Ohio Partnership Agreement for Business

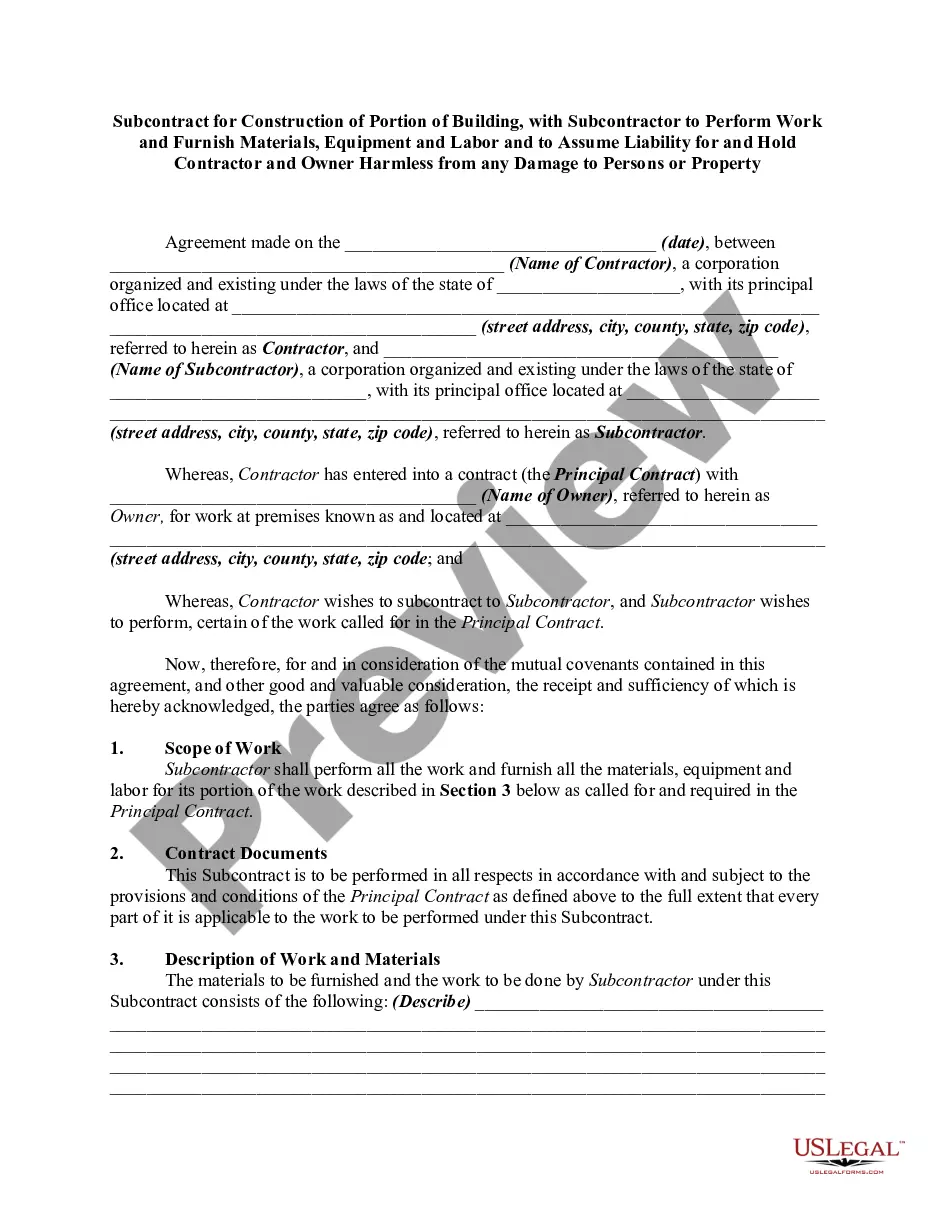

Description

How to fill out Partnership Agreement For Business?

You can dedicate hours online searching for the legal document template that meets the state and federal standards you require.

US Legal Forms offers a vast array of legal forms that can be reviewed by experts.

You can obtain or create the Ohio Partnership Agreement for Business through our service.

If available, use the Review button to examine the document template as well.

- If you already have a US Legal Forms account, you can Log In and click the Download button.

- After that, you can complete, modify, print, or sign the Ohio Partnership Agreement for Business.

- Every legal document template you purchase is yours permanently.

- To get an additional copy of any bought form, go to the My documents tab and click the respective button.

- If this is your first time using the US Legal Forms website, follow the straightforward instructions below.

- First, ensure you have selected the correct document template for your preferred area/city.

- Review the form information to confirm you have chosen the accurate form.

Form popularity

FAQ

How to Write a Business Partnership Agreementname of the partnership.goals of the partnership.duration of the partnership.contribution amounts of each partner (cash, property, services, future contributions)ownership interests of each partner (assets)management roles and terms of authority of each partner.More items...

If you are a business owner, looking to draft your own partnership agreement, you can do so using free templates available online. It is advisable to contact a business lawyer or a partnership agreement lawyer to ensure that the agreement follows the federal, state and local laws.

Here are five clauses every partnership agreement should include:Capital contributions.Duties as partners.Sharing and assignment of profits and losses.Acceptance of liabilities.Dispute resolution.

Please note: A partnership agreement and other internal documents are not required to be filed with the Ohio Secretary of State. The filing fee for the Statement is $99.00 and the filing may be expedited for an additional fee (see page 24 for expedited information). The Statement must include a business name.

The partnership agreement spells out who owns what portion of the firm, how profits and losses will be split, and the assignment of roles and duties. The partnership agreement will also typically spell how out disputes are to be adjudicated and what happens if one of the partners dies prematurely.

Partnership tax returns must be filed annually to report income, deductions, gains, losses, etc. from their operations, but the Partnership does not pay income tax. Schedule K-1 (Form 1065) of the partnership must be furnished by the partnership.

The registration of a partnership firm is optional and not compulsory under the Indian Partnership Act. It is at the discretion of the partners and voluntary. The firm's registration can be done at the time of its formation or incorporation or during the continuance of the partnership business.

Simply put, a general partnership does not need to file annual accounts. On the other hand, LLPs must file certain information with Companies House.

Forming a Partnership in OhioChoose a business name for your partnership and check for availability.Register the business name with local, state, and/or federal authorities.Draft and sign a partnership agreement.Obtain any required local licenses.More items...

If you are a business owner, looking to draft your own partnership agreement, you can do so using free templates available online. It is advisable to contact a business lawyer or a partnership agreement lawyer to ensure that the agreement follows the federal, state and local laws.