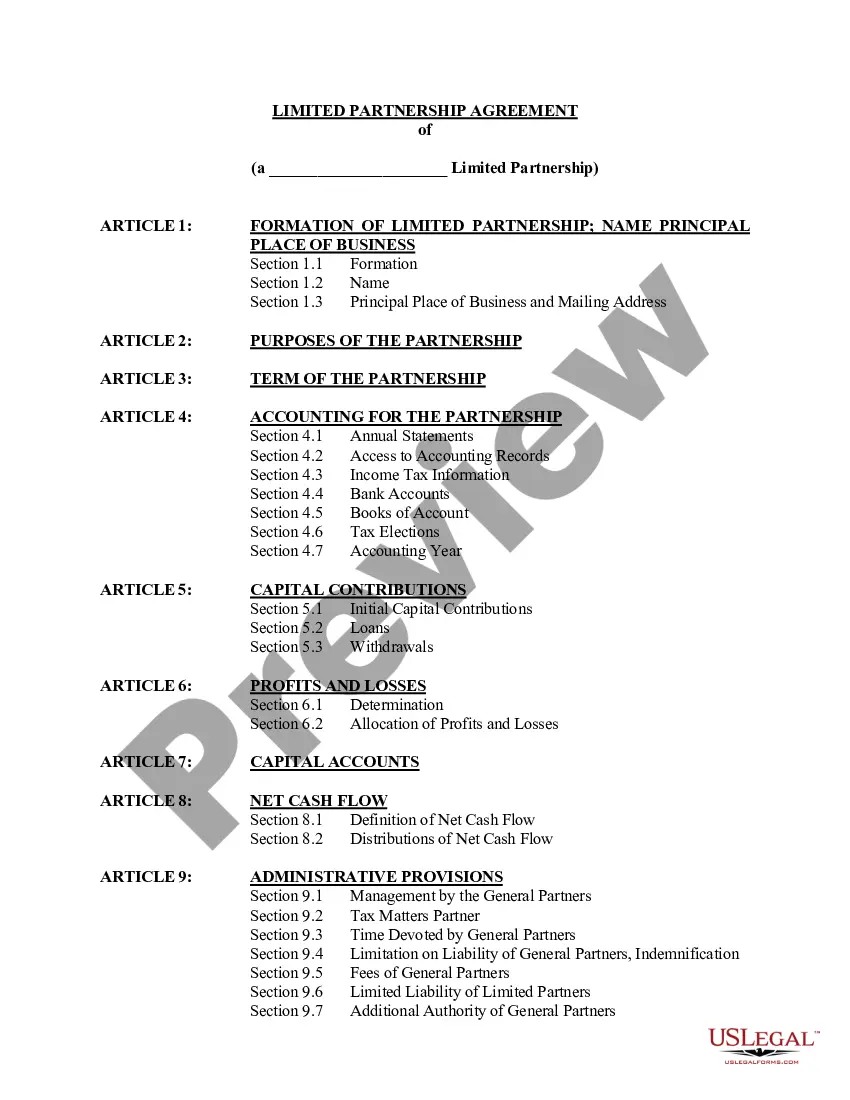

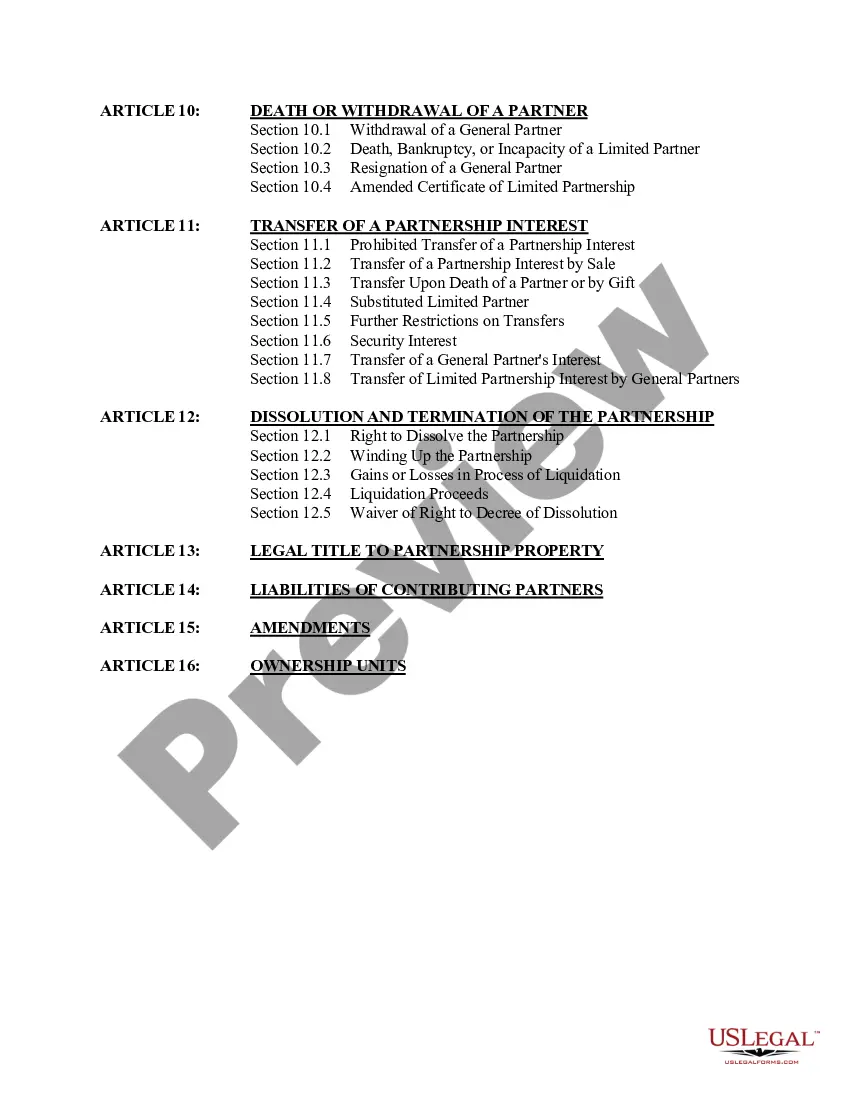

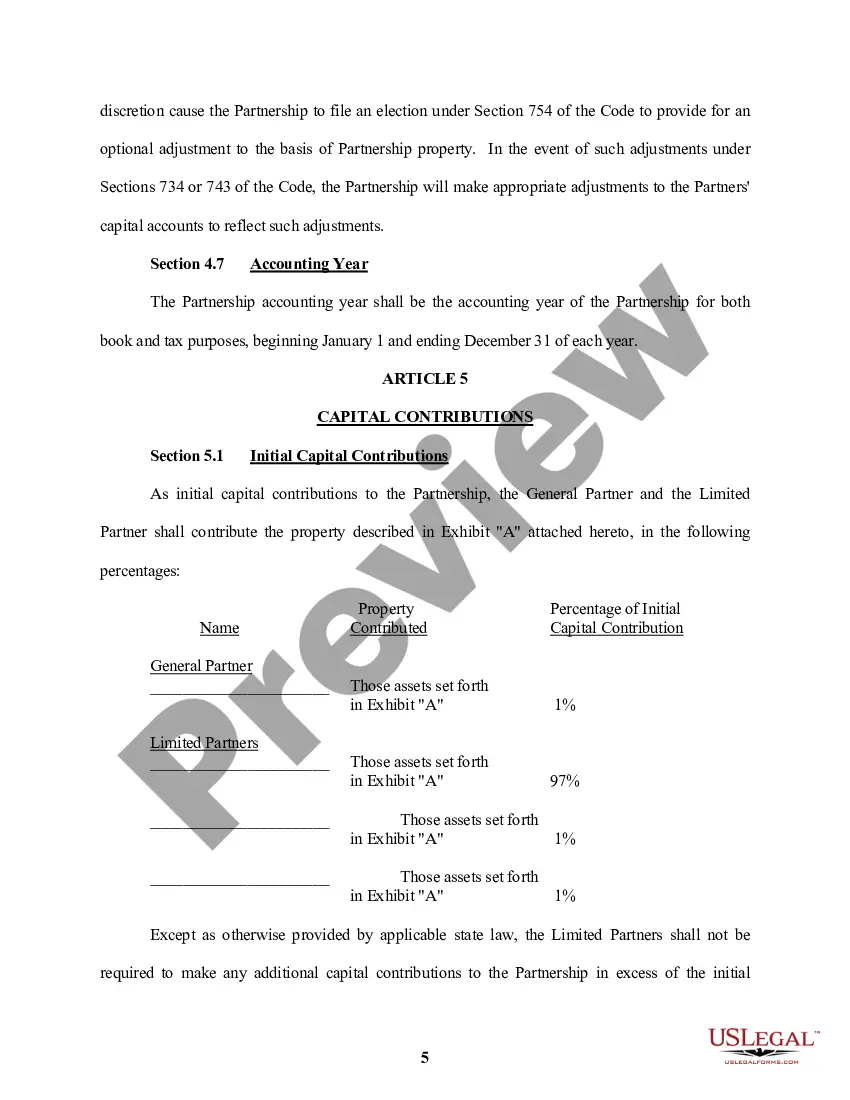

The Ohio Family Limited Partnership Agreement and Certificate is a legal document that establishes a type of partnership primarily used for estate planning and asset protection among family members in Ohio. This type of agreement provides a framework for organizing and managing family assets while ensuring the benefits of limited liability and tax advantages. The Ohio Family Limited Partnership (FLP) Agreement outlines the terms and conditions under which the family partnership will be operated, including the roles and responsibilities of each partner, the distribution of profits and losses, and the transferability of partnership interests. This agreement acts as the governing document that sets the rules and regulations for all family members involved. One of the main benefits of an Ohio FLP is the ability to protect family assets from potential creditors and lawsuits. By participating in the partnership, family members can shield their personal assets from individual