

FAQ

Although one person can be both trustor and trustee, or both trustee and beneficiary, the roles of the trustor, trustee, and beneficiary are distinctly different.

Any individual may be a trustee and a beneficiary of a trust assuming that the trust agreement names other lifetime beneficiaries or successor beneficiaries after the death of the initial beneficiaries. For example, suppose a client wanted to serve as trustee of an irrevocable trust created for his benefit.

Revocable trusts give you much more than probate avoidance. With a POD or TOD account, a durable power of attorney would be needed to have another person handle the account.

With a TOD account, you can't. With a trust, however, your final expenses can be paid out of trust assets, and the remainder, once your debts are settled, distributed equally to your intended beneficiaries. Trusts do involve more expense and effort at the outset than transfer on death accounts.

While a grantor may technically be allowed to serve as the trustee of an irrevocable trust he creates, this can cause some problems.

An irrevocable trust cannot be modified or terminated without permission of the beneficiary. "Once the grantor transfers the assets into the irrevocable trust, he or she removes all rights of ownership to the trust and assets," Orman explained.

Option 2: Naming a trust as a TOD beneficiaryIt helps avoid probate. Option 2 is easier than Option 3. It's easier to set up TOD beneficiary designations than to change ownership of accounts, especially banking accounts with a lot of activity.

A grantor does not have to give up rights of ownership and control of a living trust so s/he may be the Trustee of the living trust. On the other hand, if the grantor creates an irrevocable trust s/he cannot be the trustee of that trust.

The short answer is yes, a beneficiary can also be a trustee of the same trustbut it may not always be wise, and certain guidelines must be followed. Is it a good idea for a beneficiary to be a trustee? There are good reasons for naming a trust beneficiary as trustee. For one, it is convenient.

Removing a Trustee But if the trustor is no longer alive or has an irrevocable trust, anyone wishing to remove a trustee will have to go to court. Any party with a reasonable interest in the trustsuch as co-trustee or a beneficiarymust file a petition with the probate court requesting that it remove the trustee.