liabilities and lawsuits, as the FLP is considered a separate legal entity. This arrangement can be particularly advantageous for families with significant wealth or complex estate planning needs. Furthermore, the Ohio FLP Agreement allows for effective estate planning and wealth transfer strategies. By transferring assets into the partnership, family members can take advantage of valuation discounts and gifting techniques, which can reduce estate taxes and minimize the burden on future generations. Additionally, the FLP provides a means for the orderly transition of assets from one generation to the next, ensuring that family wealth remains intact and protected. While the Ohio Family Limited Partnership Agreement and Certificate serve as a general framework for establishing a family partnership, there may be different variations or specialized agreements available based on specific family circumstances. Some common types of the Alps in Ohio include: 1. General Family Limited Partnership (FLP): This is the most common form of FLP, where there are both general partners with management control and limited partners who contribute capital but have limited decision-making power. 2. Limited Liability Family Partnership (LFP): This variation incorporates the limited liability advantages of a limited liability company (LLC) with the flexible structure of an FLP. This allows family members to limit personal liability while still enjoying the benefits of a partnership. 3. Family Limited Liability Limited Partnership (FLL LP): This type of FLP combines the best of both worlds by providing limited liability protection for all partners, including general partners. It offers an additional layer of protection against personal liability. In conclusion, the Ohio Family Limited Partnership Agreement and Certificate offer families a powerful tool for estate planning, asset protection, and wealth transfer. By utilizing this legally binding agreement, family members can safeguard their assets, reduce estate taxes, and ensure the orderly transfer of wealth to future generations. Different variations of the Alps can be tailored to meet specific family needs, providing added flexibility and protection.

Ohio Family Limited Partnership Agreement and Certificate

Description

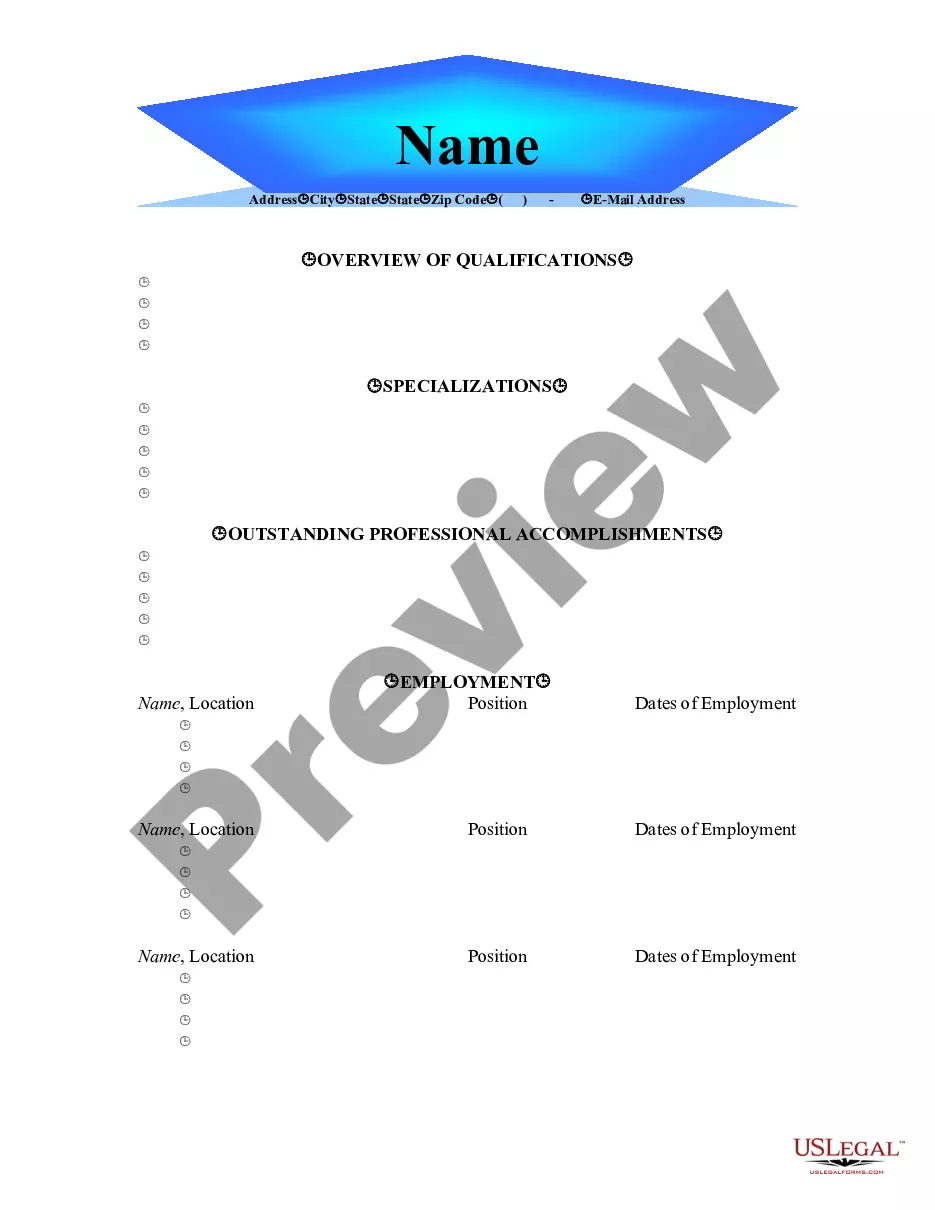

How to fill out Ohio Family Limited Partnership Agreement And Certificate?

Are you presently within a placement in which you will need files for either organization or individual reasons almost every day time? There are plenty of authorized papers themes available online, but getting types you can depend on isn`t effortless. US Legal Forms offers thousands of kind themes, much like the Ohio Family Limited Partnership Agreement and Certificate, that happen to be created in order to meet federal and state requirements.

In case you are already informed about US Legal Forms web site and have a merchant account, simply log in. Following that, you can download the Ohio Family Limited Partnership Agreement and Certificate template.

If you do not have an profile and need to begin using US Legal Forms, abide by these steps:

- Obtain the kind you require and make sure it is for your correct city/region.

- Take advantage of the Preview button to examine the form.

- Read the outline to ensure that you have selected the appropriate kind.

- In the event the kind isn`t what you`re trying to find, take advantage of the Lookup area to discover the kind that meets your needs and requirements.

- Once you find the correct kind, just click Buy now.

- Choose the pricing prepare you want, submit the desired details to create your account, and pay money for an order with your PayPal or credit card.

- Choose a practical paper structure and download your backup.

Locate all of the papers themes you may have purchased in the My Forms menu. You may get a more backup of Ohio Family Limited Partnership Agreement and Certificate whenever, if required. Just click on the required kind to download or print out the papers template.

Use US Legal Forms, by far the most comprehensive variety of authorized forms, to save time and avoid errors. The services offers skillfully created authorized papers themes that can be used for a selection of reasons. Produce a merchant account on US Legal Forms and start generating your daily life easier.

Form popularity

FAQ

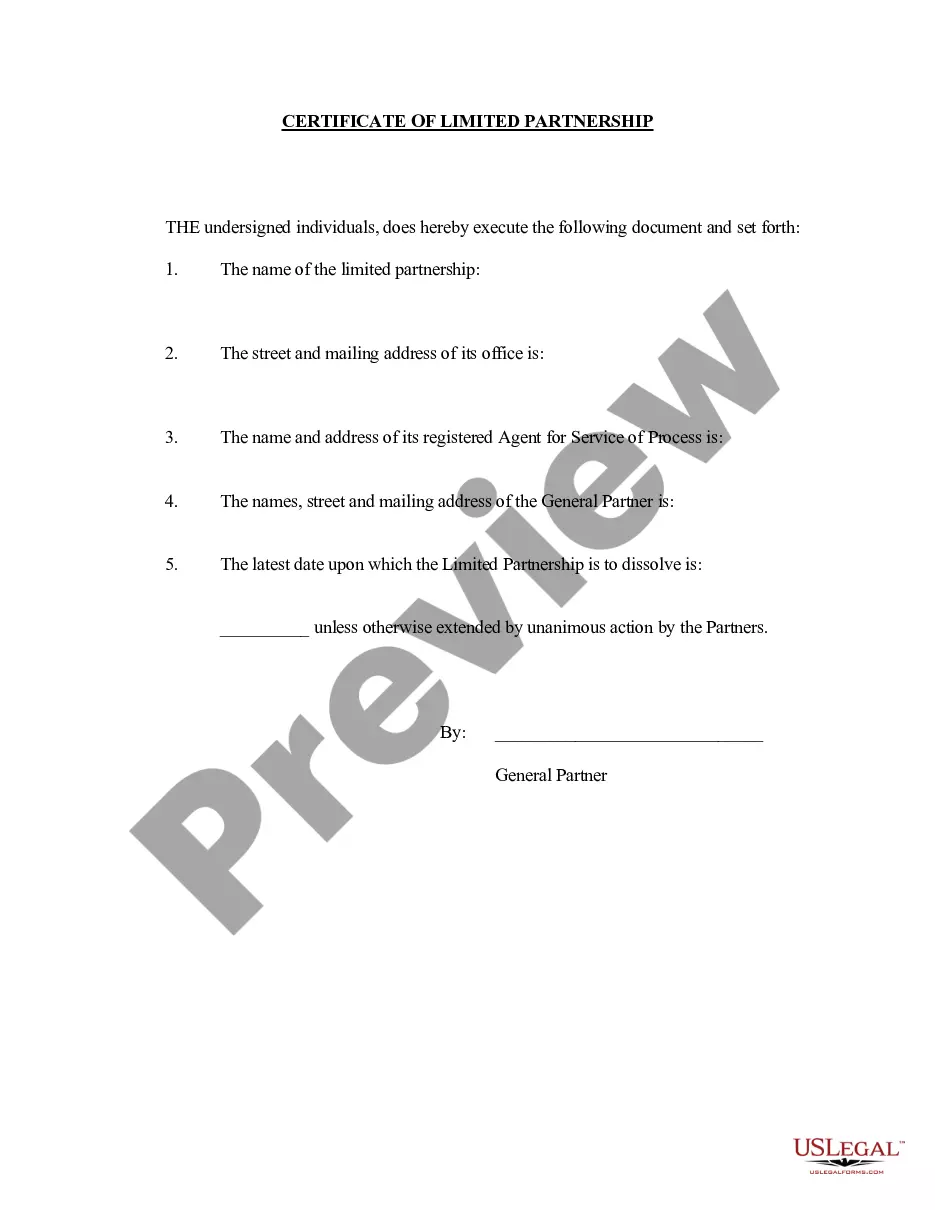

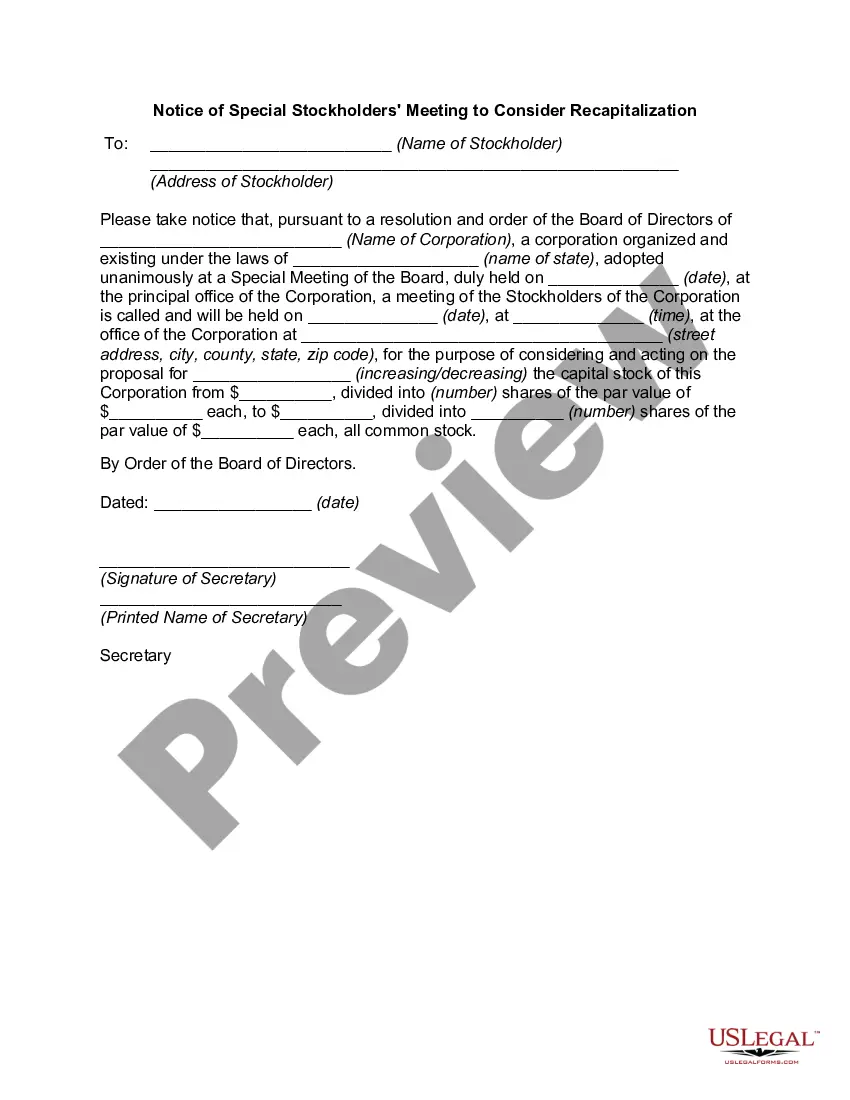

Some states only require that the certificate contains the name of the limited partnership, the name and address of the registered agent and registered office, and the names and addresses of all of the general partners.

Ohio law currently permits for-profit corporations, limited liability companies, limited partnerships, limited liability partnerships and general partnerships to convert.

Limited Liability Partnership In order to create a LLP in Ohio, a Statement of Qualification must be filed with the Secretary of State. A LLP limits liability in that partners are not liable for obligations created by the other partners. The partnership itself, however, is liable for the acts of the partners.

How to Form an Ohio Limited Partnership (in 6 Steps) Step One) Choose an LP Name. ... Step Two) Designate a Registered Agent. ... Step Three) File the Certificate of Limited Partnership. ... Step Four) Create a Limited Partnership Agreement. ... Step Five) Handle Taxation Requirements. ... Step Six) Obtain Business Licenses and Permits.

Minimum two partners are required to incorporate an LLP. However, there is no upper limit on the maximum number of partners of an LLP. Among the partners, there should be a minimum of two designated partners who must be natural persons, and at least one of them should be resident in India.

One of the most popular structures for limiting liability is the limited liability partnership (LLP). Limited liability partnerships allow firms to retain their partnership structure while protecting the personal assets of partners who have no involvement in a negligence action.

Filing Statement of Partnership Authority While not required in order to conduct business in the state of Ohio, Statement of Partnership Authority (Form 535) (Statement) may be filed with the Ohio Secretary of State.